As global markets navigate through a landscape of economic shifts, with central banks adjusting rates and indices like the Russell 2000 underperforming against larger-cap peers, investors are keenly observing the impact on small-cap stocks. Amidst these dynamics, identifying promising opportunities requires a focus on companies with strong fundamentals and resilience in volatile environments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Forest Packaging GroupLtd | 17.72% | 2.87% | -6.03% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Elite Color Environmental Resources Science & Technology | 30.80% | 12.99% | 1.83% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Albaraka Türk Katilim Bankasi (IBSE:ALBRK)

Simply Wall St Value Rating: ★★★★★★

Overview: Albaraka Türk Katilim Bankasi A.S. offers a range of banking products and services in Turkey, with a market capitalization of TRY15.93 billion.

Operations: Albaraka Türk Katilim Bankasi A.S. generates revenue primarily from its Commercial and Corporate segment, contributing TRY33.27 billion, followed by the Treasury segment at TRY18.51 billion and the Retail segment at TRY8.53 billion.

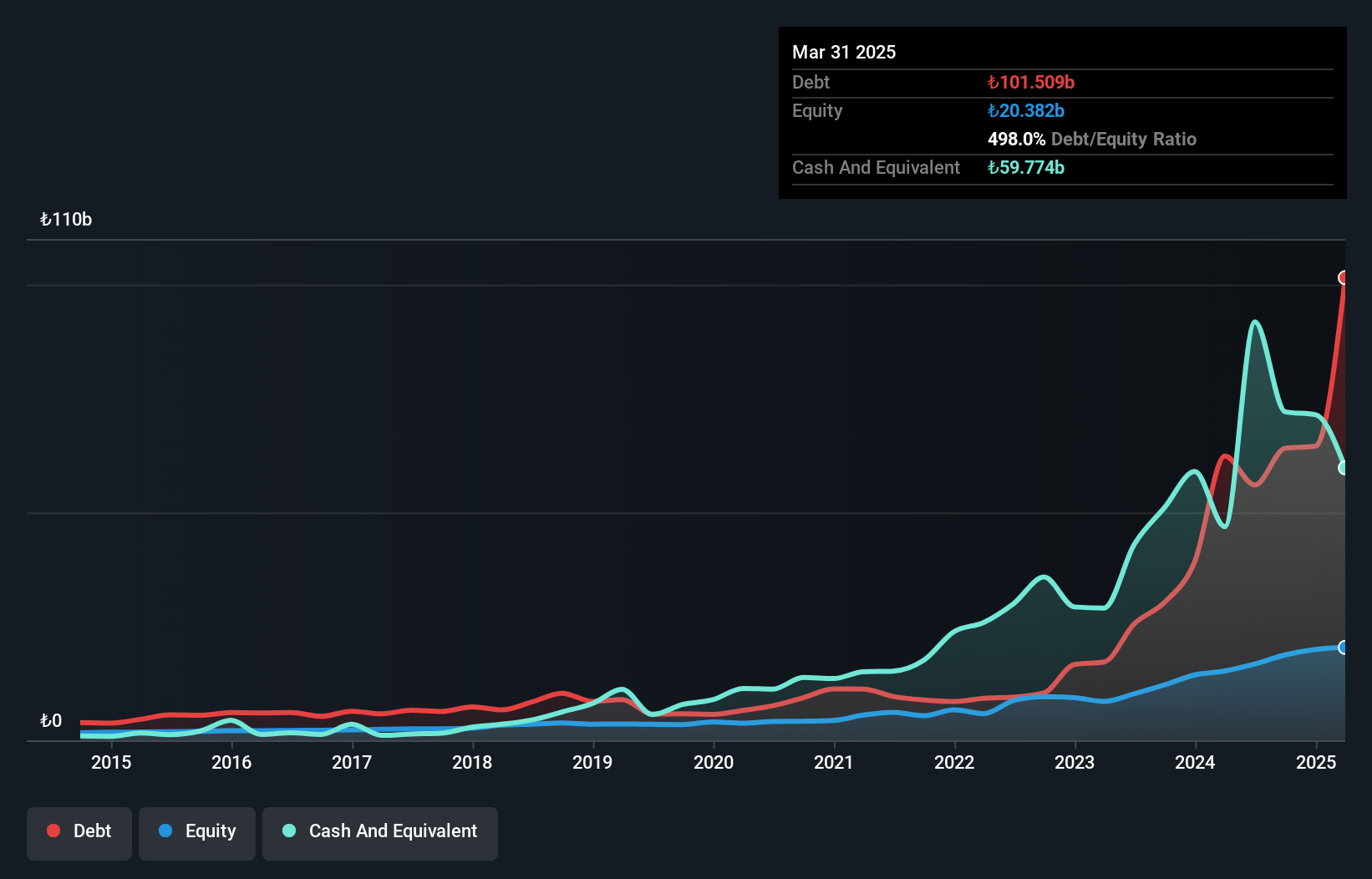

Albaraka Türk Katilim Bankasi, a smaller player in the banking sector, showcases a robust foundation with total assets of TRY299.6 billion and equity at TRY18.7 billion. The bank's non-performing loans are well-managed at 1.4%, supported by a sufficient allowance for bad loans at 163%. It benefits from primarily low-risk funding sources, with customer deposits making up 70% of liabilities. A notable one-off gain of TRY3.3 billion has influenced recent earnings, which grew by 40% over the past year—outpacing industry growth rates significantly—and it trades attractively with a price-to-earnings ratio of just 3x compared to the TR market average of 16.3x.

Sparebanken Møre (OB:MORG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sparebanken Møre, along with its subsidiaries, offers banking services to retail and corporate clients in Norway and has a market capitalization of NOK4.58 billion.

Operations: The primary revenue streams for Sparebanken Møre are derived from its retail and corporate banking segments, generating NOK1.06 billion and NOK1.00 billion respectively. The real estate brokerage segment contributes an additional NOK43 million to the overall revenue.

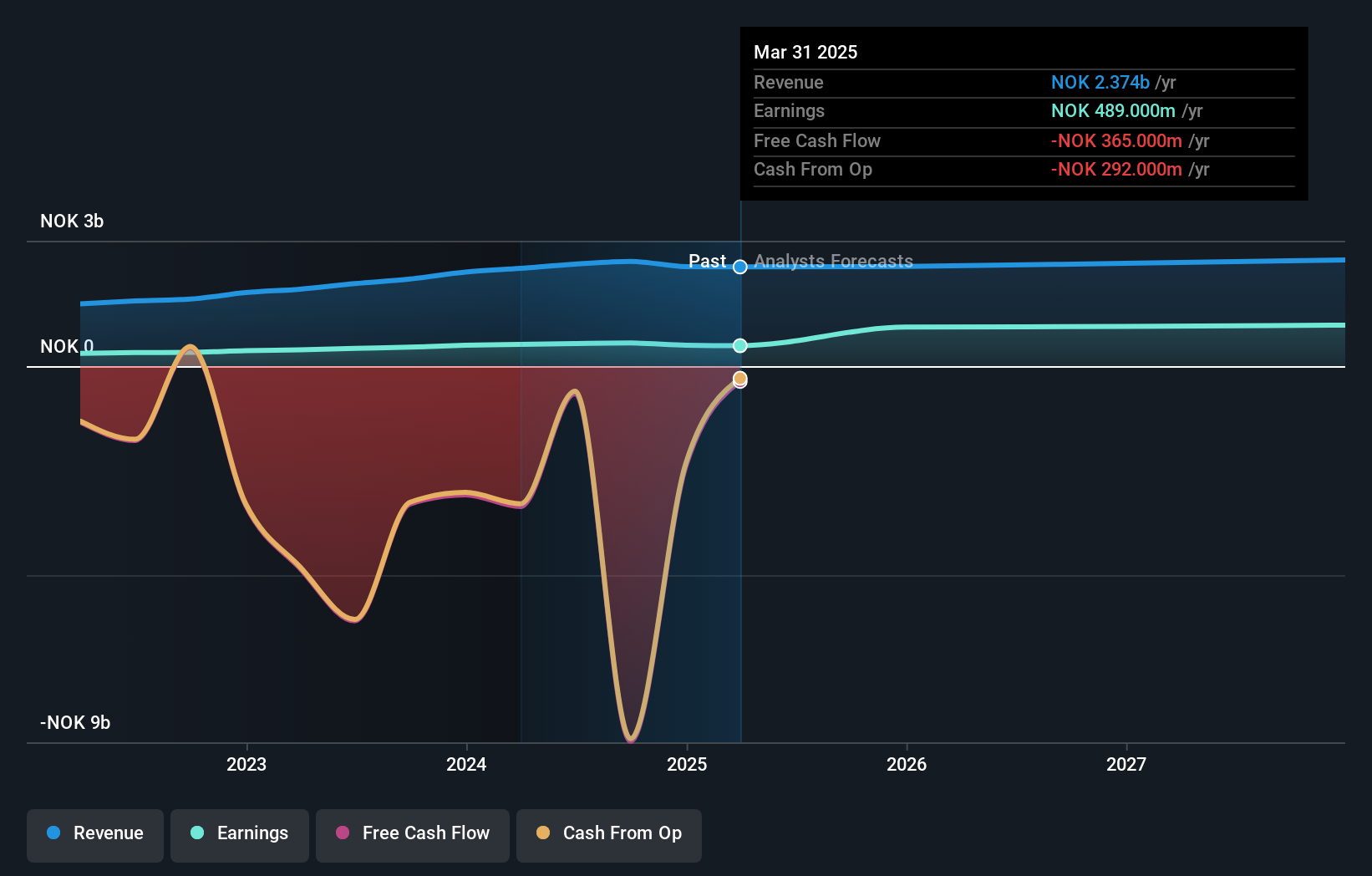

Sparebanken Møre, a notable player in the banking sector, showcases a robust financial profile with total assets of NOK106.9 billion and equity standing at NOK8.8 billion. Its loan book totals NOK90 billion against deposits of NOK49.2 billion, indicating significant lending activity. The bank is trading at 35% below its estimated fair value, suggesting potential undervaluation compared to peers. With an appropriate bad loans ratio of 0.5% and a low allowance for bad loans at 53%, risk management seems solidly in place. Earnings growth over the past year hit 22%, outpacing industry averages, highlighting its competitive edge in profitability expansion.

Asian Alliance International (SET:AAI)

Simply Wall St Value Rating: ★★★★★★

Overview: Asian Alliance International Public Company Limited, along with its subsidiaries, is engaged in the production and sale of pet food and ready-to-eat human food products across various international markets including Thailand, the United States, the United Kingdom, Saudi Arabia, Japan, and Italy; it has a market capitalization of THB12.64 billion.

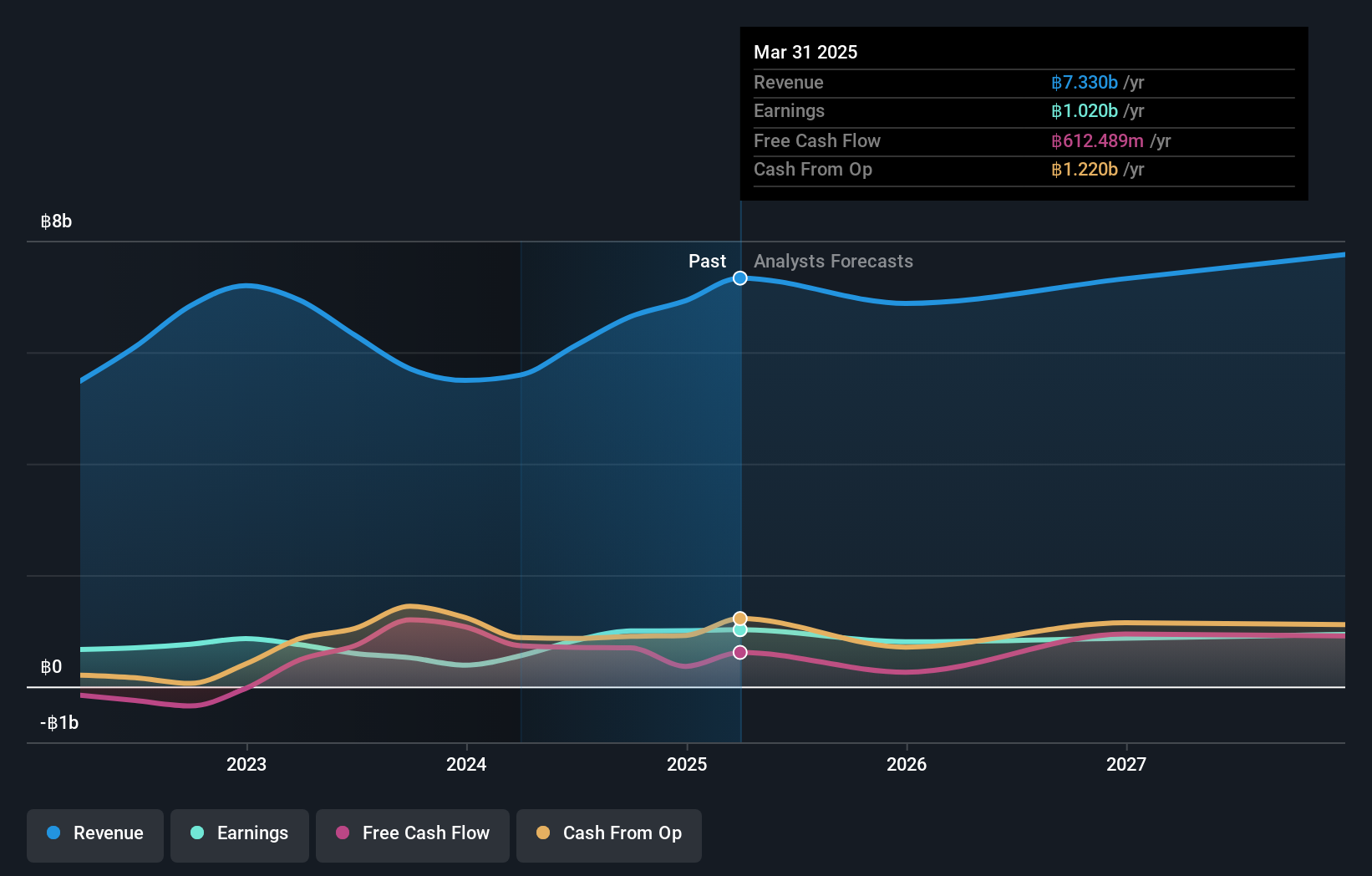

Operations: Asian Alliance International generates revenue primarily from the manufacturing and distribution of shelf-stable foods, amounting to THB6.67 billion.

Asian Alliance International shines with its debt-free status, a stark contrast to five years ago when it had a 25.8% debt-to-equity ratio. Its recent performance is notable, with third-quarter sales reaching THB 1,871.95 million and net income climbing to THB 289.11 million from THB 118.18 million the previous year. The company is trading at a significant discount of 63% below estimated fair value, suggesting potential upside for investors seeking undervalued opportunities in the food industry sector where its earnings growth of 92.8% last year outpaced the industry's average of 34%.

- Delve into the full analysis health report here for a deeper understanding of Asian Alliance International.

Understand Asian Alliance International's track record by examining our Past report.

Key Takeaways

- Reveal the 4502 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ALBRK

Albaraka Türk Katilim Bankasi

Provides various banking products and services in Turkey.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives