- Luxembourg

- /

- Real Estate

- /

- BDL:ORCL

Oracle's Cloud and AI Momentum Might Change The Case For Investing In CPI FIM (BDL:ORCL)

Reviewed by Sasha Jovanovic

- Oracle recently held an investor day where it raised its long-term revenue and earnings outlook based on accelerated growth in its cloud infrastructure business and a substantial deal backlog from clients investing heavily in artificial intelligence.

- Analyst feedback emphasized Oracle’s emergence as a credible hyperscaler, spotlighting its rapid expansion within the AI database market and strong momentum from major AI partners like OpenAI and Meta Platforms.

- We’ll explore how Oracle’s progress in cloud and AI infrastructure supports its broader investment narrative, with its $500 billion deal backlog capturing investors’ attention.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is CPI FIM's Investment Narrative?

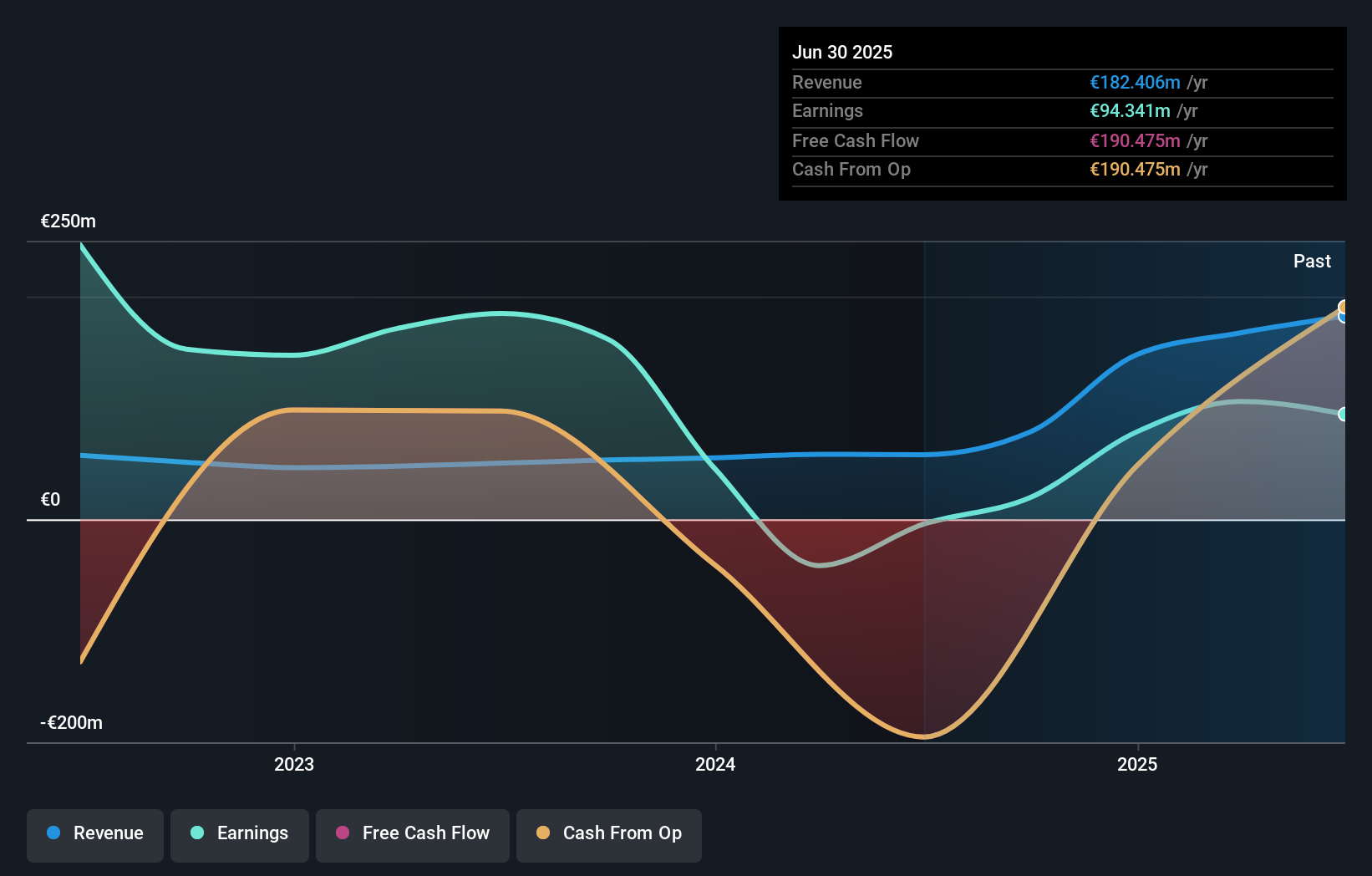

For anyone considering CPI FIM, the investment thesis relies on believing in the company’s ability to sustain and build upon its recent sharp rebound in sales, revenue, and profitability, as evidenced by robust half-year and full-year growth. The most important near-term catalyst remains its capacity to maintain this positive earnings momentum, especially given past volatility and sector-wide unpredictability. The company’s highly volatile share price over the past three months and relatively low Return on Equity do remain core risks. While the recent news about Oracle’s surge and AI-driven demand in cloud infrastructure is grabbing headlines, it doesn’t appear to shift the needle on CPI FIM’s key demand drivers or risk factors based on current data and price reaction. However, investors will likely continue to scrutinize whether strong recent returns can be sustained while managing exposure to sector headwinds and earnings fluctuations.

But there’s a risk tied to that recent earnings volatility that investors shouldn’t ignore.

CPI FIM's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on CPI FIM - why the stock might be worth over 2x more than the current price!

Build Your Own CPI FIM Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CPI FIM research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CPI FIM research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CPI FIM's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BDL:ORCL

CPI FIM

CPI FIM SA, société anonyme (the “Company”) and its subsidiaries (together the “Group” or “CPI FIM”), is an owner of income-generating real estate and land bank primarily in Poland and in the Czech Republic.

Solid track record and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)