- South Korea

- /

- Media

- /

- KOSE:A030000

Top 3 KRX Dividend Stocks To Consider

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has dropped 5.4%, and it is down 3.8% over the past 12 months, although earnings are forecast to grow by 29% annually. In such a fluctuating market, dividend stocks can provide a reliable income stream and potential for growth, making them an attractive option for investors seeking stability.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.56% | ★★★★★★ |

| Hansae (KOSE:A105630) | 3.34% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.83% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.16% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.66% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.46% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.18% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.41% | ★★★★★☆ |

| Tong Yang Life Insurance (KOSE:A082640) | 6.62% | ★★★★☆☆ |

| Korea Cast Iron Pipe Ind (KOSE:A000970) | 6.17% | ★★★★☆☆ |

Click here to see the full list of 74 stocks from our Top KRX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

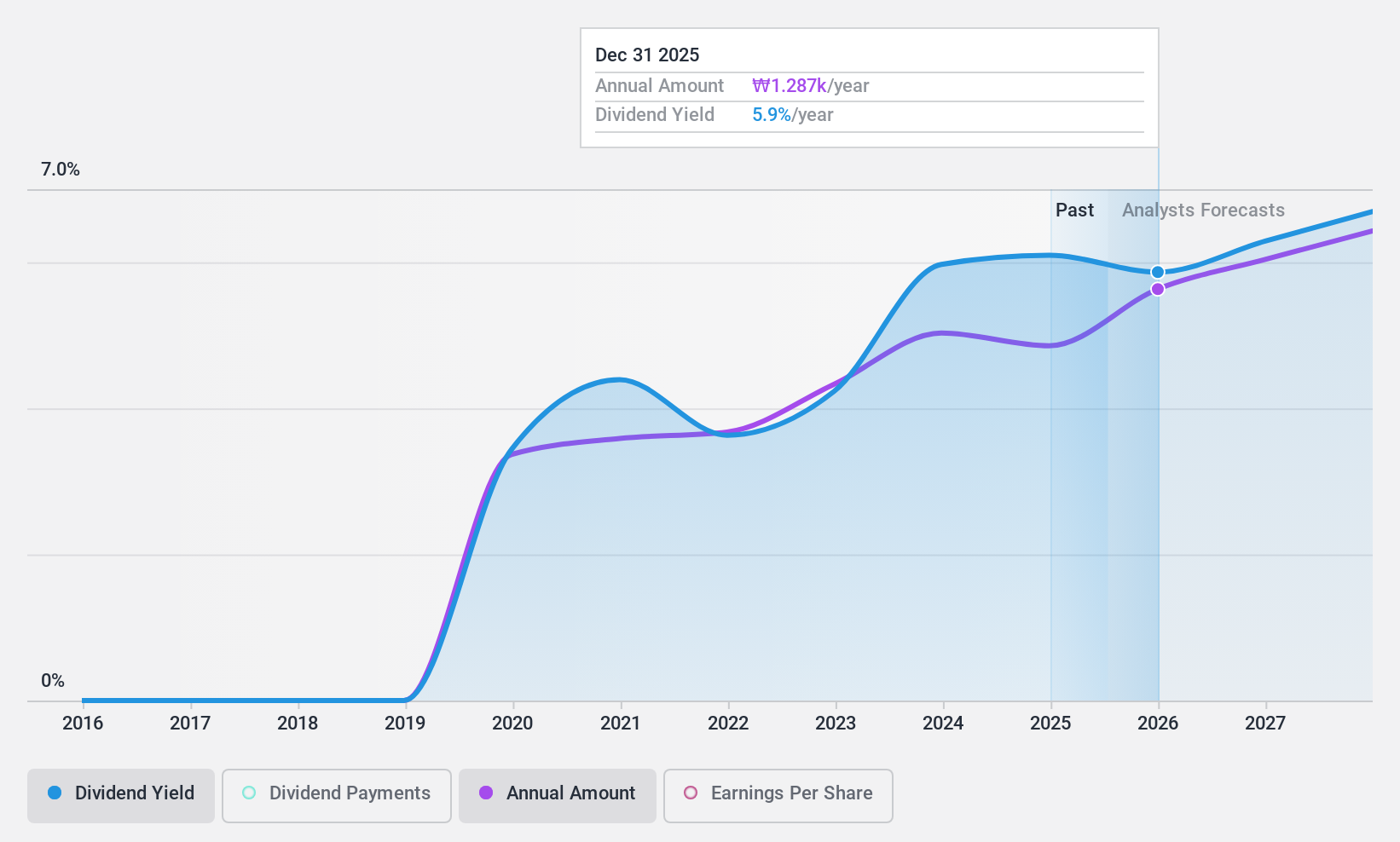

Cheil Worldwide (KOSE:A030000)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cheil Worldwide Inc. offers a range of marketing solutions globally and has a market cap of ₩1.88 trillion.

Operations: Cheil Worldwide Inc. generates revenue primarily from its advertising segment, amounting to ₩4.33 billion.

Dividend Yield: 6%

Cheil Worldwide's dividend payments are well-covered by earnings and cash flows, with a payout ratio of 59% and a cash payout ratio of 40.5%. Trading at good value compared to its peers, the stock is currently priced 52.9% below its estimated fair value. Although dividends have increased over the past five years, they remain less established due to the short payment history. The dividend yield stands at 5.98%, placing it in the top tier of South Korean dividend payers.

- Take a closer look at Cheil Worldwide's potential here in our dividend report.

- Our valuation report here indicates Cheil Worldwide may be undervalued.

KT (KOSE:A030200)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: KT Corporation offers integrated telecommunications and platform services both in Korea and internationally, with a market cap of ₩10.18 trillion.

Operations: KT Corporation's revenue segments include ICT at ₩18.84 billion, Finance at ₩3.66 billion, Real Estate at ₩534.64 million, and Satellite Broadcasting at ₩708.98 million.

Dividend Yield: 4.8%

KT Corporation's dividend payments have been volatile over the past decade, but they have shown growth. The current dividend yield of 4.83% ranks in the top 25% of South Korean dividend payers. Despite an unstable track record, dividends are well-covered by earnings (payout ratio: 68.1%) and cash flows (cash payout ratio: 19.6%). Recent Q2 earnings reported stable revenue at KRW 6.55 billion and net income at KRW 393 million, reflecting consistent financial performance.

- Delve into the full analysis dividend report here for a deeper understanding of KT.

- Our comprehensive valuation report raises the possibility that KT is priced lower than what may be justified by its financials.

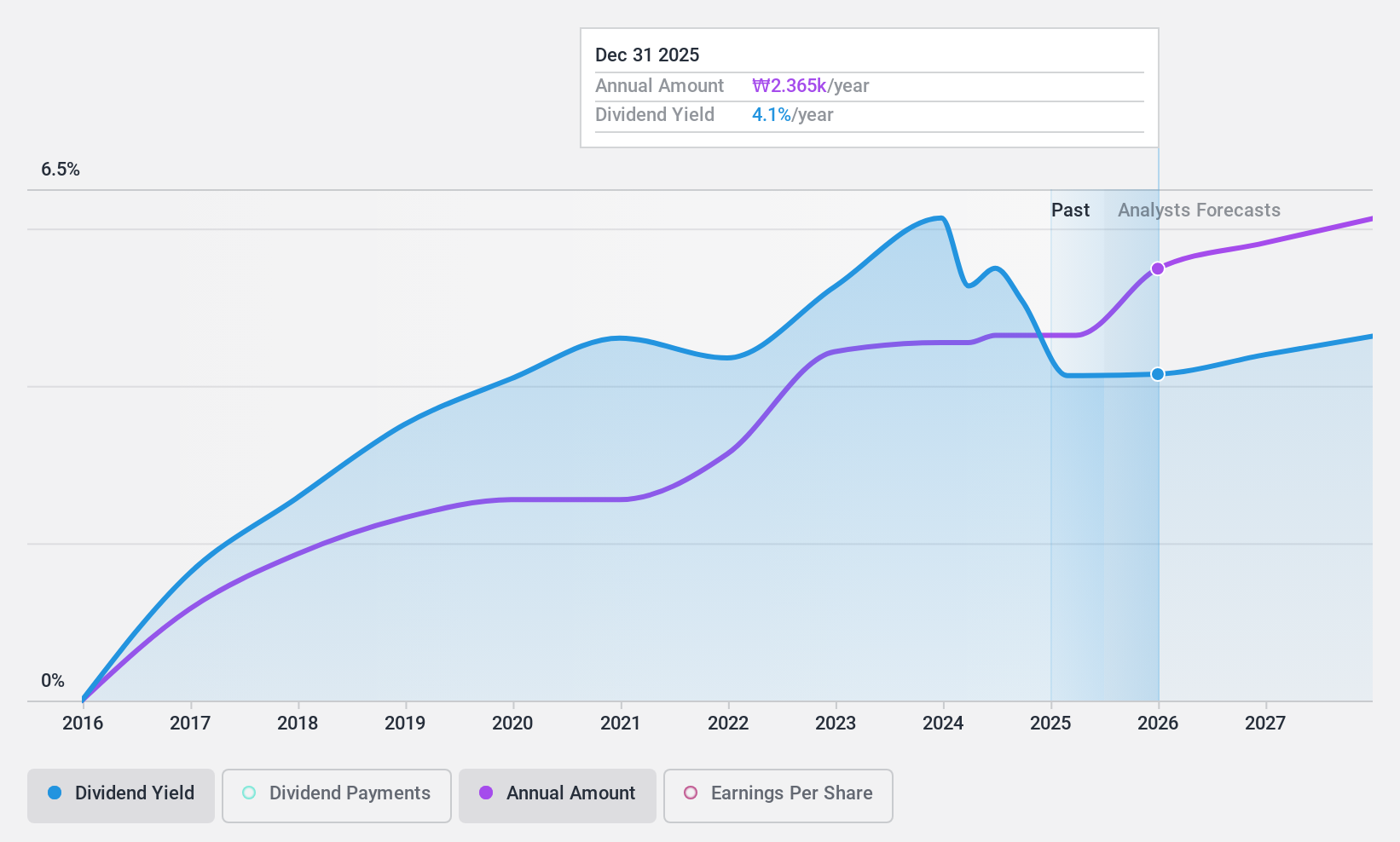

LG Uplus (KOSE:A032640)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LG Uplus Corp. provides various telecommunication services primarily in South Korea and has a market cap of approximately ₩4.25 trillion.

Operations: LG Uplus Corp. generates revenue primarily from its LG U+ Division, which contributes ₩13.40 billion, and its LG Hello Vision Division, which adds ₩1.17 billion.

Dividend Yield: 6.6%

LG Uplus has paid dividends for 5 years, with recent increases despite a volatile history. Its current cash payout ratio is 78.7%, and the earnings payout ratio is 50.5%, indicating coverage by both earnings and cash flows. The dividend yield of 6.57% ranks in the top quartile of South Korean payers, though high debt levels raise concerns about financial stability. Recent Q2 earnings call on Aug-07-2024 followed an ex-dividend date on Aug-08-2024 for a KRW 250 cash dividend.

- Click here and access our complete dividend analysis report to understand the dynamics of LG Uplus.

- Our valuation report unveils the possibility LG Uplus' shares may be trading at a discount.

Make It Happen

- Discover the full array of 74 Top KRX Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A030000

Very undervalued with flawless balance sheet and pays a dividend.