- South Korea

- /

- Biotech

- /

- KOSDAQ:A206650

Exploring Three High Growth Tech Stocks with Potential

Reviewed by Simply Wall St

As global markets navigate a period marked by stronger-than-expected U.S. labor market data and persistent inflation concerns, small-cap stocks have notably underperformed, with the Russell 2000 Index entering correction territory. In this environment of choppy market conditions and cautious investor sentiment, identifying high growth tech stocks involves looking for companies that demonstrate resilience through innovation and adaptability to shifting economic landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| CD Projekt | 23.18% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| TG Therapeutics | 30.33% | 44.07% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 29.92% | 61.97% | ★★★★★★ |

Click here to see the full list of 1223 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Cafe24 (KOSDAQ:A042000)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cafe24 Corp. operates a global e-commerce platform and has a market capitalization of approximately ₩886.13 billion.

Operations: The company generates revenue primarily from its Internet Business Solution segment, which accounts for ₩237.10 billion. Additional revenue streams include Transit and Clothing, contributing ₩44.06 billion and ₩22.16 billion respectively.

Cafe24, amidst a challenging tech landscape, showcases robust growth metrics that are commendable. With an annualized revenue increase of 11.3% and earnings growth soaring at 35.5%, the company outpaces the broader Korean market's averages of 9.2% and 29%, respectively. Significantly, its R&D investment strategy is aggressive, dedicating substantial resources to innovation—evidenced by a recent ₩13.4 billion spend on research activities which underscore its commitment to staying at the forefront of e-commerce solutions development despite some financial fluctuations due to one-off losses in the past year. This strategic focus not only fuels Cafe24's product enhancements but also positions it well for future technological advancements and market demands.

- Unlock comprehensive insights into our analysis of Cafe24 stock in this health report.

Explore historical data to track Cafe24's performance over time in our Past section.

EuBiologics (KOSDAQ:A206650)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EuBiologics Co., Ltd. is a biopharmaceutical company based in South Korea that specializes in providing vaccines for epidemics, with a market capitalization of ₩454.49 billion.

Operations: EuBiologics focuses on the development and provision of vaccines, generating revenue primarily from its pharmaceuticals segment, which totals ₩69.37 billion.

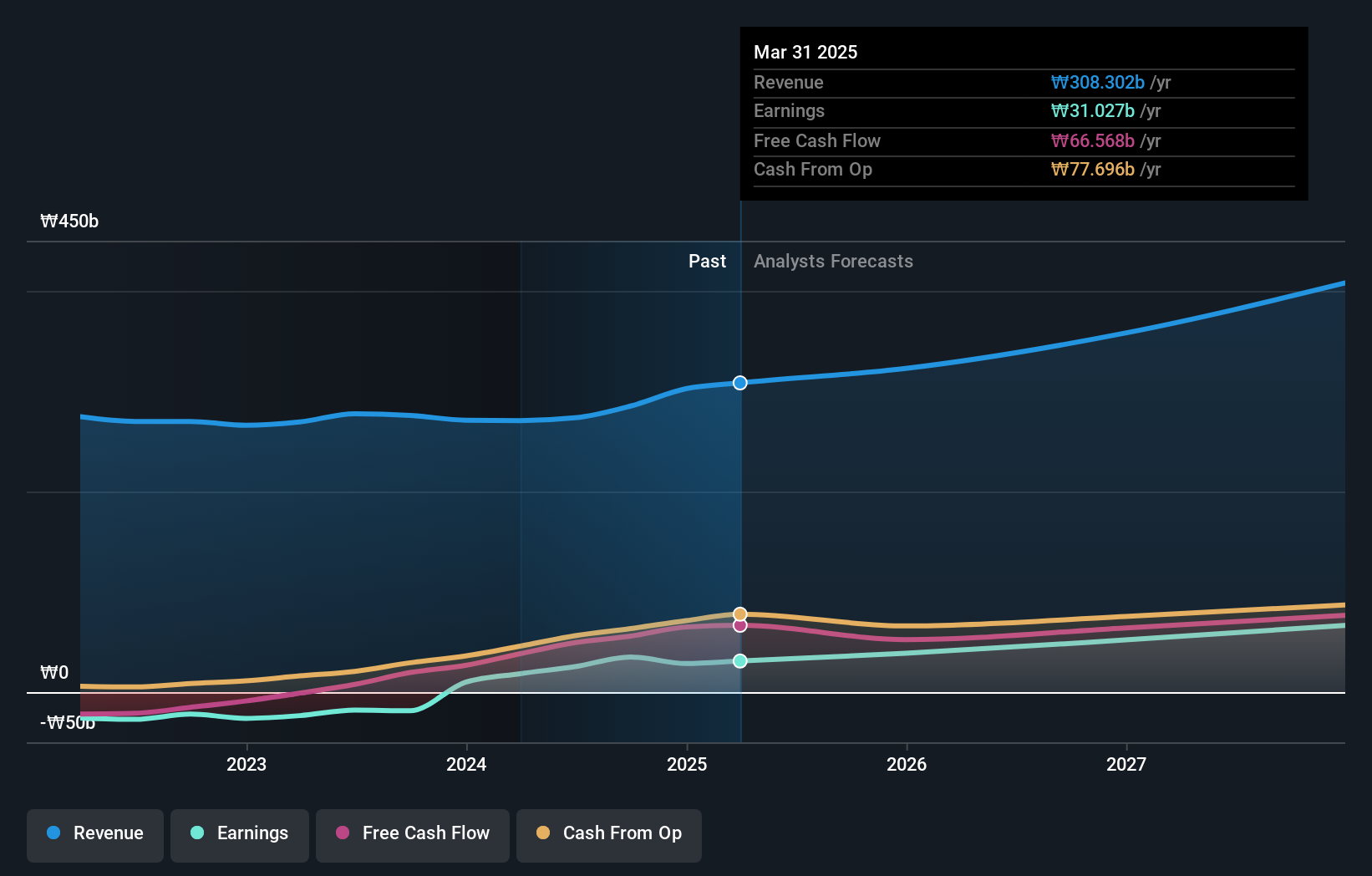

EuBiologics, navigating a competitive biotech landscape, has demonstrated impressive growth dynamics. The company's revenue surged by 21.9% annually, outstripping the broader market's expansion rate of 9.2%. This performance is bolstered by an aggressive R&D posture; last year alone saw R&D expenditures reach $50 million, representing a significant reinvestment into product development and innovation. These efforts are poised to keep EuBiologics at the forefront of vaccine development and disease prevention technologies, crucial in an era where healthcare resilience is paramount.

- Click here and access our complete health analysis report to understand the dynamics of EuBiologics.

Understand EuBiologics' track record by examining our Past report.

I'LL (TSE:3854)

Simply Wall St Growth Rating: ★★★★☆☆

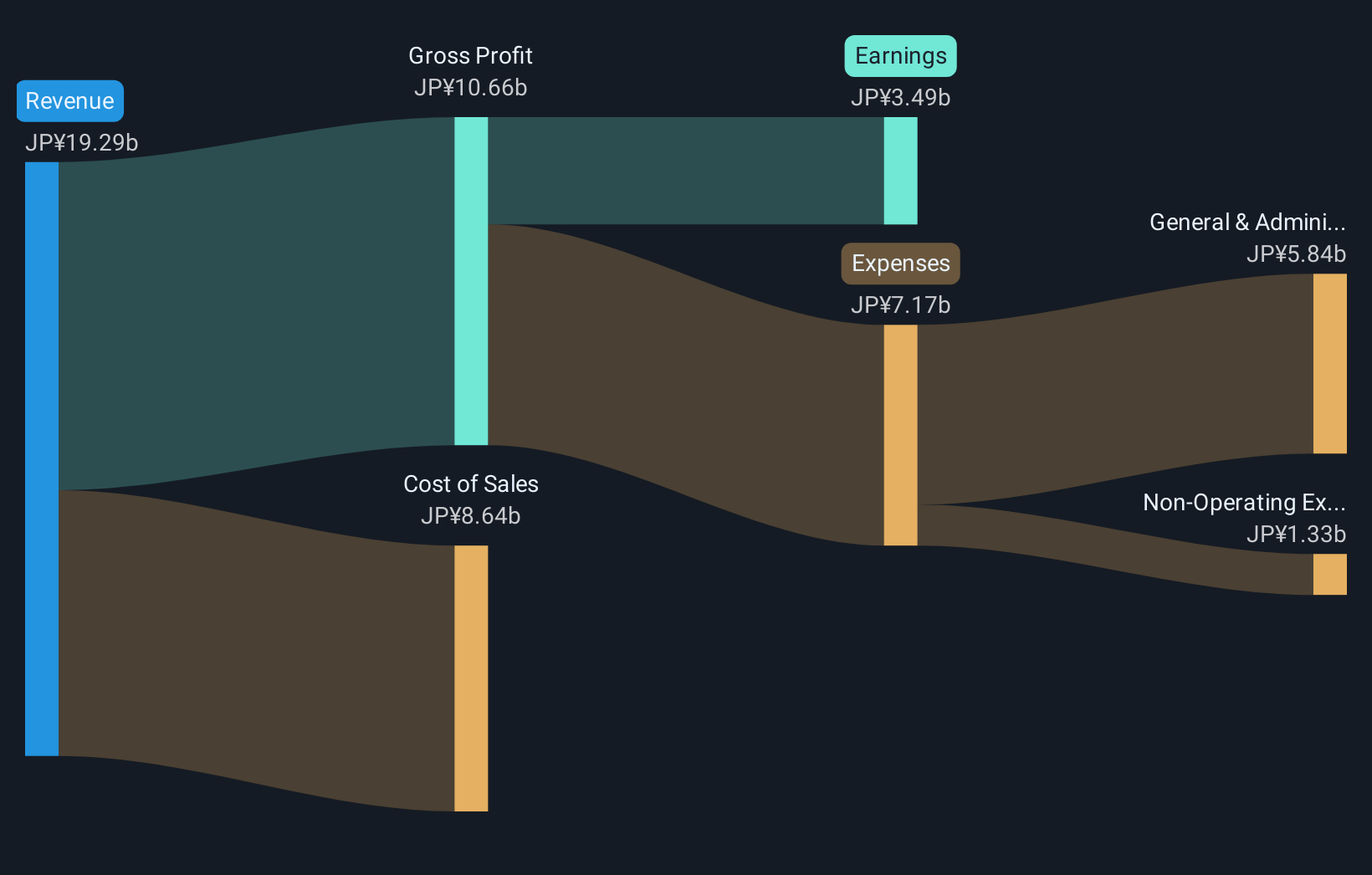

Overview: I'LL Inc. is a Japanese company specializing in system solutions, with a market capitalization of ¥64.35 billion.

Operations: The company focuses on providing system solutions in Japan, contributing to its market capitalization of ¥64.35 billion.

I'LL, amidst a tech landscape where innovation is paramount, has shown resilience with a steady annual revenue growth of 9.4%, outpacing the Japanese market's average of 4.2%. The company's commitment to advancement is evident in its R&D spending, which significantly contributes to its earnings growth forecast at 14.6% annually—surpassing the JP market forecast of 8%. This strategic focus on development is further underscored by I'LL's robust earnings quality and an impressive projected Return on Equity of 27.5% in three years, reflecting efficient reinvestment and operational prowess.

- Dive into the specifics of I'LL here with our thorough health report.

Gain insights into I'LL's past trends and performance with our Past report.

Summing It All Up

- Explore the 1223 names from our High Growth Tech and AI Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade EuBiologics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EuBiologics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A206650

EuBiologics

A biopharmaceutical company, provides vaccines for epidemics in South Korea.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives