- South Korea

- /

- Tech Hardware

- /

- KOSE:A005930

Samsung Electronics (KOSE:A005930): Reassessing Valuation After a 105% One-Year Share Price Rebound

Reviewed by Simply Wall St

Samsung Electronics (KOSE:A005930) has quietly doubled investors’ money over the past year, with the stock up about 105% as earnings rebound and semiconductor sentiment improves, drawing fresh attention to its valuation.

See our latest analysis for Samsung Electronics.

That surge in confidence has been building for months, with the 90 day share price return of 47.14% and a 1 year total shareholder return of 104.71% underscoring how quickly sentiment has flipped in Samsung’s favor.

If Samsung’s rebound has you thinking bigger about chip and platform winners, this is a good moment to search for other high growth tech names via high growth tech and AI stocks.

Yet even after a doubling share price, analysts still see upside and cash flows are recovering strongly. This raises the key question: is Samsung still trading below its true value, or is the market already pricing in all that future growth?

Most Popular Narrative Narrative: 16.7% Undervalued

Compared with Samsung Electronics' last close of ₩108000, the most followed narrative sees room for upside based on a higher fair value estimate.

Industry pricing for memory and storage products is now rebounding, with inventory normalized and potential for supply tightness in legacy DRAM/NAND. This is expected to translate into stronger financial results (revenue and margin recovery) as pricing improvements flow through to ASPs and earnings in coming quarters.

Curious how steady revenue expansion, rising margins, and a richer earnings multiple all combine into that upside case? The full narrative unpacks the entire valuation playbook.

Result: Fair Value of ₩129604.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting macro conditions, including geopolitical tensions and intensifying chip competition, could squeeze margins and challenge the upbeat earnings and valuation story.

Find out about the key risks to this Samsung Electronics narrative.

Another View: Valuation Looks Stretched On Earnings

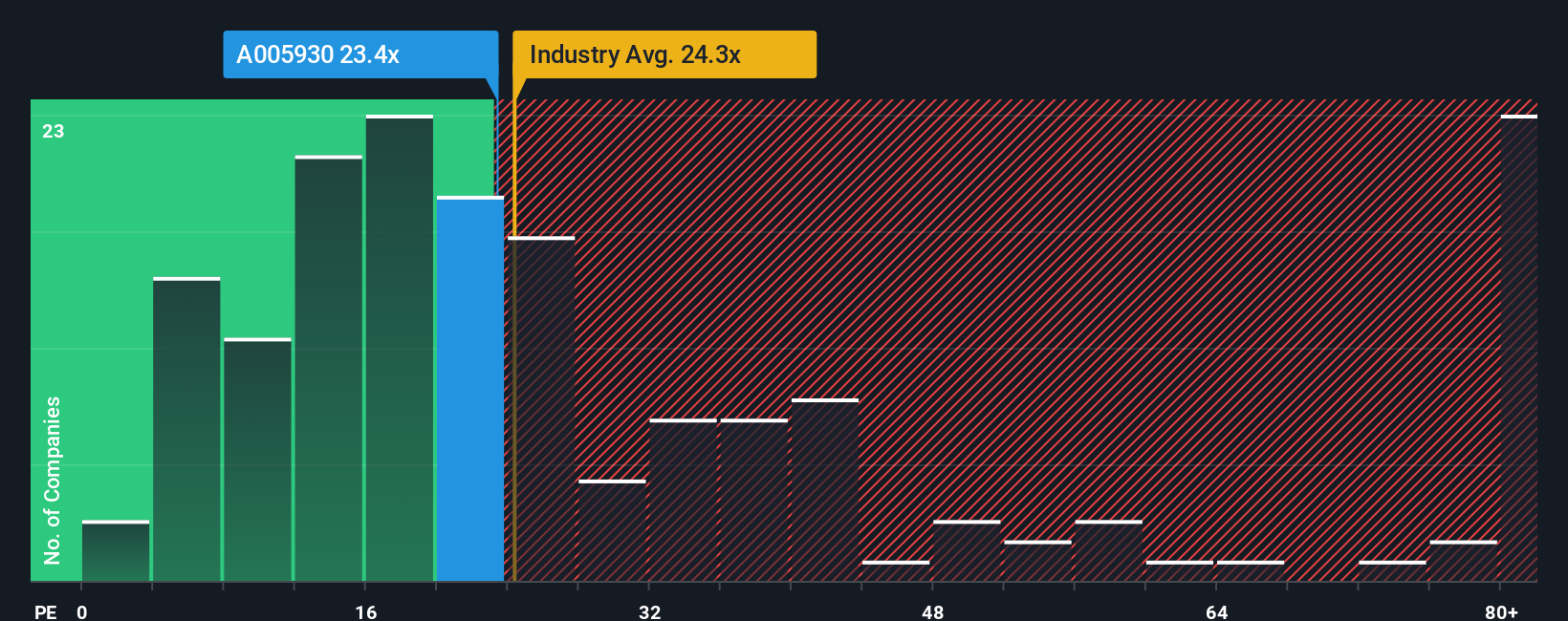

Samsung screens as expensive on earnings, trading on a 24.7x P/E versus 15.4x for peers and 22.7x for the broader Asian tech sector, even though its own fair ratio is estimated at 44.8x. That premium can reward believers in the narrative, but it also raises the question of what happens if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Samsung Electronics Narrative

If you see the numbers differently, or simply want to test your own thesis, you can build a custom Samsung narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Samsung Electronics.

Looking for your next investing move?

Samsung might be in the spotlight today, but your next big winner could be waiting in the data, so do not leave the rest of the market unchecked.

- Capture early-stage momentum by targeting quality growth with these 3590 penny stocks with strong financials that still fly under most investors’ radars.

- Strengthen your portfolio’s income engine using these 15 dividend stocks with yields > 3% that can help support returns even when markets turn choppy.

- Position yourself ahead of the next computing revolution through these 27 quantum computing stocks shaping tomorrow’s breakthroughs today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A005930

Samsung Electronics

Engages in the consumer electronics, information technology and mobile communications, and device solutions businesses worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)