- Japan

- /

- Commercial Services

- /

- TSE:4384

Unearthing Undiscovered Gems with Potential This December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets present a mixed landscape with major indices like the S&P 500 and Nasdaq Composite hitting record highs, while small-cap stocks in the Russell 2000 experience a pullback. This divergence highlights the importance of identifying promising opportunities within overlooked segments, where undiscovered gems may offer potential growth despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Forest Packaging GroupLtd | 17.72% | 2.87% | -6.03% | ★★★★★★ |

| Shandong Boyuan Pharmaceutical & Chemical | NA | 28.20% | 32.92% | ★★★★★★ |

| Tibet Development | 51.47% | -1.07% | 56.62% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

YC (KOSDAQ:A232140)

Simply Wall St Value Rating: ★★★★★★

Overview: YC Corporation develops, manufactures, and sells inspection equipment for semiconductor memories in South Korea and internationally, with a market cap of ₩782.99 billion.

Operations: YC Corporation's revenue is primarily derived from the sale of inspection equipment for semiconductor memories. The company's financial performance includes a focus on cost management and profitability, with particular attention to its gross profit margin trends over time.

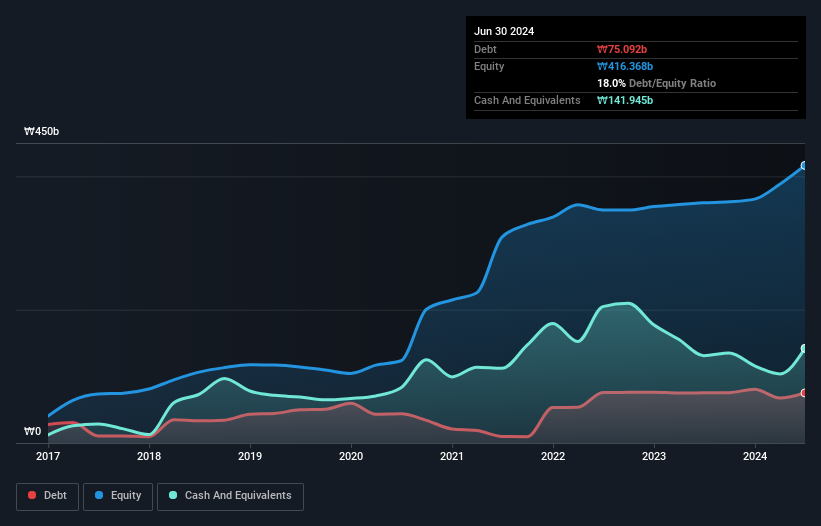

YC, a small player in the semiconductor space, presents an intriguing mix of financial strengths and challenges. Over the past five years, its debt to equity ratio has significantly decreased from 46.3% to 20.6%, highlighting improved financial leverage. Despite possessing high-quality earnings and having more cash than total debt, free cash flow remains negative. The company's share price has been highly volatile recently, which might concern some investors. However, with projected earnings growth of 55% annually and solid interest coverage capabilities, YC seems poised for potential future expansion despite recent hurdles in earnings growth compared to industry averages.

- Click to explore a detailed breakdown of our findings in YC's health report.

Examine YC's past performance report to understand how it has performed in the past.

Raksul (TSE:4384)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Raksul Inc. is a Japanese company that offers printing services and has a market capitalization of approximately ¥64.37 billion.

Operations: Raksul generates revenue primarily from its printing services, with the Raksul segment contributing ¥47.11 billion and Novasell adding ¥2.50 billion.

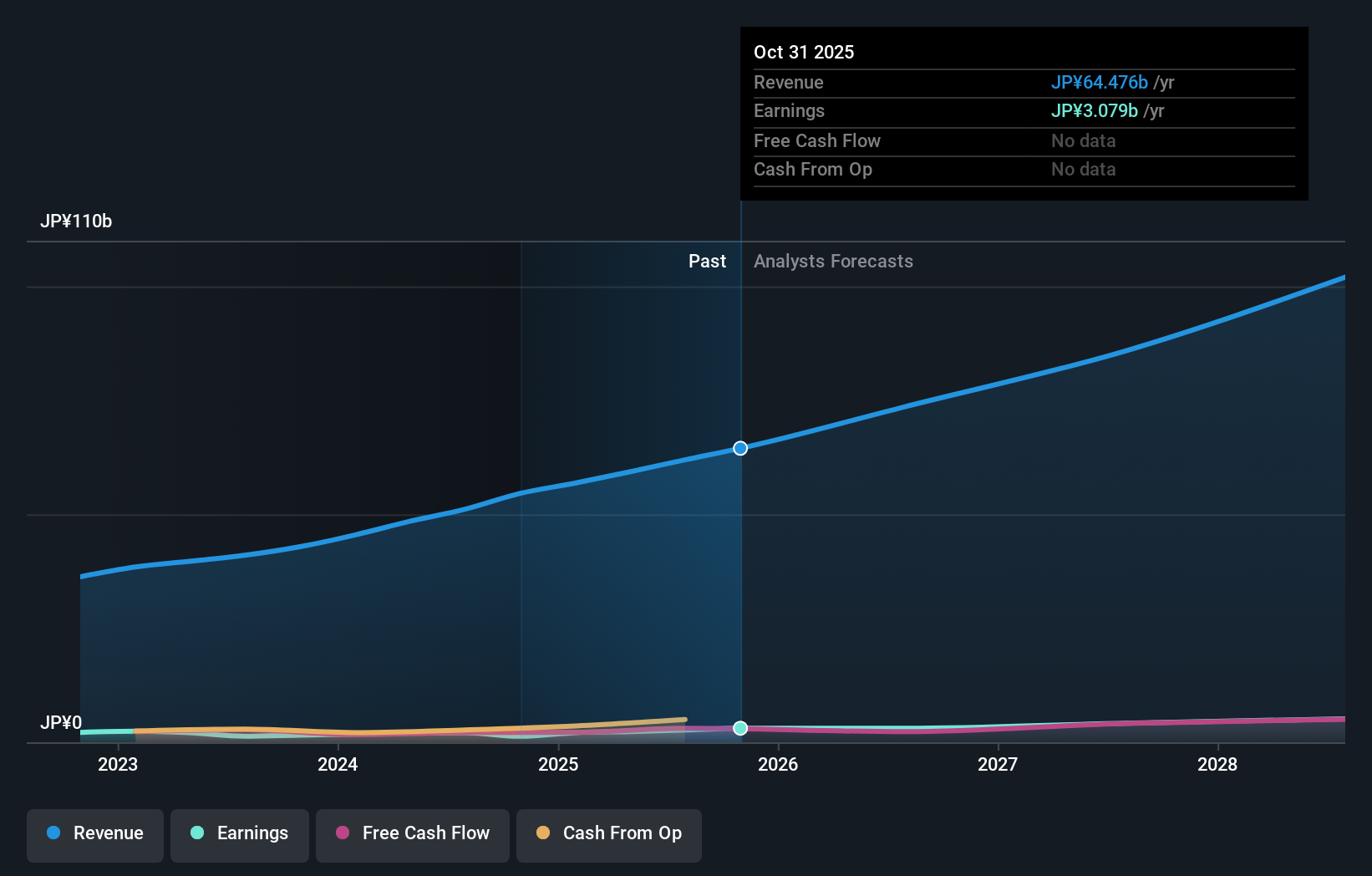

Raksul, a dynamic player in its sector, has seen a robust earnings growth of 59.4% over the past year, significantly outpacing the industry average of 9.1%. Its financial health is underscored by a satisfactory net debt to equity ratio of 8.8%, and interest payments are well covered with an EBIT coverage ratio of 48.5x. Despite this progress, Raksul's share price has been highly volatile recently. The company announced a buyback program for up to ¥700 million worth of shares to enhance profitability and capital efficiency while planning strategic business expansions through an incorporation-type split with Elastic Infra Inc., set for April 2025.

- Dive into the specifics of Raksul here with our thorough health report.

Explore historical data to track Raksul's performance over time in our Past section.

Smaregi (TSE:4431)

Simply Wall St Value Rating: ★★★★★★

Overview: Smaregi, Inc. is engaged in the planning, design, development, and provision of Internet services with a market capitalization of ¥61.36 billion.

Operations: The primary revenue stream for Smaregi comes from its Cloud Service Business, generating ¥9.09 billion.

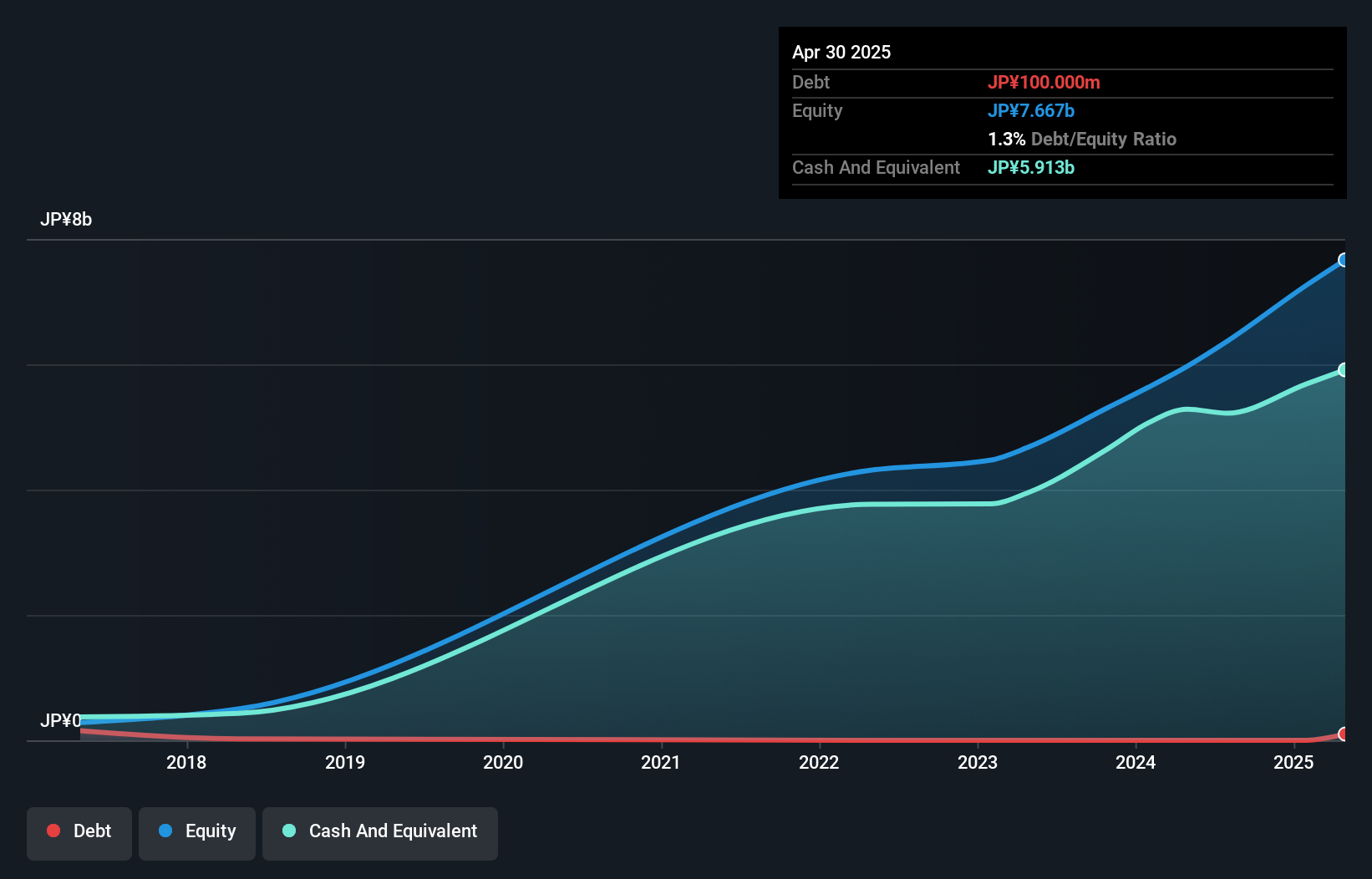

Smaregi stands out with impressive earnings growth of 46.9% over the past year, surpassing the Software industry's average of 13.5%. This company is debt-free, a notable improvement from five years ago when its debt-to-equity ratio was 1%. Additionally, Smaregi's levered free cash flow reached A$1.35 billion as of April 2024, highlighting its strong financial health and operational efficiency. Despite recent share price volatility over the last three months, Smaregi's high-quality earnings and positive cash flow position it well within its sector for potential future growth at an estimated rate of 18.69% annually.

- Unlock comprehensive insights into our analysis of Smaregi stock in this health report.

Assess Smaregi's past performance with our detailed historical performance reports.

Key Takeaways

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4623 more companies for you to explore.Click here to unveil our expertly curated list of 4626 Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4384

Reasonable growth potential with adequate balance sheet.