- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6745

Jiuzhitang And 2 Other Small Cap Gems With Promising Fundamentals

Reviewed by Simply Wall St

As global markets show signs of resilience with easing inflation and strong earnings reports, the S&P MidCap 400 and Russell 2000 indices have posted notable gains, highlighting investor interest in smaller-cap stocks. In this environment, identifying stocks with solid fundamentals becomes crucial for investors looking to capitalize on potential growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| L&K Engineering | 14.36% | 37.26% | 54.49% | ★★★★★★ |

| Sesoda | 71.33% | 11.54% | 15.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 35.98% | -1.56% | 50.16% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| China Electric Mfg | 13.74% | -13.57% | -32.70% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 45.76% | 269.05% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Nestlé Pakistan | 40.95% | 14.04% | 17.18% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

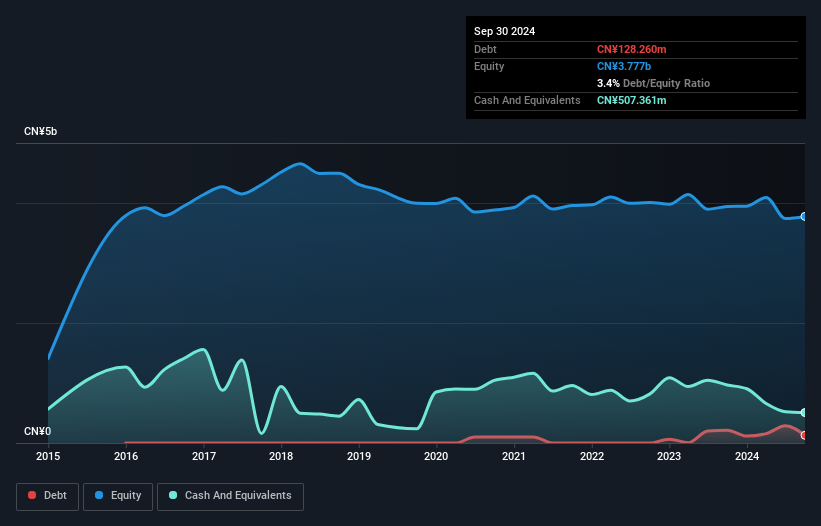

Jiuzhitang (SZSE:000989)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiuzhitang Co., Ltd. is a company that offers traditional Chinese, chemical, biological, and health medicine products in China with a market cap of CN¥6.67 billion.

Operations: The company generates revenue primarily from traditional Chinese, chemical, biological, and health medicine products. It has a market cap of CN¥6.67 billion.

Jiuzhitang, a notable player in the pharmaceutical sector, has recently seen a strategic move with Heilongjiang Chenneng Gongda Venture Capital acquiring an additional 6.25% stake for approximately ¥380 million, increasing its ownership to 24.04%. The company also completed a share buyback of 9.66 million shares for ¥76.21 million by December 2024. Despite these activities, Jiuzhitang's earnings have faced challenges; net income for the nine months ended September 2024 was ¥240.3 million compared to ¥288.74 million the previous year, while basic earnings per share dipped from ¥0.34 to ¥0.28 during this period.

- Delve into the full analysis health report here for a deeper understanding of Jiuzhitang.

Gain insights into Jiuzhitang's historical performance by reviewing our past performance report.

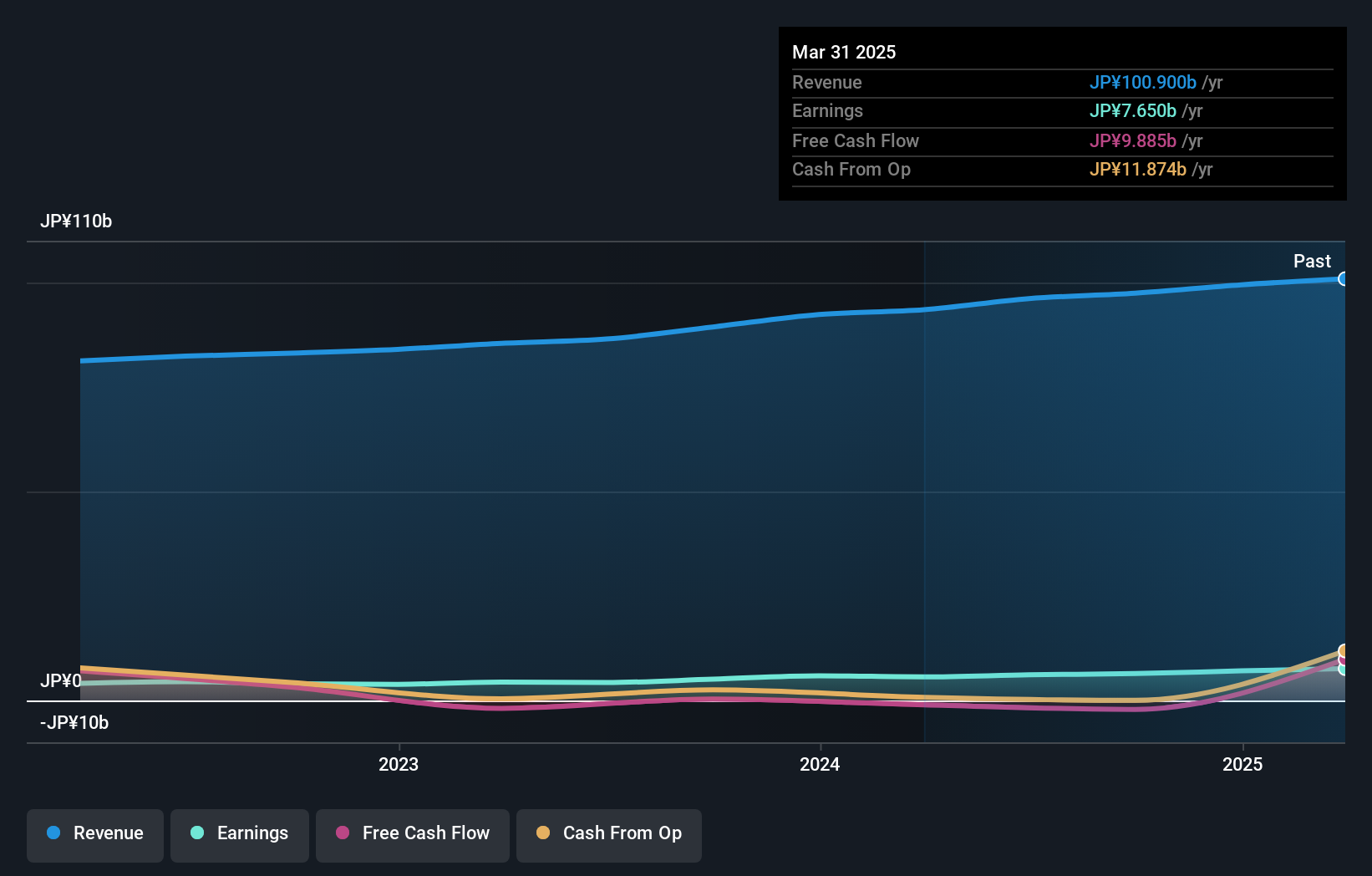

Hochiki (TSE:6745)

Simply Wall St Value Rating: ★★★★★★

Overview: Hochiki Corporation is involved in the research, development, manufacture, sale, consulting, engineering, design, and maintenance of fire alarm and security systems both in Japan and internationally with a market cap of ¥63.22 billion.

Operations: Hochiki generates revenue primarily from its Fire Prevention Business, amounting to ¥72.30 billion. The company's market cap stands at ¥63.22 billion.

Hochiki, a promising player in the electronics sector, has demonstrated impressive financial health with its earnings growing 26.3% over the past year, outpacing the industry average of -0.2%. The company is debt-free now compared to five years ago when it had a debt-to-equity ratio of 2.2%, reflecting prudent management. Its price-to-earnings ratio stands at 9.8x, which is attractive against Japan's market average of 13.5x, suggesting potential undervaluation. Despite not being free cash flow positive recently and having high non-cash earnings levels, Hochiki’s forecasted growth rate of nearly 4% per year indicates steady future prospects.

- Get an in-depth perspective on Hochiki's performance by reading our health report here.

Understand Hochiki's track record by examining our Past report.

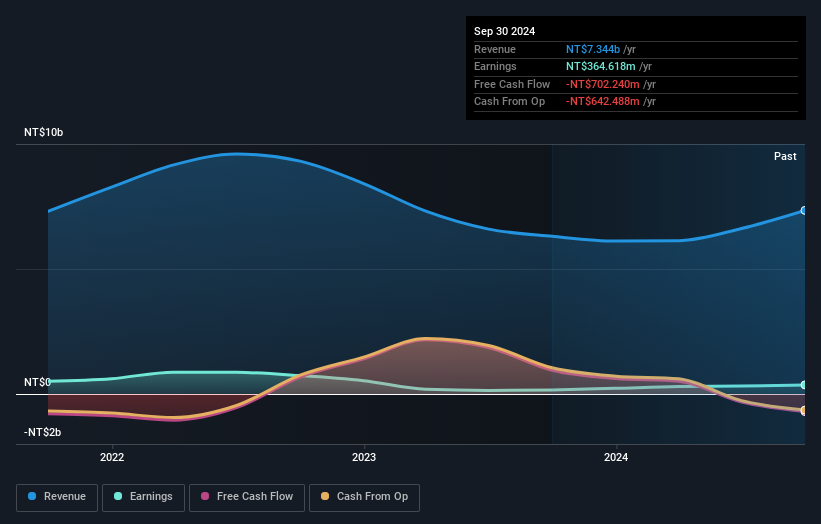

Shenmao Technology (TWSE:3305)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenmao Technology Inc., along with its subsidiaries, specializes in the manufacturing and sale of solder materials across Taiwan, Mainland China, Thailand, Malaysia, and other international markets with a market capitalization of NT$8.67 billion.

Operations: Shenmao Technology generates significant revenue from its operations in Mainland China and Taiwan, with Mainland China contributing NT$5.17 billion and Taiwan NT$2.43 billion.

Shenmao Technology, a nimble player in its industry, has shown impressive financial strides recently. Earnings surged by 121% over the past year, outpacing the Machinery sector's growth of 14.6%. This growth is backed by well-covered interest payments with an EBIT coverage of 10.3 times and a satisfactory net debt to equity ratio at 39.9%. However, over five years, its debt to equity ratio climbed from 59.7% to 73.9%, indicating rising leverage concerns. Recent quarterly sales reached TWD 2,367 million compared to TWD 1,641 million last year with net income jumping from TWD 76 million to TWD 125 million this quarter.

- Click here to discover the nuances of Shenmao Technology with our detailed analytical health report.

Evaluate Shenmao Technology's historical performance by accessing our past performance report.

Seize The Opportunity

- Explore the 4647 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hochiki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6745

Hochiki

Engages in the research and development, manufacture, sale, consulting, engineering, design, and maintenance of fire alarm systems, information and communication, fire extinguishing, crime prevention systems, and network and security systems.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion