As global markets continue to navigate the complexities of cooling inflation and strong earnings reports, major U.S. stock indexes have shown resilience with notable gains, particularly in value stocks and the financial sector. In this dynamic environment, dividend stocks offer a compelling option for investors seeking steady income streams amid fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.07% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.97% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.59% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.91% | ★★★★★★ |

Click here to see the full list of 1978 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Mitsubishi Gas Chemical Company (TSE:4182)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsubishi Gas Chemical Company, Inc. operates in Japan, focusing on the manufacturing and sale of basic and fine chemicals as well as functional materials, with a market cap of ¥554.85 billion.

Operations: Mitsubishi Gas Chemical Company, Inc. generates revenue from its Specialty Chemicals segment with ¥437.94 billion and Green Energy & Chemicals segment contributing ¥367.42 billion.

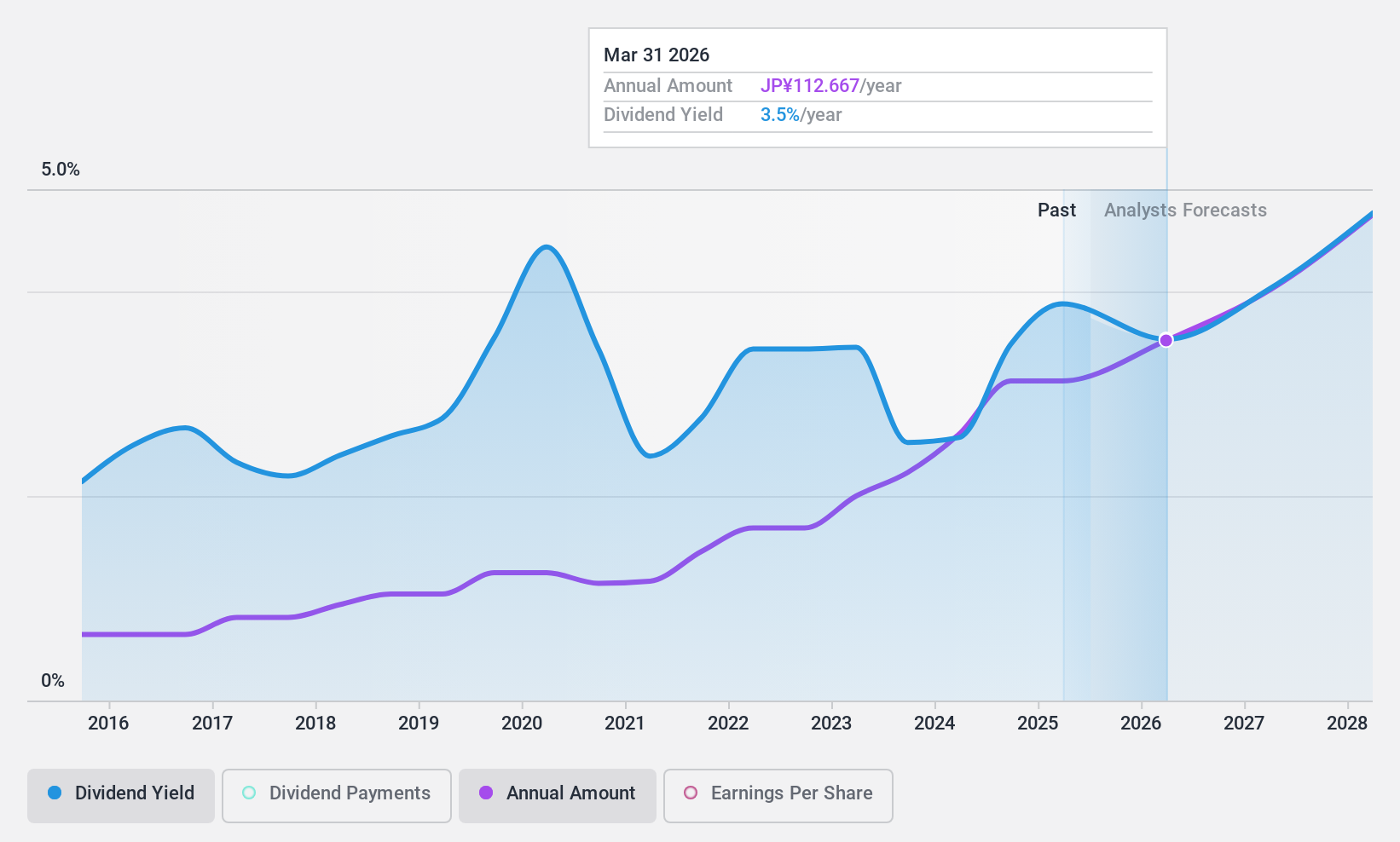

Dividend Yield: 3.6%

Mitsubishi Gas Chemical Company offers a stable dividend history with a 10-year track record of reliable payments, although its current yield of 3.56% is below the top tier in Japan. The payout ratio is reasonable at 52.9%, but dividends are not supported by free cash flow, raising sustainability concerns. Recent share buybacks and increased dividends signal shareholder value focus, yet profit margins have declined slightly to 4%.

- Click here to discover the nuances of Mitsubishi Gas Chemical Company with our detailed analytical dividend report.

- According our valuation report, there's an indication that Mitsubishi Gas Chemical Company's share price might be on the expensive side.

Oiles (TSE:6282)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oiles Corporation manufactures and sells bearings, structural equipment, and construction equipment both in Japan and internationally, with a market cap of ¥74.45 billion.

Operations: Oiles Corporation's revenue segments include General Bearing Equipment at ¥14.48 billion, Automotive Bearing Equipment at ¥33.76 billion, Structural Equipment at ¥13.82 billion, and Construction Equipment at ¥6.20 billion.

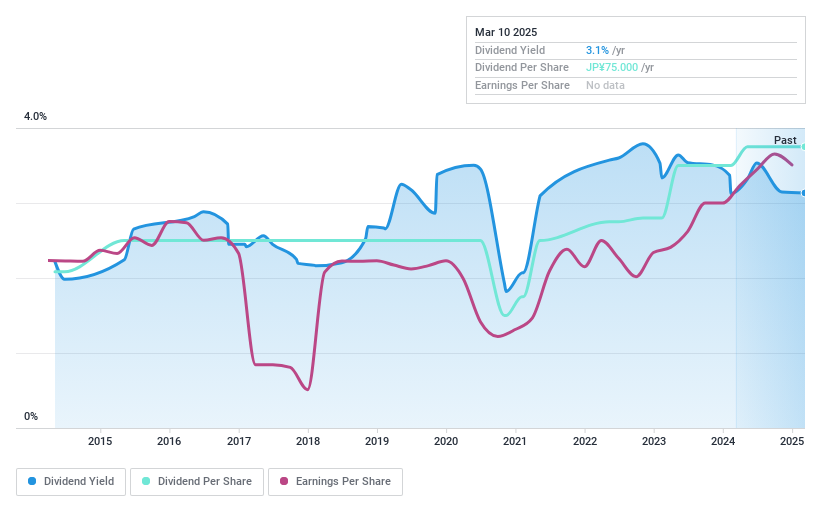

Dividend Yield: 3.1%

Oiles Corporation's dividend payments are well covered by both earnings and cash flows, with payout ratios of 38.3% and 36.2%, respectively. However, the dividend track record has been volatile over the past decade, impacting reliability. Despite trading significantly below estimated fair value, its yield of 3.05% is lower than top-tier Japanese dividend payers. Recent buybacks totaling ¥684.14 million aim to enhance shareholder returns amid raised earnings guidance for fiscal year-end March 2025.

- Unlock comprehensive insights into our analysis of Oiles stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Oiles is priced lower than what may be justified by its financials.

Toyota Tsusho (TSE:8015)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Toyota Tsusho Corporation operates globally across various sectors including metals, parts and logistics, mobility, machinery, energy and projects, chemicals and electronics, as well as food and consumer services; it has a market cap of approximately ¥2.80 trillion.

Operations: Toyota Tsusho Corporation's revenue is derived from its operations in the metals, parts and logistics, mobility, machinery, energy and project sectors, chemicals and electronics, along with food and consumer services.

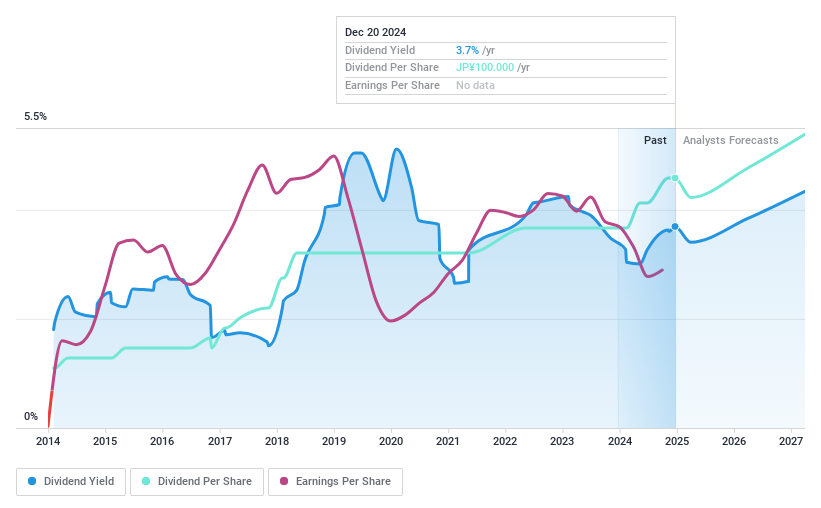

Dividend Yield: 3.7%

Toyota Tsusho's dividend payments are well covered by earnings and cash flows, with payout ratios of 29.4% and 35.3%, respectively. Despite this coverage, the dividends have been volatile over the past decade, affecting reliability. The stock trades at a favorable price-to-earnings ratio of 8.4x compared to the JP market average of 13.5x, yet its yield of 3.74% is slightly below top-tier Japanese dividend payers' standards (3.82%).

- Delve into the full analysis dividend report here for a deeper understanding of Toyota Tsusho.

- Insights from our recent valuation report point to the potential undervaluation of Toyota Tsusho shares in the market.

Key Takeaways

- Click this link to deep-dive into the 1978 companies within our Top Dividend Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4182

Mitsubishi Gas Chemical Company

Manufactures and sells basic and fine chemicals, and functional materials in Japan.

Excellent balance sheet average dividend payer.