As global markets experience a rebound, driven by cooling inflation and strong earnings in the U.S., investors are increasingly focused on value stocks, which have recently outperformed growth shares. In this environment, identifying undervalued stocks can be a strategic approach to leverage market conditions where sectors like financials and energy show robust performance.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Livero (TSE:9245) | ¥1558.00 | ¥3105.30 | 49.8% |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$526.96 | 49.8% |

| Strike CompanyLimited (TSE:6196) | ¥3595.00 | ¥7189.64 | 50% |

| Fevertree Drinks (AIM:FEVR) | £6.575 | £13.12 | 49.9% |

| Solum (KOSE:A248070) | ₩18700.00 | ₩37346.38 | 49.9% |

| North Electro-OpticLtd (SHSE:600184) | CN¥10.81 | CN¥21.57 | 49.9% |

| Vestas Wind Systems (CPSE:VWS) | DKK92.60 | DKK184.75 | 49.9% |

| ASMPT (SEHK:522) | HK$75.15 | HK$150.05 | 49.9% |

| St. James's Place (LSE:STJ) | £9.315 | £18.60 | 49.9% |

| Condor Energies (TSX:CDR) | CA$1.82 | CA$3.63 | 49.8% |

We'll examine a selection from our screener results.

Best Pacific International Holdings (SEHK:2111)

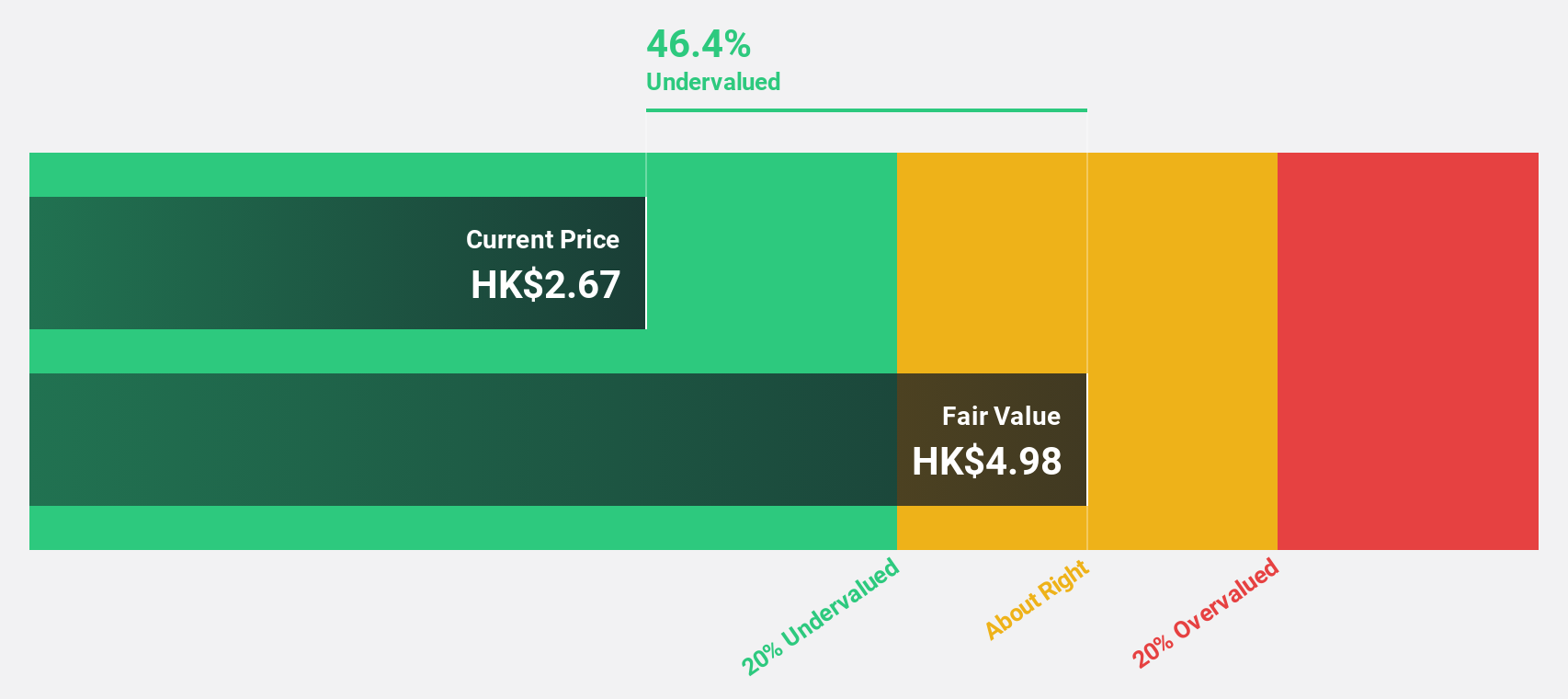

Overview: Best Pacific International Holdings Limited, along with its subsidiaries, is engaged in the manufacturing, trading, and selling of elastic fabric, elastic webbing, and lace with a market capitalization of HK$3.07 billion.

Operations: The company's revenue segments include HK$915.53 million from the manufacturing and trading of elastic webbing and HK$3.76 billion from elastic fabric and lace.

Estimated Discount To Fair Value: 46.5%

Best Pacific International Holdings is trading at HK$2.96, significantly below its estimated fair value of HK$5.54, indicating it may be undervalued based on cash flows. Despite a history of unstable dividends, the company shows strong earnings growth potential with forecasts exceeding 21% annually over the next three years. Although revenue growth is slower than 20%, it surpasses the Hong Kong market average, and recent earnings surged by 80.3%, highlighting robust financial health amidst undervaluation concerns.

- Our expertly prepared growth report on Best Pacific International Holdings implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Best Pacific International Holdings here with our thorough financial health report.

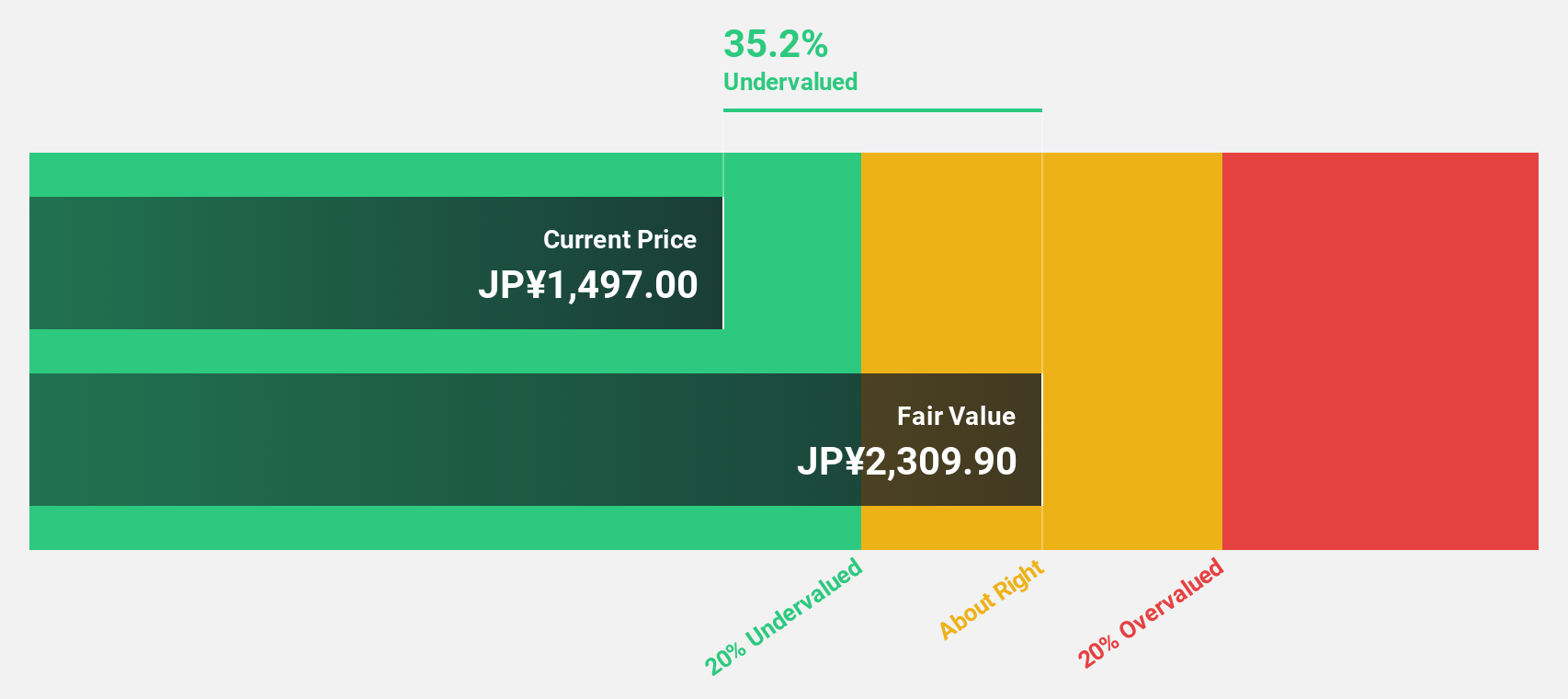

Avant Group (TSE:3836)

Overview: Avant Group Corporation, with a market cap of ¥69.88 billion, operates through its subsidiaries to offer accounting, business intelligence, and outsourcing services.

Operations: The company's revenue segments include the Group Governance Business with ¥7.88 billion, Management Solutions Business at ¥8.96 billion, and Digital Transformation Business totaling ¥9.16 billion.

Estimated Discount To Fair Value: 48.8%

Avant Group is trading at ¥1926, considerably below its estimated fair value of ¥3763.65, suggesting potential undervaluation based on cash flows. While revenue growth is projected at 15.8% annually—slower than 20%—it outpaces the Japanese market average. Earnings are expected to grow 18.1% per year, exceeding the market's forecasted growth rate of 8%. Despite recent share price volatility, Avant Group's strong return on equity and completed buyback program underscore its financial resilience.

- Upon reviewing our latest growth report, Avant Group's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Avant Group with our comprehensive financial health report here.

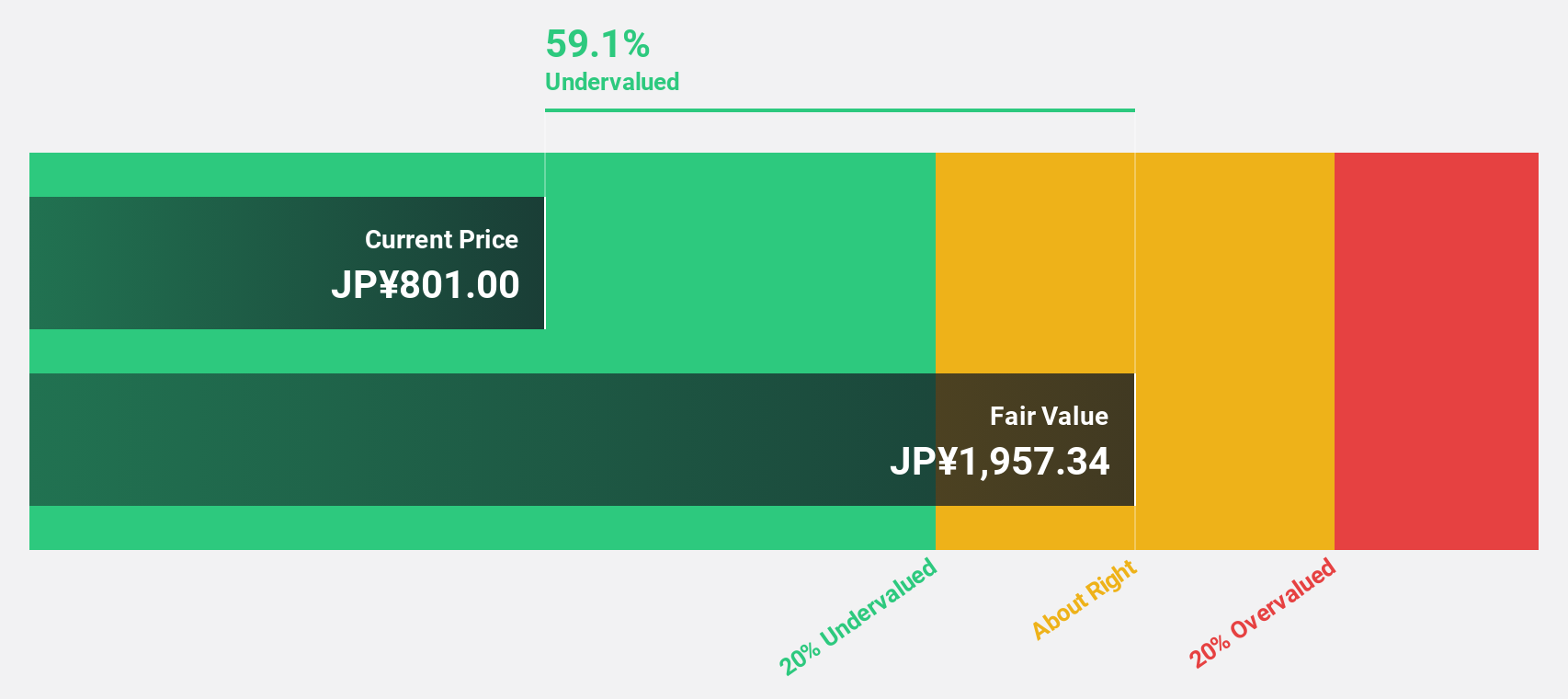

Takara Bio (TSE:4974)

Overview: Takara Bio Inc., with a market cap of ¥123.55 billion, operates in the bioindustry, contract development and manufacturing organization (CDMO), and gene therapy sectors across Japan, China, the rest of Asia, the United States, Europe, and internationally.

Operations: The company's revenue segments include ¥44.15 billion from its Drug Discovery Company division.

Estimated Discount To Fair Value: 40.6%

Takara Bio, trading at ¥1017, is significantly undervalued with a fair value estimate of ¥1711.93. Its earnings are forecast to grow 26% annually over the next three years, surpassing the Japanese market's growth rate of 8%. Despite recent profit margin declines from 13.2% to 2.1%, Takara Bio's revenue is expected to increase by 5.3% per year, outpacing the market average of 4.3%, highlighting potential for recovery and growth based on cash flows.

- The growth report we've compiled suggests that Takara Bio's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Takara Bio's balance sheet health report.

Seize The Opportunity

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 873 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takara Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4974

Takara Bio

Engages in bioindustry, contract development and manufacturing organization (CDMO), and gene therapy businesses in Japan, China, rest of Asia, the United States, Europe, and internationally.

Flawless balance sheet with reasonable growth potential.