Undiscovered Gems And 2 Other Hidden Small Caps With Strong Potential

Reviewed by Simply Wall St

In a week marked by easing core inflation and robust bank earnings, major U.S. stock indexes rebounded, with small-cap indices like the S&P MidCap 400 showing notable strength. As investors navigate these dynamic market conditions, identifying promising small-cap stocks requires a keen eye for companies that can leverage current economic trends to drive growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

NICE Information Service (KOSE:A030190)

Simply Wall St Value Rating: ★★★★★☆

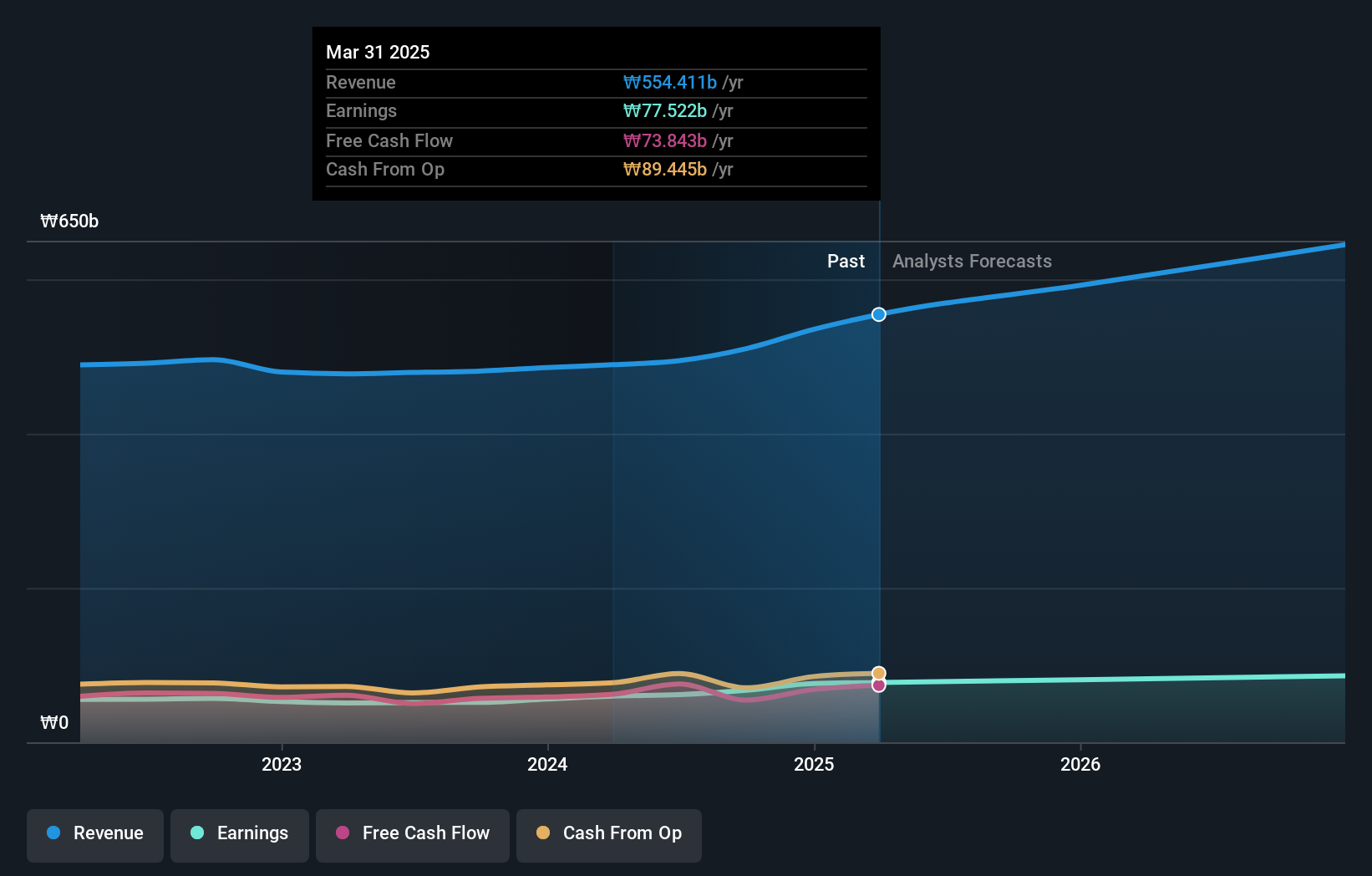

Overview: NICE Information Service Co., Ltd. is a South Korean company that offers credit evaluation, credit inquiries, credit investigations, and debt collection services with a market cap of approximately ₩715.40 billion.

Operations: The company's primary revenue streams include corporate and personal credit information services, generating approximately ₩432.83 billion, and debt collection services, contributing around ₩71.50 billion.

NICE Information Service, a promising player in the financial sector, showcases robust earnings growth of 30.5% over the past year, outpacing its industry peers. Trading at a notable 37.5% below estimated fair value, it offers an attractive prospect for investors seeking undervalued opportunities. The company reported net income of KRW 18.87 billion for Q3 2024 compared to KRW 13.15 billion the previous year, with basic earnings per share climbing from KRW 222 to KRW 322 during this period. Additionally, their strategic repurchase of shares amounting to KRW 5.95 billion underscores confidence in their long-term potential and stability.

Smaregi (TSE:4431)

Simply Wall St Value Rating: ★★★★★★

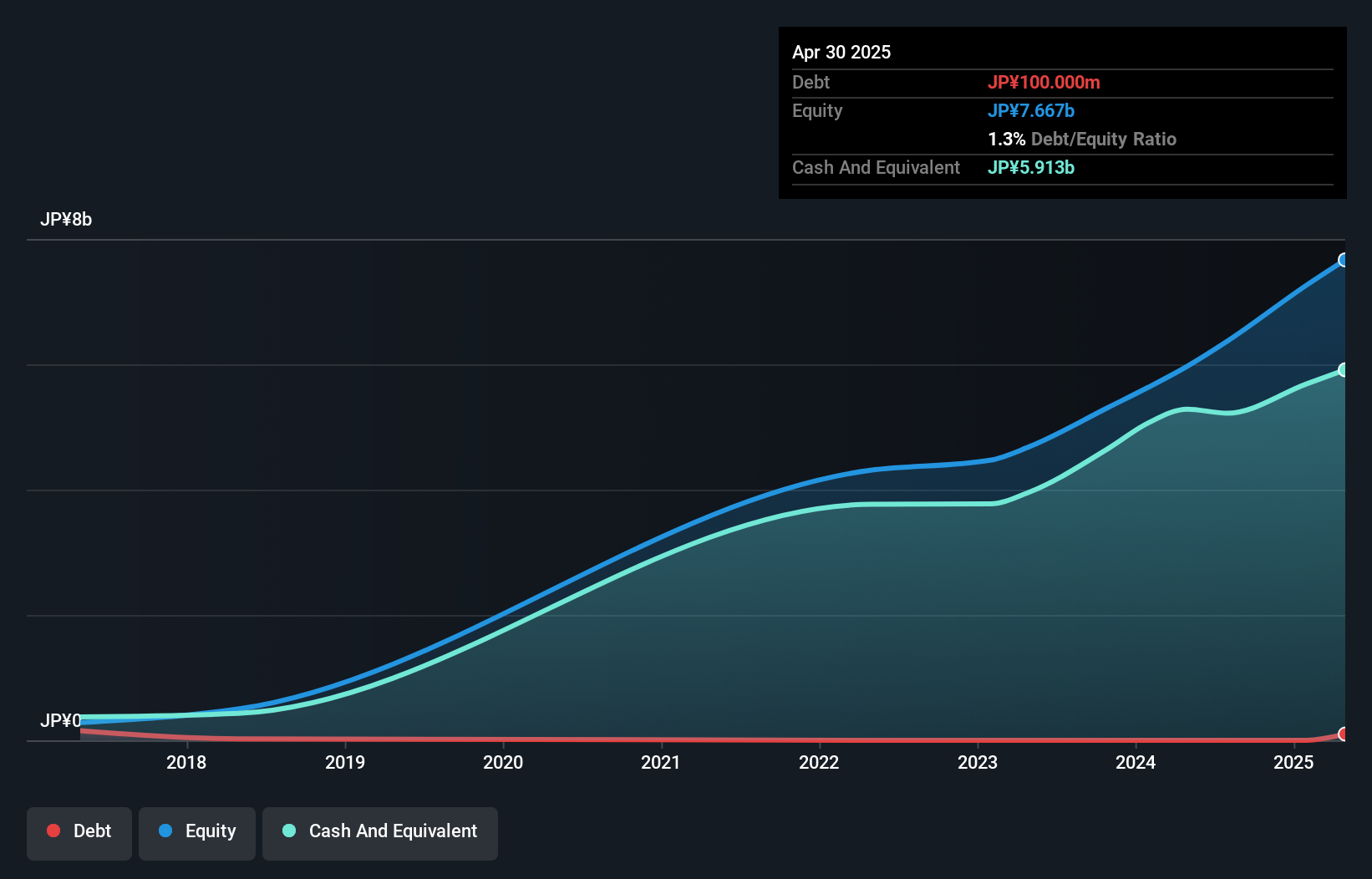

Overview: Smaregi, Inc. plans, designs, develops, and provides Internet services with a market capitalization of ¥53.86 billion.

Operations: Smaregi generates revenue primarily from its Cloud Service Business, which amounted to ¥9.09 billion. The company's financial strategy involves focusing on this segment as a key revenue driver.

Smaregi, a nimble player in the tech sector, showcases impressive growth with earnings surging 46.9% over the past year, outpacing the software industry's 12.1%. The company operates debt-free, eliminating concerns about interest payments and highlighting its robust financial health. Despite recent share price volatility, Smaregi's high-quality earnings and positive free cash flow reflect strong operational performance. With a strategic focus on long-term growth through its VISION2031 plan and a newly announced JPY 15 per share dividend for fiscal year-end April 2025, Smaregi is poised to balance shareholder returns with sustainable business expansion.

- Click here and access our complete health analysis report to understand the dynamics of Smaregi.

Assess Smaregi's past performance with our detailed historical performance reports.

OptorunLtd (TSE:6235)

Simply Wall St Value Rating: ★★★★★★

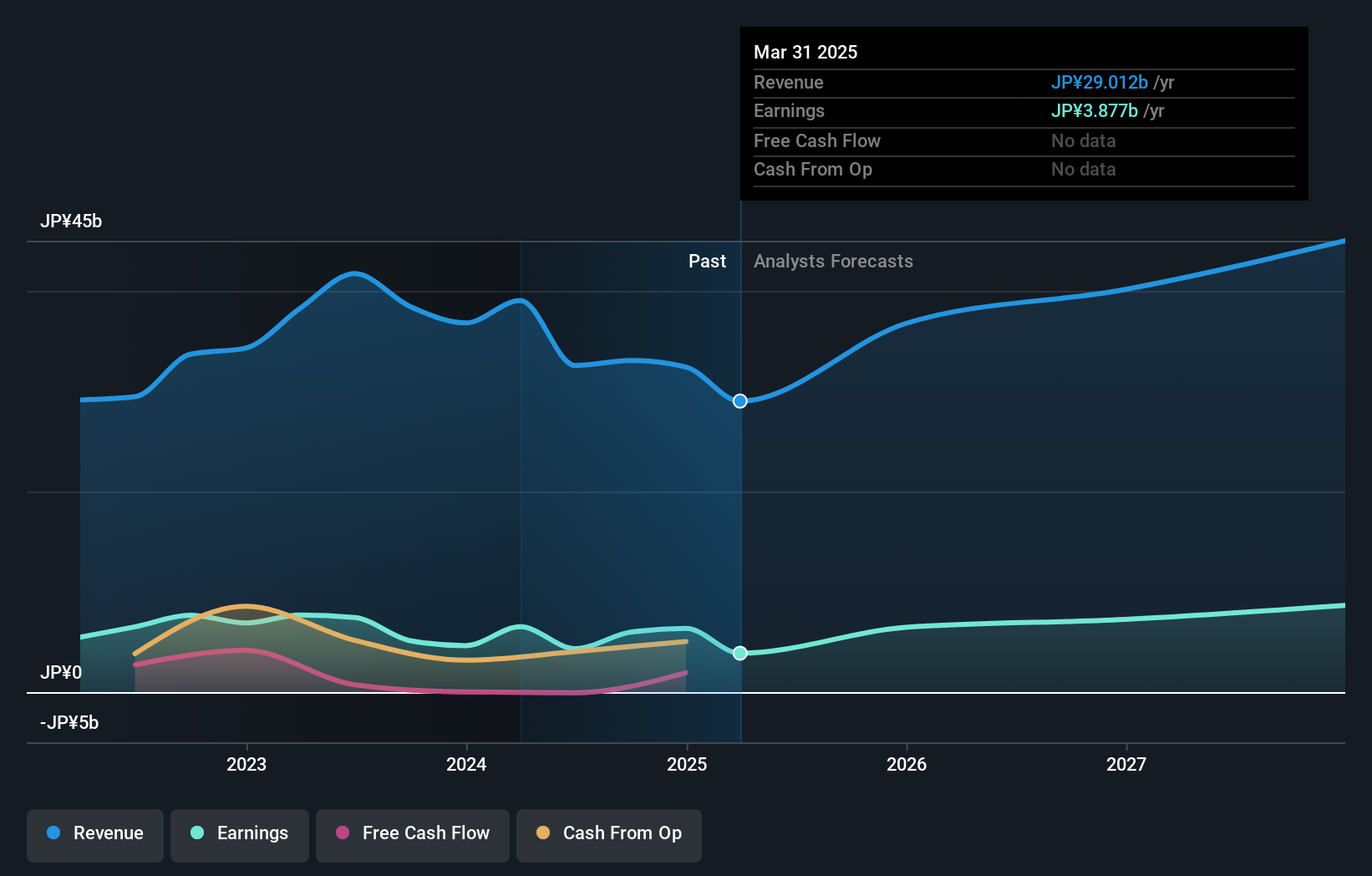

Overview: Optorun Co., Ltd. is involved in the manufacture, distribution, and import/export of vacuum coating machines and related equipment in Japan with a market capitalization of ¥74.36 billion.

Operations: Optorun generates revenue primarily from its Film Deposition Equipment Business, which reported ¥33.06 billion in sales. The company's financial performance includes monitoring net profit margins, which have shown notable variations over recent periods.

OptorunLtd has been making waves with a notable 16.5% earnings growth over the past year, outpacing the Semiconductor industry average of 7.4%. This performance is bolstered by a significant one-off gain of ¥2.7 billion, impacting its recent financial results up to September 2024. The company's debt to equity ratio impressively decreased from 2% to 0.7% over five years, highlighting prudent financial management. Recently, Optorun completed a share buyback program repurchasing approximately 5.74% of its shares for ¥4.78 billion, indicating confidence in its valuation and future prospects within the industry context.

- Delve into the full analysis health report here for a deeper understanding of OptorunLtd.

Evaluate OptorunLtd's historical performance by accessing our past performance report.

Make It Happen

- Gain an insight into the universe of 4652 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4431

Exceptional growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion