- Japan

- /

- Paper and Forestry Products

- /

- TSE:3877

3 Exceptional Dividend Stocks Yielding Up To 4.6%

Reviewed by Simply Wall St

As global markets experience a rebound driven by cooling inflation and strong bank earnings, investors are increasingly looking to dividend stocks as a reliable source of income amidst fluctuating economic conditions. In this context, identifying exceptional dividend stocks that offer attractive yields can provide stability and potential growth in an investment portfolio.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Financial Institutions (NasdaqGS:FISI) | 4.45% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.29% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.17% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.97% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.09% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.91% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

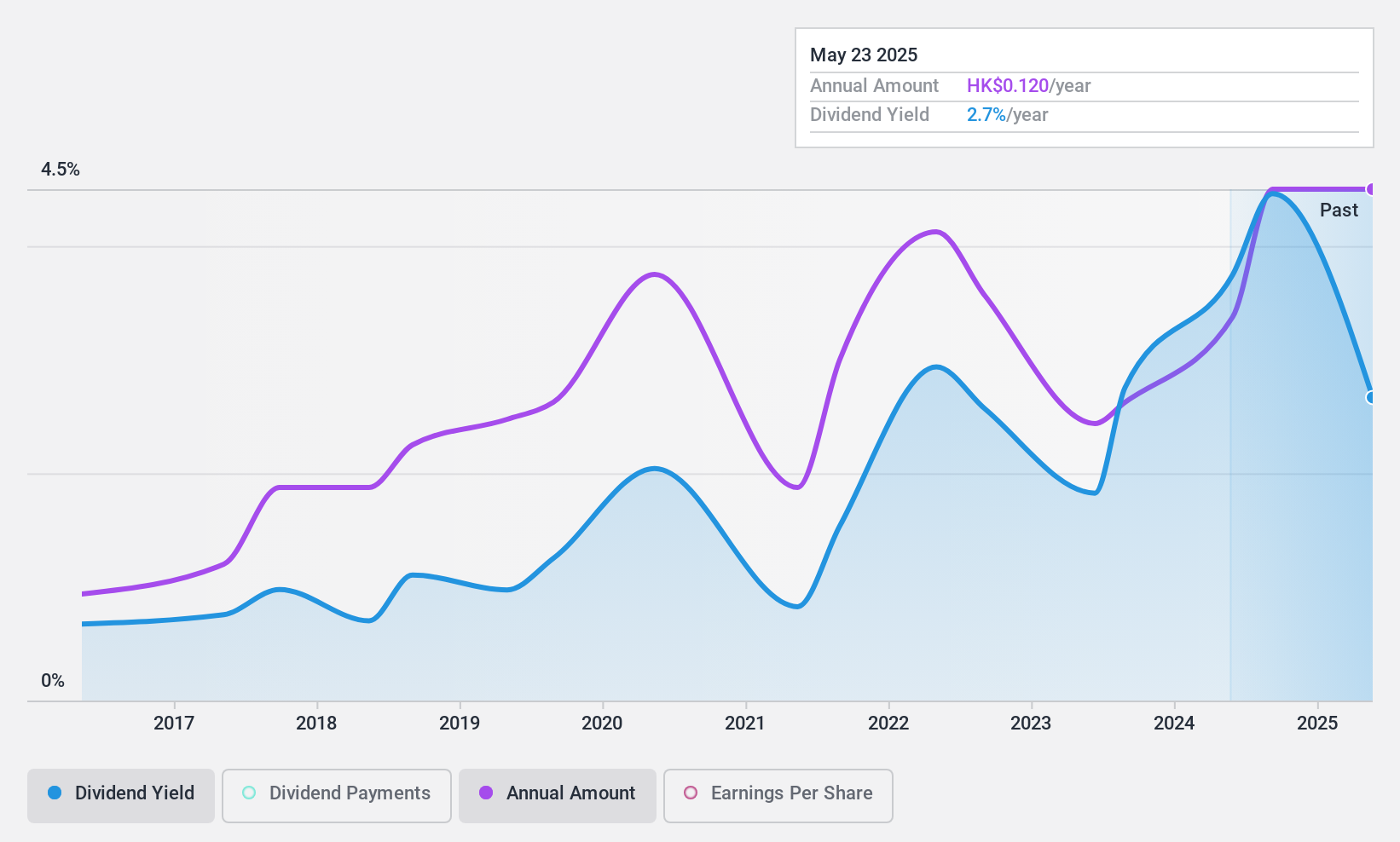

Essex Bio-Technology (SEHK:1061)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Essex Bio-Technology Limited is an investment holding company that develops, manufactures, distributes, and sells bio-pharmaceutical products in the People’s Republic of China, Hong Kong, and internationally with a market cap of HK$1.57 billion.

Operations: Essex Bio-Technology's revenue is primarily derived from its Surgical segment, which generated HK$871.44 million, and its Ophthalmology segment, with HK$747.39 million in revenue.

Dividend Yield: 4.3%

Essex Bio-Technology's dividend payments are well-covered by earnings and cash flows, with a low payout ratio of 22.7% and cash payout ratio of 32.2%. However, its dividend yield of 4.27% is modest compared to the top quartile in Hong Kong. Despite trading at a favorable price-to-earnings ratio of 6.1x, the company's dividends have been volatile over the past decade, indicating an unstable track record for income-focused investors.

- Get an in-depth perspective on Essex Bio-Technology's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Essex Bio-Technology is priced lower than what may be justified by its financials.

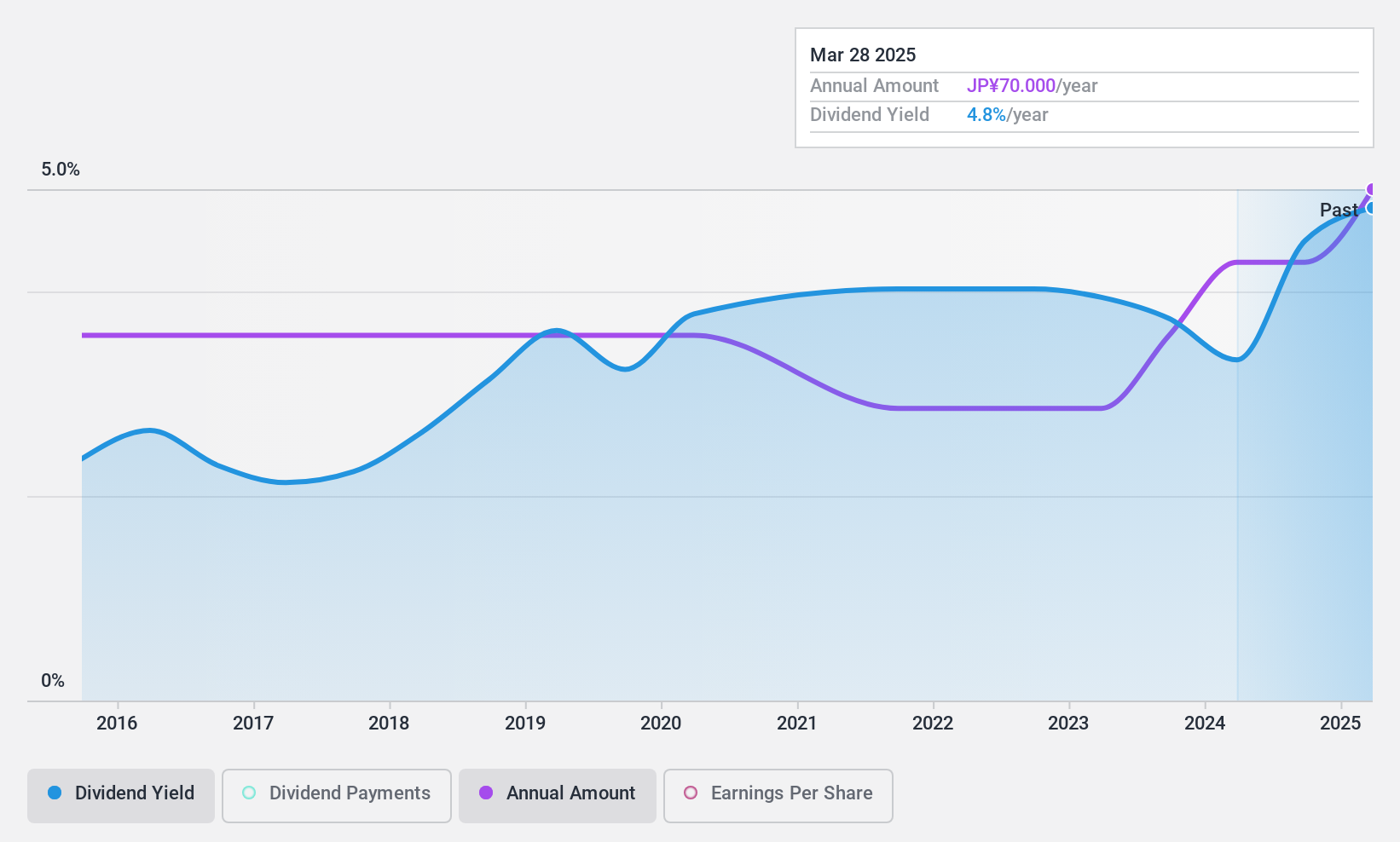

Chuetsu Pulp & Paper (TSE:3877)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chuetsu Pulp & Paper Co., Ltd. operates in the production, processing, and sale of paper, pulp, and related by-products both in Japan and internationally, with a market cap of ¥19 billion.

Operations: Chuetsu Pulp & Paper Co., Ltd.'s revenue segments include the Paper and Pulp Manufacture Business, generating ¥100.93 billion, and the Power Generation Business, contributing ¥6.11 billion.

Dividend Yield: 4.7%

Chuetsu Pulp & Paper's dividends are supported by earnings and cash flows, with payout ratios of 26.5% and 27.3%, respectively. The company offers a competitive dividend yield of 4.65%, placing it in the top quartile in Japan, though its dividend history has been volatile over the past decade. Recent guidance reports net sales of ¥112 billion and operating profit of ¥5 billion for fiscal year ending March 2025, alongside a dividend increase to ¥35 per share from ¥30 previously.

- Take a closer look at Chuetsu Pulp & Paper's potential here in our dividend report.

- According our valuation report, there's an indication that Chuetsu Pulp & Paper's share price might be on the cheaper side.

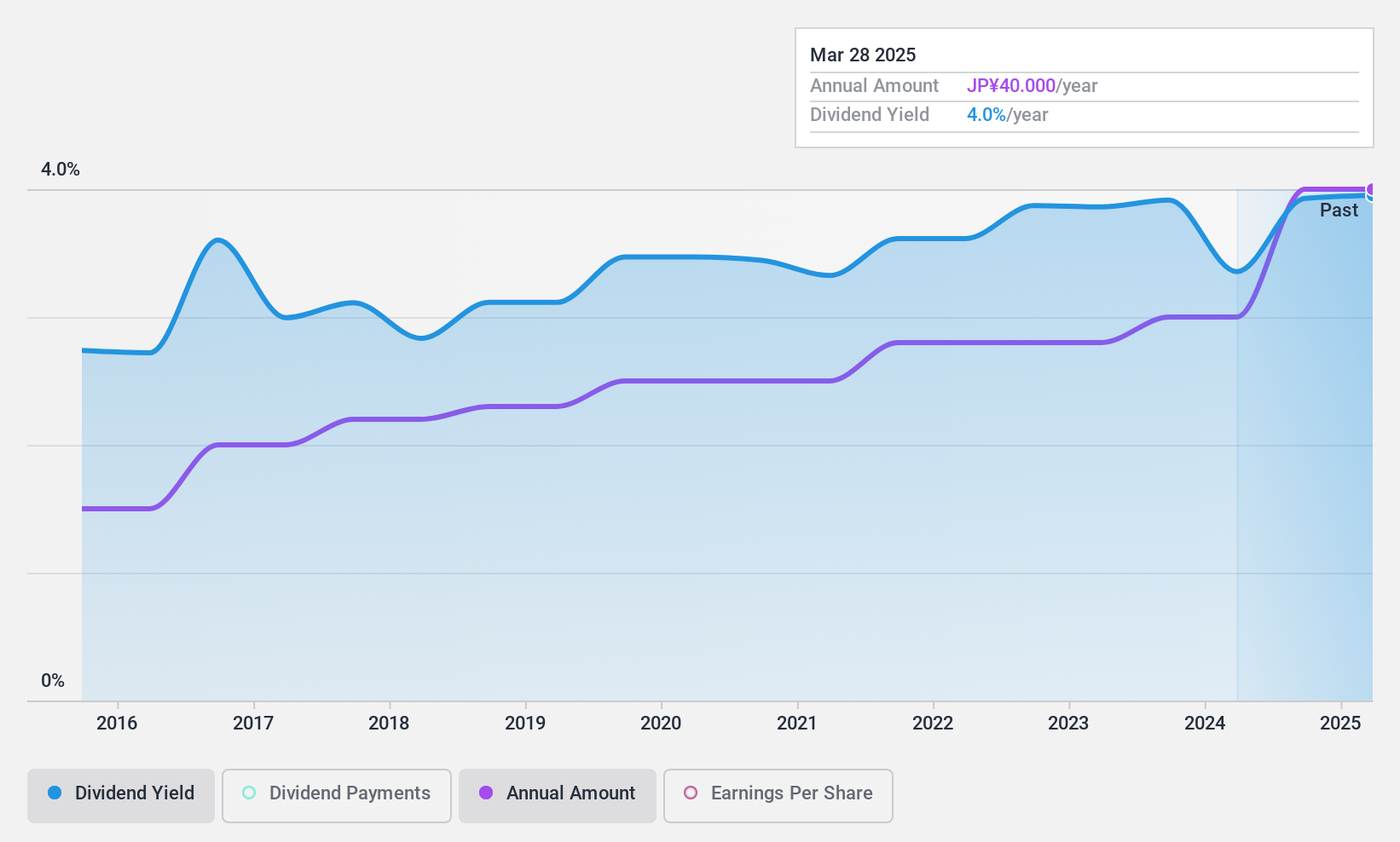

Nippon Air conditioning Services (TSE:4658)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Air Conditioning Services Co., Ltd. operates in the air conditioning services industry and has a market cap of ¥36.13 billion.

Operations: The company's revenue primarily comes from Maintenance Services and Renewal Construction, totaling ¥61.03 billion.

Dividend Yield: 3.8%

Nippon Air Conditioning Services offers a dividend yield of 3.81%, slightly below the top quartile in Japan. Despite having no free cash flows to cover dividends, its payout ratio is a manageable 48.4%. The company's dividends have been stable and growing over the past decade, supported by consistent earnings growth. Trading at a price-to-earnings ratio of 11.6x, it presents good value compared to the broader Japanese market average of 13.5x.

- Click to explore a detailed breakdown of our findings in Nippon Air conditioning Services' dividend report.

- Our valuation report here indicates Nippon Air conditioning Services may be undervalued.

Seize The Opportunity

- Take a closer look at our Top Dividend Stocks list of 1981 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3877

Chuetsu Pulp & Paper

Produces, process, and sells paper, pulp, and related by-products in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives