As global markets experience a rebound, buoyed by easing core inflation in the U.S. and strong bank earnings, investors are increasingly turning their attention to dividend stocks as a potential source of stable income amid economic fluctuations. In this environment, selecting dividend stocks with solid fundamentals and consistent payout histories can be an effective strategy for those seeking reliable returns while navigating market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Financial Institutions (NasdaqGS:FISI) | 4.45% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.29% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.17% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.97% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.09% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.91% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

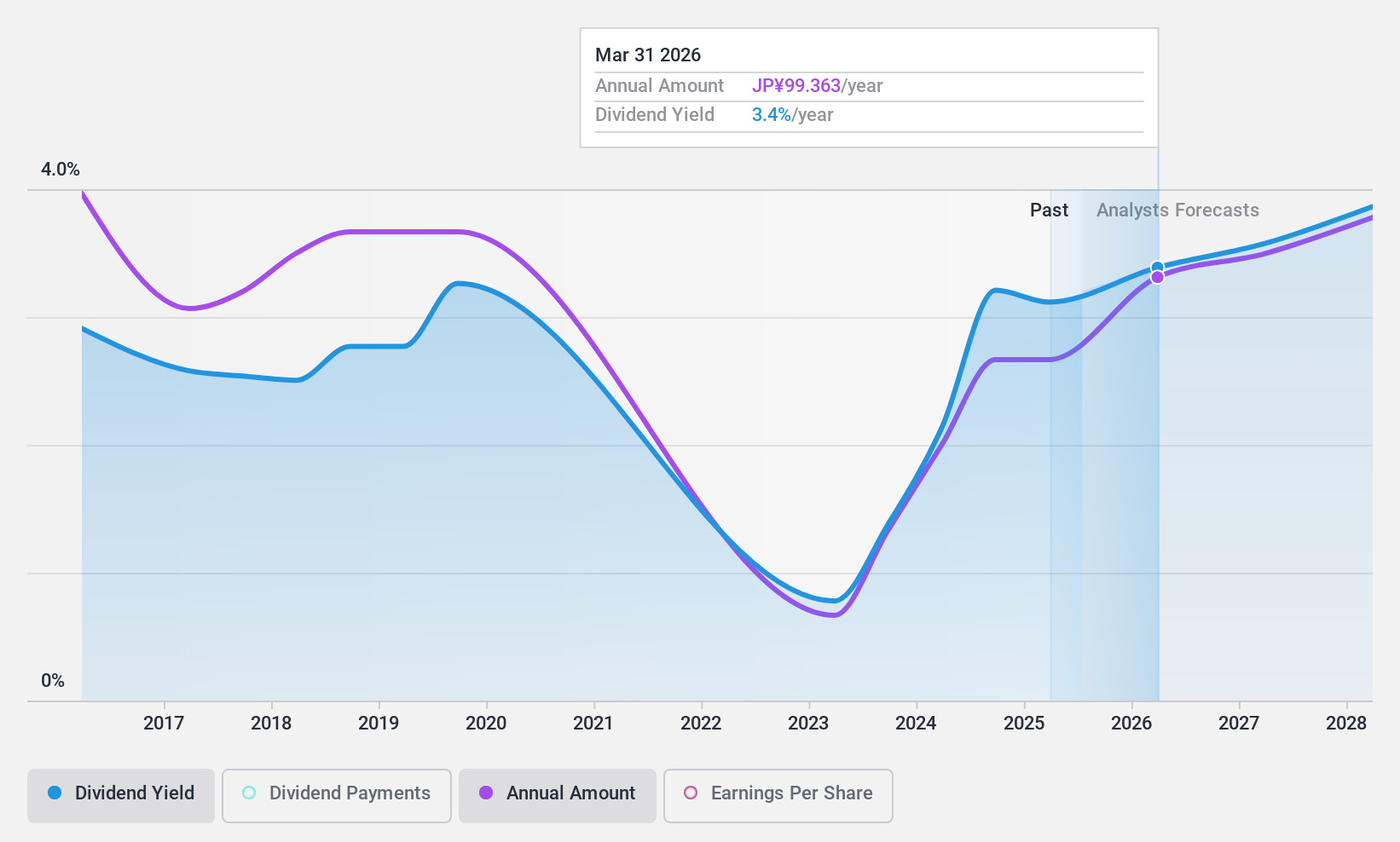

Krosaki Harima (TSE:5352)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Krosaki Harima Corporation, along with its subsidiaries, manufactures and sells refractory and ceramic products both in Japan and internationally, with a market cap of ¥82.21 billion.

Operations: Krosaki Harima Corporation generates revenue through the manufacturing and sale of refractory and ceramic products.

Dividend Yield: 4.3%

Krosaki Harima offers a compelling dividend profile with a payout ratio of 49%, indicating dividends are well-covered by earnings. However, its dividend history has been volatile, with significant annual drops over the past decade. Despite this, dividends have grown overall during the same period. The stock's 4.3% yield ranks in the top quartile of Japanese dividend payers and is supported by cash flows with a cash payout ratio of 64.8%. Krosaki trades at good value relative to peers and industry standards.

- Take a closer look at Krosaki Harima's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Krosaki Harima is trading behind its estimated value.

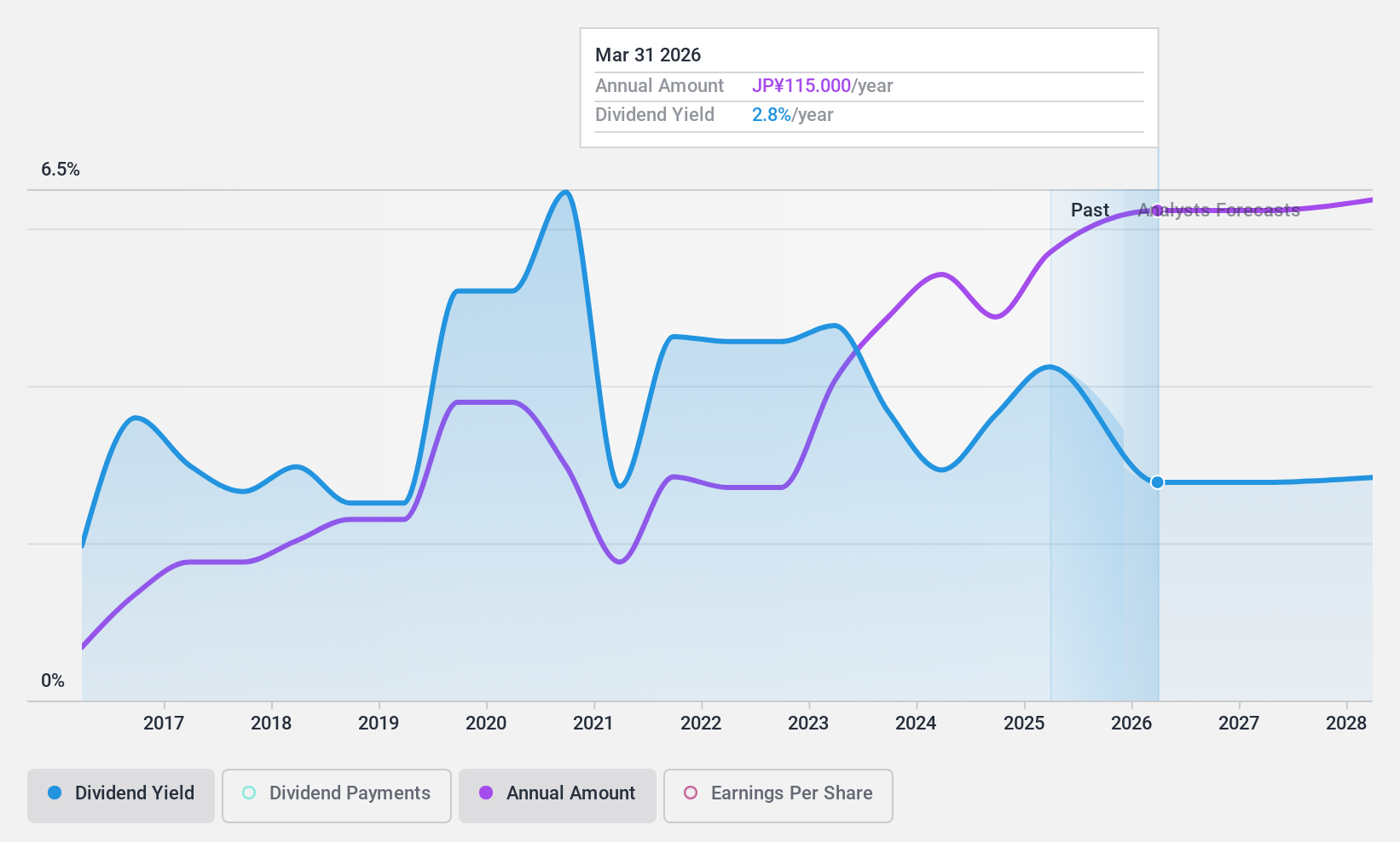

Subaru (TSE:7270)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Subaru Corporation is a global manufacturer and seller of automobiles and aerospace products, with operations in Japan, the rest of Asia, North America, Europe, and other international markets; it has a market cap of approximately ¥1.96 trillion.

Operations: Subaru Corporation generates revenue primarily from its Automobiles segment, which accounts for ¥4.64 trillion, and its Aerospace segment, contributing ¥111.40 billion.

Dividend Yield: 3.5%

Subaru's dividend profile is marked by a low payout ratio of 18.1%, indicating strong coverage by earnings, and a cash payout ratio of 15.6%, ensuring sustainability through cash flows. Despite an increase in dividends over the past decade, payments have been volatile with significant annual drops. Its current yield of 3.54% is below the top quartile in Japan's market, while trading at 59.4% below estimated fair value suggests potential undervaluation relative to peers.

- Dive into the specifics of Subaru here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Subaru shares in the market.

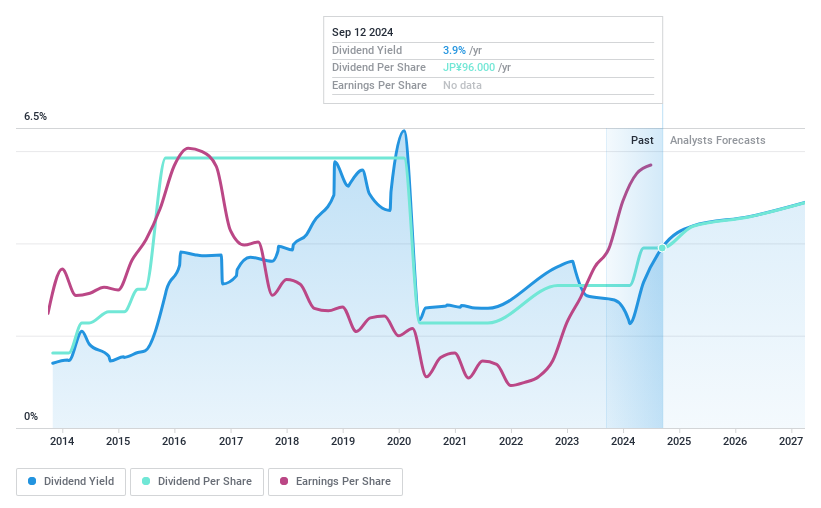

Japan Airlines (TSE:9201)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Japan Airlines Co., Ltd. operates scheduled and non-scheduled air transport services across Japan, Asia, Oceania, North America, the United Kingdom, and Europe, with a market cap of ¥1.06 trillion.

Operations: Japan Airlines Co., Ltd. generates revenue through its air transport services, offering both scheduled and non-scheduled flights across various regions including Asia, Oceania, North America, the United Kingdom, and Europe.

Dividend Yield: 3.3%

Japan Airlines' dividend payments have been volatile over the past decade, though recent increases suggest potential improvement. With a payout ratio of 60%, dividends are adequately covered by earnings, while an 85.4% cash payout ratio indicates coverage through cash flows. Despite a yield of 3.25% being below Japan's top quartile, the stock trades at a favorable price-to-earnings ratio of 12.8x compared to the market average, suggesting reasonable valuation relative to earnings potential.

- Delve into the full analysis dividend report here for a deeper understanding of Japan Airlines.

- Insights from our recent valuation report point to the potential overvaluation of Japan Airlines shares in the market.

Key Takeaways

- Embark on your investment journey to our 1981 Top Dividend Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7270

Subaru

Manufactures and sells automobiles and aerospace products in Japan, rest of Asia, North America, Europe, and internationally.

Undervalued with solid track record and pays a dividend.