Amidst the global market fluctuations, Asia's economic landscape remains a focal point for investors seeking growth opportunities. In this environment, companies with high insider ownership can be particularly appealing as they often indicate strong alignment between management and shareholder interests, which is crucial during times of economic uncertainty.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.5% | 23.4% |

| Schooinc (TSE:264A) | 29.6% | 68.9% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11% | 63.3% |

| Laopu Gold (SEHK:6181) | 22% | 40.5% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 94.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

Let's review some notable picks from our screened stocks.

Duk San NeoluxLtd (KOSDAQ:A213420)

Simply Wall St Growth Rating: ★★★★★☆

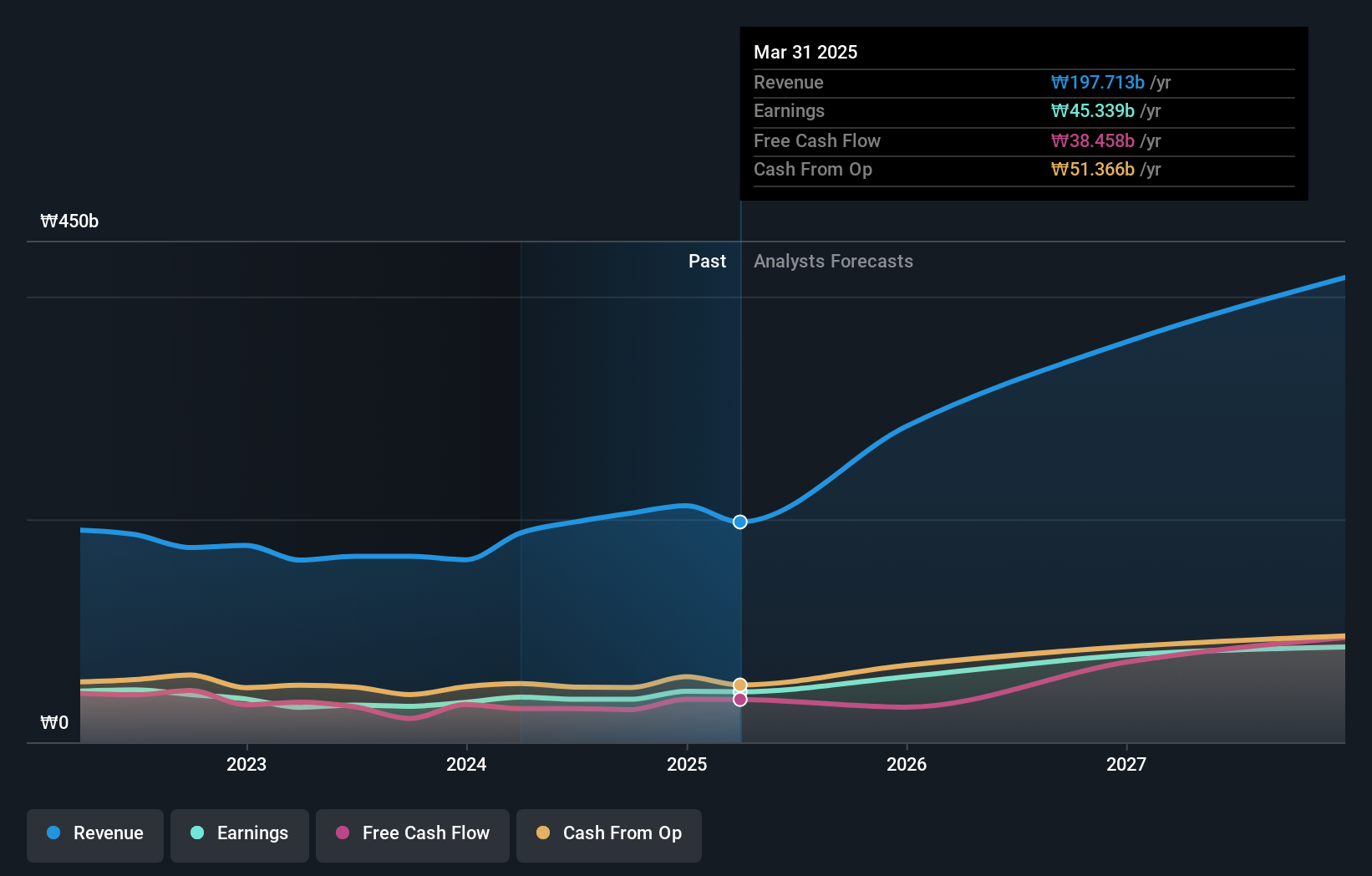

Overview: Duk San Neolux Co., Ltd is a South Korean company that develops and manufactures OLED materials for the display industry, with a market cap of ₩900.23 billion.

Operations: Revenue Segments (in millions of ₩):

Insider Ownership: 10.3%

Duk San Neolux Ltd. demonstrates potential as a growth company with high insider ownership, despite recent share price volatility. Analysts forecast revenue growth of 26.1% annually, outpacing the Korean market's 7.4%, and expect earnings to rise significantly at 24.4% per year over the next three years. Trading at 41.1% below its estimated fair value suggests potential upside, although return on equity is expected to remain modest at 16.1%.

- Unlock comprehensive insights into our analysis of Duk San NeoluxLtd stock in this growth report.

- According our valuation report, there's an indication that Duk San NeoluxLtd's share price might be on the cheaper side.

Xi'an Manareco New MaterialsLtd (SHSE:688550)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xi'an Manareco New Materials Co., Ltd specializes in the production and sale of liquid crystal materials, OLED materials, and drug intermediates with a market capitalization of CN¥7.14 billion.

Operations: The company generates revenue from its Specialty Chemicals segment, amounting to CN¥1.47 billion.

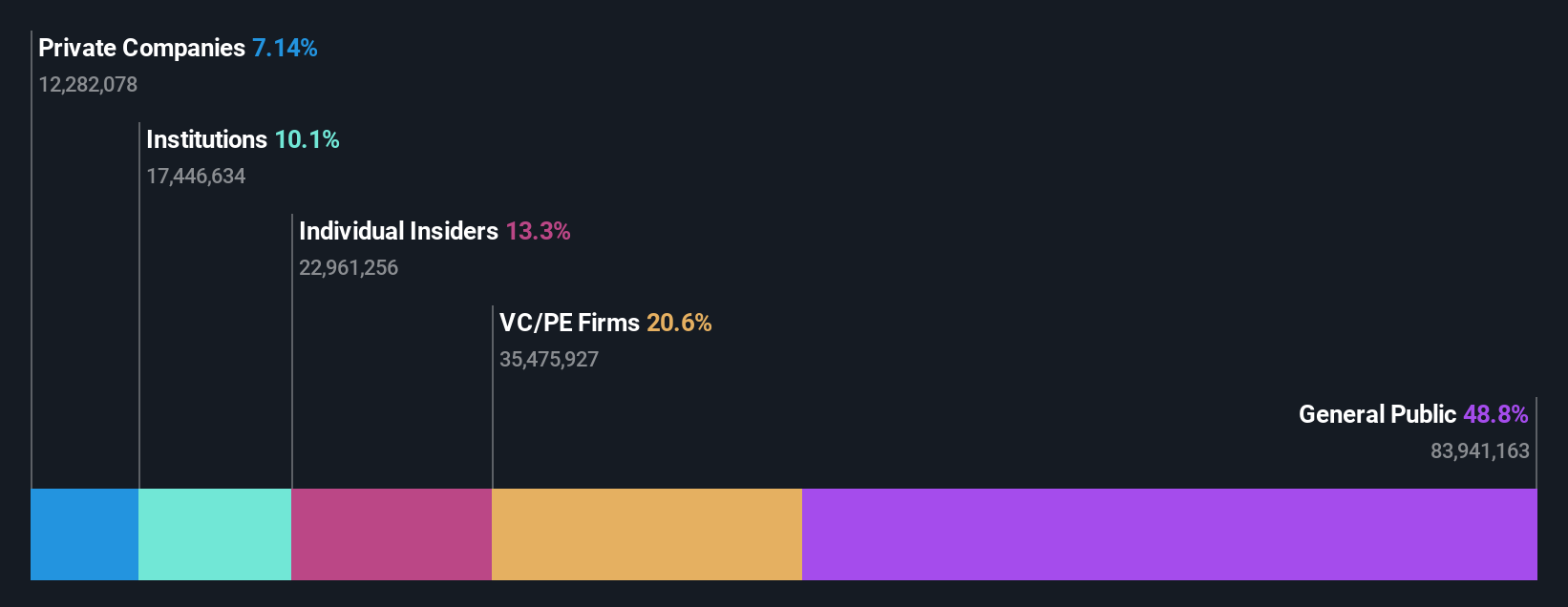

Insider Ownership: 13.3%

Xi'an Manareco New Materials Ltd. shows strong growth potential with expected annual earnings growth of 21.84%, although slightly below the Chinese market's average of 23.4%. The company benefits from a favorable price-to-earnings ratio of 27.2x, below the CN market average of 37.8x, and forecasts revenue growth at an impressive 23.2% annually, surpassing market expectations. Recent financial results highlight robust performance with net income rising to CNY 45.63 million in Q1 2025 from CNY 34.33 million a year ago despite an unstable dividend track record and low forecasted return on equity at 11.5%.

- Take a closer look at Xi'an Manareco New MaterialsLtd's potential here in our earnings growth report.

- The analysis detailed in our Xi'an Manareco New MaterialsLtd valuation report hints at an inflated share price compared to its estimated value.

Kasumigaseki CapitalLtd (TSE:3498)

Simply Wall St Growth Rating: ★★★★★★

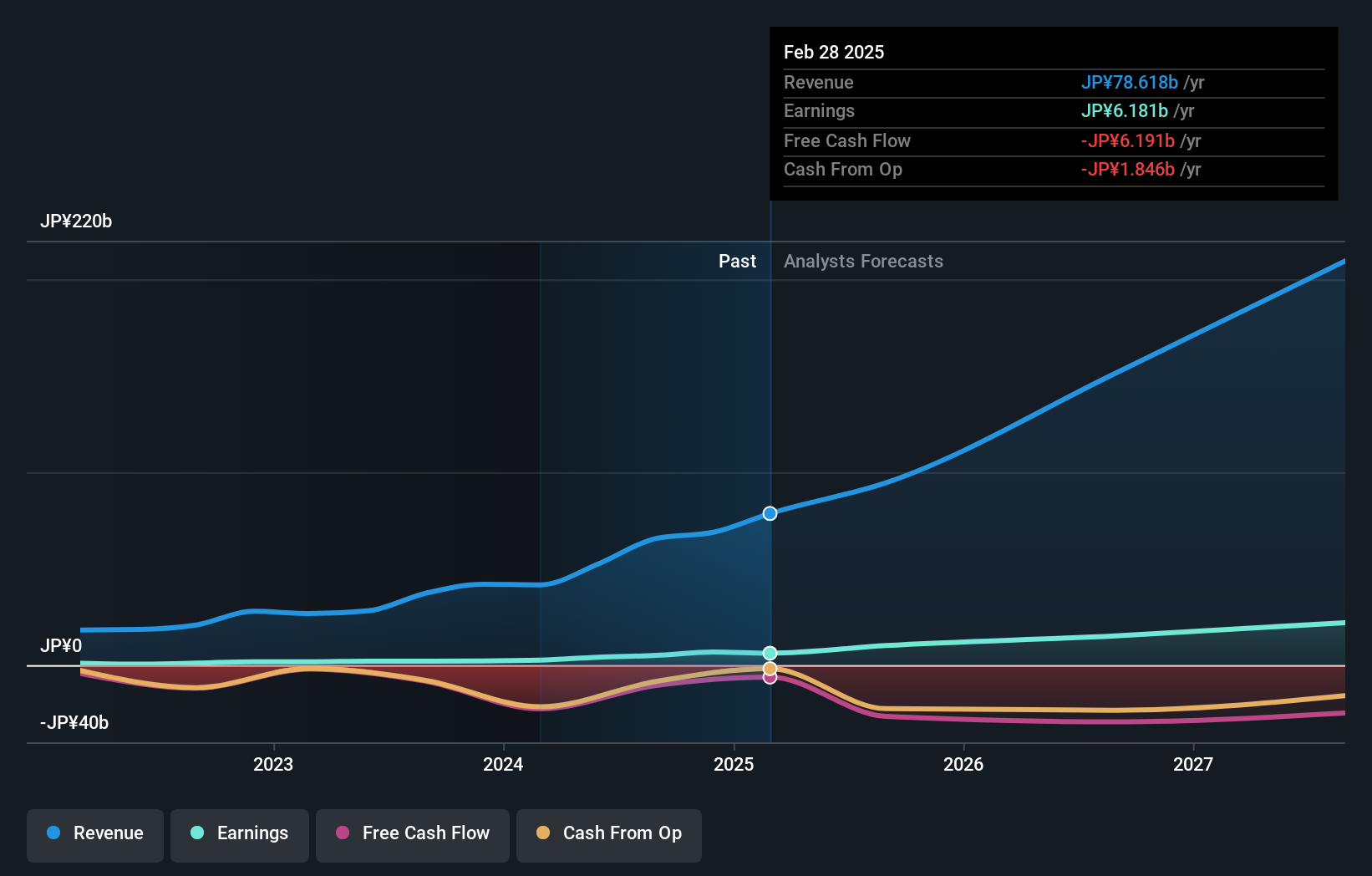

Overview: Kasumigaseki Capital Co., Ltd. operates in the real estate consulting sector in Japan, with a market capitalization of ¥129.13 billion.

Operations: The company's revenue primarily comes from its real estate consulting business, generating ¥78.62 billion.

Insider Ownership: 27.5%

Kasumigaseki Capital Ltd. is poised for significant growth, with revenue expected to increase by 31.4% annually, outpacing the Japanese market's 3.7%. Earnings are projected to rise by 36.4% per year, well above the market average of 7.6%. Despite a volatile share price and debt concerns relative to operating cash flow, insider ownership remains high without substantial recent insider trading activity. The company forecasts JPY 95 billion in net sales and JPY 10 billion in profits for fiscal year-end August 2025.

- Click here to discover the nuances of Kasumigaseki CapitalLtd with our detailed analytical future growth report.

- Our expertly prepared valuation report Kasumigaseki CapitalLtd implies its share price may be too high.

Turning Ideas Into Actions

- Dive into all 626 of the Fast Growing Asian Companies With High Insider Ownership we have identified here.

- Ready To Venture Into Other Investment Styles? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688550

Xi'an Manareco New MaterialsLtd

Manufactures and markets display materials.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)