- Japan

- /

- Commercial Services

- /

- TSE:4384

3 Growth Companies With High Insider Ownership Growing Revenues Up To 24%

Reviewed by Simply Wall St

As global markets experience a rebound, with U.S. stocks advancing on the back of cooling inflation and strong bank earnings, investors are increasingly focused on identifying growth opportunities that align with these shifting economic conditions. In this context, companies exhibiting high insider ownership can be particularly appealing as they often signal confidence from those most familiar with the business's potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| CD Projekt (WSE:CDR) | 29.7% | 30.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.8% |

| Pharma Mar (BME:PHM) | 11.9% | 56.1% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Let's uncover some gems from our specialized screener.

EO Technics (KOSDAQ:A039030)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EO Technics Co., Ltd. manufactures and supplies laser processing equipment globally, with a market cap of ₩1.90 trillion.

Operations: The company generates revenue primarily from its Semiconductor Machine Division, amounting to ₩301.92 billion.

Insider Ownership: 30.7%

Revenue Growth Forecast: 24.3% p.a.

EO Technics is poised for significant growth, with earnings expected to increase by 50.52% annually over the next three years, outpacing the Korean market's 28.8%. Revenue is also projected to grow at 24.3% per year, surpassing the market average of 9.3%. Despite a volatile share price recently, it trades at approximately 16.4% below its estimated fair value. Recent presentations and dividend announcements highlight ongoing investor engagement and financial health in a competitive landscape.

- Take a closer look at EO Technics' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that EO Technics is trading beyond its estimated value.

Eugene TechnologyLtd (KOSDAQ:A084370)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Eugene Technology Co., Ltd. manufactures and sells semiconductor equipment and parts in South Korea and internationally, with a market cap of ₩851.91 billion.

Operations: The company's revenue is primarily derived from semiconductor equipment, amounting to ₩282.49 billion, and industrial gases for semiconductors, contributing ₩11.72 billion.

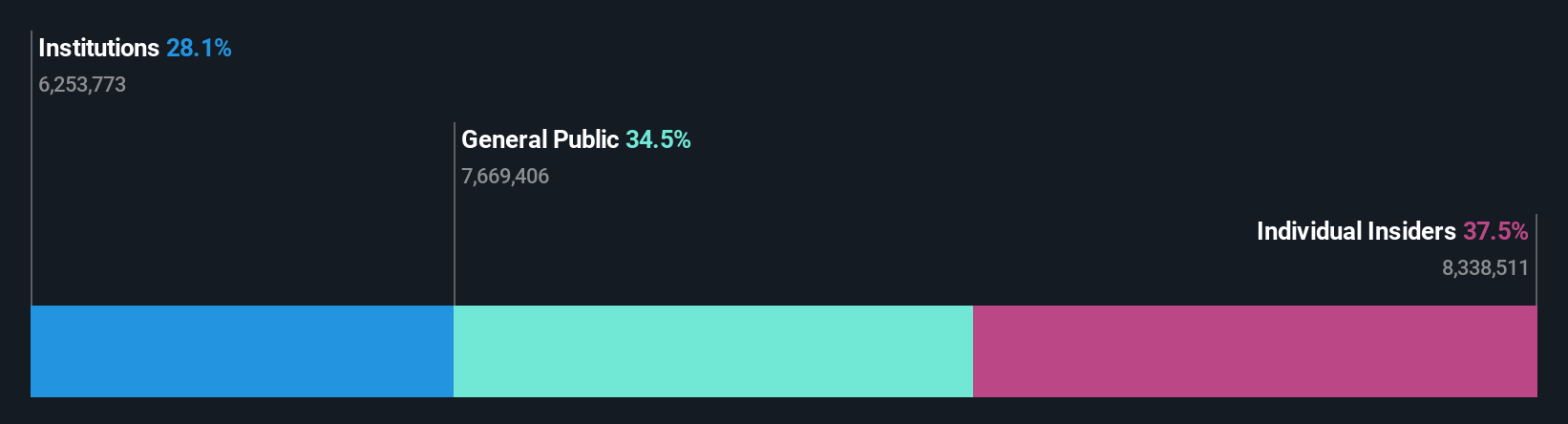

Insider Ownership: 37.5%

Revenue Growth Forecast: 19% p.a.

Eugene Technology Ltd. demonstrates strong growth potential, with earnings increasing significantly by 83.2% over the past year and forecasted to grow at 32.7% annually, outpacing the Korean market's average. Recent third-quarter results showed substantial improvements in net income and earnings per share, reflecting a robust financial performance. While revenue growth is expected at 19% annually, slightly below high-growth benchmarks, it still surpasses the market average of 9.3%.

- Delve into the full analysis future growth report here for a deeper understanding of Eugene TechnologyLtd.

- Upon reviewing our latest valuation report, Eugene TechnologyLtd's share price might be too optimistic.

Raksul (TSE:4384)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Raksul Inc. operates as a provider of printing services in Japan, with a market capitalization of ¥70.55 billion.

Operations: The company generates revenue through its printing services in Japan.

Insider Ownership: 14.1%

Revenue Growth Forecast: 10% p.a.

Raksul's earnings are projected to grow significantly at 24.9% annually, surpassing the JP market average of 8.1%. The company plans a ¥4.5 billion debt financing with major banks, and its recent share repurchase program aims to enhance profitability and capital efficiency. Despite lower profit margins compared to last year, Raksul trades below its estimated fair value by 12.8%, with analysts predicting a 28.4% stock price increase, highlighting potential for growth amidst high insider ownership dynamics.

- Click here to discover the nuances of Raksul with our detailed analytical future growth report.

- Our valuation report here indicates Raksul may be overvalued.

Seize The Opportunity

- Click this link to deep-dive into the 1465 companies within our Fast Growing Companies With High Insider Ownership screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4384

Reasonable growth potential with adequate balance sheet.