- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6787

3 Promising Growth Companies With Insider Ownership Up To 36%

Reviewed by Simply Wall St

As global markets experience a rebound, driven by cooling inflation and robust bank earnings, investors are increasingly optimistic about potential rate cuts later in the year. With major U.S. stock indexes climbing and European markets buoyed by hopes of continued interest rate reductions, the focus shifts to identifying growth companies with strong insider ownership—a factor that often signals confidence in a company's future prospects amidst evolving economic conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Let's review some notable picks from our screened stocks.

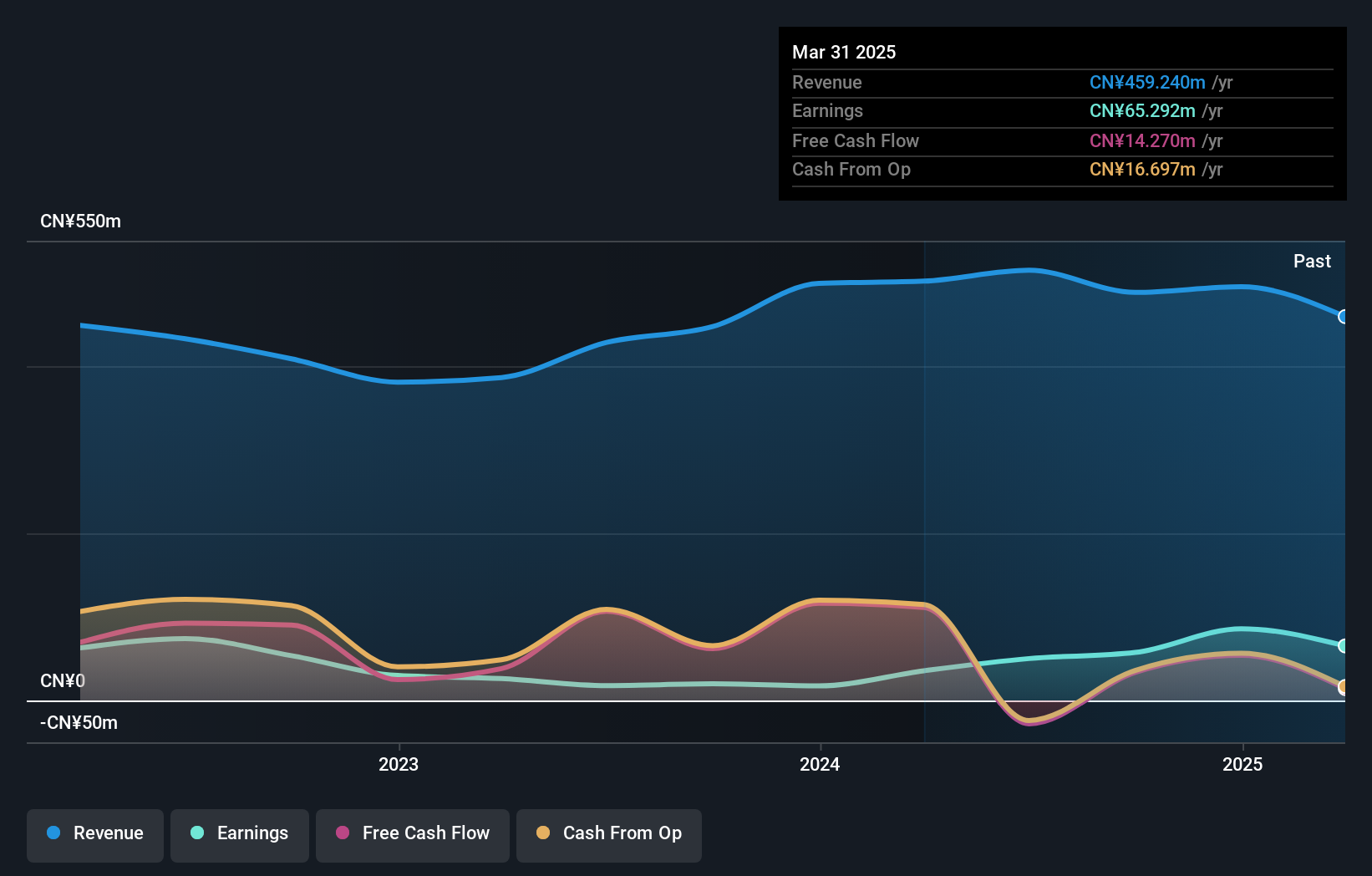

Beijing Tricolor Technology (SHSE:603516)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Tricolor Technology Co., Ltd is a company that manufactures and sells professional audio and video products globally, with a market cap of approximately CN¥11.10 billion.

Operations: The company generates revenue from the Display Control Industry segment, amounting to CN¥484.76 million.

Insider Ownership: 37%

Beijing Tricolor Technology's recent earnings report highlights a substantial increase in net income, reaching CNY 51.51 million for the first nine months of 2024, up from CNY 11.59 million the previous year. Despite a slight decline in revenue to CNY 326.52 million, the company is projected to experience significant earnings growth at 49.15% annually and revenue growth at 32.3%, outpacing market averages. However, its share price has been highly volatile recently and forecasted return on equity remains low at 12.6%.

- Click here and access our complete growth analysis report to understand the dynamics of Beijing Tricolor Technology.

- Our valuation report here indicates Beijing Tricolor Technology may be overvalued.

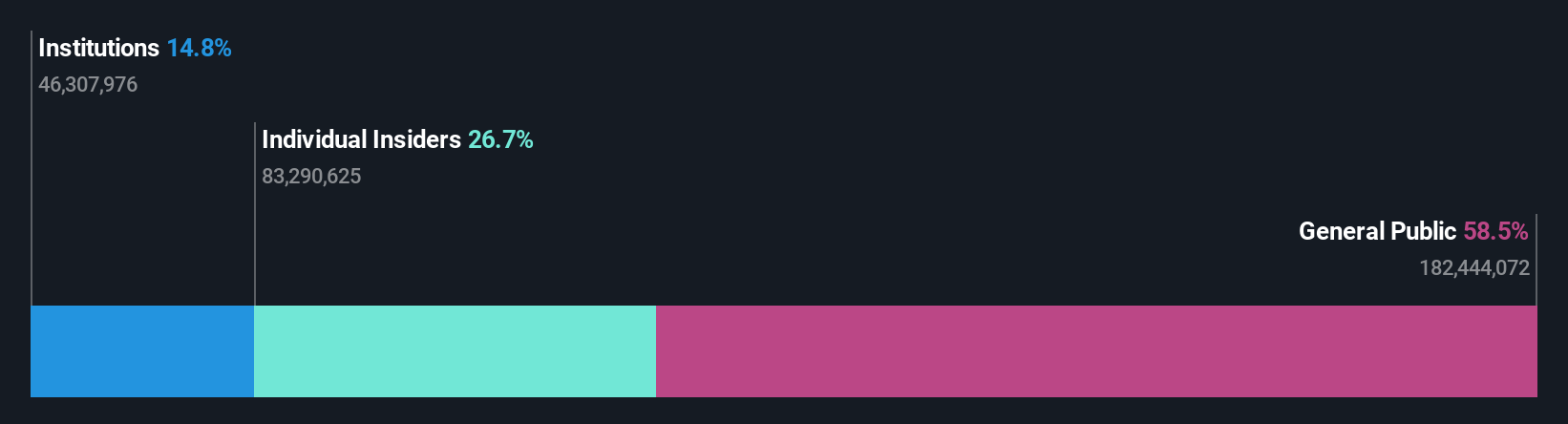

Shenzhen Sinexcel ElectricLtd (SZSE:300693)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenzhen Sinexcel Electric Co., Ltd. operates as a provider of energy interconnection ecosystems across various continents including Asia, Oceania, Europe, North America, South America, and Africa with a market capitalization of CN¥8.27 billion.

Operations: Shenzhen Sinexcel Electric Co., Ltd. generates revenue through its operations in energy interconnection across multiple global regions, including Asia, Oceania, Europe, North America, South America, and Africa.

Insider Ownership: 29.1%

Shenzhen Sinexcel Electric Ltd. demonstrates strong growth potential with forecasted earnings and revenue growth of 29.1% and 28.8% annually, respectively, outpacing the broader Chinese market. Despite a modest net income decline to CNY 270.57 million for the first nine months of 2024, its return on equity is expected to reach a high level in three years. The stock trades at a significant discount to its estimated fair value but lacks recent insider trading activity or substantial dividend coverage by free cash flows.

- Navigate through the intricacies of Shenzhen Sinexcel ElectricLtd with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Shenzhen Sinexcel ElectricLtd shares in the market.

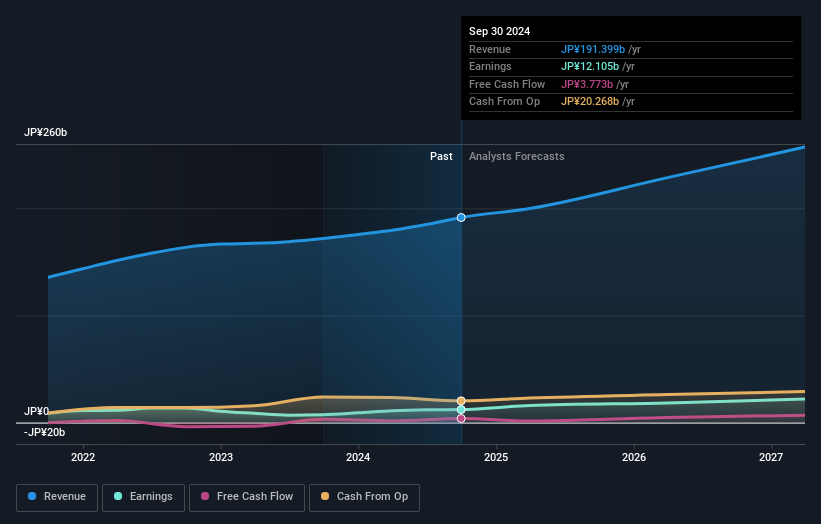

Meiko Electronics (TSE:6787)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meiko Electronics Co., Ltd. designs, manufactures, and sells printed circuit boards and auxiliary electronics across Japan, China, Vietnam, other parts of Asia, North America, Europe, and globally with a market cap of ¥226.80 billion.

Operations: The company's revenue from the Electronic Related Business segment amounts to ¥191.26 billion.

Insider Ownership: 20.7%

Meiko Electronics shows potential with forecasted earnings growth of 22.3% annually, surpassing the JP market's 8.1%. Despite high debt levels and volatile share prices, it trades below its estimated fair value. Recent updates include an increased dividend for Q2 2024 and revised earnings guidance, raising net income projections to JPY 15 billion for fiscal year 2024. However, it lacks recent insider trading activity and plans a slight year-end dividend decrease to JPY 40 per share.

- Take a closer look at Meiko Electronics' potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Meiko Electronics shares in the market.

Next Steps

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1463 more companies for you to explore.Click here to unveil our expertly curated list of 1466 Fast Growing Companies With High Insider Ownership.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6787

Meiko Electronics

Engages in the design, manufacture, and sale of printed circuit boards (PCBs) and auxiliary electronics in Japan, China, Vietnam, the rest of Asia, North America, Europe, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives