- Japan

- /

- Capital Markets

- /

- TSE:8698

Dream International Joins 2 Strong Dividend Stocks For Income Growth

Reviewed by Simply Wall St

As global markets experience a resurgence, driven by easing core U.S. inflation and robust bank earnings, investors are increasingly turning their attention to dividend stocks as a source of reliable income amidst fluctuating economic conditions. With value stocks outperforming growth shares and strong performances in key sectors like financials, identifying dividend-paying companies with stable cash flows and solid growth potential becomes crucial for those looking to bolster their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.27% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.50% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.65% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.92% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.82% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1971 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Dream International (SEHK:1126)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dream International Limited is an investment holding company that designs, develops, manufactures, sells, and trades plush stuffed toys, plastic figures, dolls, die-casting products, and tarpaulin products across various international markets with a market cap of HK$3.61 billion.

Operations: Dream International Limited generates revenue from plush stuffed toys (HK$2.69 billion), plastic figures (HK$1.87 billion), and tarpaulin products (HK$322.71 million).

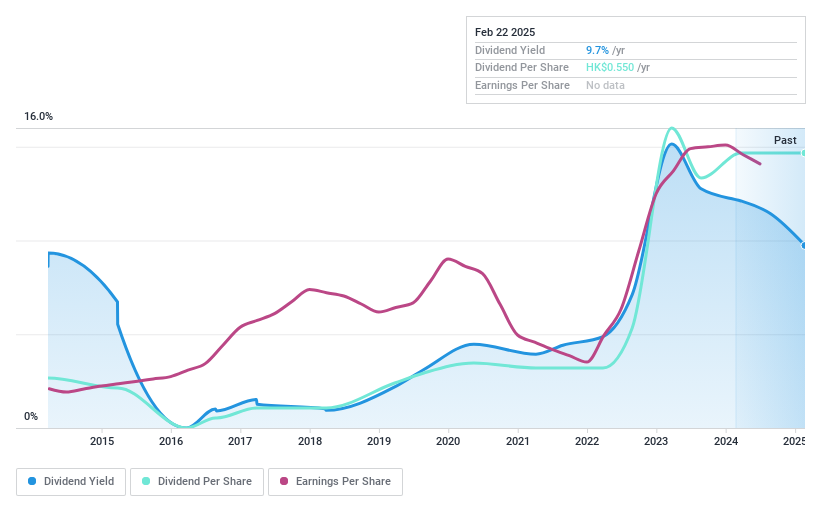

Dividend Yield: 10%

Dream International offers a strong dividend yield of 9.96%, placing it in the top 25% of Hong Kong's dividend payers. Its dividends are well covered by both earnings and cash flows, with payout ratios at 48% and 41.7%, respectively. However, the company's dividend history has been volatile over the past decade, despite some growth in payments during this period. Trading significantly below estimated fair value may present an opportunity for investors seeking dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Dream International.

- Our valuation report unveils the possibility Dream International's shares may be trading at a discount.

Channel Well TechnologyLtd (TPEX:3078)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Channel Well Technology Co., Ltd. engages in the manufacturing, processing, trading, and sale of power supply and electronic components across Taiwan, Asia, the United States, Europe, and other international markets with a market cap of NT$17.65 billion.

Operations: Channel Well Technology Co., Ltd.'s revenue from processing, manufacturing, and trading of power supplies is NT$8.82 billion.

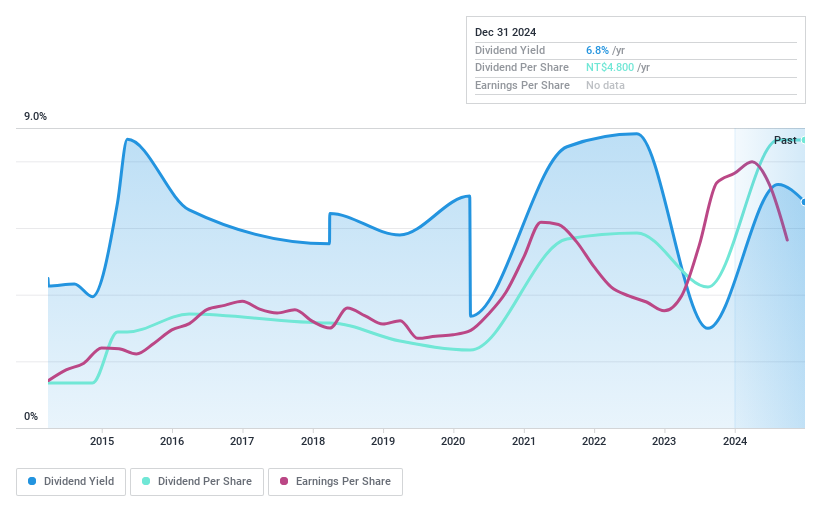

Dividend Yield: 6.1%

Channel Well Technology's dividend yield of 6.11% ranks in the top 25% of Taiwan's market, but its sustainability is questionable due to a high payout ratio of 95.8%, indicating dividends are not well covered by earnings. Although there has been growth in dividend payments over the past decade, they have been volatile and unreliable. Recent earnings show decreased sales and net income, potentially impacting future dividend stability despite being undervalued by 43.4%.

- Get an in-depth perspective on Channel Well TechnologyLtd's performance by reading our dividend report here.

- The analysis detailed in our Channel Well TechnologyLtd valuation report hints at an deflated share price compared to its estimated value.

Monex Group (TSE:8698)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Monex Group, Inc. is an online financial institution offering retail brokerage services in Japan, the United States, China, and Australia with a market cap of ¥230.58 billion.

Operations: Monex Group's revenue is primarily derived from its operations in the United States (¥50.17 billion), Japan (¥10.81 billion), and its Crypto-Asset Business (¥11.83 billion).

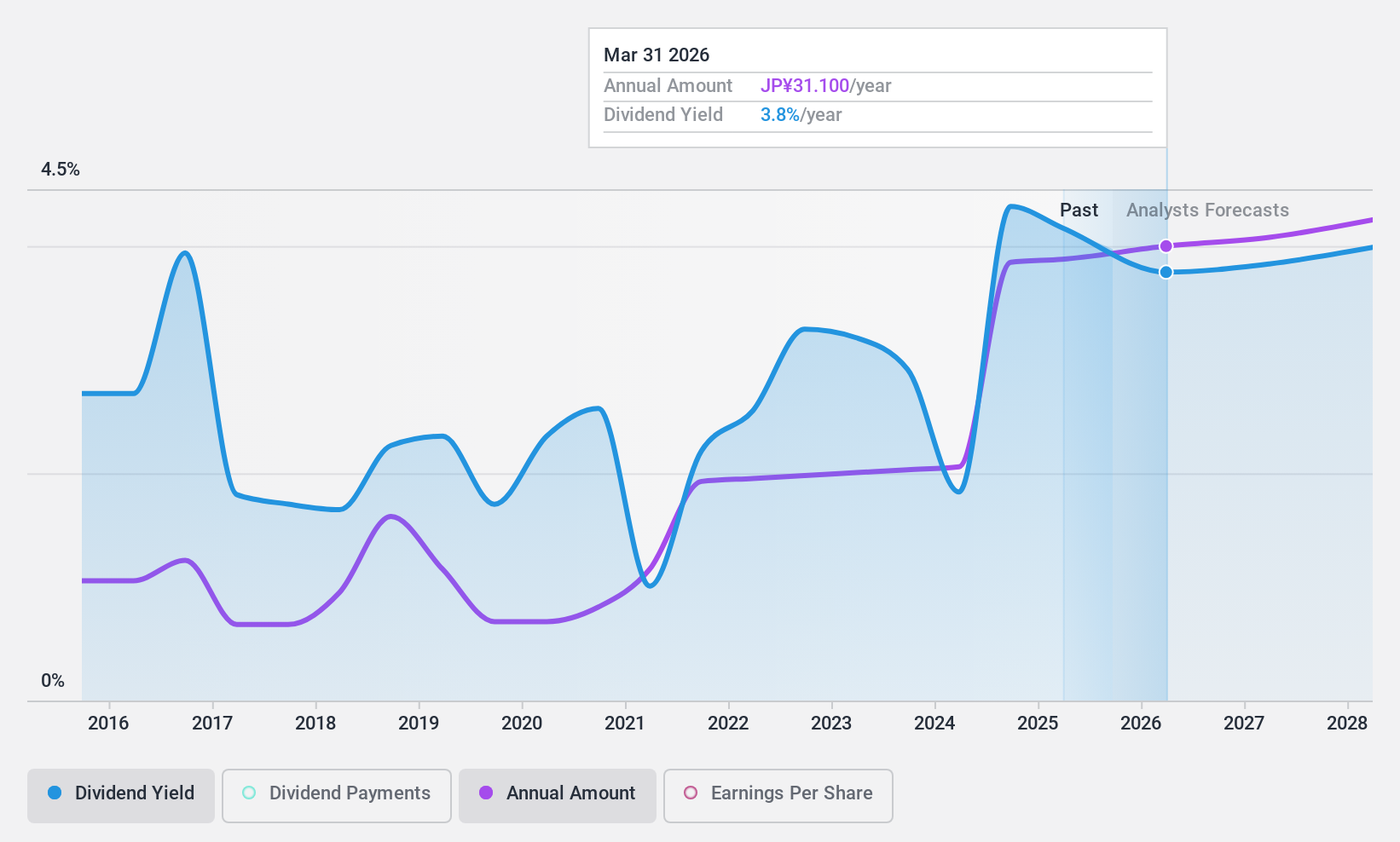

Dividend Yield: 3.3%

Monex Group's dividend payments are well-covered by earnings and cash flows, with payout ratios of 52.4% and 56.3%, respectively. Despite a recent dividend increase and special dividend announcement, the company's dividends have been volatile over the past decade. The stock trades at a favorable price-to-earnings ratio of 12.4x compared to the JP market average of 13.4x, but its dividend yield of 3.32% is lower than top-tier payers in Japan's market (3.83%).

- Delve into the full analysis dividend report here for a deeper understanding of Monex Group.

- Insights from our recent valuation report point to the potential undervaluation of Monex Group shares in the market.

Next Steps

- Click through to start exploring the rest of the 1968 Top Dividend Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8698

Monex Group

An online financial institution, provides retail online brokerage services in Japan, the United States, China, and Australia.

Proven track record with adequate balance sheet.