- South Korea

- /

- Personal Products

- /

- KOSE:A192820

March 2025's Asian Market Stocks Priced Below Estimated Value

Reviewed by Simply Wall St

As global markets face volatility, with U.S. consumer confidence declining and trade tensions impacting economies worldwide, the Asian markets have also experienced fluctuations. In this environment, identifying stocks priced below their estimated value can be crucial for investors seeking opportunities in potentially undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wiwynn (TWSE:6669) | NT$1920.00 | NT$3781.24 | 49.2% |

| Chifeng Jilong Gold MiningLtd (SHSE:600988) | CN¥18.16 | CN¥36.02 | 49.6% |

| Shenzhou International Group Holdings (SEHK:2313) | HK$57.10 | HK$114.14 | 50% |

| RACCOON HOLDINGS (TSE:3031) | ¥965.00 | ¥1903.17 | 49.3% |

| Hyosung Heavy Industries (KOSE:A298040) | ₩432500.00 | ₩855375.21 | 49.4% |

| Cosmax (KOSE:A192820) | ₩171300.00 | ₩338433.71 | 49.4% |

| LITALICO (TSE:7366) | ¥1081.00 | ¥2155.11 | 49.8% |

| Nanjing King-Friend Biochemical PharmaceuticalLtd (SHSE:603707) | CN¥12.50 | CN¥24.90 | 49.8% |

| Sung Kwang BendLtd (KOSDAQ:A014620) | ₩27800.00 | ₩55093.57 | 49.5% |

| Sunny Optical Technology (Group) (SEHK:2382) | HK$84.65 | HK$168.45 | 49.7% |

Let's uncover some gems from our specialized screener.

Cosmax (KOSE:A192820)

Overview: Cosmax, Inc. is involved in the research, development, production, and manufacturing of cosmetic and health functional food products both in Korea and internationally, with a market cap of ₩1.94 trillion.

Operations: The company's revenue primarily comes from the Cosmetics Sector, which generated approximately ₩2.04 trillion.

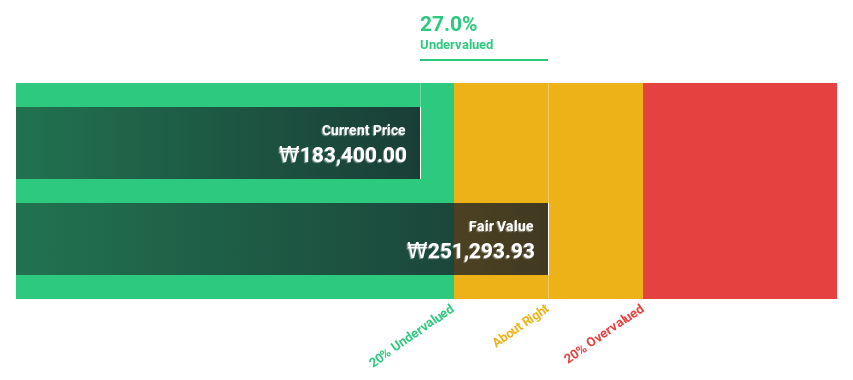

Estimated Discount To Fair Value: 49.4%

Cosmax is trading at ₩171,300, significantly below its estimated fair value of ₩338,433.71, indicating it may be undervalued based on cash flows. The company's earnings grew by 123.9% last year and are forecast to grow at 25.7% annually over the next three years, outpacing the Korean market's growth rate of 25.4%. Despite a high debt level, Cosmax's revenue is expected to grow faster than the market average at 13.4% per year.

- Our expertly prepared growth report on Cosmax implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Cosmax.

Ficont Industry (Beijing) (SHSE:605305)

Overview: Ficont Industry (Beijing) Co., Ltd. is engaged in the provision of wind energy, construction, and safety protection equipment both in China and internationally, with a market capitalization of CN¥5.97 billion.

Operations: The company's revenue segment includes Construction Machinery & Equipment, which generated CN¥1.34 billion.

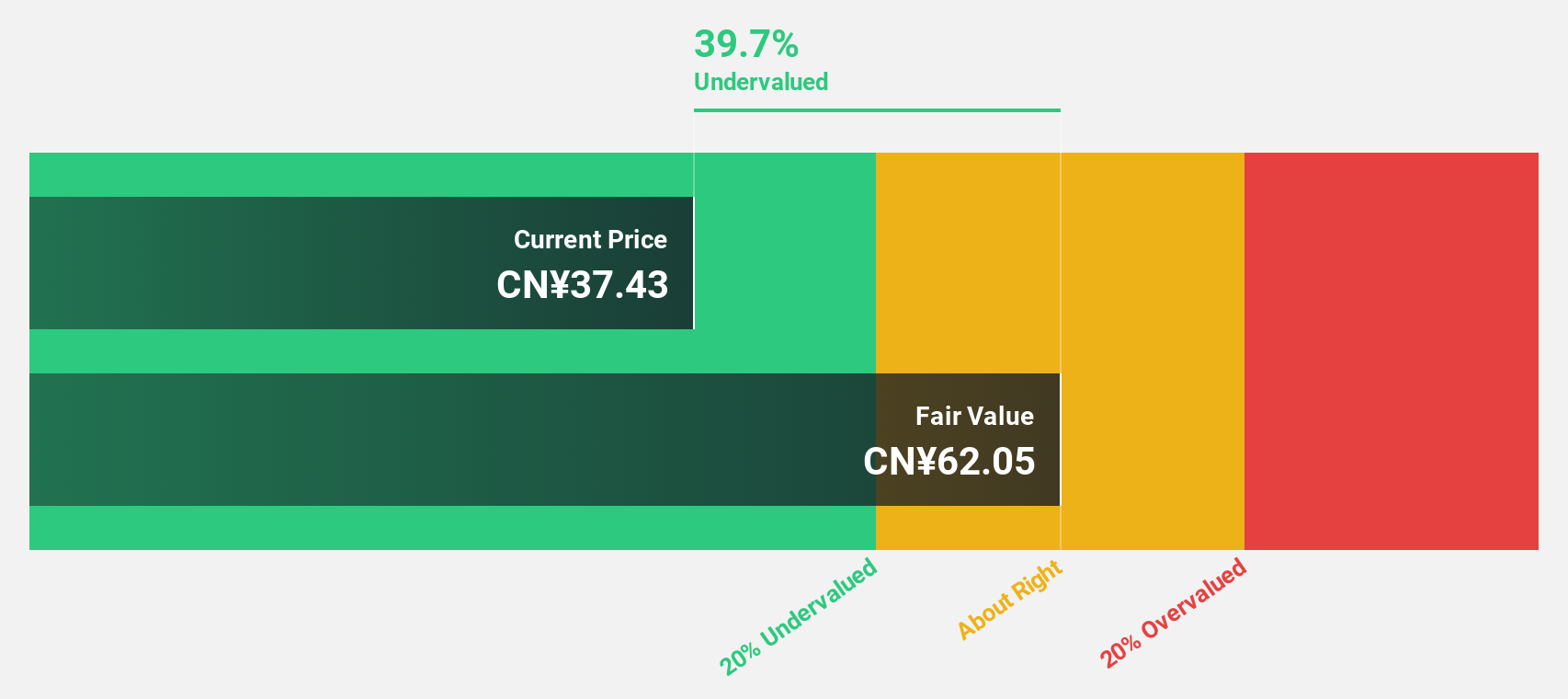

Estimated Discount To Fair Value: 46.4%

Ficont Industry (Beijing) is trading at CN¥28.08, significantly below its estimated fair value of CN¥52.36, highlighting a potential undervaluation based on cash flows. The company's earnings soared by 130.5% last year and are projected to grow 24.86% annually over the next three years, although slightly slower than the Chinese market's rate of 25.3%. Despite an unstable dividend history and low forecasted return on equity, revenue growth remains robust at 24.8% per year.

- Our earnings growth report unveils the potential for significant increases in Ficont Industry (Beijing)'s future results.

- Click to explore a detailed breakdown of our findings in Ficont Industry (Beijing)'s balance sheet health report.

Eastroc Beverage(Group) (SHSE:605499)

Overview: Eastroc Beverage(Group) Co., Ltd. engages in the research, development, production, and sales of beverages in China with a market cap of CN¥117.21 billion.

Operations: The company's revenue is primarily derived from the production, sales, and wholesale of beverages and pre-packaged foods, totaling CN¥15.18 billion.

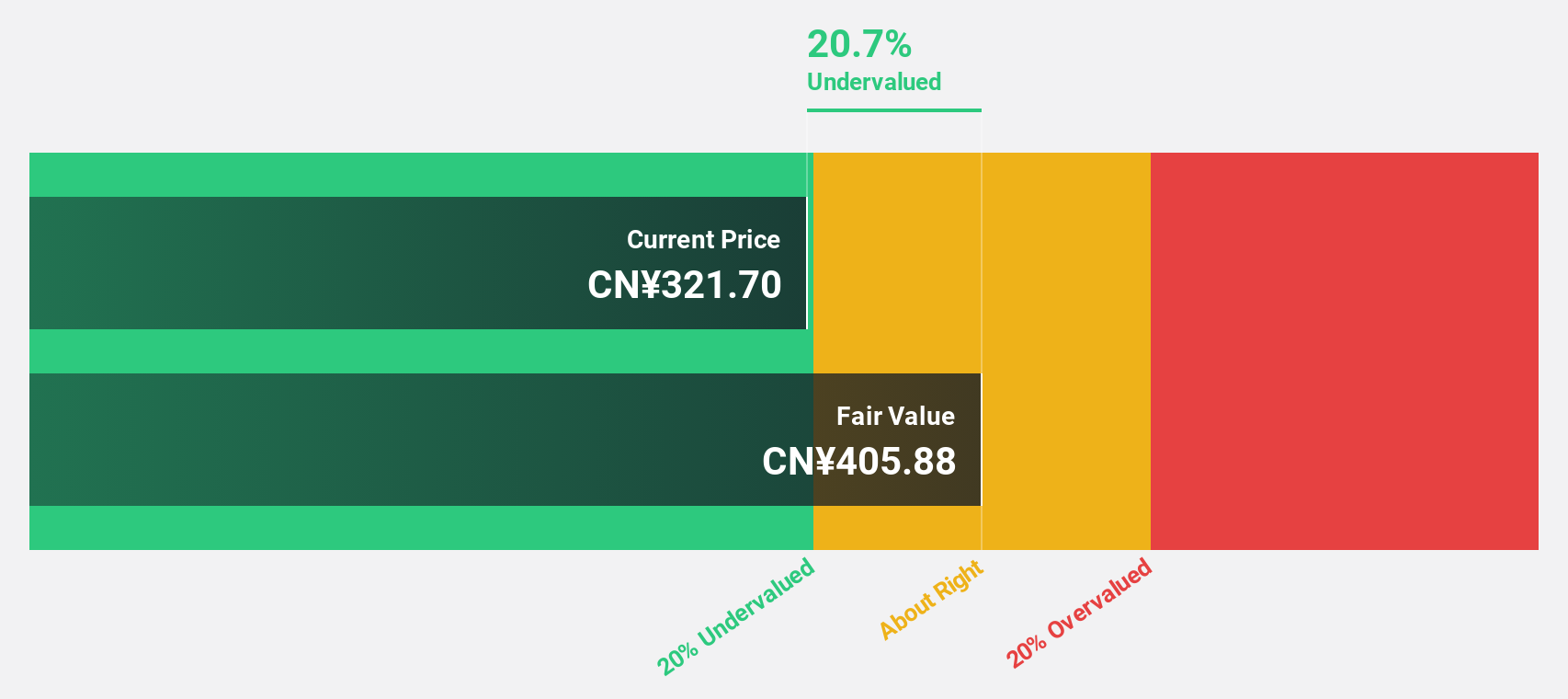

Estimated Discount To Fair Value: 26.6%

Eastroc Beverage (Group) is trading at CN¥225.4, below its estimated fair value of CN¥307.12, suggesting potential undervaluation based on cash flows. The company's earnings grew by 60.1% last year and are expected to rise significantly at 25.09% annually over the next three years, albeit slightly slower than the Chinese market's average growth rate of 25.3%. Revenue is anticipated to grow faster than the market at 23.1% per year despite an unstable dividend history.

- The growth report we've compiled suggests that Eastroc Beverage(Group)'s future prospects could be on the up.

- Dive into the specifics of Eastroc Beverage(Group) here with our thorough financial health report.

Seize The Opportunity

- Discover the full array of 286 Undervalued Asian Stocks Based On Cash Flows right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A192820

Cosmax

Researches, develops, produces, and manufactures cosmetic and health function food products in Korea and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives