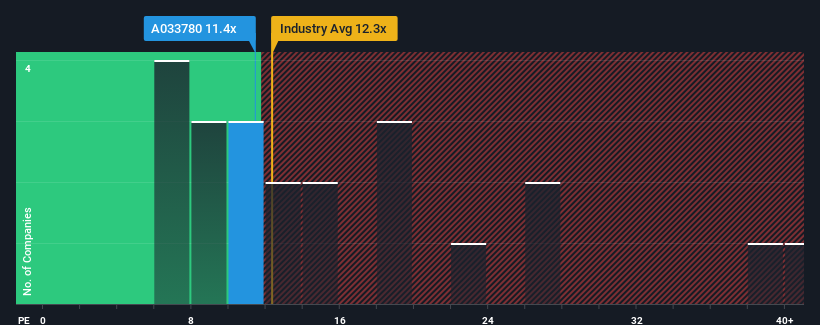

With a price-to-earnings (or "P/E") ratio of 11.4x KT&G Corporation (KRX:033780) may be sending bullish signals at the moment, given that almost half of all companies in Korea have P/E ratios greater than 15x and even P/E's higher than 30x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

KT&G has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for KT&G

What Are Growth Metrics Telling Us About The Low P/E?

KT&G's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 7.7%. As a result, earnings from three years ago have also fallen 13% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 20% each year during the coming three years according to the analysts following the company. That's shaping up to be similar to the 20% per annum growth forecast for the broader market.

With this information, we find it odd that KT&G is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On KT&G's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of KT&G's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for KT&G with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than KT&G. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if KT&G might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A033780

KT&G

Engages in the production, distribution, and sale of tobacco products in South Korea, Europe, and internationally.

Flawless balance sheet 6 star dividend payer.