- South Korea

- /

- Auto

- /

- KOSE:A000270

3 Excellent Dividend Stocks Yielding Up To 5.5%

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by rate cuts from the ECB and SNB, alongside expectations for a Federal Reserve rate cut, investors are keenly observing shifts in major indices. While most indexes have declined, the Nasdaq Composite has reached record highs, highlighting the resilience of certain sectors amid broader economic challenges. In this environment, dividend stocks can offer stability and income potential; they are often valued for their ability to provide consistent returns even when market conditions fluctuate.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.80% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.00% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.25% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.50% | ★★★★★☆ |

Click here to see the full list of 1967 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

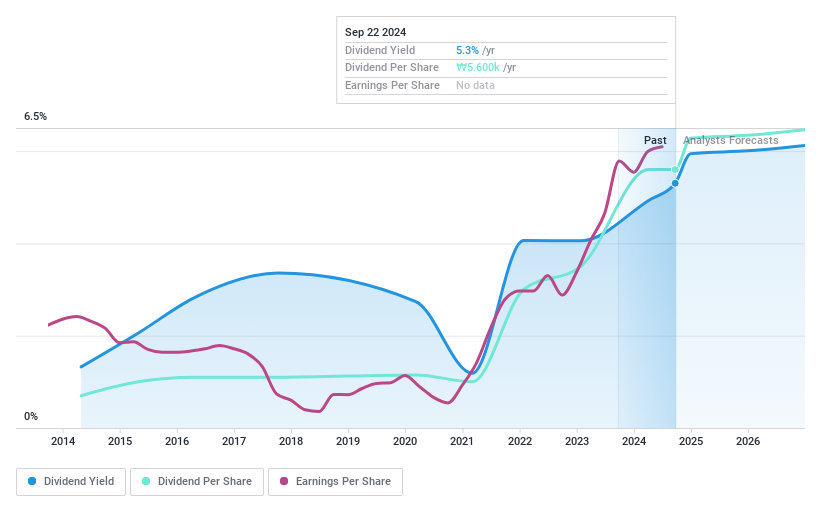

Kia (KOSE:A000270)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Kia Corporation manufactures and sells vehicles across South Korea, North America, and Europe with a market cap of ₩39.20 trillion.

Operations: Kia Corporation's revenue from auto manufacturing amounts to ₩104.63 billion.

Dividend Yield: 5.6%

Kia's dividend profile is compelling, offering a high yield of 5.57%, placing it in the top 25% of dividend payers in South Korea. The dividends are well-covered by both earnings and cash flows, with payout ratios of 22.8% and 35.8%, respectively, indicating sustainability. Over the past decade, Kia's dividends have been stable and growing with little volatility. Recent executive changes aim to support sustainable growth amidst global uncertainties, potentially impacting future performance positively.

- Click to explore a detailed breakdown of our findings in Kia's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Kia shares in the market.

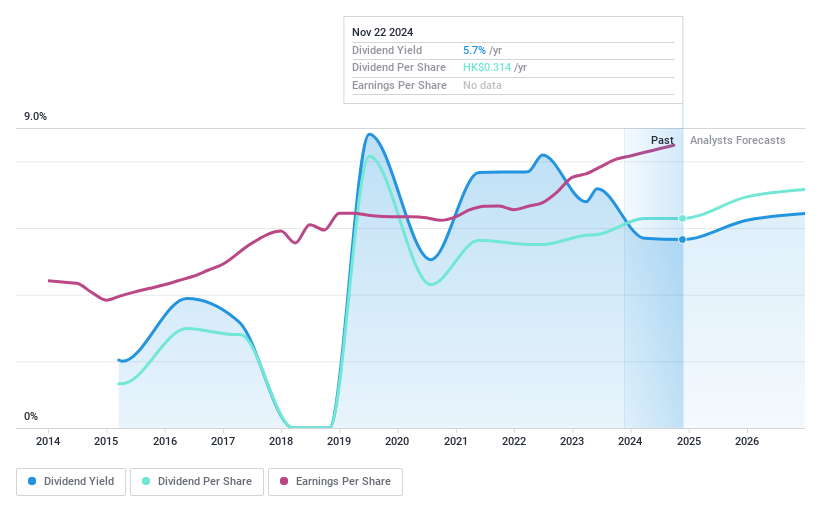

Qingdao Port International (SEHK:6198)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qingdao Port International Co., Ltd. operates the Port of Qingdao and has a market capitalization of HK$54.72 billion.

Operations: Qingdao Port International Co., Ltd. generates revenue from its operations at the Port of Qingdao, with key segments contributing to its financial performance.

Dividend Yield: 5.2%

Qingdao Port International's dividend yield of 5.19% is relatively low compared to Hong Kong's top payers, but dividends are well-covered by earnings with a payout ratio of 37.1%. Despite a history of volatility, recent affirmations indicate stability, with an interim dividend approved for December payment. The company's price-to-earnings ratio of 7.2x suggests good relative value in its market context, though cash flow coverage remains tight at a 77.8% cash payout ratio.

- Click here to discover the nuances of Qingdao Port International with our detailed analytical dividend report.

- The analysis detailed in our Qingdao Port International valuation report hints at an deflated share price compared to its estimated value.

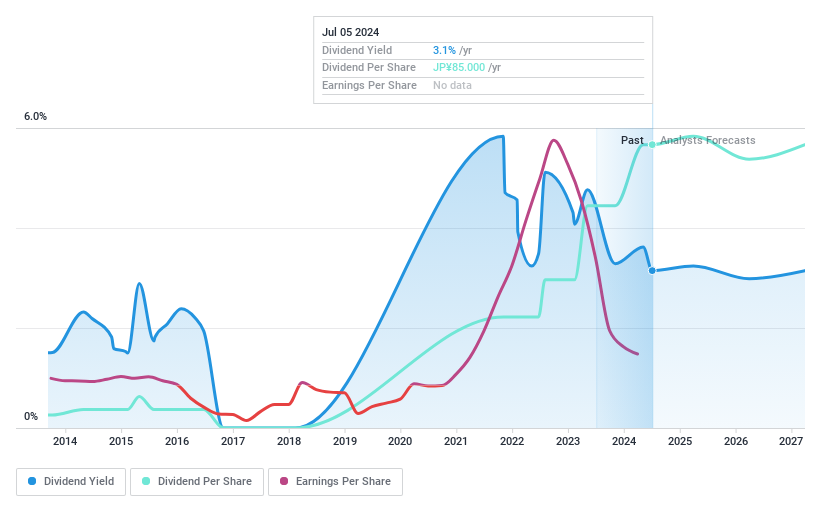

Kawasaki Kisen Kaisha (TSE:9107)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kawasaki Kisen Kaisha, Ltd. offers marine, land, and air transportation services across Japan, the United States, Europe, Asia, and internationally with a market cap of ¥1.38 trillion.

Operations: Kawasaki Kisen Kaisha, Ltd.'s revenue segments include Dry Bulk at ¥329.04 billion, Resource at ¥106.31 billion, and Product Logistics at ¥600.11 billion.

Dividend Yield: 4.7%

Kawasaki Kisen Kaisha's dividend yield of 4.67% ranks in the top 25% in Japan, supported by a low payout ratio of 30.9%, ensuring coverage by earnings. However, past dividend volatility raises concerns about reliability despite recent growth. The company's share buyback program aims to enhance shareholder returns, with plans to repurchase up to ¥90 billion worth of shares by February 2025. Its price-to-earnings ratio of 6.1x indicates favorable market valuation compared to peers.

- Get an in-depth perspective on Kawasaki Kisen Kaisha's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Kawasaki Kisen Kaisha's share price might be too optimistic.

Where To Now?

- Click here to access our complete index of 1967 Top Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000270

Kia

Manufactures and sells vehicles in South Korea, North America, and Europe.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives