- Austria

- /

- Electric Utilities

- /

- WBAG:EVN

High-Quality Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets continue to react positively to recent political developments and economic indicators, with U.S. stocks reaching record highs, investors are increasingly focused on opportunities that balance growth potential with stability. In such an environment, high-quality dividend stocks can offer a reliable income stream while potentially benefiting from favorable market conditions and economic policies.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.44% | ★★★★★★ |

Click here to see the full list of 1949 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

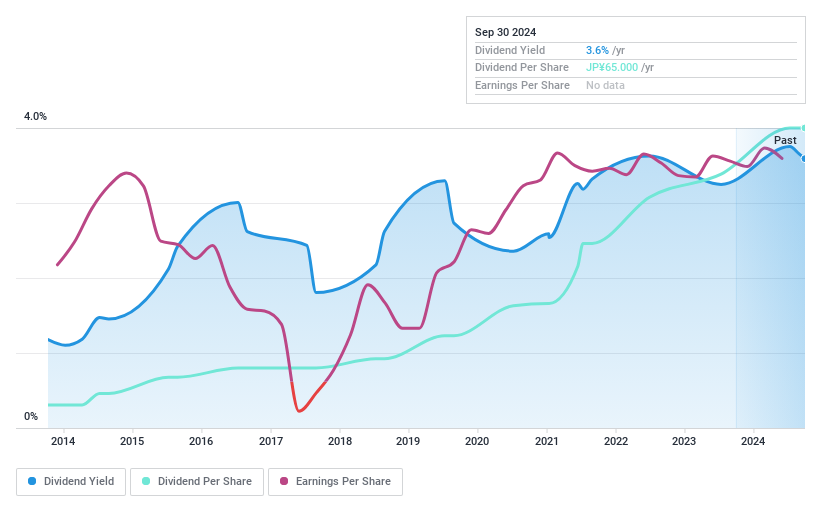

E J Holdings (TSE:2153)

Simply Wall St Dividend Rating: ★★★★★★

Overview: E J Holdings Inc. operates through its subsidiaries in the civil engineering consultant business both in Japan and internationally, with a market cap of ¥25.68 billion.

Operations: E J Holdings Inc. generates revenue through its subsidiaries by providing civil engineering consultancy services in both domestic and international markets.

Dividend Yield: 4%

E J Holdings offers a compelling dividend profile, with stable and reliable payments over the past decade. The dividend yield of 3.97% places it in the top 25% of Japanese market payers. Supported by a low payout ratio of 33.7% and a cash payout ratio of 43.4%, dividends are well covered by earnings and cash flows, suggesting sustainability. Additionally, the stock trades at a significant discount to its estimated fair value.

- Navigate through the intricacies of E J Holdings with our comprehensive dividend report here.

- Our expertly prepared valuation report E J Holdings implies its share price may be lower than expected.

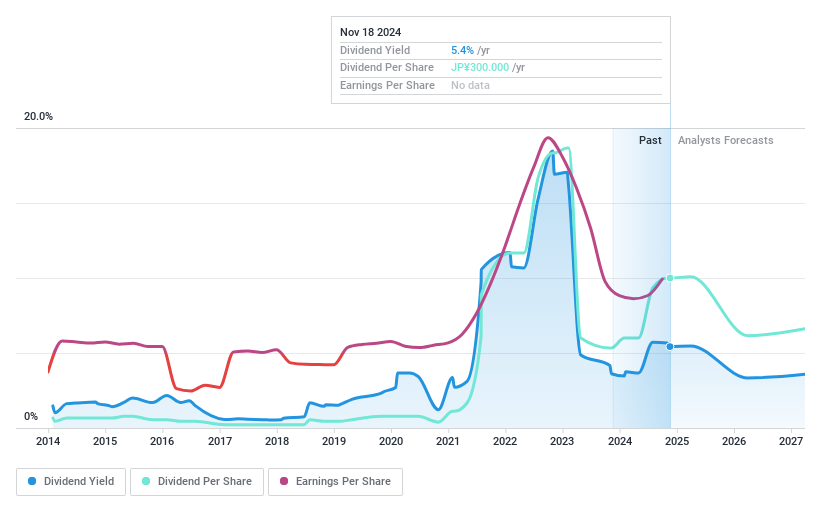

Mitsui O.S.K. Lines (TSE:9104)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsui O.S.K. Lines, Ltd. operates in the marine transportation industry both in Japan and globally, with a market capitalization of ¥1.81 trillion.

Operations: Mitsui O.S.K. Lines, Ltd.'s revenue segments include the Energy Business at ¥515.10 billion, Dry Bulk Business at ¥420.16 billion, Product Transport Business - Car Carriers, Terminal and Logistics, Ferries and Coastal Roro Ships at ¥579.82 billion, Product Transport Business - Container Ships at ¥60.42 billion, Ferry· Coastal RORO Ship and Cruise Business at ¥66.69 billion, Real Estate Business at ¥45.93 billion, and Connection Businesses (excluding Real Estate) at ¥88.02 billion.

Dividend Yield: 5.9%

Mitsui O.S.K. Lines has increased its annual dividend to ¥300 per share, reflecting improved earnings forecasts. Despite a top-tier yield of 5.86% in the Japanese market, dividends are not covered by free cash flows and have been volatile over the past decade. The company is addressing shareholder returns through a significant buyback program worth ¥100 billion, repurchasing shares to enhance value. However, high debt levels and projected earnings decline pose challenges for dividend sustainability.

- Dive into the specifics of Mitsui O.S.K. Lines here with our thorough dividend report.

- The analysis detailed in our Mitsui O.S.K. Lines valuation report hints at an deflated share price compared to its estimated value.

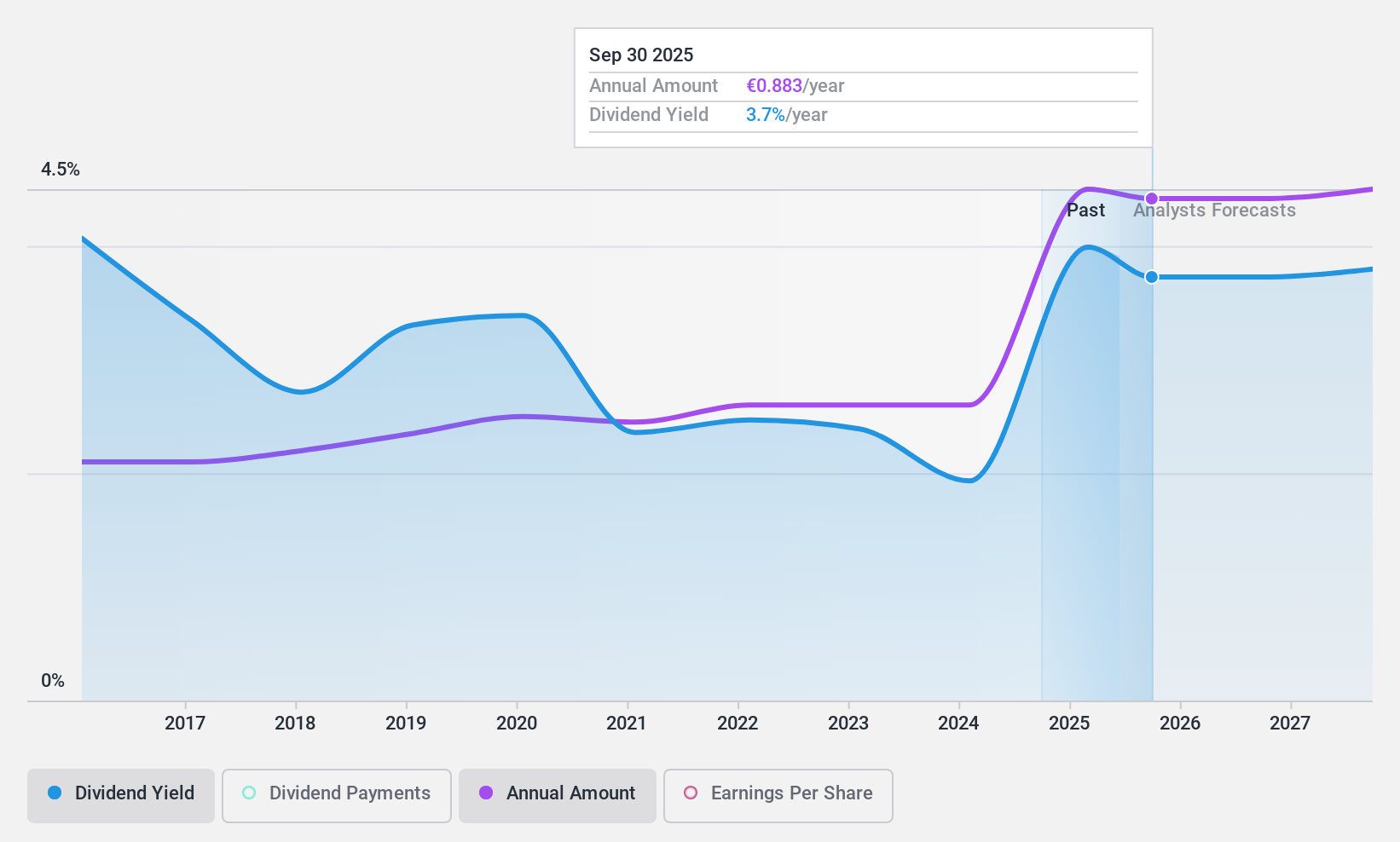

EVN (WBAG:EVN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EVN AG is an energy and environmental services provider operating in Austria, Bulgaria, North Macedonia, Croatia, Germany, and Albania with a market cap of €4.02 billion.

Operations: EVN AG's revenue segments include Energy (€799.80 million), Networks (€643.70 million), Production (€426 million), South East Europe (€1.34 billion), and Environmental Services (€428.70 million).

Dividend Yield: 3.9%

EVN offers a reliable dividend yield of 3.93%, though it's below the Austrian market's top tier. The dividends are well-covered by earnings and cash flows, with payout ratios of 34% and 38.7%, respectively, indicating sustainability. Despite stable and growing dividends over the past decade, earnings are forecast to decline by 2.1% annually over the next three years, which could impact future payouts. Trading at a discount to its fair value suggests potential for capital appreciation despite recent revenue declines from €3.77 billion to €3.26 billion year-on-year.

- Click to explore a detailed breakdown of our findings in EVN's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of EVN shares in the market.

Make It Happen

- Explore the 1949 names from our Top Dividend Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EVN might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:EVN

EVN

Provides energy and environmental services in Austria, Bulgaria, North Macedonia, Croatia, Germany, and Albania.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives