- Japan

- /

- Electronic Equipment and Components

- /

- TSE:268A

Does Rigaku Holdings' (TSE:268A) Persistent Buyback Pace Reveal Deep Conviction or Limited Alternatives?

Reviewed by Sasha Jovanovic

- Rigaku Holdings Corporation reported that, as of November 30, 2025, it had repurchased 844,300 shares in November, bringing total buybacks under the August 7, 2025 board authorization to about 3.6 million shares through market purchases on the Tokyo Stock Exchange.

- This active buyback program highlights management’s focus on capital structure efficiency and signals confidence in the company’s long-term value creation approach.

- We will now examine how Rigaku’s ongoing share repurchase activity shapes its investment narrative and what it might mean for shareholders.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

What Is Rigaku Holdings' Investment Narrative?

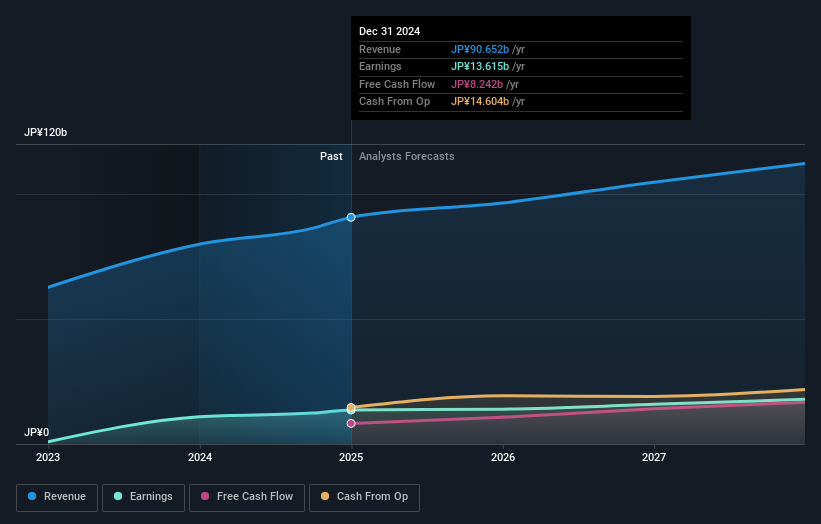

To own Rigaku, you need to be comfortable with a story built around specialty analytical and semiconductor-related equipment, where execution on its product roadmap and end-market demand remain the key swing factors. Short-term, the main catalysts are whether management can stabilize growth after the guidance cut tied to U.S. policy changes and softer EUV multilayer mirror demand, and how quickly the new Taiwan technology center turns into orders rather than just higher costs. Against that backdrop, the ongoing buyback, now at about 3.6 million shares, and the sharply higher dividend signal a clear tilt toward shareholder returns, but they do not remove the core demand and policy risks that drove the guidance revision in the first place.

But one important policy-driven risk is easier to miss at first glance. Rigaku Holdings' shares have been on the rise but are still potentially undervalued by 10%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Rigaku Holdings - why the stock might be worth as much as 12% more than the current price!

Build Your Own Rigaku Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rigaku Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Rigaku Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rigaku Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:268A

Rigaku Holdings

Engages in the manufacture and sale of scientific equipment in Japan, the United States, Europe, and Asia.

Excellent balance sheet with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026