C&G Systems (TSE:6633) Could Be At Risk Of Shrinking As A Company

When it comes to investing, there are some useful financial metrics that can warn us when a business is potentially in trouble. Businesses in decline often have two underlying trends, firstly, a declining return on capital employed (ROCE) and a declining base of capital employed. This indicates to us that the business is not only shrinking the size of its net assets, but its returns are falling as well. So after we looked into C&G Systems (TSE:6633), the trends above didn't look too great.

Return On Capital Employed (ROCE): What Is It?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on C&G Systems is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.016 = JP¥71m ÷ (JP¥5.6b - JP¥1.1b) (Based on the trailing twelve months to March 2024).

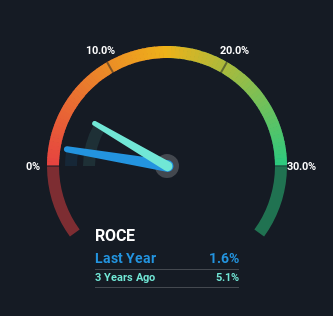

Thus, C&G Systems has an ROCE of 1.6%. Ultimately, that's a low return and it under-performs the Software industry average of 14%.

View our latest analysis for C&G Systems

Historical performance is a great place to start when researching a stock so above you can see the gauge for C&G Systems' ROCE against it's prior returns. If you're interested in investigating C&G Systems' past further, check out this free graph covering C&G Systems' past earnings, revenue and cash flow.

What Can We Tell From C&G Systems' ROCE Trend?

We are a bit worried about the trend of returns on capital at C&G Systems. To be more specific, the ROCE was 5.3% five years ago, but since then it has dropped noticeably. Meanwhile, capital employed in the business has stayed roughly the flat over the period. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. If these trends continue, we wouldn't expect C&G Systems to turn into a multi-bagger.

The Key Takeaway

In the end, the trend of lower returns on the same amount of capital isn't typically an indication that we're looking at a growth stock. In spite of that, the stock has delivered a 0.4% return to shareholders who held over the last five years. Either way, we aren't huge fans of the current trends and so with that we think you might find better investments elsewhere.

One final note, you should learn about the 3 warning signs we've spotted with C&G Systems (including 1 which is a bit concerning) .

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6633

Cgs Holdings

Develops, distributes, and supports CAD/CAM, production management, and prototyping solutions in Japan and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026