Dareway SoftwareLtd And 2 Other Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing inflation and strong bank earnings, small-cap stocks have shown notable resilience with indices like the S&P MidCap 400 and Russell 2000 posting significant gains. In this vibrant market landscape, identifying promising small-cap companies can offer unique opportunities for growth, particularly when these firms demonstrate robust fundamentals and potential for expansion.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 30.82% | 63.88% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Dareway SoftwareLtd (SHSE:688579)

Simply Wall St Value Rating: ★★★★★★

Overview: Dareway Software Co., Ltd. specializes in developing software solutions for intelligent human society, smart government services, smart medical insurance, healthcare, and electricity applications, with a market capitalization of CN¥3.70 billion.

Operations: Dareway Software Ltd. generates revenue primarily from software solutions tailored for smart government services, medical insurance, healthcare, and electricity applications. The company has a market capitalization of CN¥3.70 billion.

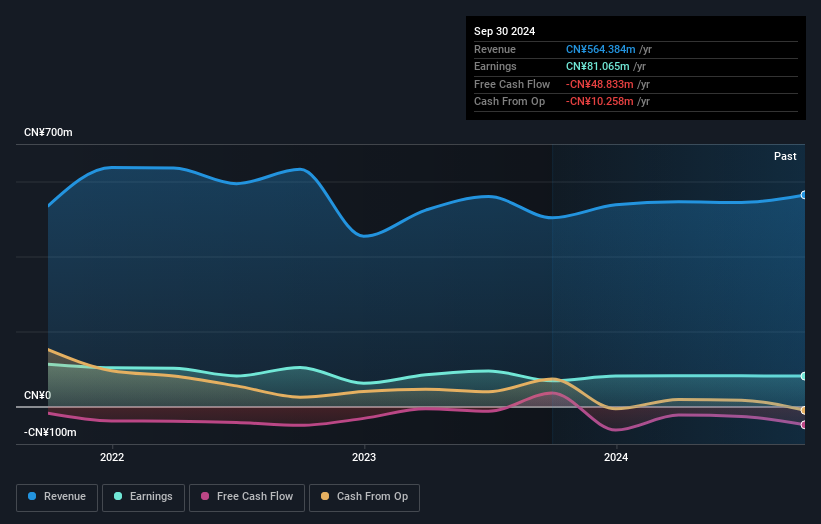

Dareway Software, a nimble player in the tech space, has shown an 18.3% earnings growth over the past year, outpacing the industry average of -11.2%. Despite this impressive growth, its net income for nine months ending September 2024 was CNY 31.11 million, nearly unchanged from CNY 31.2 million last year. The company boasts high-quality earnings and operates debt-free with a Price-to-Earnings ratio of 45.6x—considerably lower than the industry average of 84.4x—suggesting potential value for investors seeking opportunities in smaller tech firms despite its lack of free cash flow positivity recently.

- Unlock comprehensive insights into our analysis of Dareway SoftwareLtd stock in this health report.

Explore historical data to track Dareway SoftwareLtd's performance over time in our Past section.

Cybozu (TSE:4776)

Simply Wall St Value Rating: ★★★★★★

Overview: Cybozu, Inc. specializes in the development, sale, and operation of groupware solutions in Japan with a market capitalization of ¥124.18 billion.

Operations: Revenue from software development and sales for Cybozu is ¥28.16 billion.

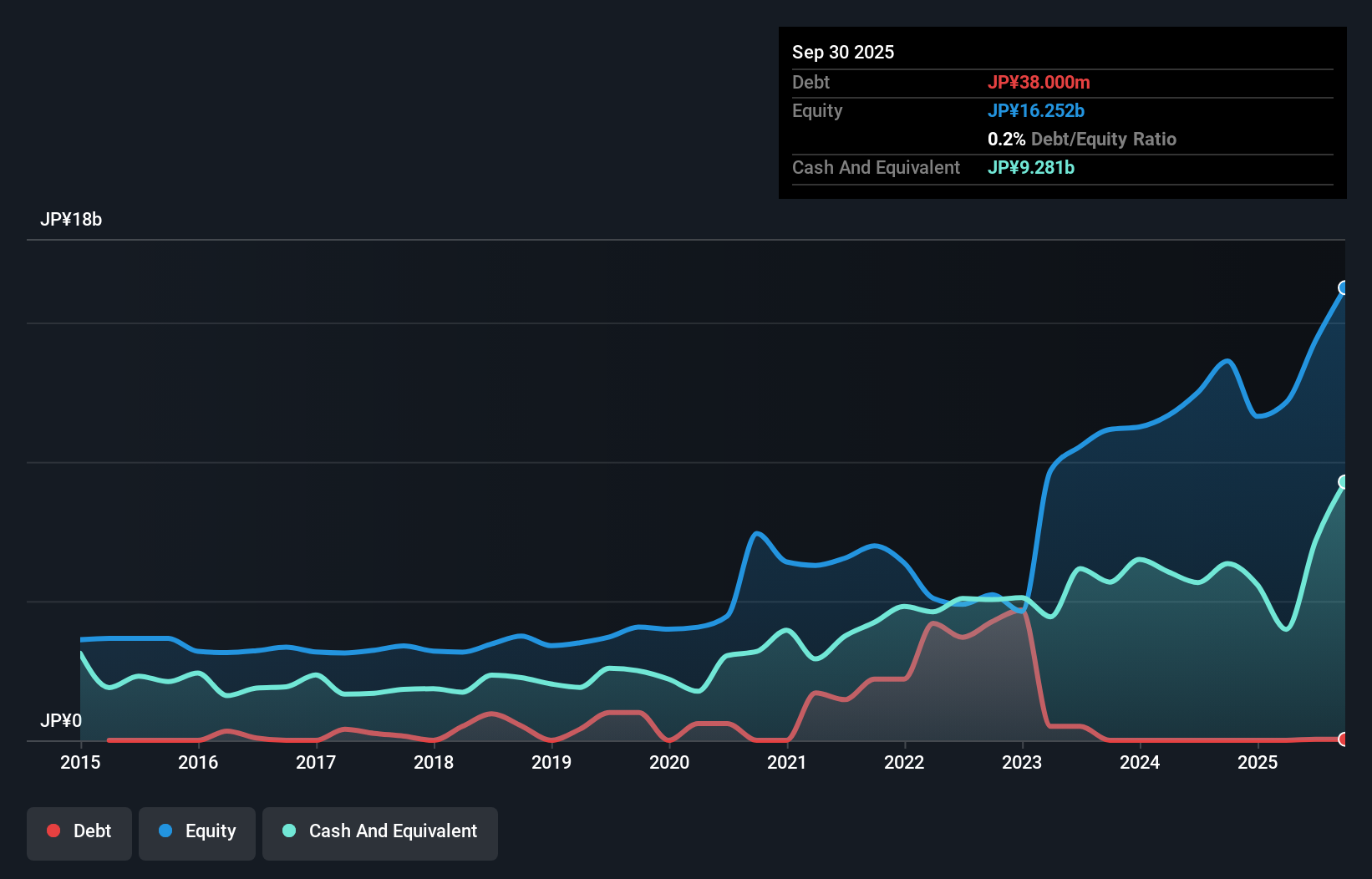

Cybozu, a nimble player in the software industry, showcases impressive growth with earnings surging 39% over the past year, outpacing the sector's average of 12%. This debt-free company has seen its debt to equity ratio shrink from 24.6% five years ago to zero today. Its recent buyback activity is notable; between October and December 2024, Cybozu repurchased 1.41 million shares for ¥2.93 billion, representing nearly 3% of its stock. Despite these positive strides, potential investors should be aware of its volatile share price in recent months and consider this alongside its promising forecasted earnings growth of over 20% annually.

- Get an in-depth perspective on Cybozu's performance by reading our health report here.

Evaluate Cybozu's historical performance by accessing our past performance report.

Maeda Kosen (TSE:7821)

Simply Wall St Value Rating: ★★★★★★

Overview: Maeda Kosen Co., Ltd. is a Japanese company that manufactures and sells civil engineering, construction, and agricultural materials, as well as nonwoven fabrics, with a market cap of ¥130.62 billion.

Operations: Revenue is primarily generated from the Social Infrastructure Business and Industry Infrastructure Business, contributing ¥31.93 billion and ¥25.80 billion, respectively.

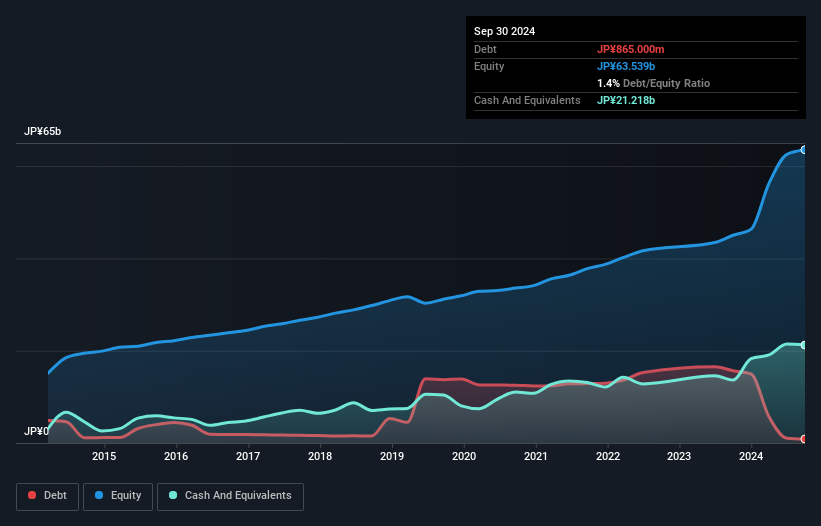

Maeda Kosen, a dynamic player in the market, reported first-quarter sales of ¥15.66 billion (up from ¥13.78 billion) with net income reaching ¥2.29 billion compared to last year's ¥1.86 billion, showcasing robust growth. Basic earnings per share rose to ¥33.75 from the previous year's ¥30.64, indicating strong profitability and operational efficiency with high-quality earnings and EBIT covering interest payments 388 times over, reflecting financial health and stability amidst industry challenges. The company's debt-to-equity ratio impressively shrank from 44% to just 1% over five years, suggesting prudent financial management that enhances its investment appeal further bolstered by trading below estimated fair value by nearly 41%.

- Delve into the full analysis health report here for a deeper understanding of Maeda Kosen.

Assess Maeda Kosen's past performance with our detailed historical performance reports.

Where To Now?

- Access the full spectrum of 4662 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4776

Flawless balance sheet with high growth potential.