- Japan

- /

- Professional Services

- /

- TSE:4641

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets experience a rebound with cooling inflation and strong bank earnings in the U.S., investors are seeing value stocks outshine growth shares, particularly within the energy sector. In this dynamic environment, dividend stocks can offer a compelling blend of income and stability, making them an attractive option for those looking to navigate these shifting market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.04% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.48% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.45% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.65% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.82% | ★★★★★★ |

Click here to see the full list of 1980 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Altech (TSE:4641)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Altech Corporation offers technical and engineering assignment services both in Japan and internationally, with a market cap of ¥48.08 billion.

Operations: Altech Corporation's revenue is primarily derived from its Outsourcing Service Business, including staffing services, which accounts for ¥44.87 billion, complemented by its Global Business segment generating ¥3.09 billion.

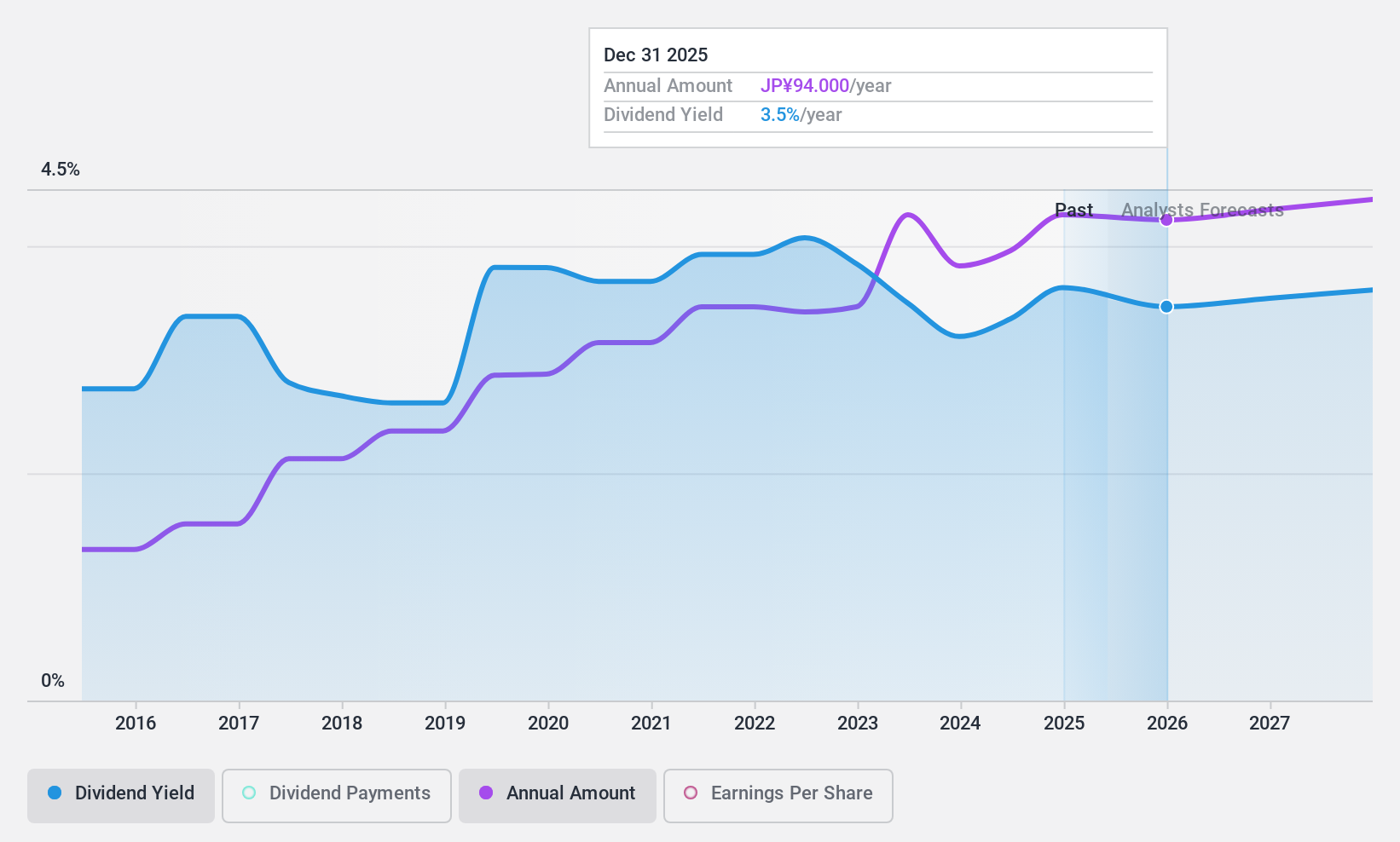

Dividend Yield: 3.8%

Altech's dividend profile shows mixed signals for investors. While its dividend yield is among the top 25% in the JP market, its track record has been volatile over the past decade with significant annual drops. However, dividends are well-covered by both earnings and cash flows, with payout ratios of 53.6% and 44.1%, respectively. Additionally, Altech trades at a significant discount to estimated fair value, suggesting potential upside if stability improves.

- Take a closer look at Altech's potential here in our dividend report.

- Upon reviewing our latest valuation report, Altech's share price might be too pessimistic.

SintokogioLtd (TSE:6339)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sintokogio, Ltd., along with its subsidiaries, manufactures and sells foundry, surface treatment, environmental, and material handling products both in Japan and internationally, with a market cap of ¥47.94 billion.

Operations: Sintokogio, Ltd.'s revenue is primarily derived from its Surface Treatment Business at ¥57.78 billion, Foundry Business at ¥41.89 billion, Environmental Business at ¥11.24 billion, Transportation Business at ¥9.15 billion, and Special Equipment Business at ¥9.03 billion.

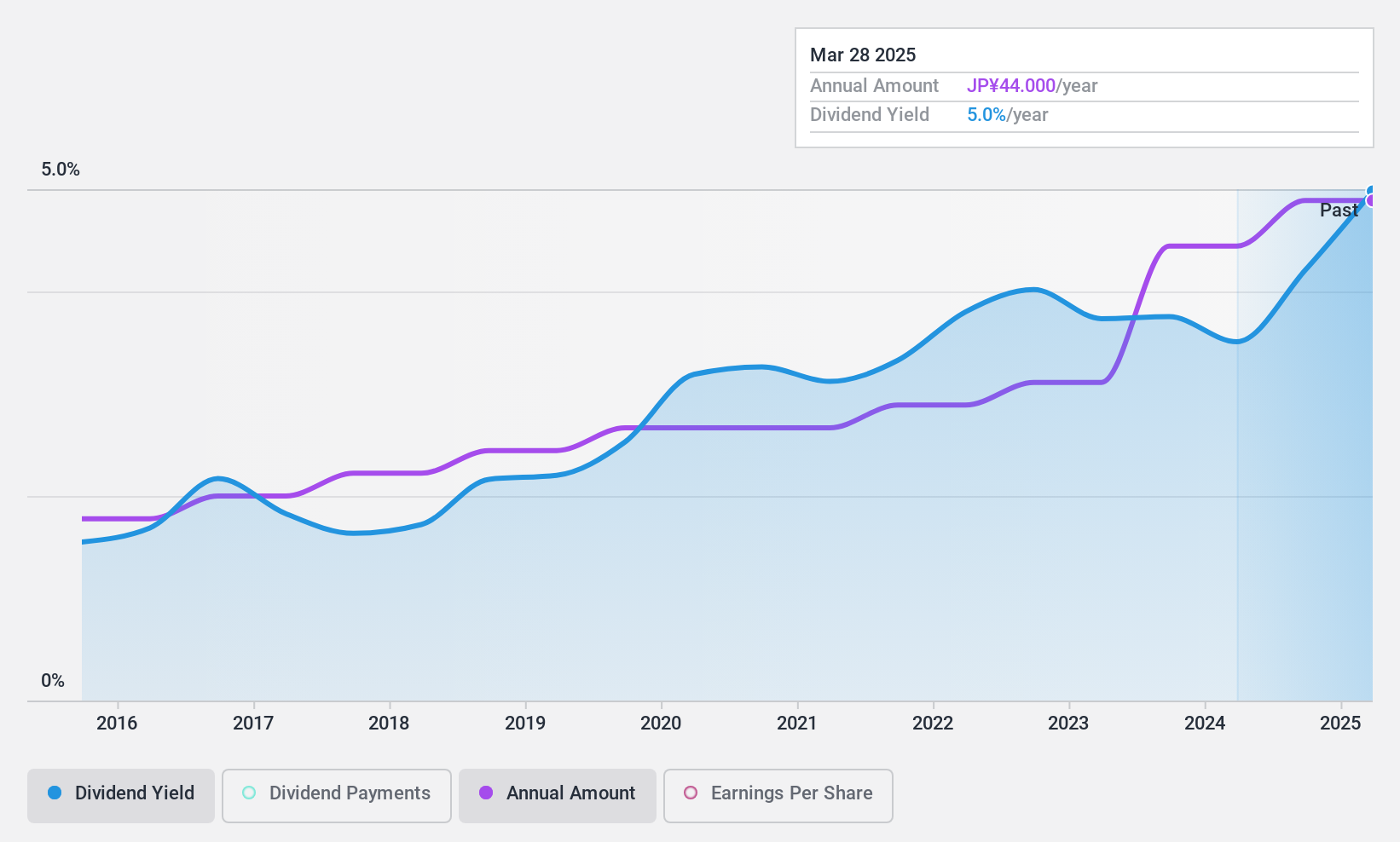

Dividend Yield: 4.8%

Sintokogio Ltd. offers a compelling dividend yield of 4.79%, placing it in the top 25% of JP market payers, yet concerns arise as dividends are not covered by free cash flows and earnings. Despite this, dividends have been stable and growing for a decade with low volatility, supported by a payout ratio of 33.2%. The company's price-to-earnings ratio is attractively low at 6.6x compared to the market average of 13.4x, indicating potential value for investors seeking dividends amidst financial constraints.

- Get an in-depth perspective on SintokogioLtd's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, SintokogioLtd's share price might be too optimistic.

Shin-Etsu PolymerLtd (TSE:7970)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shin-Etsu Polymer Co., Ltd. is a global manufacturer and seller of polyvinyl chloride (PVC) products, with a market capitalization of ¥130.91 billion.

Operations: Shin-Etsu Polymer Co., Ltd. generates revenue from three main segments: Electronic Device at ¥26.05 billion, Precision Molded Product at ¥50.10 billion, and Living Environment/Living Materials at ¥22.43 billion.

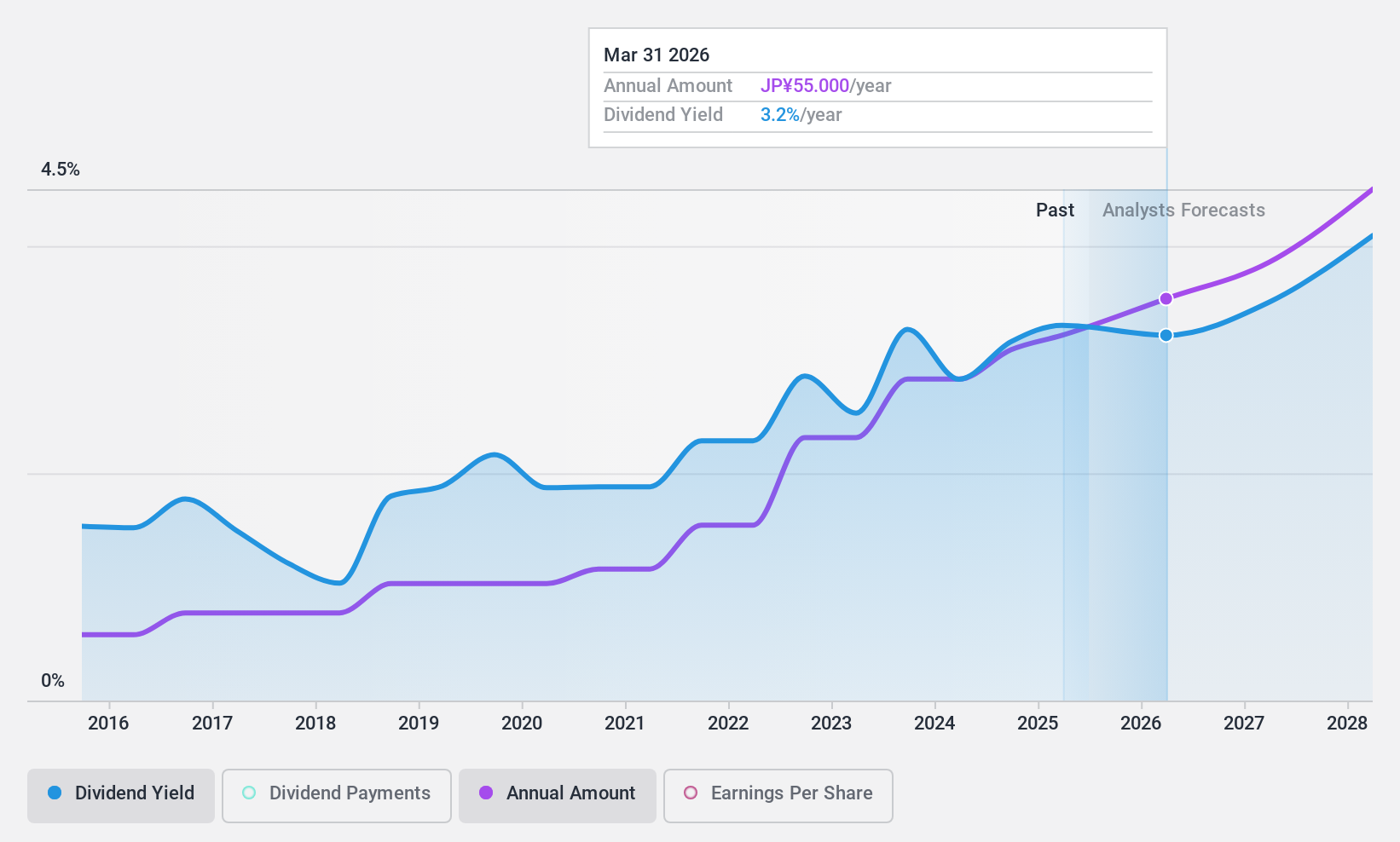

Dividend Yield: 3%

Shin-Etsu Polymer Ltd. has maintained stable and growing dividends over the past decade, though its 3.04% yield is below the top 25% in Japan. Despite a low payout ratio of 45.8%, dividends are not well covered by cash flows, indicated by a high cash payout ratio of 1800.8%. Recent completion of a ¥809.62 million share buyback may impact future dividend sustainability amidst forecasted earnings growth of 13.92% annually.

- Click here to discover the nuances of Shin-Etsu PolymerLtd with our detailed analytical dividend report.

- Our expertly prepared valuation report Shin-Etsu PolymerLtd implies its share price may be lower than expected.

Next Steps

- Dive into all 1980 of the Top Dividend Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4641

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives