- Japan

- /

- Entertainment

- /

- TSE:7458

Uncovering 3 Undiscovered Gems On None Exchange

Reviewed by Simply Wall St

As global markets experience a rebound, driven by cooling U.S. inflation and robust bank earnings, small-cap stocks have shown notable resilience with the S&P MidCap 400 Index gaining 3.81% over the week. In this dynamic environment, identifying promising stocks requires a keen eye for companies that can capitalize on emerging economic trends and demonstrate strong growth potential despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 30.82% | 63.88% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

HitGen (SHSE:688222)

Simply Wall St Value Rating: ★★★★★☆

Overview: HitGen Inc. operates as a drug discovery research platform focusing on small molecules and nucleic acid drugs, with a market cap of CN¥4.84 billion.

Operations: HitGen generates revenue primarily through its drug discovery research services, focusing on small molecules and nucleic acid drugs. The company's financial performance is highlighted by a net profit margin trend worth noting.

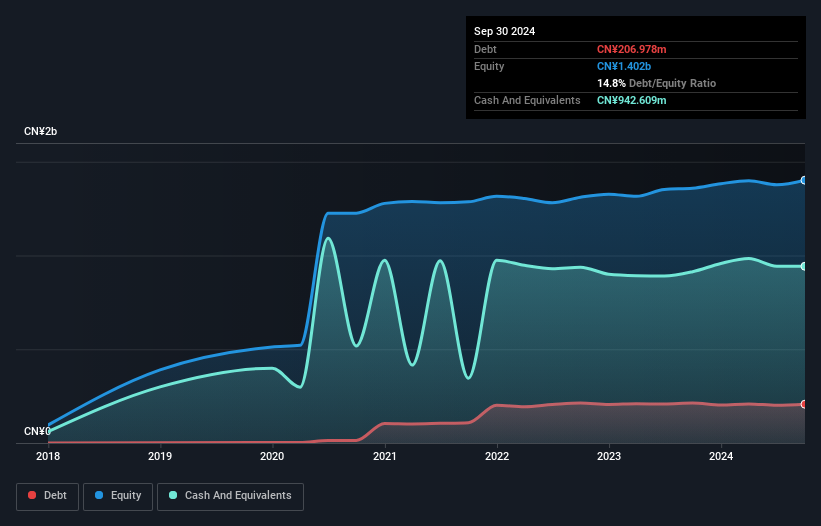

HitGen is carving out a promising niche with its robust earnings growth, outpacing the Life Sciences industry by 58.7% in the past year. The company's financial health seems solid, boasting more cash than total debt and maintaining profitability without concerns about cash runway. Recent reports highlight a revenue increase to CNY 298 million and net income rising to CNY 30 million for the first nine months of 2024, indicating positive momentum. With earnings per share climbing from CNY 0.05 to CNY 0.08, HitGen's trajectory appears aligned with forecasts of continued annual growth at around 20%.

- Take a closer look at HitGen's potential here in our health report.

Gain insights into HitGen's past trends and performance with our Past report.

Jiangxi Everbright Measurement And Control TechnologyLtd (SZSE:300906)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangxi Everbright Measurement And Control Technology Co., Ltd. operates in the field of measurement and control technology, with a market capitalization of CN¥2.04 billion.

Operations: Jiangxi Everbright generates revenue primarily through its measurement and control technology solutions. The company's net profit margin shows variability, reflecting changes in operational efficiency and cost management over time.

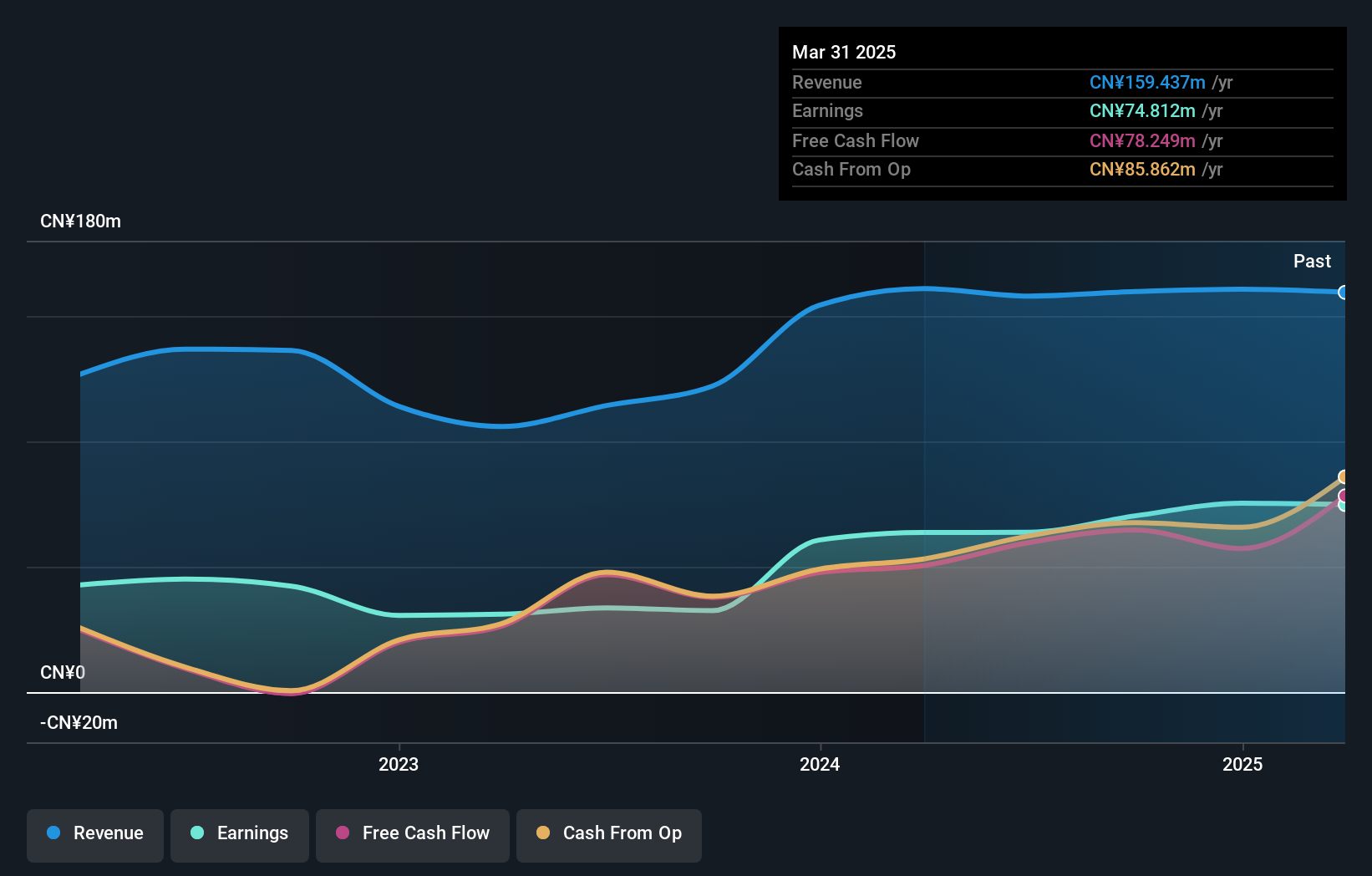

Jiangxi Everbright Measurement and Control Technology, a nimble player in the electronics sector, has shown impressive earnings growth of 116% over the past year, outpacing its industry benchmark of 2%. The company is trading at a notable discount of 31.9% below its estimated fair value. Over five years, earnings have slightly decreased by 0.3% annually; however, it boasts high-quality past earnings and remains debt-free since reducing its debt-to-equity ratio from 1.9%. Recent results highlight sales reaching CNY 90.77 million with net income climbing to CNY 43.67 million compared to last year's figures.

Daiichikosho (TSE:7458)

Simply Wall St Value Rating: ★★★★★☆

Overview: Daiichikosho Co., Ltd. specializes in the sale and rental of commercial karaoke systems in Japan, with a market capitalization of ¥184.28 billion.

Operations: Daiichikosho generates revenue primarily from its Commercial Karaoke and Karaoke and Restaurant Business segments, contributing ¥61.39 billion and ¥65.87 billion, respectively. The Music Soft segment adds an additional ¥6.34 billion to the overall revenue stream.

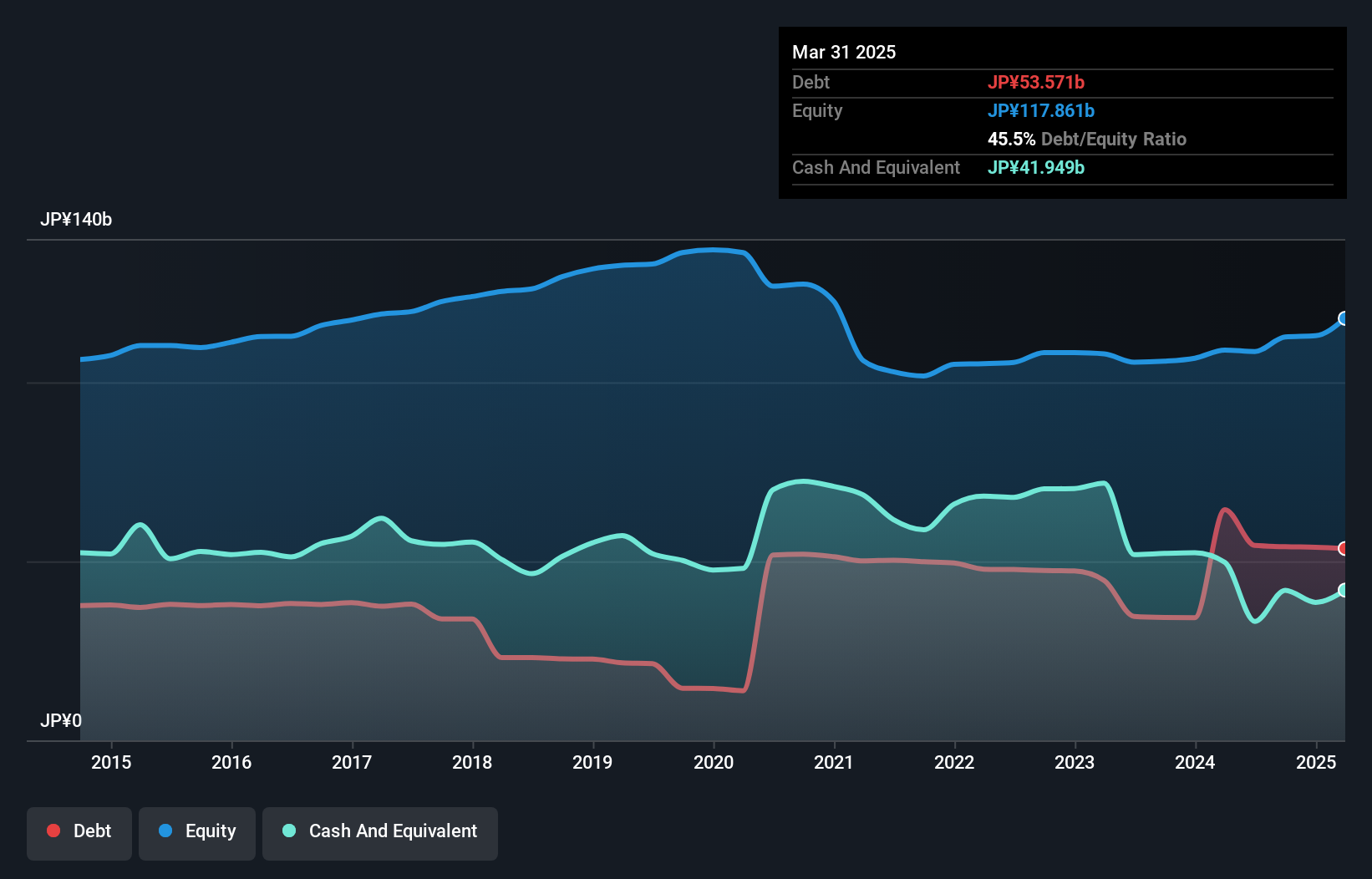

Daiichikosho, a player in the entertainment sector, has shown impressive earnings growth of 75.1% over the past year, outpacing its industry peers. The company trades at a price-to-earnings ratio of 12x, which is favorable compared to Japan's market average of 13.4x. Despite an increase in debt to equity from 10.7% to 48% over five years, interest payments are comfortably covered by EBIT at a whopping 396 times coverage. Recently, Daiichikosho repurchased shares worth ¥3.99 billion and announced plans for a new karaoke system launch in April 2025, signaling ongoing strategic initiatives and product innovation efforts.

- Click here and access our complete health analysis report to understand the dynamics of Daiichikosho.

Explore historical data to track Daiichikosho's performance over time in our Past section.

Turning Ideas Into Actions

- Discover the full array of 4662 Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7458

Daiichikosho

Engages in the sale and rental of commercial karaoke systems in Japan.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion