3 Global Stocks Estimated To Be Up To 27.9% Below Intrinsic Value

Reviewed by Simply Wall St

In the current global market landscape, characterized by mixed performances and heightened trade tensions, investors are navigating a complex environment. While larger indices like the Dow Jones and S&P 500 have experienced declines, smaller-cap indexes such as the S&P MidCap 400 and Russell 2000 have shown resilience. In this context, identifying undervalued stocks can be particularly rewarding, as these stocks may offer potential for growth when their intrinsic values are recognized in such fluctuating conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pegasus (TSE:6262) | ¥462.00 | ¥920.05 | 49.8% |

| Members (TSE:2130) | ¥1121.00 | ¥2241.88 | 50% |

| Lindab International (OM:LIAB) | SEK186.80 | SEK371.74 | 49.8% |

| Rakus (TSE:3923) | ¥2186.00 | ¥4351.62 | 49.8% |

| Etteplan Oyj (HLSE:ETTE) | €11.55 | €23.07 | 49.9% |

| BIKE O (TSE:3377) | ¥385.00 | ¥766.62 | 49.8% |

| Aozora Bank (TSE:8304) | ¥1859.00 | ¥3690.62 | 49.6% |

| Sunstone Development (SHSE:603612) | CN¥16.12 | CN¥32.16 | 49.9% |

| Swire Properties (SEHK:1972) | HK$16.08 | HK$31.96 | 49.7% |

| Innovent Biologics (SEHK:1801) | HK$47.25 | HK$93.85 | 49.7% |

Let's review some notable picks from our screened stocks.

Akbank T.A.S (IBSE:AKBNK)

Overview: Akbank T.A.S., along with its subsidiaries, offers a range of banking products and services both in Turkey and internationally, with a market capitalization of TRY266.76 billion.

Operations: The company's revenue segments include Consumer Banking and Private Banking, generating TRY101.65 billion, and Commercial Banking, Corporate Banking, and SME Banking, contributing TRY100.28 billion.

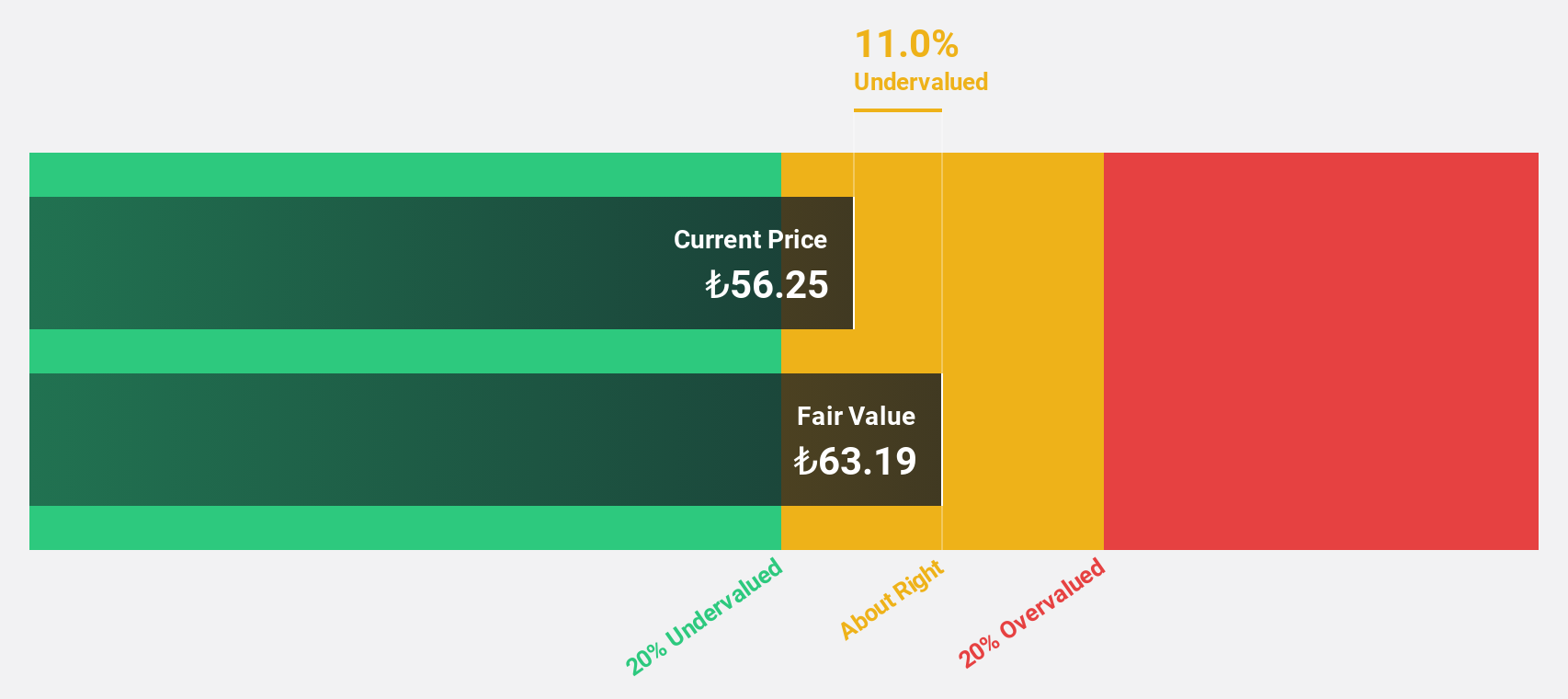

Estimated Discount To Fair Value: 27.9%

Akbank T.A.S. is trading 27.9% below its estimated fair value of TRY71.11, suggesting it may be undervalued based on cash flows. Despite a high level of bad loans at 2.7%, revenue is forecast to grow significantly at 32.7% annually, outpacing the Turkish market's growth rate of 21.3%. However, profit margins have decreased from last year and earnings are expected to grow slower than the market average despite significant projected growth over three years.

- According our earnings growth report, there's an indication that Akbank T.A.S might be ready to expand.

- Unlock comprehensive insights into our analysis of Akbank T.A.S stock in this financial health report.

Toray Industries (TSE:3402)

Overview: Toray Industries, Inc. is a global company that manufactures and sells fibers, textiles, performance chemicals, carbon fiber composite materials, environment and engineering products, and life science products across various regions including Japan, China, North America, and Europe with a market cap of approximately ¥1.43 trillion.

Operations: Toray Industries generates revenue through its diverse operations in fibers and textiles, performance chemicals, carbon fiber composite materials, environment and engineering products, and life science products across Japan, China, North America, Europe, and other international markets.

Estimated Discount To Fair Value: 18.9%

Toray Industries is trading 18.9% below its estimated fair value of ¥1,135.7, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 20.7% annually, outpacing the Japanese market's growth rate of 7.7%. However, Toray has a volatile share price and an unstable dividend track record. Recent strategic moves include a share buyback and collaboration with Bolt Biotherapeutics to develop innovative cancer therapies targeting Caprin-1.

- Our expertly prepared growth report on Toray Industries implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Toray Industries' balance sheet by reading our health report here.

Lai Yih Footwear (TWSE:6890)

Overview: Lai Yih Footwear Co., Ltd. is engaged in the production and sale of vulcanized shoes, athletic footwear, cold-pressed shoes, and specialized functional footwear with a market cap of NT$77.81 billion.

Operations: The company's revenue from the production and sales of sports and leisure footwear is NT$37.69 billion.

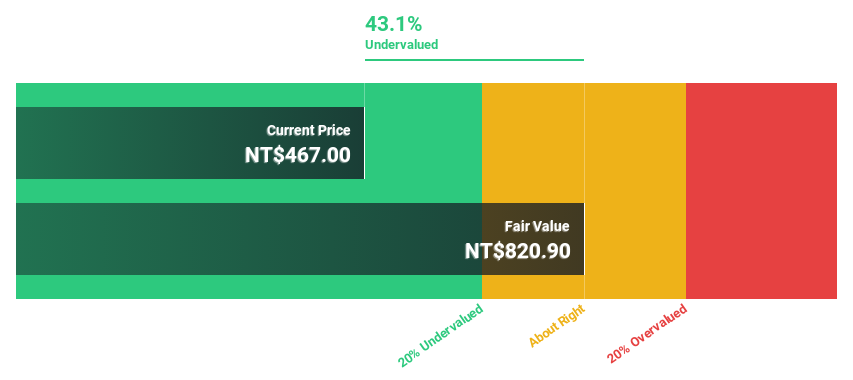

Estimated Discount To Fair Value: 12.6%

Lai Yih Footwear is trading below its estimated fair value of NT$373.07, with a current price of NT$326, suggesting potential undervaluation based on cash flows. The company's earnings grew by 177% last year and are expected to increase by 20.34% annually, outpacing the Taiwanese market's growth rate of 14.8%. However, the dividend yield of 2.76% is not well supported by free cash flows, and the share price has been highly volatile recently.

- The growth report we've compiled suggests that Lai Yih Footwear's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Lai Yih Footwear.

Seize The Opportunity

- Get an in-depth perspective on all 480 Undervalued Global Stocks Based On Cash Flows by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6890

Lai Yih Footwear

Produces and sells vulcanized shoes, athletic footwear, cold-pressed shoes, and specialized functional footwear.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)