Japan's stock markets have experienced significant volatility recently, driven by a rebounding yen and shifting central bank policies. Despite these fluctuations, the Nikkei 225 Index and TOPIX Index managed to recoup much of their losses by the end of the week. In this environment, identifying undervalued stocks becomes crucial for investors looking to capitalize on potential market rebounds. The following three stocks stand out as top value picks on the Japanese exchange for August 2024.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Strike CompanyLimited (TSE:6196) | ¥3535.00 | ¥6620.29 | 46.6% |

| NittoseikoLtd (TSE:5957) | ¥531.00 | ¥1016.01 | 47.7% |

| Insource (TSE:6200) | ¥849.00 | ¥1617.19 | 47.5% |

| Taiyo Yuden (TSE:6976) | ¥3385.00 | ¥6307.10 | 46.3% |

| Members (TSE:2130) | ¥748.00 | ¥1400.18 | 46.6% |

| Daiichi Kigenso Kagaku Kogyo (TSE:4082) | ¥797.00 | ¥1570.40 | 49.2% |

| Fudo Tetra (TSE:1813) | ¥2259.00 | ¥4412.86 | 48.8% |

| Premium Group (TSE:7199) | ¥1778.00 | ¥3315.56 | 46.4% |

| BuySell TechnologiesLtd (TSE:7685) | ¥3800.00 | ¥7519.08 | 49.5% |

| TORIDOLL Holdings (TSE:3397) | ¥3764.00 | ¥7192.92 | 47.7% |

Let's uncover some gems from our specialized screener.

Kotobuki Spirits (TSE:2222)

Overview: Kotobuki Spirits Co., Ltd. produces and sells sweets in Japan, with a market cap of ¥259.54 billion.

Operations: Kotobuki Spirits generates revenue primarily from its Shukrei segment at ¥27.03 billion, Casey Shii at ¥18.88 billion, Kotobuki Confectionery/Tajima Kotobuki at ¥13.19 billion, Sales Subsidiaries at ¥7.06 billion, and Kujukushima at ¥6.56 billion.

Estimated Discount To Fair Value: 29.6%

Kotobuki Spirits is trading at ¥1,667.5, significantly below its estimated fair value of ¥2,368.46. Analysts agree the stock price could rise by 65.3%. Despite a recent dividend cut to ¥28 per share, earnings are forecasted to grow by 14% annually and revenue by 11.1%, outpacing the broader Japanese market's growth rates of 8.7% and 4.3%, respectively. The company's return on equity is projected to reach a high of 31.9% in three years.

- The analysis detailed in our Kotobuki Spirits growth report hints at robust future financial performance.

- Click here to discover the nuances of Kotobuki Spirits with our detailed financial health report.

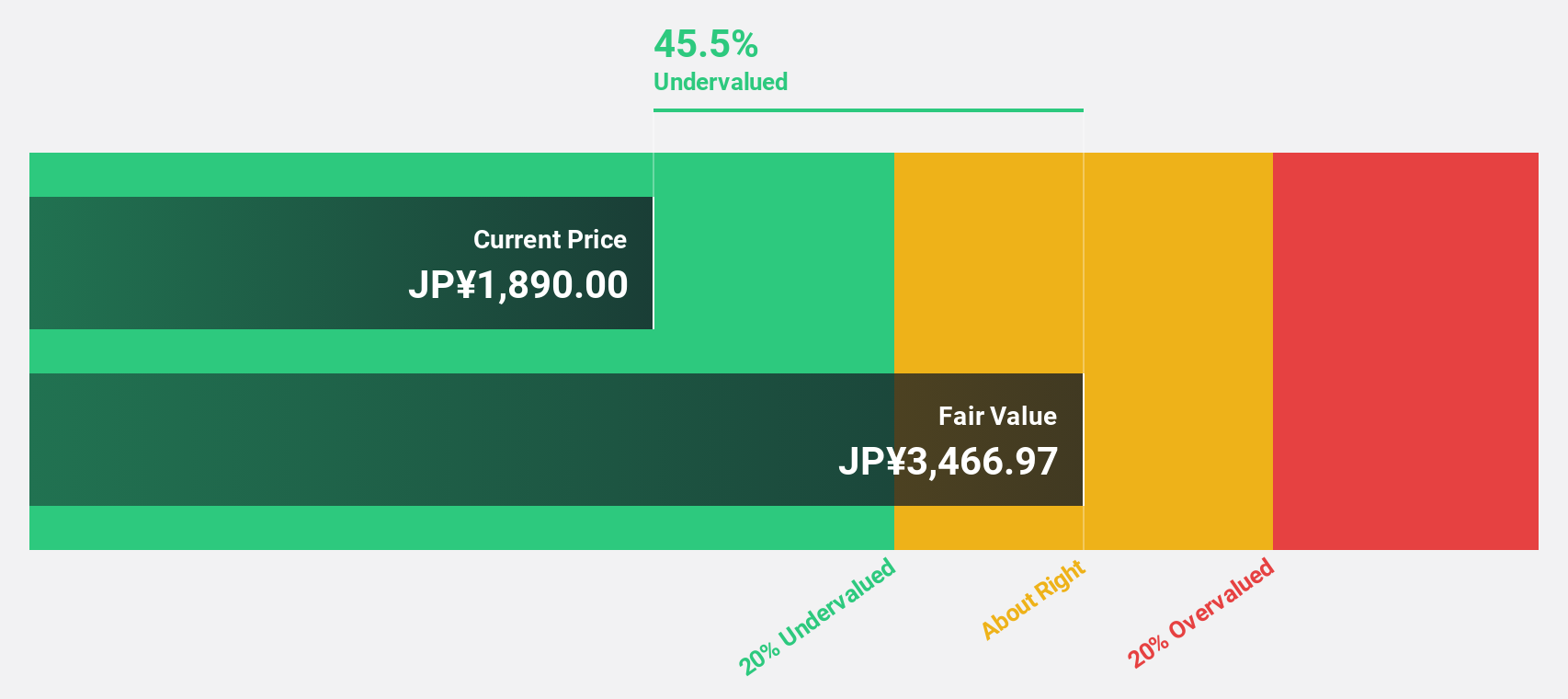

Sansan (TSE:4443)

Overview: Sansan, Inc. engages in the planning, development, and selling of cloud-based solutions in Japan with a market cap of ¥254.61 billion.

Operations: Sansan's revenue segments include ¥29.95 billion from the Sansan/Bill One Business and ¥3.55 billion from the Eight Business.

Estimated Discount To Fair Value: 14.9%

Sansan, Inc. is trading at ¥2024, slightly below its estimated fair value of ¥2377.83. The company recently announced a share repurchase program worth ¥300 million, potentially enhancing shareholder value. Earnings are forecasted to grow significantly at 30.82% per year over the next three years, outpacing the broader Japanese market's growth rate of 8.7%. Despite a highly volatile share price recently, Sansan became profitable this year and shows strong future growth prospects based on cash flows.

- Insights from our recent growth report point to a promising forecast for Sansan's business outlook.

- Get an in-depth perspective on Sansan's balance sheet by reading our health report here.

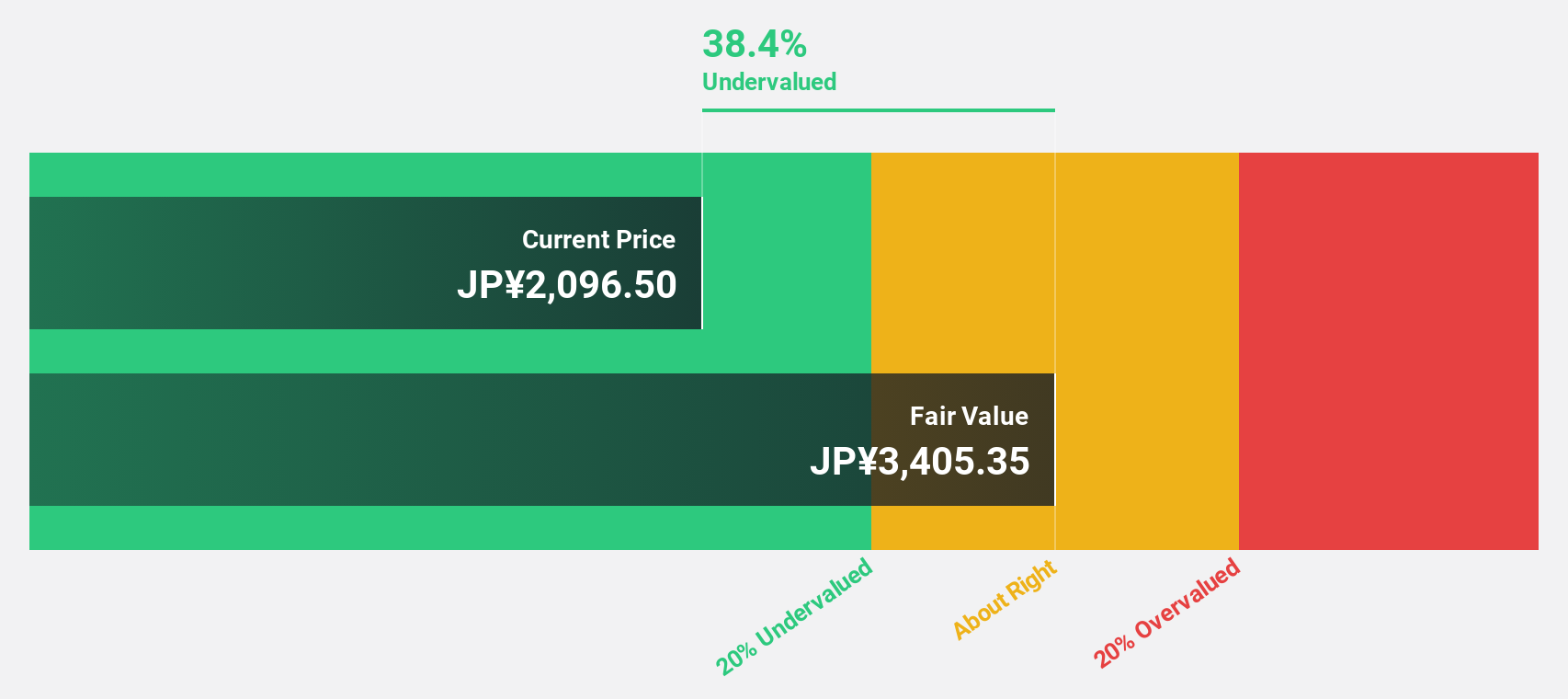

Aozora Bank (TSE:8304)

Overview: Aozora Bank, Ltd., along with its subsidiaries, offers a range of banking products and services both in Japan and internationally, with a market cap of ¥327.13 billion.

Operations: Aozora Bank's revenue segments include Corporate Sales Group (¥16.11 billion), Customer Relations Group (¥8.35 billion), Structured Finance Group (¥40.97 billion), and International Business Group (¥18.48 billion).

Estimated Discount To Fair Value: 13.8%

Aozora Bank, trading at ¥2365, is considered undervalued with an estimated fair value of ¥2743.73. The bank's revenue growth forecast of 9.6% per year surpasses the Japanese market average of 4.3%, and earnings are expected to grow significantly at 74.66% annually over the next three years. However, Aozora has a high level of bad loans (3.1%) and recent shareholder dilution may be concerns for potential investors focused on cash flow valuation metrics.

- Our growth report here indicates Aozora Bank may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Aozora Bank stock in this financial health report.

Key Takeaways

- Explore the 74 names from our Undervalued Japanese Stocks Based On Cash Flows screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4443

Sansan

Engages in the planning, development, and selling of cloud- based solutions in Japan.

Flawless balance sheet with high growth potential.