- Japan

- /

- Hospitality

- /

- TSE:3196

Exploring HOTLANDLtd And Two More Top Growth Stocks With High Insider Ownership On The Japanese Exchange

Reviewed by Simply Wall St

Amidst a backdrop of slight weekly losses for Japan's major indexes and potential shifts in the Bank of Japan's monetary policy, investors are closely watching market dynamics and the implications for various sectors. In this environment, understanding the significance of insider ownership can be crucial, as it often reflects leadership's confidence in the company's growth trajectory and resilience against market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| SHIFT (TSE:3697) | 35.5% | 27.2% |

| Hottolink (TSE:3680) | 27% | 57.3% |

| Medley (TSE:4480) | 34.1% | 23.4% |

| Micronics Japan (TSE:6871) | 15.3% | 39.5% |

| Kasumigaseki CapitalLtd (TSE:3498) | 35.5% | 44.6% |

| ExaWizards (TSE:4259) | 24.8% | 84.3% |

| Money Forward (TSE:3994) | 21.4% | 63.5% |

| Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

| Soracom (TSE:147A) | 17.2% | 59.1% |

| freee K.K (TSE:4478) | 24% | 78.8% |

Here we highlight a subset of our preferred stocks from the screener.

HOTLANDLtd (TSE:3196)

Simply Wall St Growth Rating: ★★★★☆☆

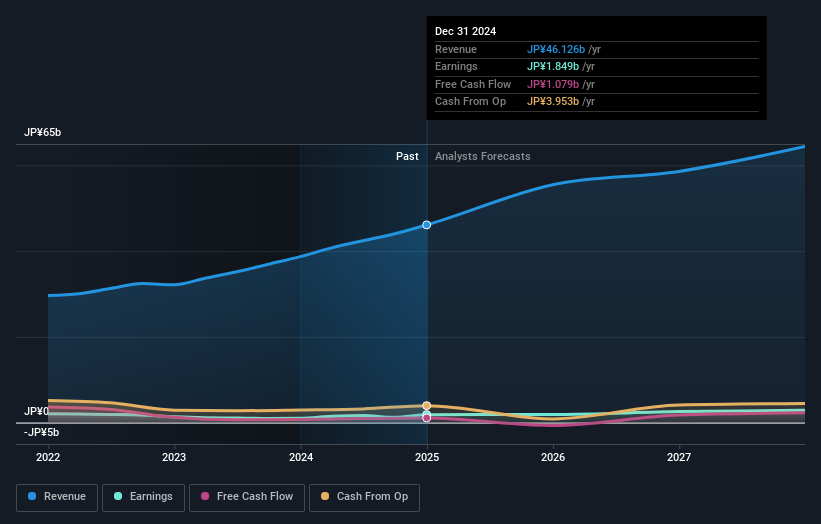

Overview: HOTLAND Co., Ltd. operates a chain of restaurants both in Japan and internationally, with a market capitalization of approximately ¥47.11 billion.

Operations: The company generates its revenue from its restaurant operations across both domestic and international markets.

Insider Ownership: 32.7%

Earnings Growth Forecast: 27% p.a.

HOTLAND Ltd., a growth-oriented company in Japan, has seen a decline in net profit margins from last year, now at 2.6%. Despite this, the company is set to outpace the Japanese market with its earnings projected to increase by 27% annually and revenue expected to grow at 10.9% per year. However, financial results have been affected by large one-off items. There's no recent insider trading activity reported, indicating stable insider confidence amidst these forecasts.

- Click to explore a detailed breakdown of our findings in HOTLANDLtd's earnings growth report.

- According our valuation report, there's an indication that HOTLANDLtd's share price might be on the expensive side.

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★★

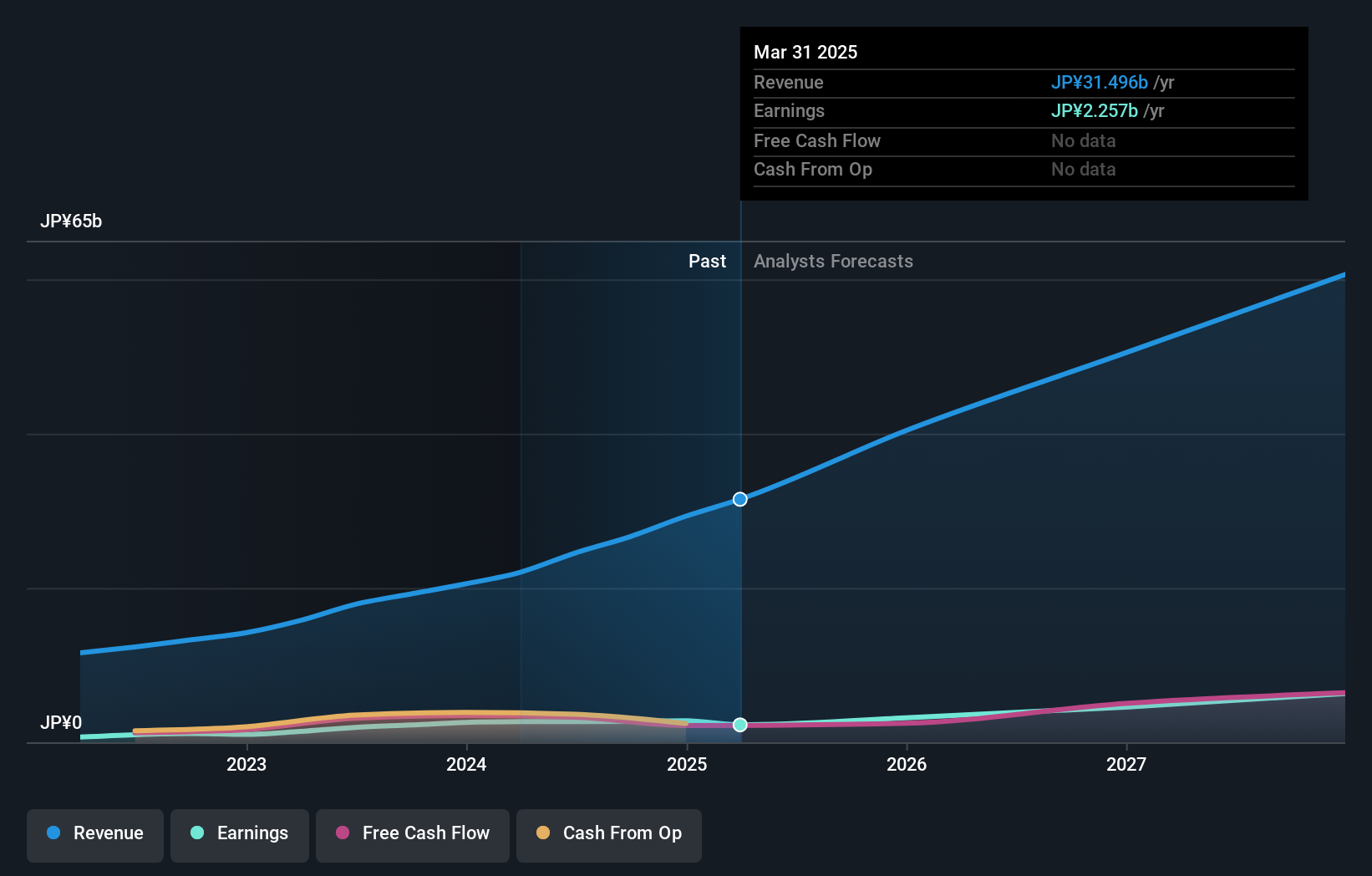

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan, with a market capitalization of approximately ¥119.39 billion.

Operations: The company generates revenue primarily through its Human Resource Platform Business and Medical Platform Business, with respective revenues of ¥14.66 billion and ¥5.46 billion.

Insider Ownership: 34.1%

Earnings Growth Forecast: 23.4% p.a.

Medley, a Japanese company with substantial insider ownership, is poised for significant growth. Recently, Medley expanded its global footprint by opening a new office in the Philippines to bolster its international operations. Financially, Medley's earnings surged by 152.3% last year and are projected to grow at 23.39% annually over the next three years. This performance surpasses the Japanese market's average growth rate significantly. Additionally, Medley is trading at 28% below its estimated fair value, highlighting potential undervaluation despite robust financial forecasts and strategic expansions.

- Delve into the full analysis future growth report here for a deeper understanding of Medley.

- In light of our recent valuation report, it seems possible that Medley is trading beyond its estimated value.

H.I.S (TSE:9603)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: H.I.S. Co., Ltd., a global travel agency, operates extensively around the world with a market capitalization of approximately ¥128.95 billion.

Operations: The firm operates primarily in global travel agency services.

Insider Ownership: 32.9%

Earnings Growth Forecast: 20.2% p.a.

H.I.S., a Japanese company, recently became profitable and is trading at 15.9% below its estimated fair value, suggesting potential undervaluation. The firm's earnings are expected to grow by 20.24% annually, outpacing the Japanese market forecast of 8.9%. However, its revenue growth projection of 7.2% per year, although above the market average of 4.4%, is considered modest for a high-growth category. Additionally, debt levels are concerning as they are not well covered by operating cash flow.

- Take a closer look at H.I.S' potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of H.I.S shares in the market.

Key Takeaways

- Investigate our full lineup of 105 Fast Growing Japanese Companies With High Insider Ownership right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade HOTLANDLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HOTLANDLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3196

Flawless balance sheet with proven track record.