- Japan

- /

- Professional Services

- /

- TSE:9757

Discovering POYA International And 2 Other Stocks That May Be Priced Below Estimated Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape of rate cuts and economic data, investors are keenly observing the performance of major indices, with the Nasdaq reaching new heights while others face declines. Amid these fluctuations, identifying stocks that may be undervalued becomes crucial for those looking to capitalize on potential market mispricings. In this context, understanding what constitutes a good stock involves assessing its intrinsic value relative to current market conditions and recognizing opportunities where price does not reflect underlying worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sudarshan Chemical Industries (BSE:506655) | ₹1129.35 | ₹2251.04 | 49.8% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.8% |

| Wuhan Keqian BiologyLtd (SHSE:688526) | CN¥14.62 | CN¥29.09 | 49.7% |

| Decisive Dividend (TSXV:DE) | CA$5.92 | CA$11.83 | 50% |

| Management SolutionsLtd (TSE:7033) | ¥1717.00 | ¥3419.48 | 49.8% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP290.00 | CLP579.00 | 49.9% |

| Wetteri Oyj (HLSE:WETTERI) | €0.297 | €0.59 | 49.9% |

| Compagnia dei Caraibi (BIT:TIME) | €0.542 | €1.08 | 50% |

| Fnac Darty (ENXTPA:FNAC) | €29.45 | €58.67 | 49.8% |

| Hanall Biopharma (KOSE:A009420) | ₩32600.00 | ₩65043.15 | 49.9% |

Here we highlight a subset of our preferred stocks from the screener.

POYA International (TPEX:5904)

Overview: POYA International Co., Ltd. operates a chain of retail stores in Taiwan and has a market capitalization of approximately NT$50.99 billion.

Operations: The company generates revenue from its General Merchandise Retail Sales Department, totaling NT$23.26 billion.

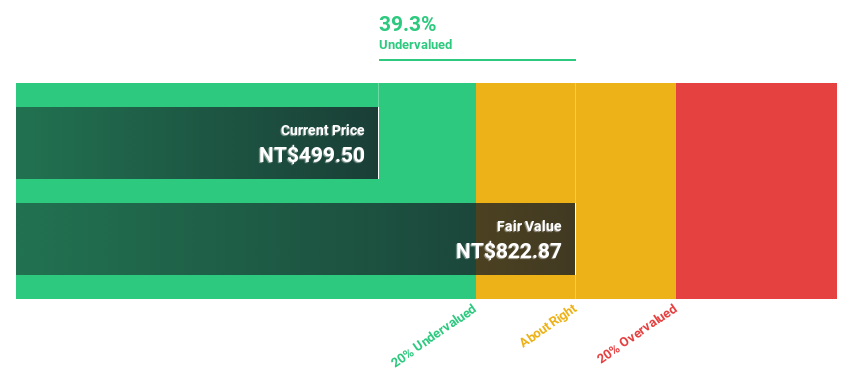

Estimated Discount To Fair Value: 40.5%

POYA International is trading at NT$489.5, significantly below its estimated fair value of NT$822.19, indicating it may be undervalued based on cash flows. Despite an unstable dividend track record, its earnings have grown 9.3% over the past year and are expected to grow at 10.94% annually, outpacing the Taiwan market's growth rate of 6.6%. Analysts agree on a potential price rise of 27.2%, highlighting good relative value compared to peers and industry standards.

- According our earnings growth report, there's an indication that POYA International might be ready to expand.

- Dive into the specifics of POYA International here with our thorough financial health report.

Nagase Brothers (TSE:9733)

Overview: Nagase Brothers Inc. operates in the education services sector in Japan, with a market cap of ¥46.28 billion.

Operations: Revenue segments for Nagase Brothers Inc. are not provided in the available text.

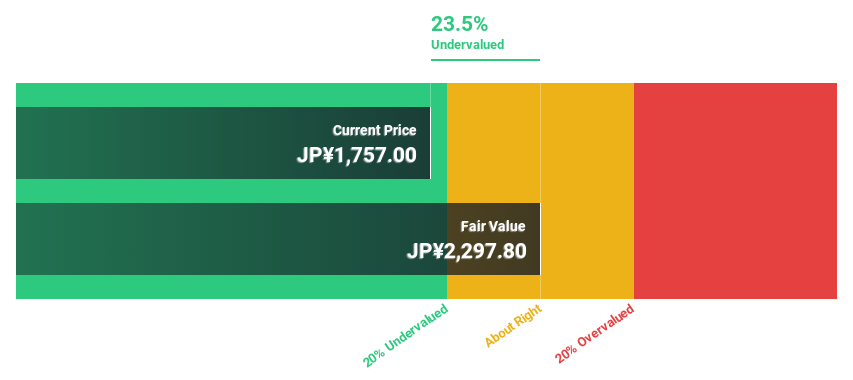

Estimated Discount To Fair Value: 23.5%

Nagase Brothers, trading at ¥1758, is priced below its estimated fair value of ¥2298.13, reflecting potential undervaluation based on cash flows. Despite a high debt level and a dividend not fully covered by earnings, the company's earnings are forecast to grow significantly at 29.7% annually, outpacing the JP market's growth rate. Recent inclusion in the S&P Global BMI Index may enhance visibility and investor interest.

- In light of our recent growth report, it seems possible that Nagase Brothers' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Nagase Brothers' balance sheet health report.

Funai Soken Holdings (TSE:9757)

Overview: Funai Soken Holdings Incorporated offers consulting services to manufacturing and retail businesses in Japan, with a market cap of ¥112.70 billion.

Operations: The company's revenue segments are comprised of Consulting services at ¥22.51 billion, Digital Solutions at ¥4.77 billion, and Logistics at ¥4.63 billion.

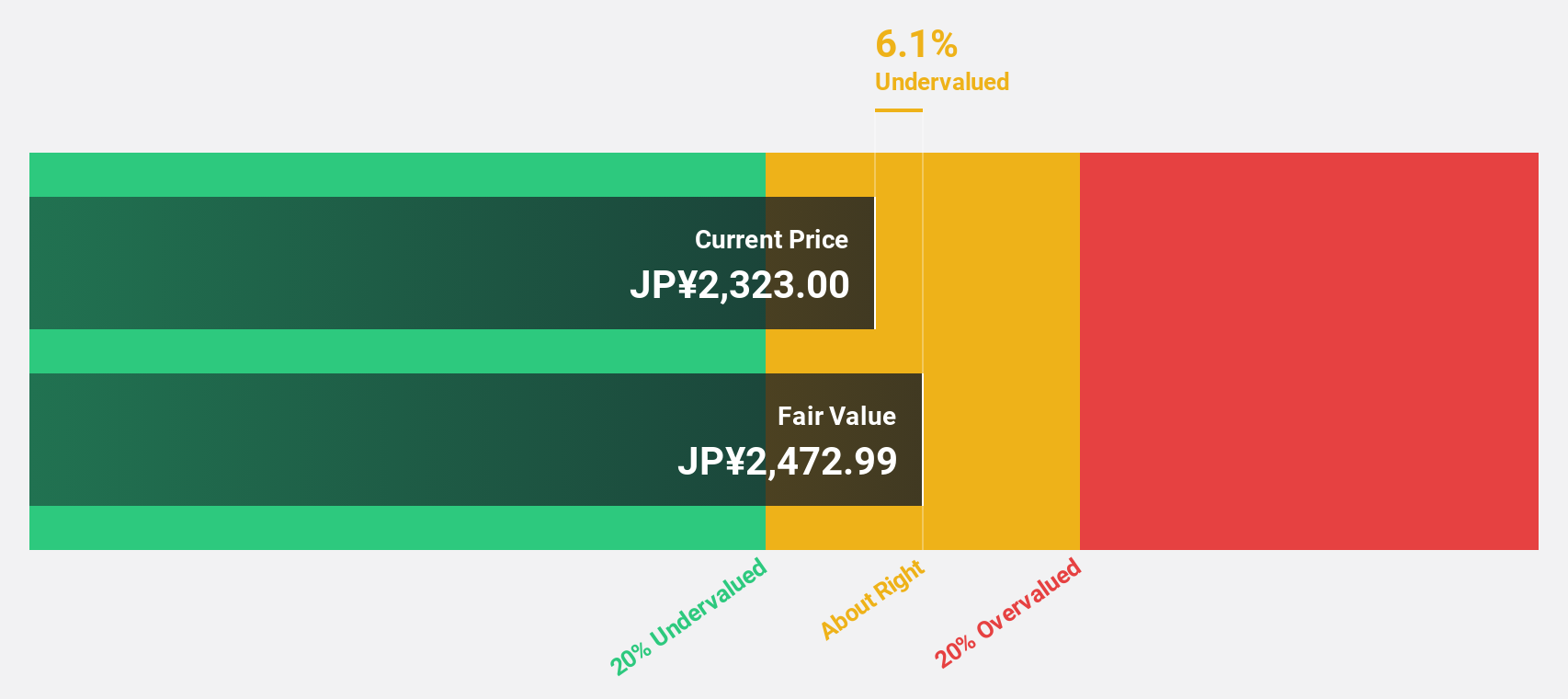

Estimated Discount To Fair Value: 20.5%

Funai Soken Holdings, trading at ¥2435, is undervalued by over 20% compared to its estimated fair value of ¥3061.55. With earnings growth of 21.8% last year and a forecasted annual increase of 10.66%, it surpasses the JP market's projected growth rate. Despite an unstable dividend history, the company shows strong revenue growth prospects and a high future return on equity forecast at 23.1%.

- Our earnings growth report unveils the potential for significant increases in Funai Soken Holdings' future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Funai Soken Holdings.

Make It Happen

- Get an in-depth perspective on all 903 Undervalued Stocks Based On Cash Flows by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9757

Funai Soken Holdings

Provides consulting services to manufacturing and retail businesses in Japan.

Outstanding track record with flawless balance sheet and pays a dividend.