- Japan

- /

- Electronic Equipment and Components

- /

- TSE:3156

3 Reliable Dividend Stocks Yielding Up To 4.8%

Reviewed by Simply Wall St

As global markets navigate a landscape of economic shifts, with interest rate cuts and mixed performances across major indices, investors are increasingly focused on finding stability amidst volatility. In such an environment, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive option for those seeking consistency in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.80% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.65% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.21% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

Click here to see the full list of 1869 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Ardentec (TPEX:3264)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ardentec Corporation offers semiconductor testing solutions for memory, logic, and mixed-signal ICs to a global clientele including integrated device manufacturers, wafer foundries, and fabless design companies, with a market cap of NT$25.50 billion.

Operations: Ardentec Corporation's revenue is primarily derived from its main operations in Taiwan, contributing NT$8.48 billion, followed by Quanzhi Technology (Shares) Company at NT$4.11 billion and Ardentec Singapore Pte. Ltd. at NT$625.33 million.

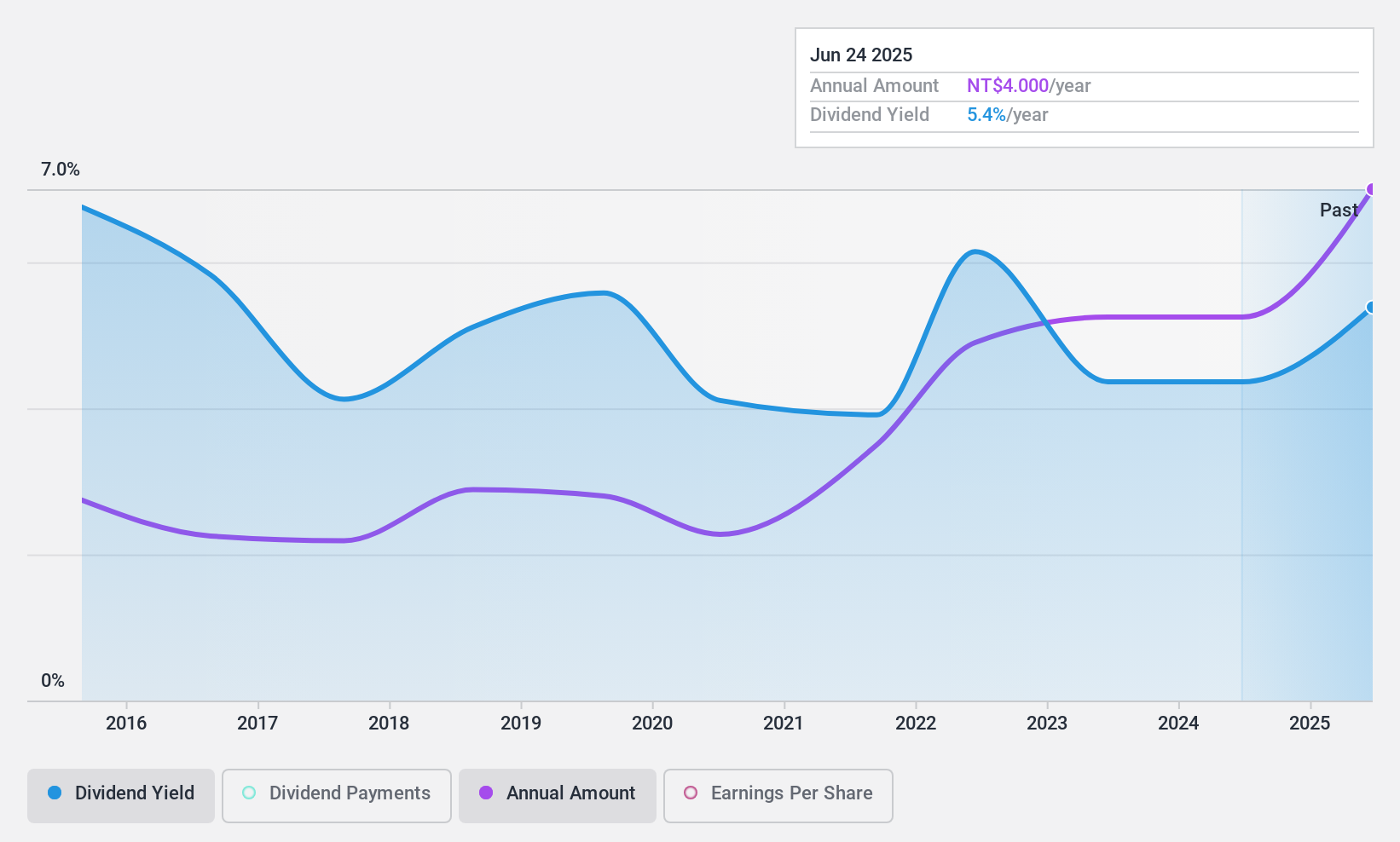

Dividend Yield: 4.5%

Ardentec's dividend payments are covered by both earnings and cash flows, with payout ratios of 52.4% and 58.7%, respectively, indicating sustainability despite a volatile track record over the past decade. The recent decline in earnings may raise concerns about future payouts. Its dividend yield matches the TW market's top 25% at 4.55%, but it's not considered top-tier due to instability in past payments. The stock appears undervalued with a P/E ratio of 11.5x compared to the market average of 21.5x.

- Click to explore a detailed breakdown of our findings in Ardentec's dividend report.

- According our valuation report, there's an indication that Ardentec's share price might be on the expensive side.

Restar (TSE:3156)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Restar Corporation operates in the electronics trading industry both in Japan and internationally, with a market cap of ¥73.34 billion.

Operations: Restar Corporation's revenue segments include Electronics Trading at ¥297.82 billion and Electronics Manufacturing Service at ¥27.96 billion.

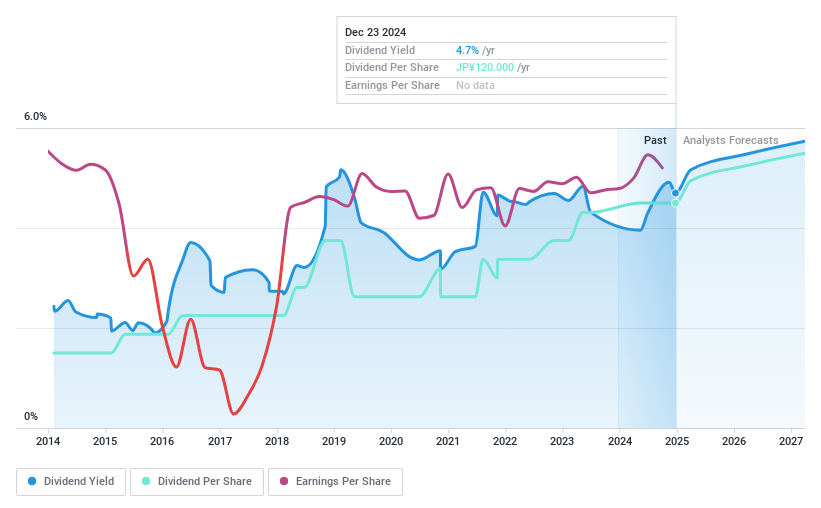

Dividend Yield: 4.9%

Restar Corporation's dividend yield of 4.89% places it in the top 25% of JP market payers, supported by a low payout ratio of 44.9%, ensuring coverage by earnings and cash flows. However, its dividend history is marked by volatility and unreliability over the past decade. The company recently completed a ¥6.91 billion share buyback to enhance shareholder returns, while its P/E ratio of 9.2x suggests good relative value compared to the market average.

- Delve into the full analysis dividend report here for a deeper understanding of Restar.

- Our comprehensive valuation report raises the possibility that Restar is priced lower than what may be justified by its financials.

Shibaura MachineLtd (TSE:6104)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Shibaura Machine Co., Ltd. manufactures and sells a range of machines both in Japan and internationally, with a market cap of ¥83.65 billion.

Operations: Shibaura Machine Co., Ltd.'s revenue is primarily derived from its Molding Machines segment, which generated ¥132.19 billion, followed by Machine Tools at ¥23.14 billion and Control Machine at ¥10.76 billion.

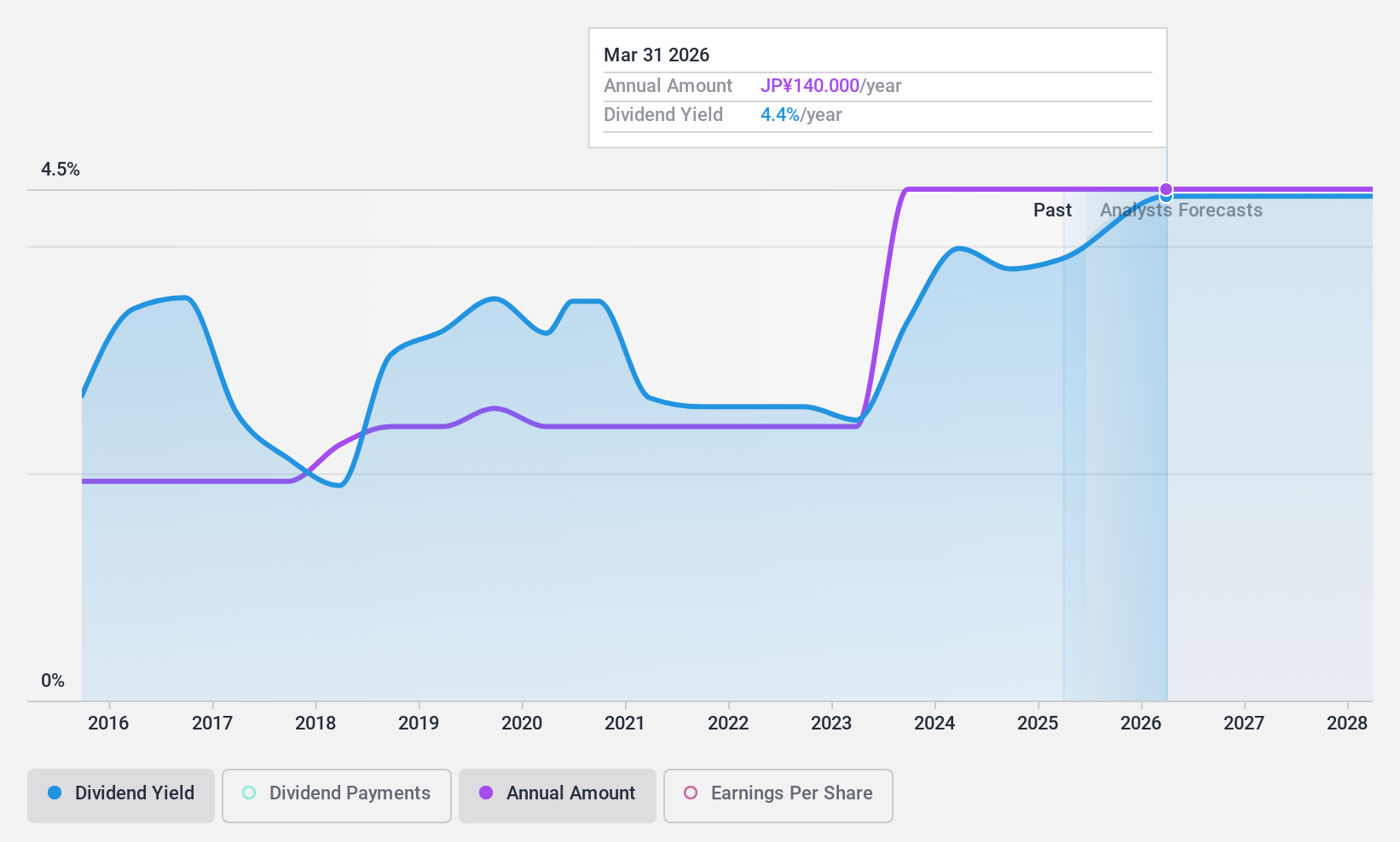

Dividend Yield: 3.9%

Shibaura Machine Co., Ltd. maintains a stable dividend of JPY 70 per share, with a low payout ratio of 27.7%, ensuring dividends are well-covered by earnings and cash flows. The dividend yield of 3.93% ranks in the top 25% in Japan, reflecting reliability over the past decade despite recent profit margin declines to 7.3%. Trading below fair value, it offers good relative value within its industry amidst forecasts for declining earnings growth.

- Navigate through the intricacies of Shibaura MachineLtd with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Shibaura MachineLtd's current price could be quite moderate.

Turning Ideas Into Actions

- Delve into our full catalog of 1869 Top Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3156

Restar

Engages in electronics trading business in Japan and internationally.

Established dividend payer with proven track record.