- Japan

- /

- Consumer Services

- /

- TSE:9733

3 Dividend Stocks That Yield Up To 5.6%

Reviewed by Simply Wall St

In a week marked by global economic shifts, the Nasdaq Composite reached a new milestone while most major stock indexes experienced declines. As markets brace for potential rate cuts from the Federal Reserve and other central banks, investors are increasingly seeking stability and income through dividend stocks. In such an environment, selecting dividend stocks that offer attractive yields can be a prudent strategy to balance growth with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.80% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.19% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

Click here to see the full list of 1869 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

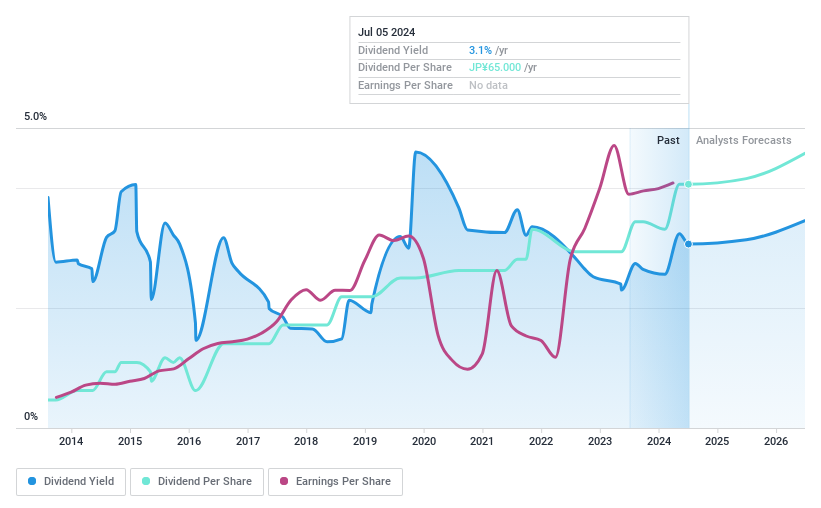

Open Up Group (TSE:2154)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Open Up Group Inc. operates in engineer dispatching, subcontracting, outsourcing, and recruiting for construction management, manufacturing, machinery, electronics, and IT software sectors both in Japan and internationally with a market cap of ¥151.99 billion.

Operations: Open Up Group Inc.'s revenue segments include ¥37.35 billion from overseas operations, ¥47.00 billion from the construction sector, and ¥94.37 billion from the mechanical and electronics/IT field.

Dividend Yield: 4.3%

Open Up Group's dividend payments are well-supported by earnings and cash flows, with payout ratios of 53.1% and 45.5%, respectively. Despite a history of volatility, dividends have increased over the past decade and currently yield 4.29%, placing them in the top 25% in Japan. The stock is trading at a significant discount to its estimated fair value, suggesting potential for capital appreciation alongside dividend income. Recent earnings calls may provide further insights into financial health.

- Get an in-depth perspective on Open Up Group's performance by reading our dividend report here.

- Our expertly prepared valuation report Open Up Group implies its share price may be lower than expected.

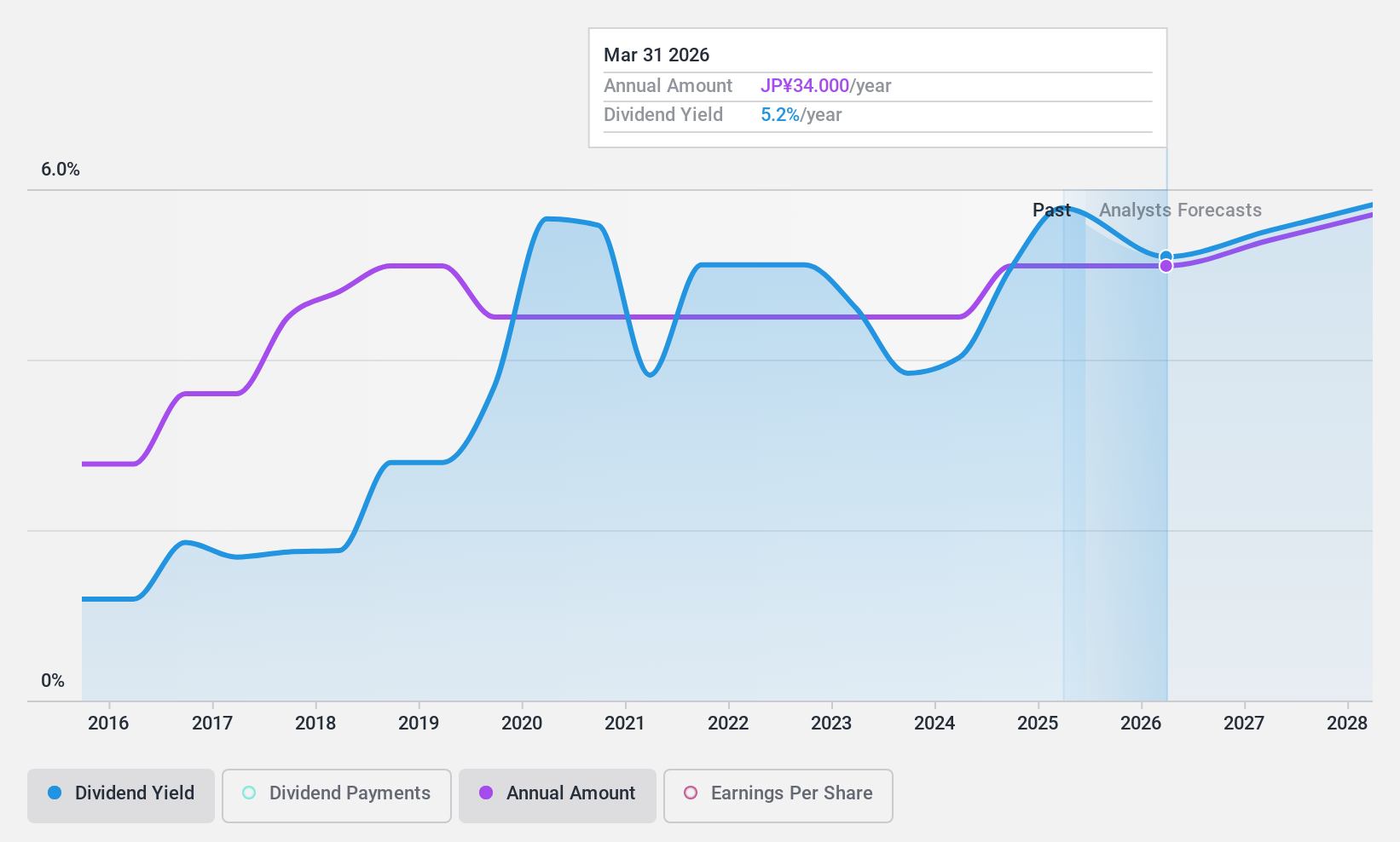

DaikyoNishikawa (TSE:4246)

Simply Wall St Dividend Rating: ★★★★★★

Overview: DaikyoNishikawa Corporation develops, manufactures, and sells automotive and housing synthetic plastic parts in Japan, with a market cap of ¥43.47 billion.

Operations: DaikyoNishikawa Corporation's revenue segments include ¥10.69 billion from Japan, ¥4.40 billion from Central America/North America, ¥1.13 billion from ASEAN, and ¥9.55 billion from China/South Korea.

Dividend Yield: 5.6%

DaikyoNishikawa's dividend payments are well-supported by earnings and cash flows, with payout ratios of 37.4% and 18.8%, respectively. The stock offers an attractive yield of 5.56%, ranking in the top quartile in Japan, and dividends have been stable over the past decade. Trading at a significant discount to its estimated fair value, it presents potential for capital appreciation alongside reliable income, supported by recent earnings growth of 20.9%.

- Click here to discover the nuances of DaikyoNishikawa with our detailed analytical dividend report.

- According our valuation report, there's an indication that DaikyoNishikawa's share price might be on the cheaper side.

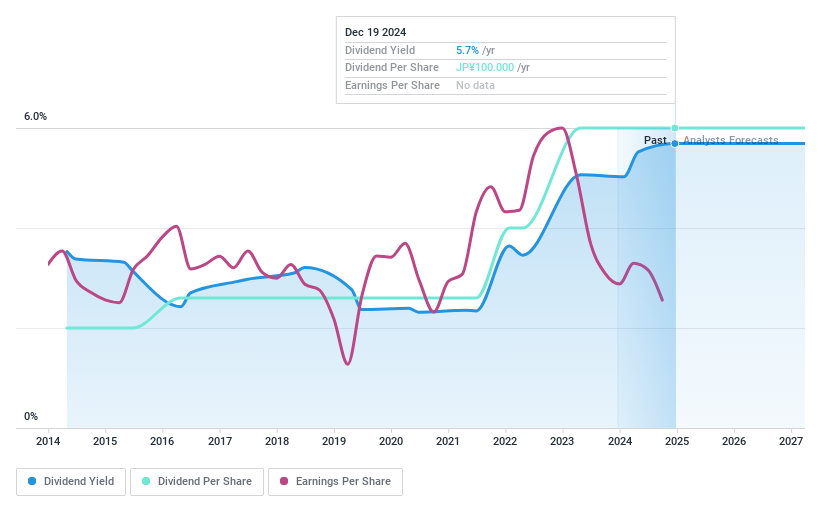

Nagase Brothers (TSE:9733)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nagase Brothers Inc. offers education services in Japan and has a market cap of ¥46.28 billion.

Operations: Nagase Brothers Inc. generates its revenue primarily through education services in Japan.

Dividend Yield: 5.7%

Nagase Brothers offers a high dividend yield of 5.69%, placing it in the top quartile of Japanese dividend payers, and its dividends have been stable and growing over the past decade. However, with a payout ratio of 130.3%, dividends are not well covered by earnings, though they are supported by cash flows at a 64.2% cash payout ratio. Recently added to the S&P Global BMI Index, it trades at 23.1% below estimated fair value despite high debt levels.

- Click here and access our complete dividend analysis report to understand the dynamics of Nagase Brothers.

- Upon reviewing our latest valuation report, Nagase Brothers' share price might be too pessimistic.

Turning Ideas Into Actions

- Click this link to deep-dive into the 1869 companies within our Top Dividend Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nagase Brothers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9733

Established dividend payer with reasonable growth potential.

Market Insights

Community Narratives