- Japan

- /

- Tech Hardware

- /

- TSE:6638

Discovering Undiscovered Gems with Strong Potential This December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets are navigating a complex landscape characterized by rate cuts from the ECB and SNB, while U.S. markets anticipate another Federal Reserve cut amidst mixed index performances. Small-cap stocks, as reflected in the Russell 2000 Index's recent underperformance compared to large-cap counterparts, face unique challenges and opportunities in this environment of shifting economic indicators and market sentiment. In such a dynamic setting, identifying promising stocks often involves looking for companies with strong fundamentals that can weather economic fluctuations and capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| ShareHope Medicine | 38.07% | 3.80% | -7.16% | ★★★★★☆ |

| Standard Chartered Bank Kenya | 9.32% | 12.22% | 22.08% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Mimaki Engineering (TSE:6638)

Simply Wall St Value Rating: ★★★★★★

Overview: Mimaki Engineering Co., Ltd. develops, manufactures, and sells computer devices and software in Japan and internationally with a market cap of ¥42.88 billion.

Operations: Mimaki Engineering generates revenue primarily from the sale of computer devices and software. The company has a market cap of ¥42.88 billion, reflecting its position in the industry.

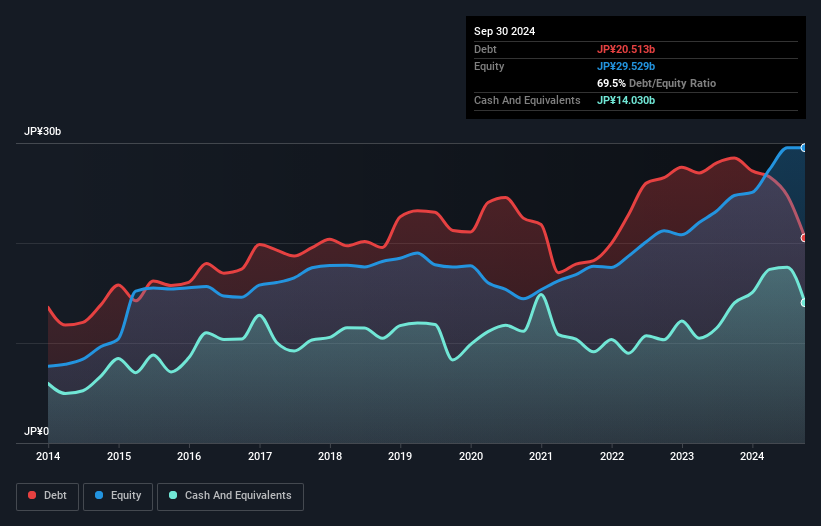

Mimaki Engineering, a tech sector player, has shown impressive earnings growth of 89.7% over the past year, outpacing the industry average of 3.3%. With its debt to equity ratio reduced from 120.8% to 69.5% in five years and a satisfactory net debt to equity ratio of 22%, financial health seems stable. The company is trading at a good value compared to peers and is priced at about two-thirds below estimated fair value. Recent events include an increased dividend payout from JPY 10 to JPY 17.50 per share, reflecting confidence in future prospects with revised earnings guidance for March 2025.

MCJ (TSE:6670)

Simply Wall St Value Rating: ★★★★★★

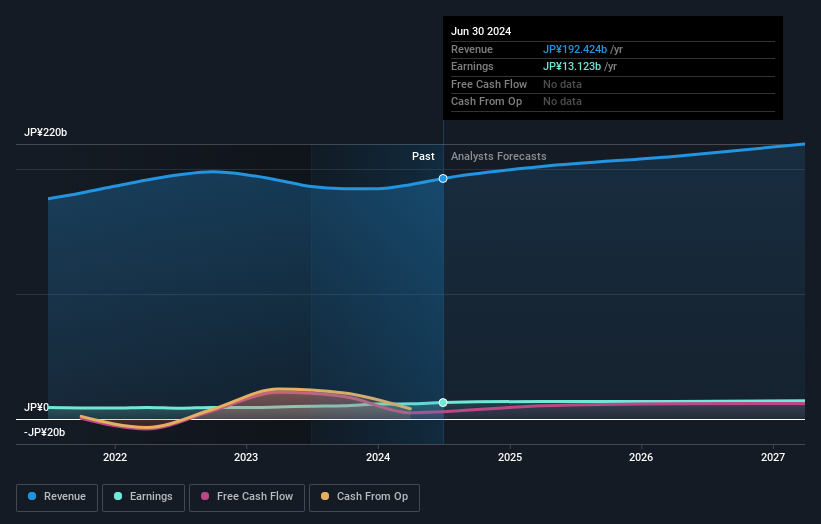

Overview: MCJ Co., Ltd. operates in Japan's PC-related and entertainment sectors with a market capitalization of approximately ¥137.17 billion.

Operations: The company generates revenue primarily from its Personal Computer Related Business, amounting to ¥189.08 billion, and a smaller portion from the Comprehensive Entertainment Business at ¥6.14 billion.

MCJ, a nimble player in the tech space, has shown impressive growth with earnings surging 24% over the past year, outpacing the broader industry. Its debt to equity ratio has notably decreased from 36% to 13.6% in five years, indicating prudent financial management. Trading at a significant discount of 40% below estimated fair value suggests potential upside for investors. The company is free cash flow positive and maintains high-quality earnings, reinforcing its financial health. With more cash than total debt and interest comfortably covered by profits, MCJ seems well-positioned for steady progress in its sector.

- Take a closer look at MCJ's potential here in our health report.

Assess MCJ's past performance with our detailed historical performance reports.

Taiwan Hon Chuan Enterprise (TWSE:9939)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taiwan Hon Chuan Enterprise Co., Ltd. specializes in the manufacturing and sale of packaging materials for the food and beverage industries across Taiwan, Mainland China, Southeast Asia, and other international markets with a market cap of NT$41.73 billion.

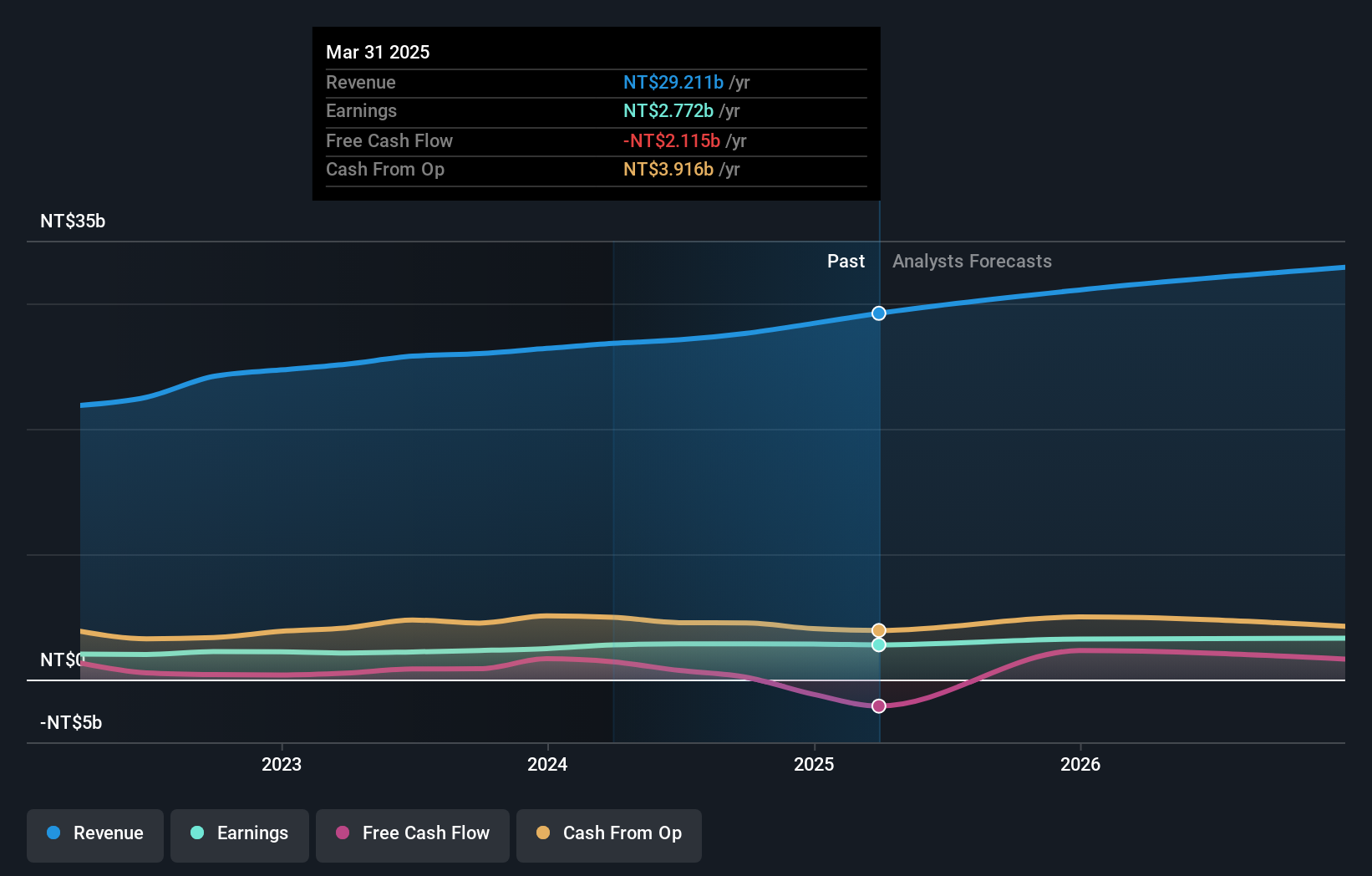

Operations: The company's revenue primarily comes from domestic sales amounting to NT$10.09 billion and overseas sales totaling NT$17.65 billion.

Taiwan Hon Chuan Enterprise, a notable player in the packaging sector, has shown impressive financial performance with earnings growth of 23.3% over the past year, outpacing the industry's 14.3%. The company reported third-quarter sales of TWD 7.89 billion and net income of TWD 858 million, reflecting steady progress from last year's figures. Despite a high net debt to equity ratio at 77.9%, its interest payments are well-covered by EBIT at an impressive 18.5x coverage, suggesting robust operational efficiency. Trading significantly below estimated fair value by approximately 74%, it remains an attractive proposition for investors seeking undervalued opportunities in this space.

Next Steps

- Explore the 4622 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6638

Mimaki Engineering

Develops, manufactures, and sells computer devices and software in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.