- Japan

- /

- Professional Services

- /

- TSE:7088

3 Stocks Estimated To Be Trading At Up To 49.2% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets rally with major indices reaching new highs, driven by optimism over potential trade deals and AI investments, investors are keenly observing the performance of growth stocks, which have recently outpaced their value counterparts. Amidst this buoyant environment, identifying undervalued stocks can be a strategic move for those looking to capitalize on discrepancies between market price and intrinsic value. Recognizing such opportunities often involves assessing a company's fundamentals against prevailing market conditions to determine its true worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Argan (NYSE:AGX) | US$137.36 | US$273.30 | 49.7% |

| Subros (BSE:517168) | ₹600.55 | ₹1197.01 | 49.8% |

| Guangdong Mingyang ElectricLtd (SZSE:301291) | CN¥50.90 | CN¥101.57 | 49.9% |

| 74Software (ENXTPA:74SW) | €26.50 | €52.89 | 49.9% |

| Solum (KOSE:A248070) | ₩18950.00 | ₩37756.10 | 49.8% |

| Dynavox Group (OM:DYVOX) | SEK68.20 | SEK136.07 | 49.9% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥26.02 | 49.8% |

| Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥25.57 | CN¥51.06 | 49.9% |

| St. James's Place (LSE:STJ) | £9.31 | £18.53 | 49.8% |

| Netum Group Oyj (HLSE:NETUM) | €2.82 | €5.63 | 49.9% |

Underneath we present a selection of stocks filtered out by our screen.

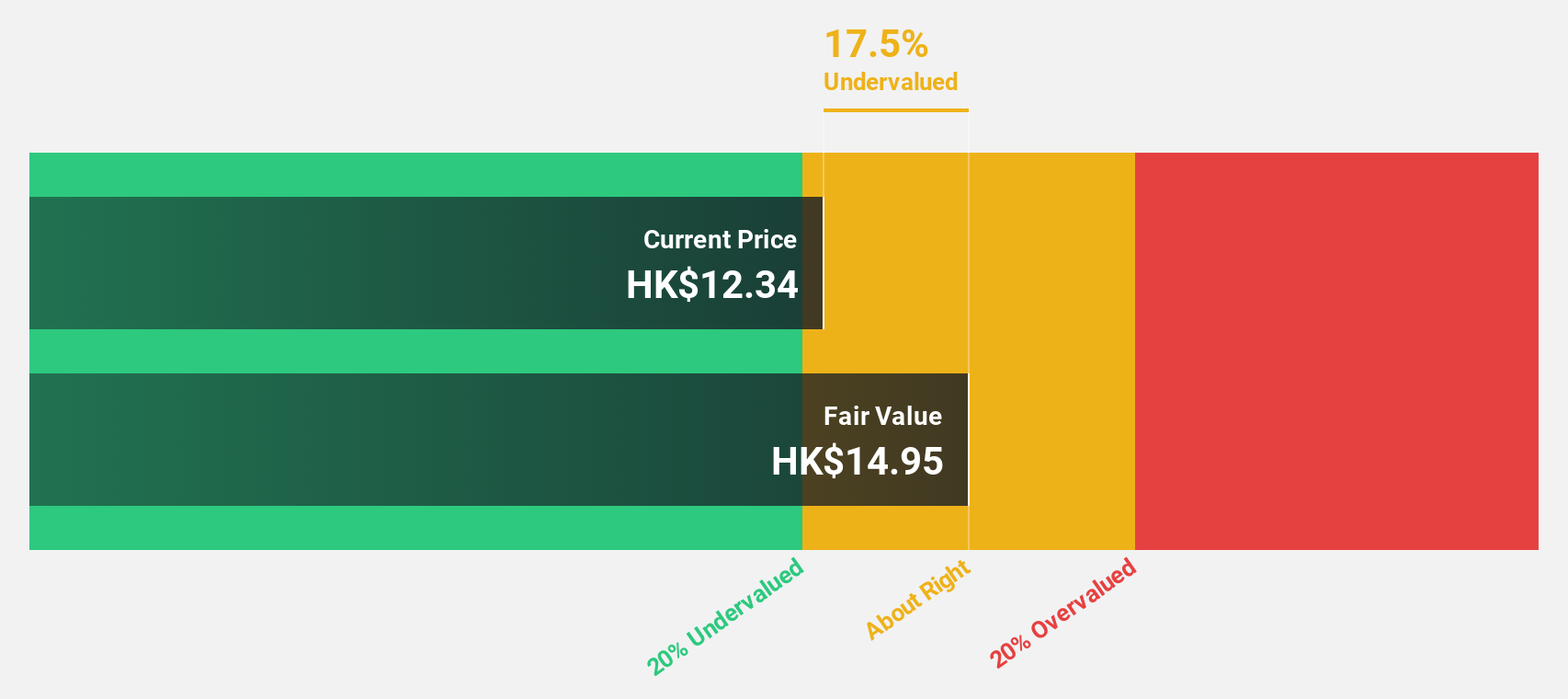

MicroPort NeuroScientific (SEHK:2172)

Overview: MicroPort NeuroScientific Corporation focuses on the research, development, production, and sale of neuro-interventional medical devices both in China and internationally, with a market cap of HK$5.91 billion.

Operations: The company generates revenue of CN¥774.66 million from its surgical and medical equipment segment.

Estimated Discount To Fair Value: 49.2%

MicroPort NeuroScientific is trading at HK$10.24, significantly below its estimated fair value of HK$20.15, suggesting undervaluation based on cash flows. The company forecasts robust revenue growth of 21.4% annually, outpacing the Hong Kong market's 7.6%. Recent guidance indicates a net profit increase of up to 100% for 2024, driven by expanded hospital coverage and improved overseas revenue. However, its Return on Equity is expected to be modest at 14.5% in three years.

- In light of our recent growth report, it seems possible that MicroPort NeuroScientific's financial performance will exceed current levels.

- Dive into the specifics of MicroPort NeuroScientific here with our thorough financial health report.

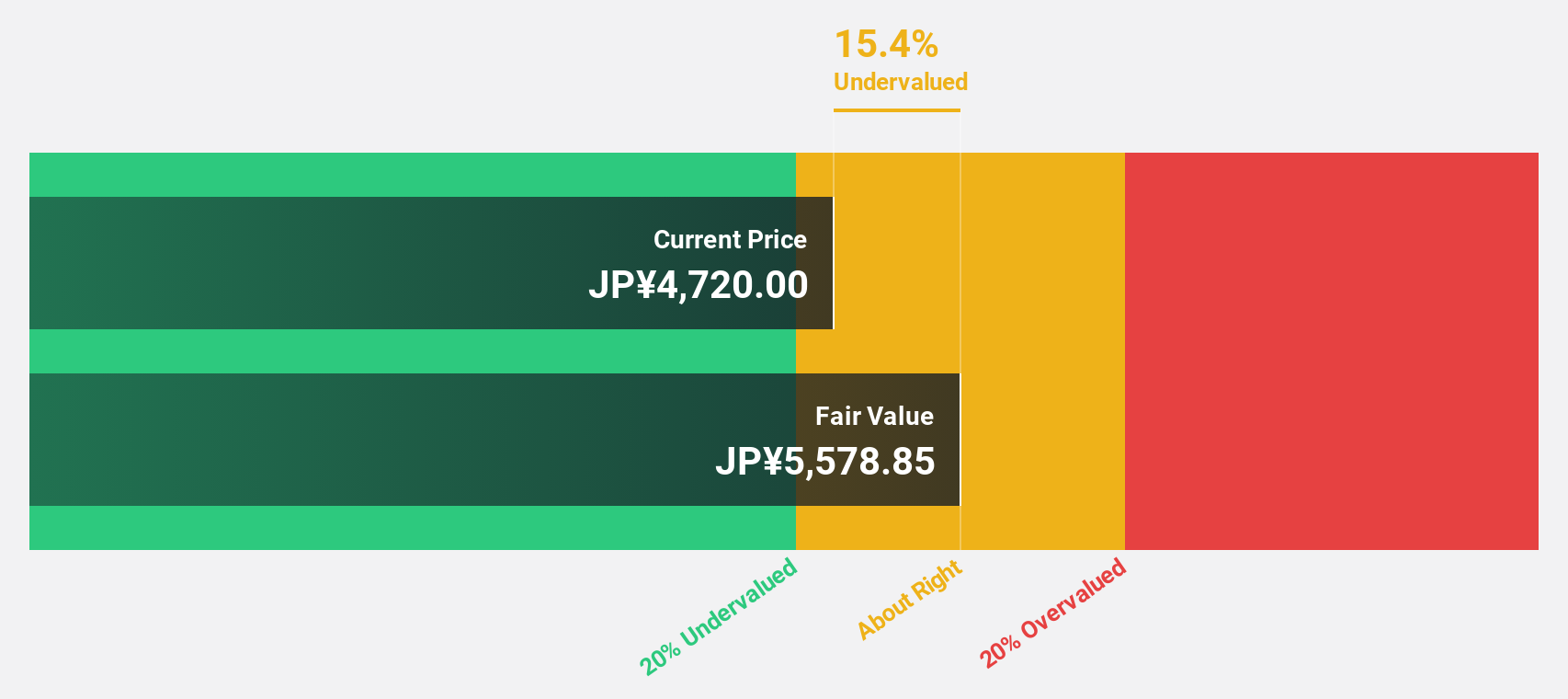

TORIDOLL Holdings (TSE:3397)

Overview: TORIDOLL Holdings Corporation operates and manages restaurants in Japan and internationally, with a market cap of ¥325.03 billion.

Operations: The company's revenue segments include Marugame Seimen at ¥121.61 billion and Overseas Business at ¥99.74 billion.

Estimated Discount To Fair Value: 32.7%

TORIDOLL Holdings is trading at ¥3,716, over 30% below its estimated fair value of ¥5,518.84, indicating undervaluation based on cash flows. Despite lowering its profit guidance for fiscal year 2025 due to overseas segment challenges, domestic operations like Marugame Seimen reported record interim sales and margins. Earnings are projected to grow significantly at 44.7% annually over the next three years, surpassing the Japanese market's growth rate of 8.1%.

- The analysis detailed in our TORIDOLL Holdings growth report hints at robust future financial performance.

- Take a closer look at TORIDOLL Holdings' balance sheet health here in our report.

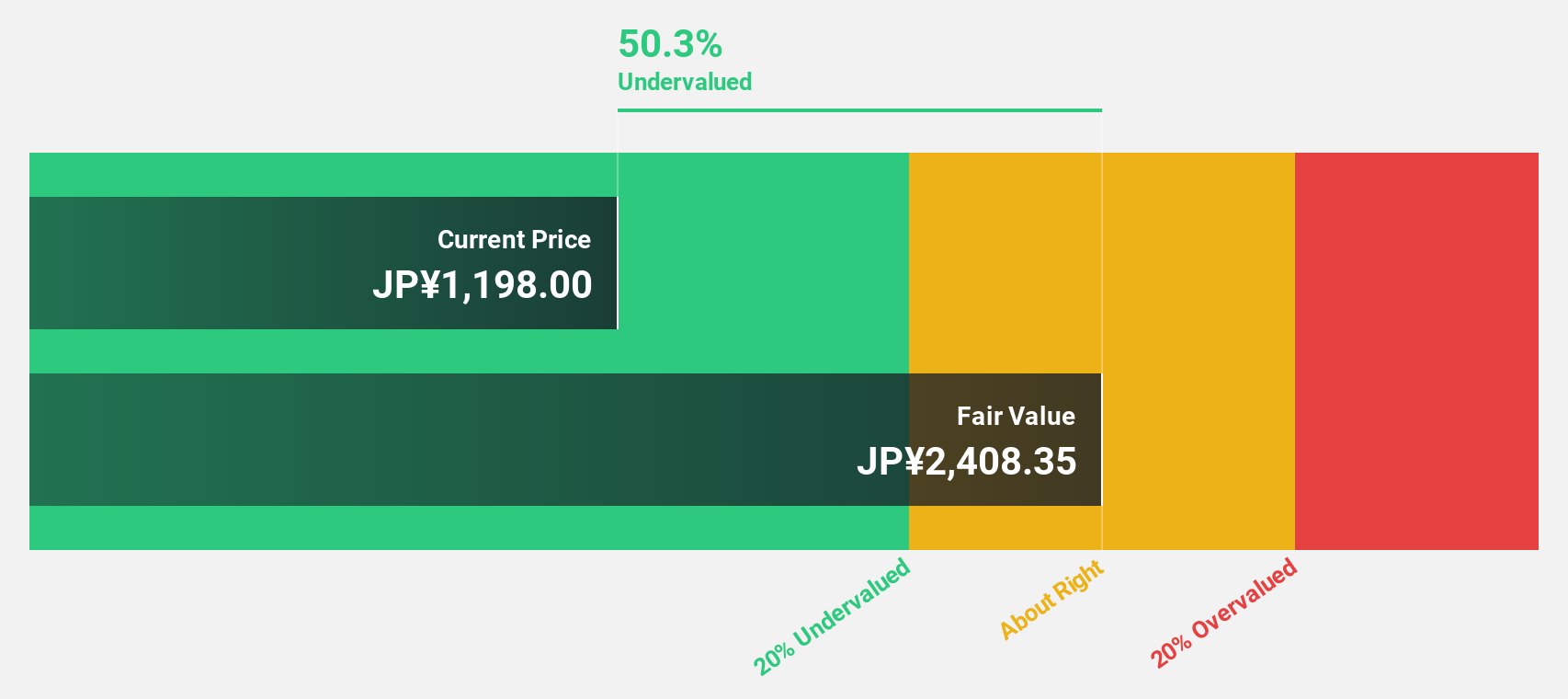

Forum Engineering (TSE:7088)

Overview: Forum Engineering Inc. offers personnel management services for mechanical and electrical engineers in Japan, with a market cap of ¥55.07 billion.

Operations: The company's revenue is primarily generated through its Engineer Dispatch/Recruitment Business, amounting to ¥32.93 billion.

Estimated Discount To Fair Value: 40.1%

Forum Engineering is trading at ¥1,051, significantly below its estimated fair value of ¥1,755.44, highlighting a potential undervaluation based on cash flows. Revenue and earnings are expected to grow faster than the Japanese market at 9.2% and 11.8% per year respectively. However, limited financial data availability poses a challenge for comprehensive analysis. Recent executive changes might impact strategic direction but have not yet shown significant effects on financial forecasts or valuation metrics.

- According our earnings growth report, there's an indication that Forum Engineering might be ready to expand.

- Unlock comprehensive insights into our analysis of Forum Engineering stock in this financial health report.

Where To Now?

- Gain an insight into the universe of 899 Undervalued Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Forum Engineering, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7088

Forum Engineering

Provides personnel management services for mechanical and electrical engineers in Japan.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives