The Market Doesn't Like What It Sees From Iwaki Co., Ltd.'s (TSE:6237) Earnings Yet As Shares Tumble 30%

The Iwaki Co., Ltd. (TSE:6237) share price has fared very poorly over the last month, falling by a substantial 30%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 33% in that time.

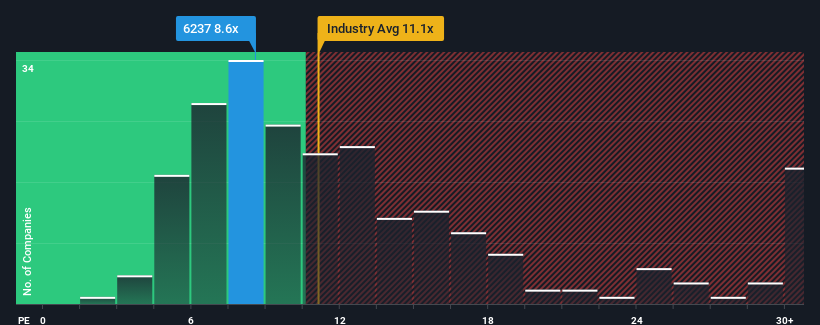

Although its price has dipped substantially, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 13x, you may still consider Iwaki as an attractive investment with its 8.6x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Iwaki has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Iwaki

Is There Any Growth For Iwaki?

In order to justify its P/E ratio, Iwaki would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 14% last year. This was backed up an excellent period prior to see EPS up by 66% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 0.2% as estimated by the sole analyst watching the company. Meanwhile, the rest of the market is forecast to expand by 10%, which is noticeably more attractive.

With this information, we can see why Iwaki is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Iwaki's P/E

The softening of Iwaki's shares means its P/E is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Iwaki's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Iwaki has 2 warning signs we think you should be aware of.

You might be able to find a better investment than Iwaki. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6237

Iwaki

Manufactures and sells chemical pumps and pump controller products for OEMs in a range of markets and applications in Japan and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives