- Japan

- /

- Commercial Services

- /

- TSE:2353

Top Three Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets experience a rebound with cooling inflation and strong bank earnings propelling U.S. stocks higher, investors are paying close attention to value stocks, particularly in the financial and energy sectors. In this environment, dividend stocks are gaining interest as they offer potential income stability amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.48% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.45% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.65% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.82% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1979 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Taisei Oncho (TSE:1904)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taisei Oncho Co., Ltd. specializes in the design and construction of air conditioning, water supply/drainage sanitary, and electrical equipment systems in Japan, with a market cap of ¥22.80 billion.

Operations: Taisei Oncho Co., Ltd.'s revenue segments include ¥11.87 billion from the USA, ¥3.02 billion from China, ¥47.66 billion from Japan, and ¥28.29 million from Australia.

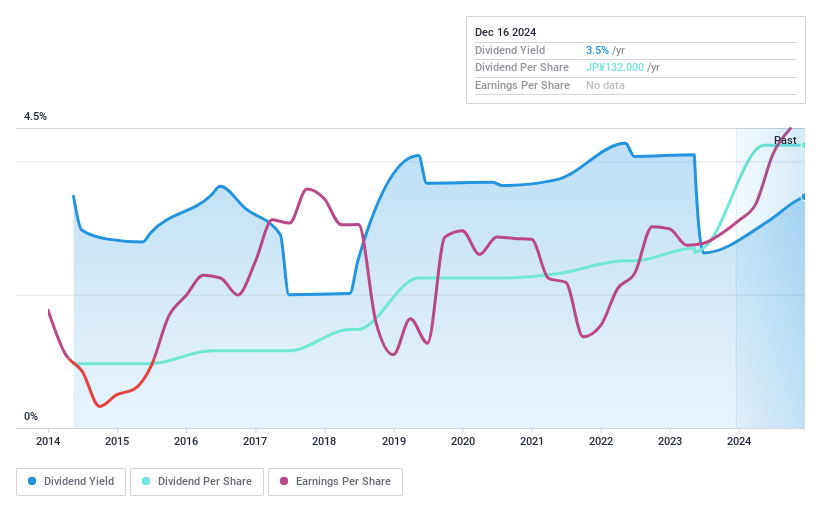

Dividend Yield: 3.5%

Taisei Oncho has maintained stable and growing dividends over the past decade, supported by a low payout ratio of 38.9%. However, its dividend yield of 3.5% is below the top quartile in Japan. Recent share buybacks totaling ¥355.5 million aim to enhance shareholder value and capital efficiency but highlight concerns as dividends are not covered by free cash flow, despite robust earnings growth of 88.7% last year.

- Take a closer look at Taisei Oncho's potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Taisei Oncho shares in the market.

NIPPON PARKING DEVELOPMENTLtd (TSE:2353)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NIPPON PARKING DEVELOPMENT Co., Ltd. offers consulting services for parking lots both in Japan and internationally, with a market cap of ¥66.71 billion.

Operations: NIPPON PARKING DEVELOPMENT Co., Ltd. generates revenue from its Parking Lot Business with ¥17.48 billion, Ski Resort Business with ¥8.59 billion, and Theme Park Business with ¥7.04 billion.

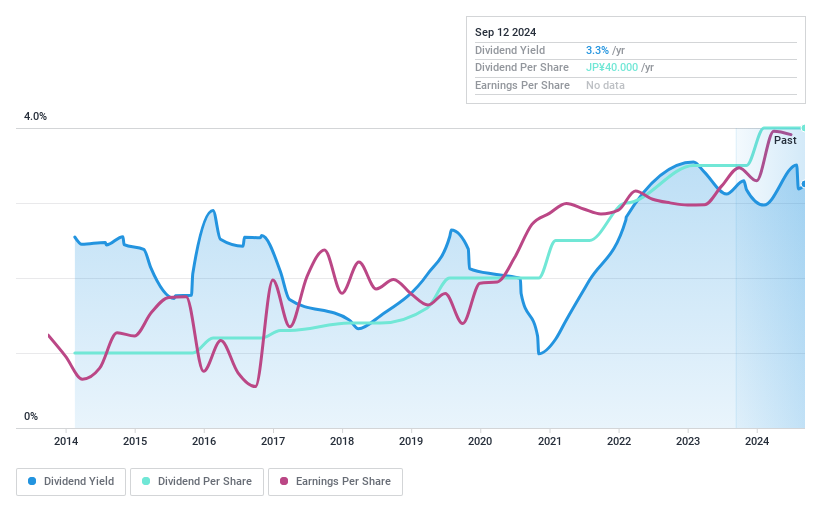

Dividend Yield: 3.3%

Nippon Parking Development's dividends have been stable and growing for a decade, supported by a low payout ratio of 34.2%, indicating coverage by earnings. However, the cash payout ratio is high at 344.3%, suggesting dividends are not covered by free cash flow. The dividend yield of 3.37% is below Japan's top quartile, though earnings grew by 28.1% last year, potentially supporting future payouts despite current sustainability concerns.

- Delve into the full analysis dividend report here for a deeper understanding of NIPPON PARKING DEVELOPMENTLtd.

- Our valuation report here indicates NIPPON PARKING DEVELOPMENTLtd may be overvalued.

Seiko Electric (TSE:6653)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Seiko Electric Co., Ltd. operates in Japan, focusing on power systems and environmental energy and control systems, with a market cap of ¥15.75 billion.

Operations: Seiko Electric Co., Ltd.'s revenue is derived from its operations in the power system and environmental energy and control system sectors in Japan.

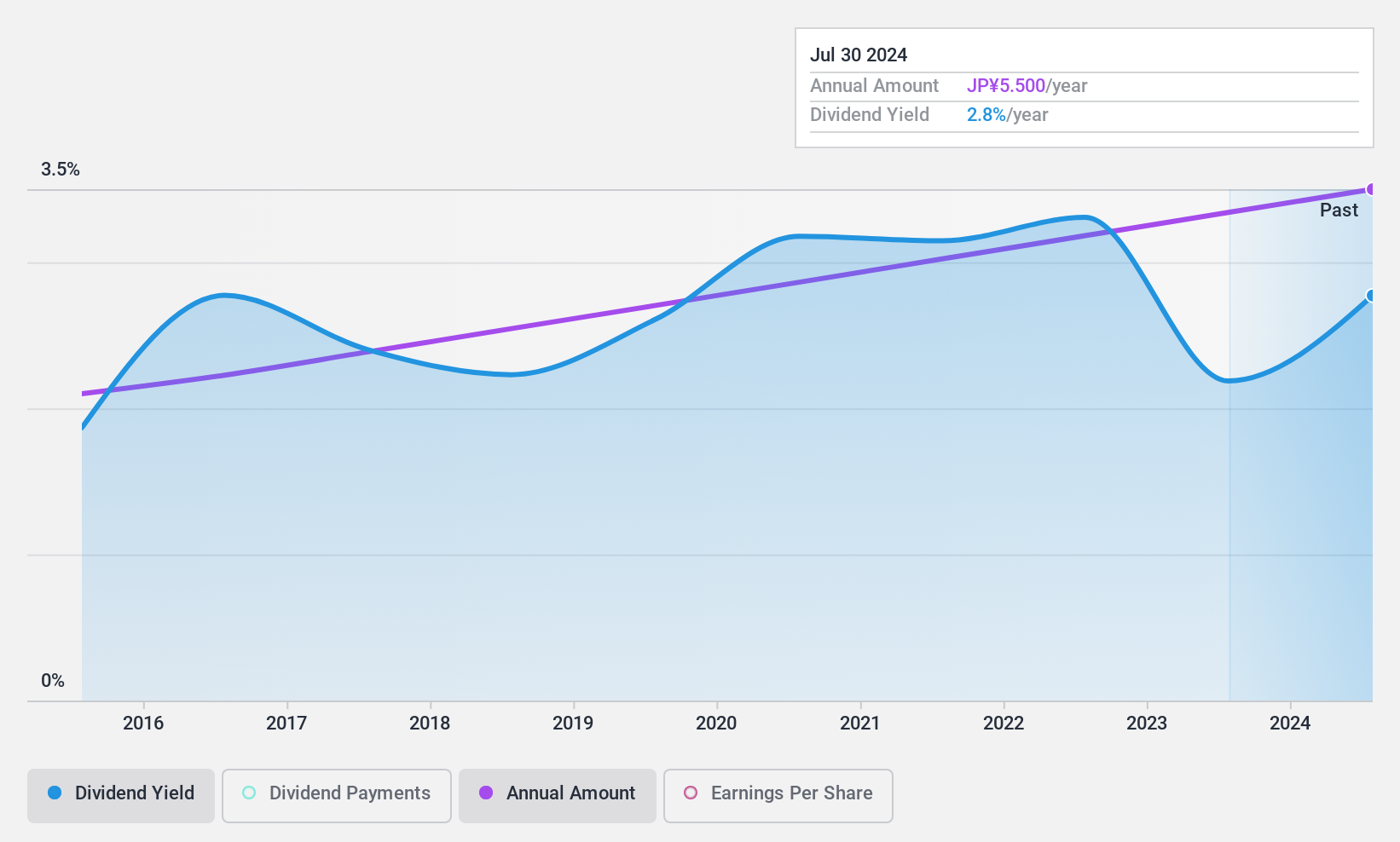

Dividend Yield: 3.4%

Seiko Electric's dividend payments have been stable and growing over the past decade, supported by a low payout ratio of 30.4%, ensuring coverage by earnings. The cash payout ratio is also low at 27%, indicating dividends are well covered by cash flows. Despite a recent dividend increase to ¥20 per share, the yield of 3.38% remains below Japan's top quartile. The stock trades significantly below its estimated fair value, suggesting potential undervaluation.

- Click here and access our complete dividend analysis report to understand the dynamics of Seiko Electric.

- Our comprehensive valuation report raises the possibility that Seiko Electric is priced lower than what may be justified by its financials.

Next Steps

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1976 more companies for you to explore.Click here to unveil our expertly curated list of 1979 Top Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIPPON PARKING DEVELOPMENTLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2353

NIPPON PARKING DEVELOPMENTLtd

Provides consulting services for parking lot in Japan and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.