- Japan

- /

- Construction

- /

- TSE:1802

Does Obayashi's (TSE:1802) Latest Share Buyback Reflect Renewed Confidence in Its Long-Term Value?

Reviewed by Sasha Jovanovic

- Between August 8, 2025 and September 30, 2025, Obayashi completed the repurchase of 5,950,200 shares, representing 0.85% of outstanding shares, for ¥14,414.23 million as previously announced.

- This completion highlights the company's active approach to capital allocation and may reflect confidence in its long-term value.

- We'll examine how the completed buyback program may strengthen Obayashi's investment narrative through focused capital management.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Obayashi's Investment Narrative?

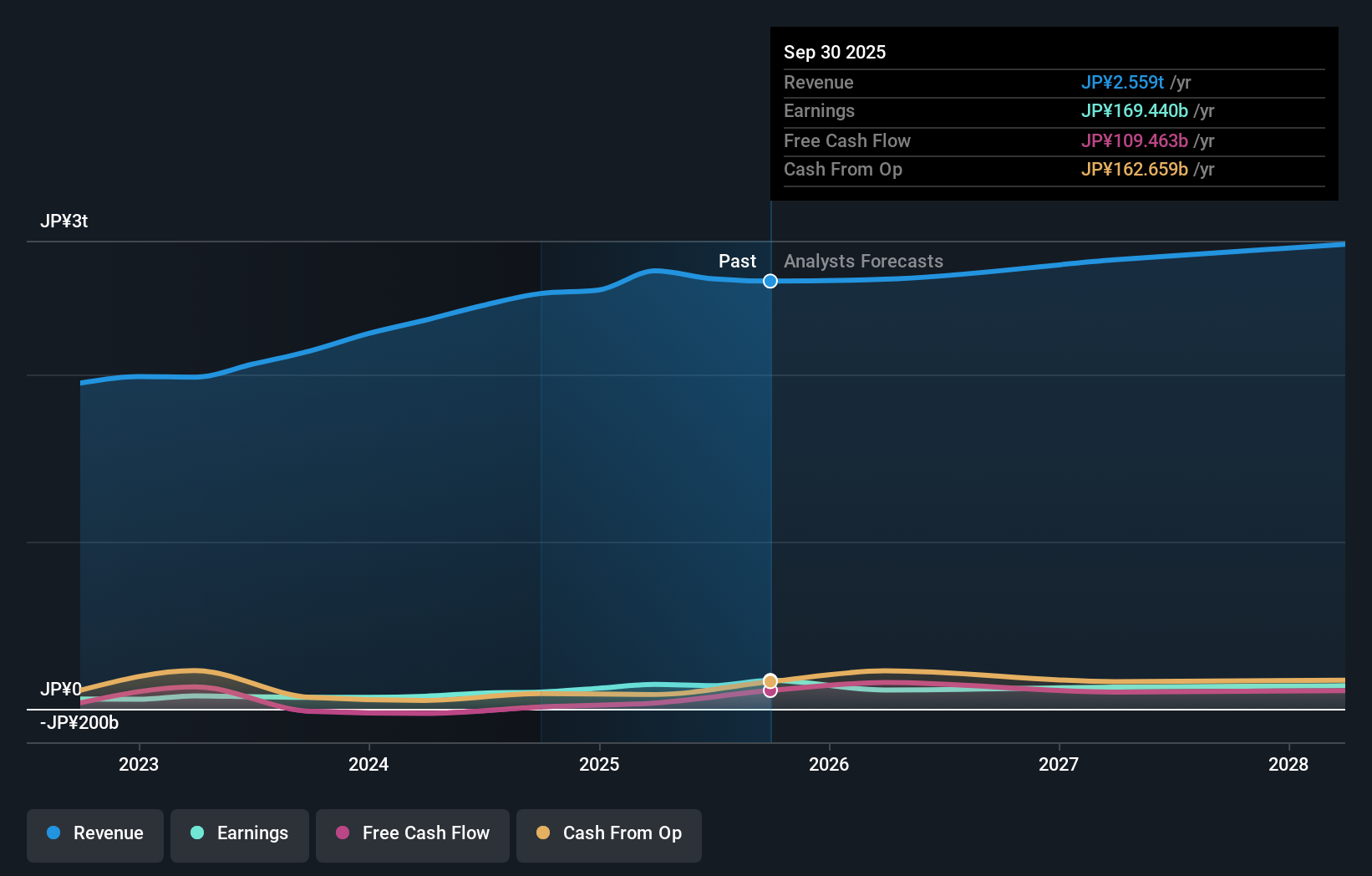

To be an Obayashi shareholder right now, you have to trust in the company's steady approach to growth and its ability to allocate capital effectively amid moderate sector momentum. The recent completion of a buyback program covering 0.85% of shares for ¥14.41 billion shows Obayashi is active in deploying capital, which may signal confidence but is not a significant game-changer considering its still-slow forecasted growth versus the broader market. Short-term catalysts, such as new infrastructure contracts and upcoming earnings releases, remain more influential for the share price than the scale of this buyback, particularly since past buybacks have not meaningfully altered top-line or profit growth trends. The largest risks still focus on slowing revenue and profit growth, a decreased dividend, and the outsized effect of one-off gains, none of which are substantially affected by the buyback’s completion.

On the other hand, dividend sustainability remains a key risk investors should be mindful of. Despite retreating, Obayashi's shares might still be trading 40% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on Obayashi - why the stock might be worth just ¥3971!

Build Your Own Obayashi Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Obayashi research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Obayashi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Obayashi's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1802

Obayashi

Engages in the construction business in Japan, North America, Asia and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives