- Turkey

- /

- Infrastructure

- /

- IBSE:CLEBI

Exploring Undiscovered Gems on Exchange None in December 2024

Reviewed by Simply Wall St

As global markets navigate the final days of 2024, small-cap stocks have faced mixed conditions with consumer confidence and manufacturing indicators showing signs of weakness, while major indices like the S&P 500 and Nasdaq Composite have seen moderate gains. In this environment, identifying promising opportunities requires a keen eye for companies that demonstrate resilience and potential for growth despite broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Jih Lin Technology | 56.44% | 4.23% | 3.89% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi | 56.22% | 44.24% | 26.23% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wealth First Portfolio Managers | 4.08% | -43.42% | 42.63% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Kirac Galvaniz Telekominikasyon Metal Makine Insaat Elektrik Sanayi ve Ticaret Anonim Sirketi | 14.19% | 33.12% | 44.33% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Çelebi Hava Servisi (IBSE:CLEBI)

Simply Wall St Value Rating: ★★★★★★

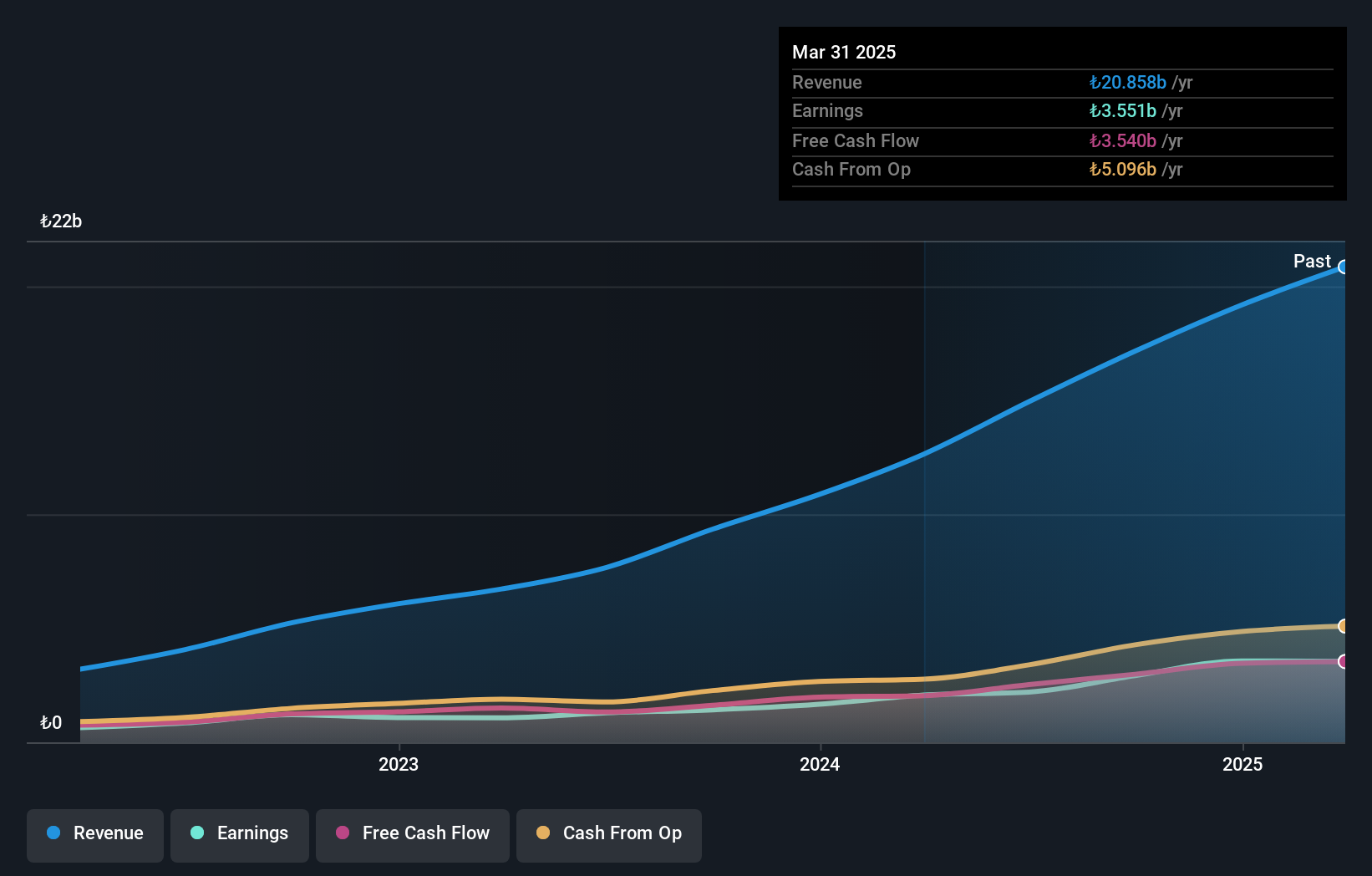

Overview: Çelebi Hava Servisi A.S. offers ground handling, cargo, and warehouse services to both domestic and international airlines as well as private air cargo companies mainly in Turkey, with a market capitalization of TRY46.51 billion.

Operations: Çelebi Hava Servisi A.S. generates revenue primarily from airport ground services, which account for TRY11.33 billion, and cargo and warehouse services, contributing TRY5.90 billion. The company's financial performance is significantly influenced by its net profit margin trends over time.

Çelebi Hava Servisi, an intriguing player in the infrastructure sector, has seen its earnings soar by 105% over the past year, outpacing industry growth of 4.8%. The company reported a significant increase in sales for Q3 2024 at TRY 5.81 billion compared to TRY 3.59 billion a year earlier, with net income rising to TRY 1.40 billion from TRY 673 million. Its debt-to-equity ratio improved dramatically from 157.6% to just under half that figure over five years, suggesting prudent financial management and strong cash flow generation with free cash flow reaching TRY 2.98 billion recently.

- Click here and access our complete health analysis report to understand the dynamics of Çelebi Hava Servisi.

Gain insights into Çelebi Hava Servisi's past trends and performance with our Past report.

Haw Par (SGX:H02)

Simply Wall St Value Rating: ★★★★★☆

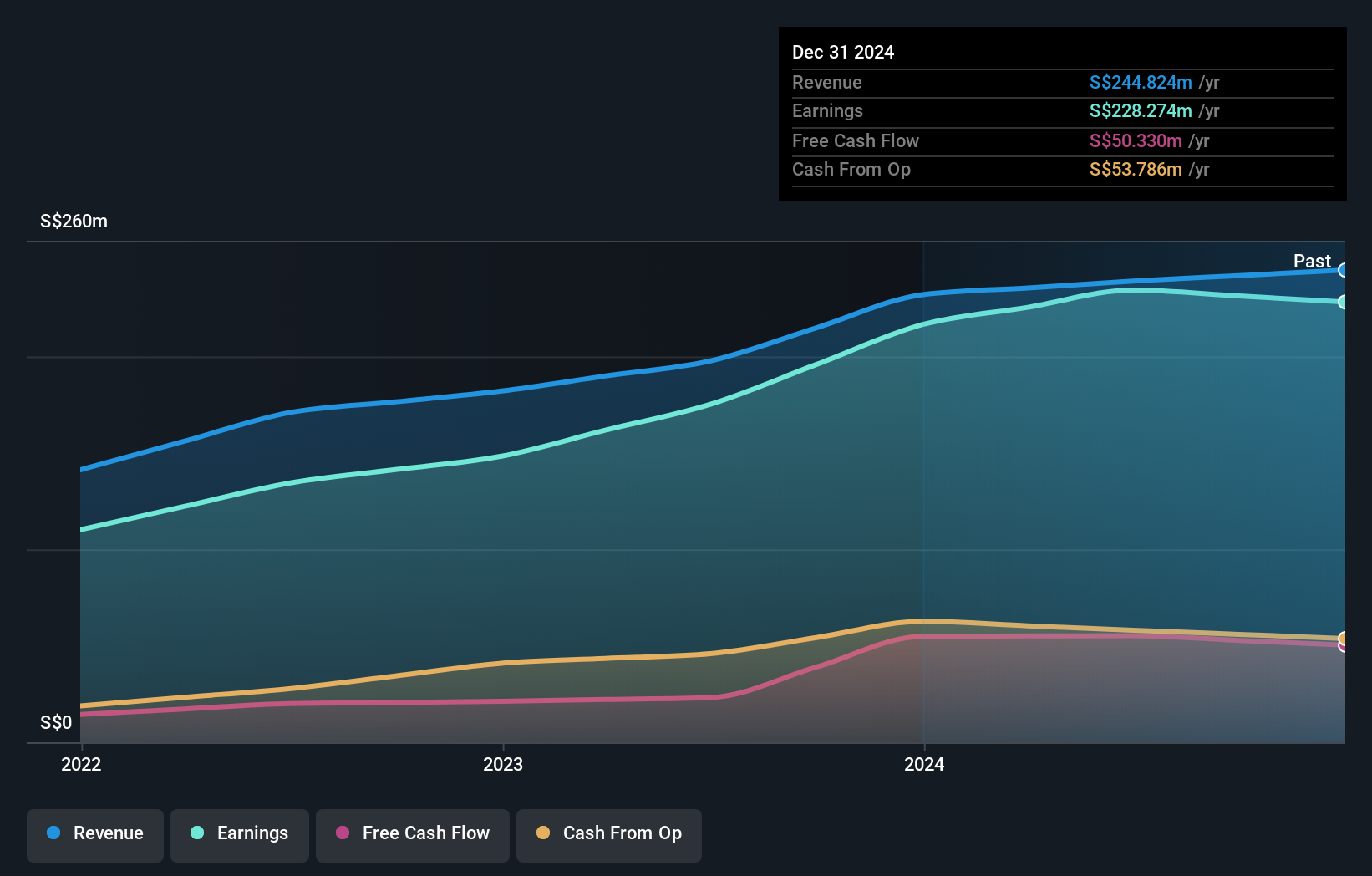

Overview: Haw Par Corporation Limited, with a market cap of SGD2.46 billion, is engaged in the manufacturing, marketing, and trading of healthcare products across Singapore, ASEAN countries, other Asian regions, and globally.

Operations: Haw Par generates revenue primarily from healthcare products, contributing SGD220.30 million. The company exhibits a notable gross profit margin of 70%.

With a price-to-earnings ratio of 10.5x, Haw Par appears undervalued compared to the SG market average of 11.6x, suggesting potential value for investors. The company has demonstrated robust earnings growth of 33.8% over the past year, outpacing the broader Pharmaceuticals industry growth rate of 7.1%. Despite an increase in its debt-to-equity ratio from 0.8% to 1% over five years, Haw Par maintains a strong financial position with more cash than total debt and high-quality earnings that cover interest payments comfortably. This financial stability positions it well within its industry context for continued performance potential.

- Take a closer look at Haw Par's potential here in our health report.

Review our historical performance report to gain insights into Haw Par's's past performance.

Ogaki Kyoritsu Bank (TSE:8361)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Ogaki Kyoritsu Bank, Ltd. is a regional financial institution offering a range of banking products and services in Japan and internationally, with a market capitalization of ¥79.35 billion.

Operations: Ogaki Kyoritsu Bank generates revenue primarily from its banking segment, totaling ¥78.20 billion, and leasing activities, contributing ¥45.32 billion. The credit guarantee segment adds an additional ¥2.89 billion to the revenue stream.

Ogaki Kyoritsu Bank, a smaller player in the banking sector, stands out with its earnings growth of 330.6% over the past year, significantly surpassing the industry average of 22.6%. Despite trading at nearly half its estimated fair value, it faces challenges with a low allowance for bad loans at 43%, while non-performing loans are at an appropriate level of 1.4%. With total assets valued at ¥6.67 trillion and deposits reaching ¥5.77 trillion, this bank primarily relies on customer deposits for funding (91%), which is generally considered less risky than external borrowing sources.

Where To Now?

- Get an in-depth perspective on all 4630 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:CLEBI

Çelebi Hava Servisi

Provides ground handling, cargo, and warehouse services to domestic and foreign airlines, and private air cargo companies primarily in Turkey.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)