As global markets navigate the early days of President Trump's administration, U.S. stocks have surged to record highs driven by optimism surrounding softer tariff policies and increased AI investment. In this dynamic environment, dividend stocks offer a compelling opportunity for investors seeking income and stability, particularly as major indices continue to show robust performance amidst political and economic developments.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.94% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.46% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.37% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.53% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.96% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Zignago Vetro (BIT:ZV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zignago Vetro S.p.A. and its subsidiaries produce, market, and sell hollow glass containers in Italy, Europe, and internationally, with a market cap of €873.27 million.

Operations: Zignago Vetro's revenue segments include €19.39 million from Vetro Revet Srl, €334.19 million from Zignago Vetro SpA, €67.66 million from Zignago Vetro Brosse SAS, and €87.80 million from Zignago Vetro Polska S.A., after accounting for a segment adjustment of -€53.22 million.

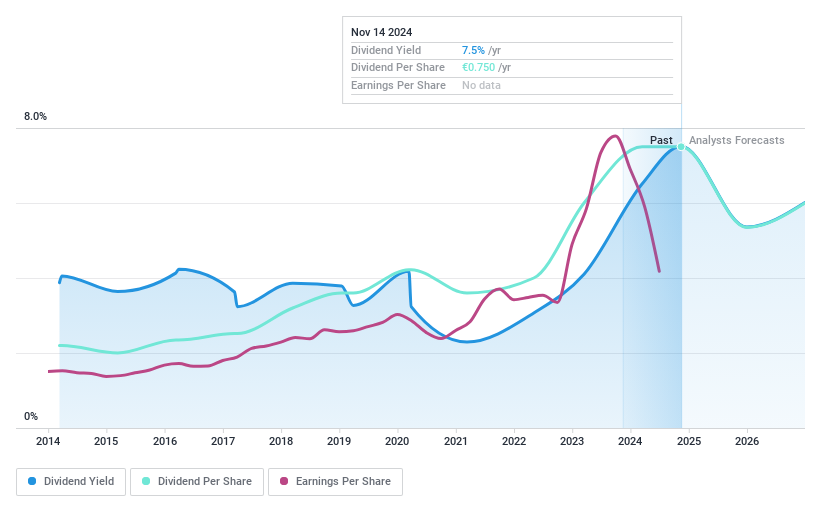

Dividend Yield: 7.4%

Zignago Vetro offers a stable dividend history with consistent increases over the past decade, placing its yield in the top 25% of Italian dividend payers. However, recent earnings have declined significantly, with net income for Q3 2024 at €5.96 million compared to €20.98 million a year prior, raising concerns about sustainability. The high payout ratios (cash: 109%, earnings: 112.4%) indicate dividends are not well covered by cash flows or earnings, highlighting potential risks for investors seeking reliable income streams.

- Take a closer look at Zignago Vetro's potential here in our dividend report.

- The analysis detailed in our Zignago Vetro valuation report hints at an deflated share price compared to its estimated value.

Tokyo Kiraboshi Financial Group (TSE:7173)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tokyo Kiraboshi Financial Group, Inc. offers financial services to small and medium-sized enterprises in Japan, with a market cap of ¥144.21 billion.

Operations: Tokyo Kiraboshi Financial Group, Inc. generates revenue through its primary segments of Banking, which contributes ¥107.90 billion, and Leasing Business, which adds ¥14.82 billion.

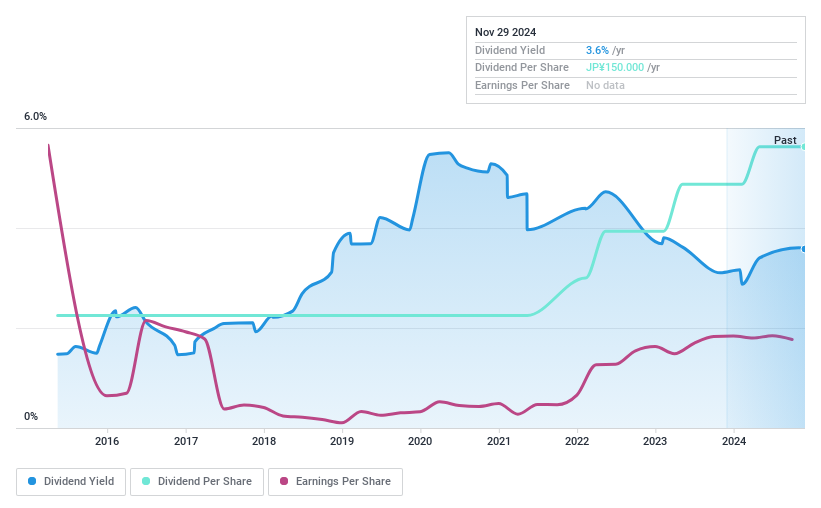

Dividend Yield: 3.1%

Tokyo Kiraboshi Financial Group provides a reliable dividend, having shown stability and growth over the past decade. The current yield of 3.14% is below Japan's top-tier dividend payers, yet its low payout ratio of 18.9% suggests dividends are well covered by earnings. However, challenges include a high level of bad loans at 2.1%, with a low allowance coverage of only 24%. Insufficient data exists to confirm future dividend sustainability or coverage by cash flows.

- Click to explore a detailed breakdown of our findings in Tokyo Kiraboshi Financial Group's dividend report.

- Our expertly prepared valuation report Tokyo Kiraboshi Financial Group implies its share price may be lower than expected.

Andritz (WBAG:ANDR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Andritz AG is a global company that supplies plants, equipment, and services across various industries including pulp and paper, metalworking and steel, hydropower stations, and solid/liquid separation, with a market cap of approximately €5.36 billion.

Operations: Andritz AG's revenue segments are comprised of Metals (€1.84 billion), Hydro Power (€1.48 billion), Pulp & Paper (€3.83 billion), and Environment & Energy (€1.33 billion).

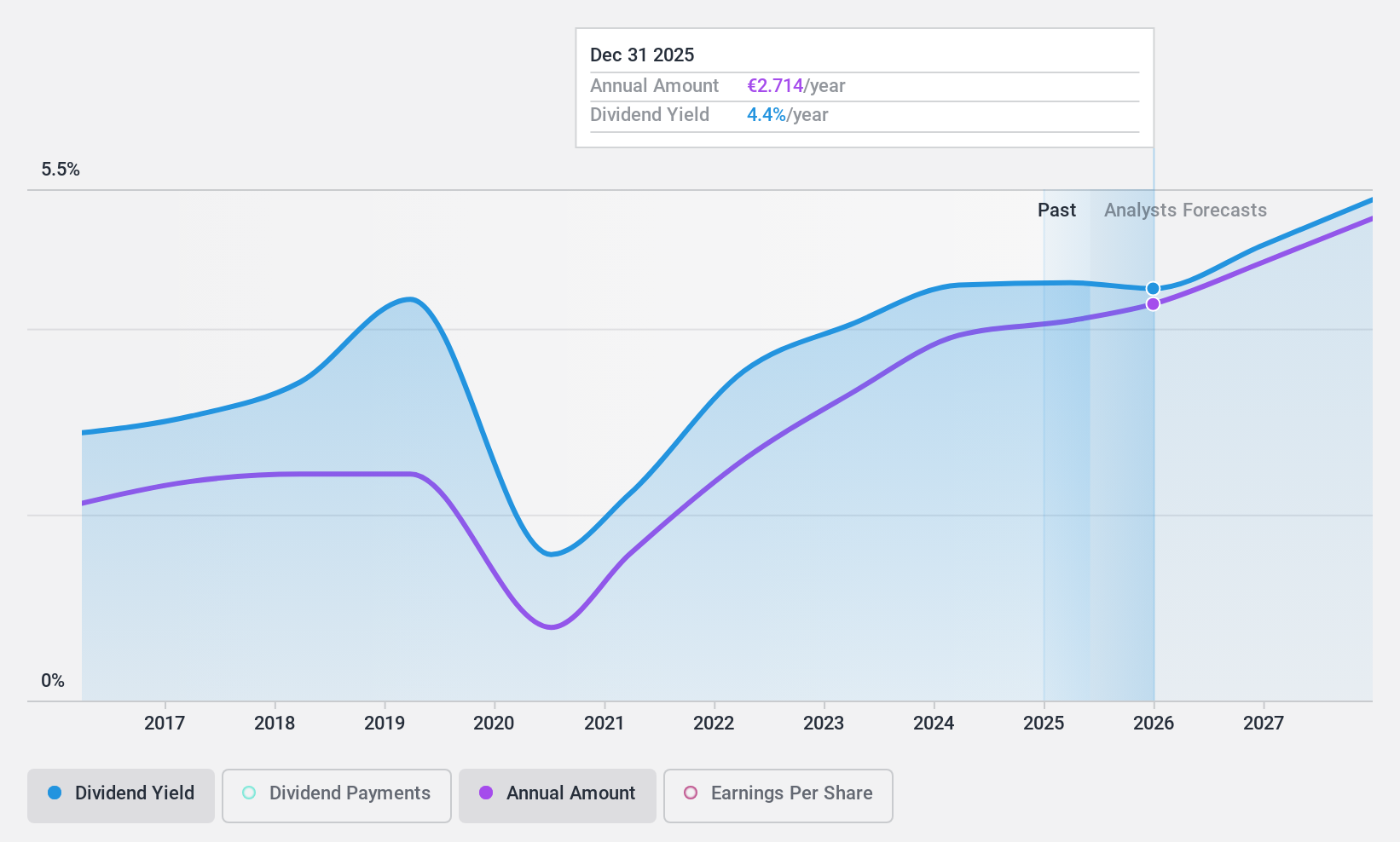

Dividend Yield: 4.6%

Andritz offers a mixed dividend profile, with payments covered by earnings and cash flows due to low payout ratios of 49.5% and 47.1%, respectively. Despite a decade of growth, dividends have been volatile, lacking reliability. The yield of 4.55% is below Austria's top-tier payers at 5.79%. Recent share buybacks totaling €128.33 million may impact future payouts positively or negatively depending on strategic execution and market conditions.

- Unlock comprehensive insights into our analysis of Andritz stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Andritz is priced lower than what may be justified by its financials.

Where To Now?

- Delve into our full catalog of 1938 Top Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Kiraboshi Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7173

Tokyo Kiraboshi Financial Group

Provides financial services for small and medium-sized enterprise in Japan.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives