As global markets navigate a landscape of mixed economic signals, with the Nasdaq hitting record highs while other major indexes face declines, investors are increasingly looking for stability in uncertain times. In this environment, dividend stocks offering reliable yields can provide a steady income stream and potential resilience against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.05% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.70% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.75% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.32% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.79% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.55% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.20% | ★★★★★★ |

Click here to see the full list of 1856 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Bank of Beijing (SHSE:601169)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Bank of Beijing Co., Ltd. offers a range of banking services to individual and corporate clients in China, with a market capitalization of approximately CN¥123.90 billion.

Operations: Bank of Beijing Co., Ltd. generates its revenue through diverse banking services tailored for both personal and corporate clients in China.

Dividend Yield: 5.4%

Bank of Beijing offers a stable and attractive dividend profile, with payments growing consistently over the past decade. Its dividend yield of 5.36% ranks in the top 25% among Chinese companies, supported by a low payout ratio of 29.7%, indicating strong coverage by earnings. Recent earnings showed modest growth, with net income reaching CNY 20.62 billion for the first nine months of 2024, suggesting continued reliability in dividend sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Bank of Beijing.

- Upon reviewing our latest valuation report, Bank of Beijing's share price might be too pessimistic.

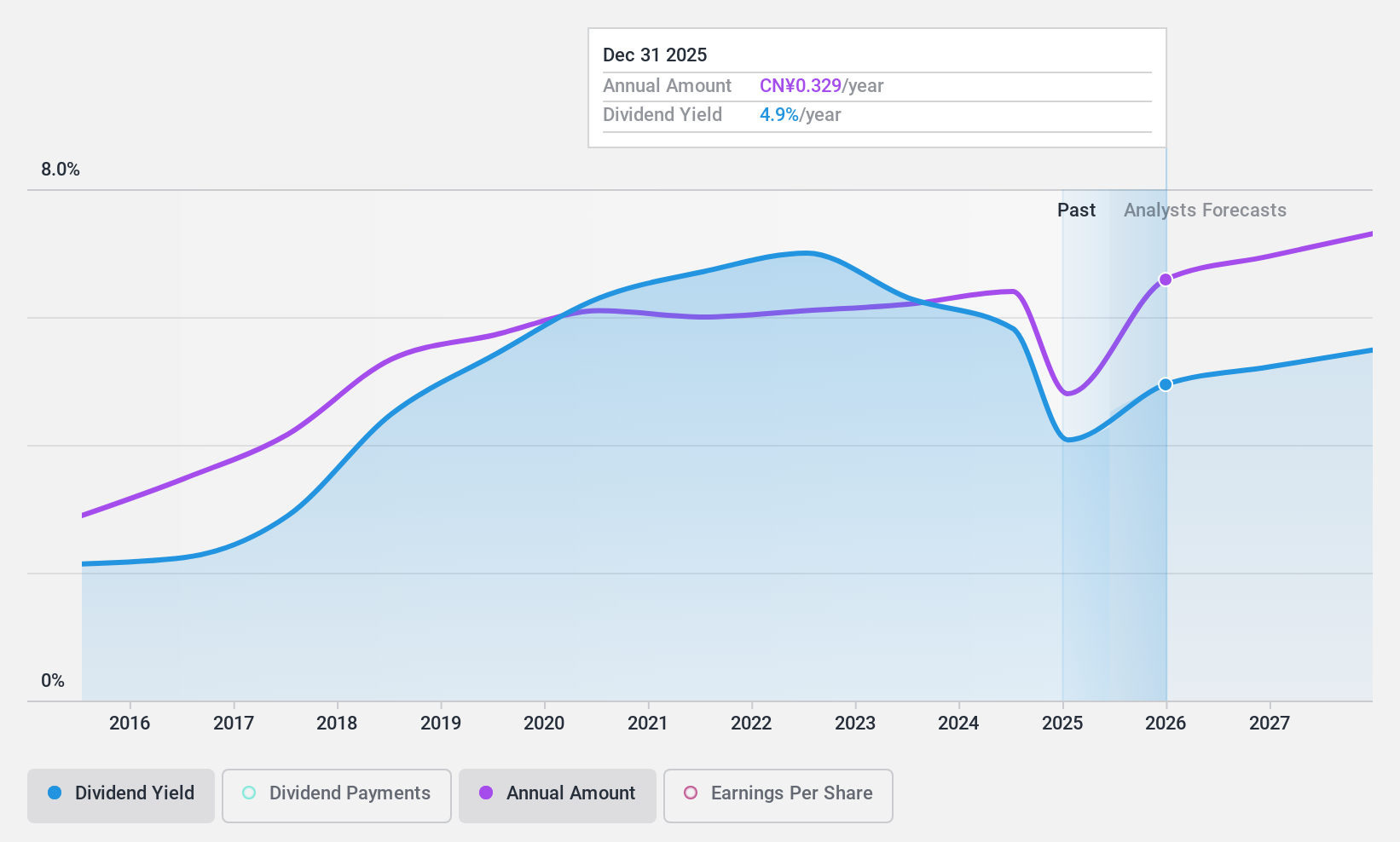

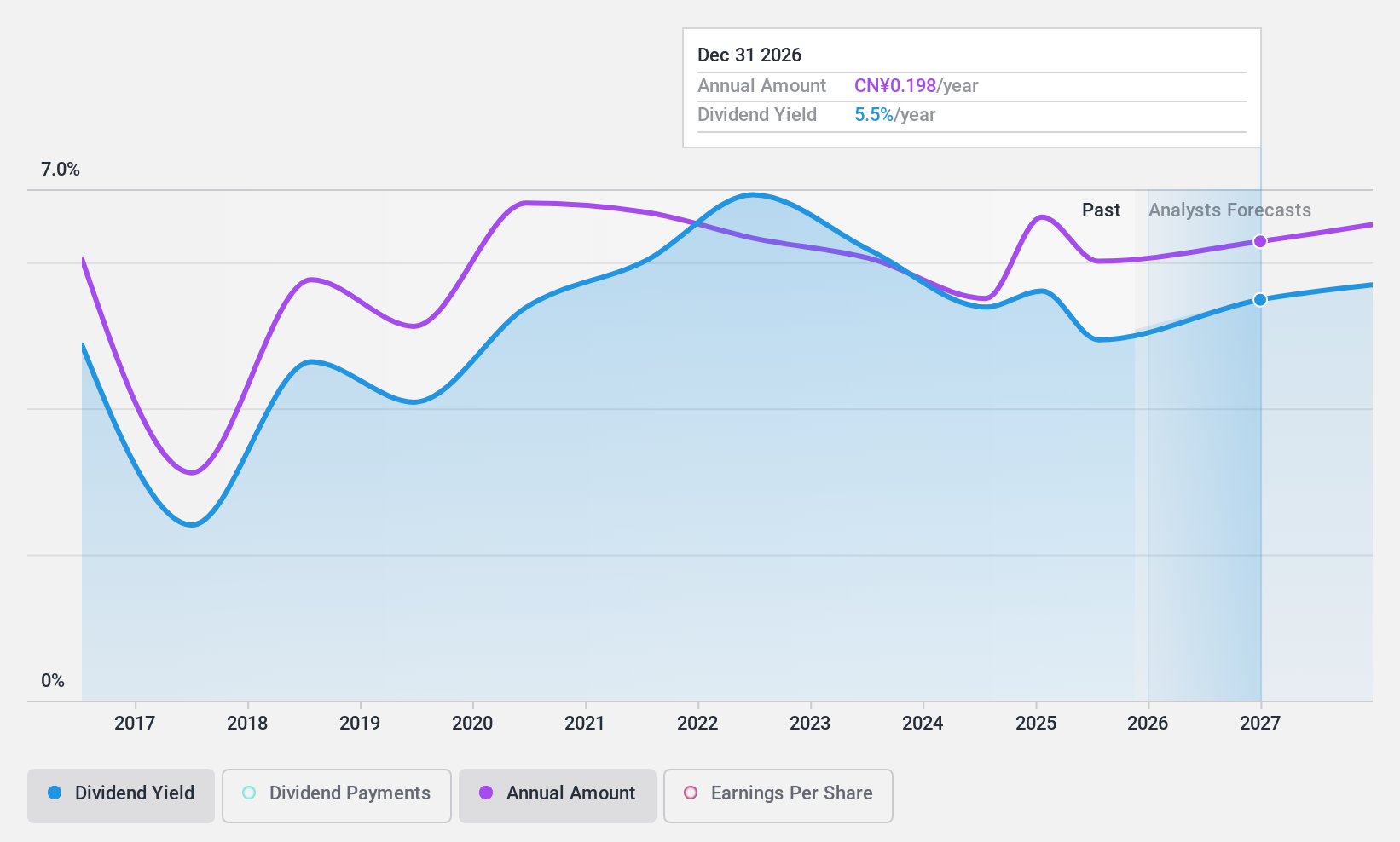

China Everbright Bank (SHSE:601818)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Everbright Bank Company Limited offers a variety of financial products and services to corporations, government agencies, retail customers, and individuals across several regions including Mainland China and Hong Kong, with a market cap of CN¥203.58 billion.

Operations: China Everbright Bank Company Limited generates revenue from providing financial products and services to corporations, government agencies, retail customers, and individuals in regions such as Mainland China, Hong Kong, Luxembourg, Macao, Seoul, and Sydney.

Dividend Yield: 5.5%

China Everbright Bank's dividend yield of 5.5% places it in the top 25% of Chinese dividend payers, supported by a manageable payout ratio of 45.5%. Despite past volatility, dividends are currently covered by earnings and forecasted to remain sustainable with a lower payout ratio expected in three years. Recent earnings showed slight growth, with net income at CNY 38.41 billion for the first nine months of 2024, reinforcing potential dividend stability.

- Click to explore a detailed breakdown of our findings in China Everbright Bank's dividend report.

- Our valuation report here indicates China Everbright Bank may be overvalued.

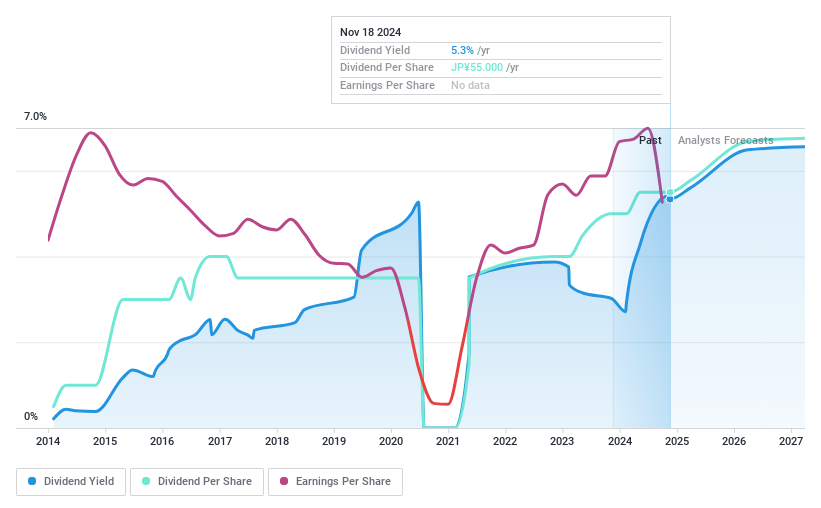

Mazda Motor (TSE:7261)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mazda Motor Corporation manufactures and sells passenger cars and commercial vehicles in Japan, the United States, North America, Europe, and internationally with a market cap of ¥6.04 billion.

Operations: Mazda Motor Corporation's revenue primarily comes from the manufacture and sale of passenger cars and commercial vehicles across various regions, including Japan, the United States, North America, Europe, and other international markets.

Dividend Yield: 5.4%

Mazda Motor's dividend yield of 5.45% ranks it among the top 25% of Japanese dividend payers, supported by a low payout ratio of 14%, indicating strong coverage by earnings and cash flows. Despite recent guidance revisions lowering earnings expectations, dividends remain stable at JPY 25 per share for Q2, with a forecasted year-end payment of JPY 30 per share. However, the company's dividend history has been volatile over the past decade.

- Navigate through the intricacies of Mazda Motor with our comprehensive dividend report here.

- Our valuation report unveils the possibility Mazda Motor's shares may be trading at a discount.

Where To Now?

- Click here to access our complete index of 1856 Top Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7261

Mazda Motor

Engages in the manufacture and sale of passenger cars and commercial vehicles in Japan, the United States, North America, Europe, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives