The Market Lifts Nissan Motor Co., Ltd. (TSE:7201) Shares 27% But It Can Do More

The Nissan Motor Co., Ltd. (TSE:7201) share price has done very well over the last month, posting an excellent gain of 27%. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.3% in the last twelve months.

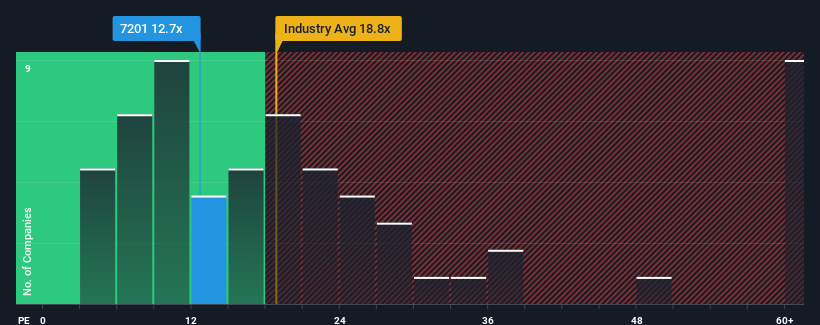

Even after such a large jump in price, there still wouldn't be many who think Nissan Motor's price-to-earnings (or "P/E") ratio of 12.7x is worth a mention when the median P/E in Japan is similar at about 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Nissan Motor hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for Nissan Motor

Is There Some Growth For Nissan Motor?

There's an inherent assumption that a company should be matching the market for P/E ratios like Nissan Motor's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 65% decrease to the company's bottom line. Even so, admirably EPS has lifted 221% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 25% per annum as estimated by the analysts watching the company. With the market only predicted to deliver 11% per year, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Nissan Motor is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Nissan Motor's P/E

Nissan Motor appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Nissan Motor currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Nissan Motor (2 are a bit unpleasant!) that you should be aware of before investing here.

You might be able to find a better investment than Nissan Motor. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nissan Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7201

Nissan Motor

Manufactures and sells vehicles and automotive parts worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives