- Japan

- /

- Auto Components

- /

- TSE:5105

Xinhua Winshare Publishing and Media And 2 Other Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets experience a rebound fueled by easing core U.S. inflation and strong bank earnings, investors are increasingly exploring dividend stocks as a reliable income source amidst fluctuating economic indicators. In this context, selecting dividend stocks with robust fundamentals can offer stability and potential income growth, making them an appealing option for those looking to navigate the current market landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.02% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

Click here to see the full list of 1987 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

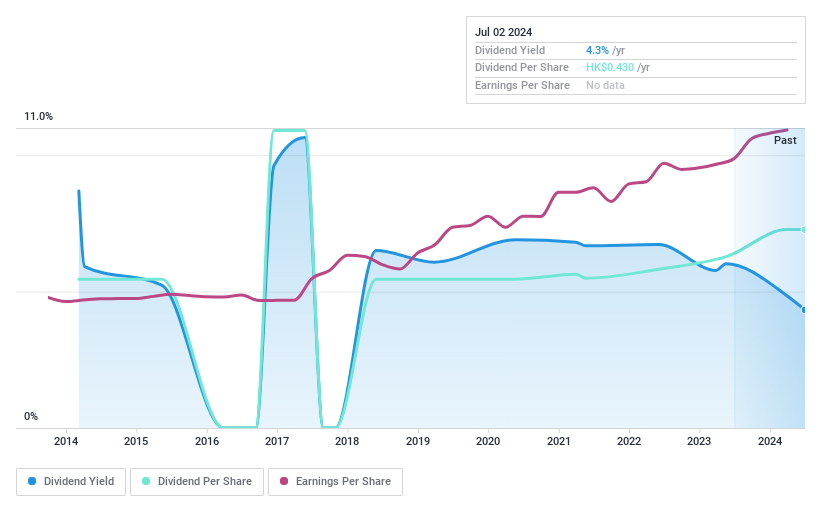

Xinhua Winshare Publishing and Media (SEHK:811)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinhua Winshare Publishing and Media Co., Ltd. operates in the publishing and media industry, with a market capitalization of approximately HK$16.97 billion.

Operations: Xinhua Winshare Publishing and Media Co., Ltd. generates its revenue from various segments within the publishing and media industry.

Dividend Yield: 3.7%

Xinhua Winshare Publishing and Media offers a dividend yield of 3.74%, which is below the top 25% of dividend payers in Hong Kong. However, its dividends are well-covered by earnings with a payout ratio of 47.6% and cash flows at 26%. Despite an unstable track record with past volatility, dividends have grown over the last decade. The stock is trading at a good value compared to peers, enhancing its appeal for value-focused investors.

- Navigate through the intricacies of Xinhua Winshare Publishing and Media with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Xinhua Winshare Publishing and Media shares in the market.

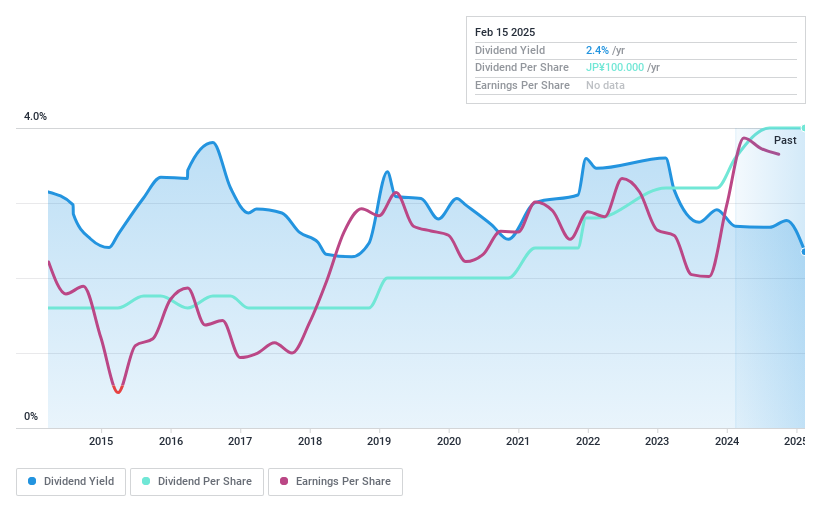

NJS (TSE:2325)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NJS Co., Ltd., along with its subsidiaries, operates in the construction consultancy sector both in Japan and internationally, with a market cap of ¥32.02 billion.

Operations: NJS Co., Ltd.'s revenue is derived from Domestic Operations amounting to ¥19.53 billion and Overseas Operations totaling ¥2.64 billion.

Dividend Yield: 3%

NJS's dividend yield of 3.03% is below the top quartile in Japan, and while its payout ratios are low—33.4% for earnings and 40.7% for cash flows—indicating good coverage, its dividends have been unreliable over the past decade due to volatility. Despite a significant recent earnings growth of 112.2%, large one-off items affect financial results, and it trades at a discount to estimated fair value, offering potential appeal for value investors.

- Click here and access our complete dividend analysis report to understand the dynamics of NJS.

- Upon reviewing our latest valuation report, NJS' share price might be too pessimistic.

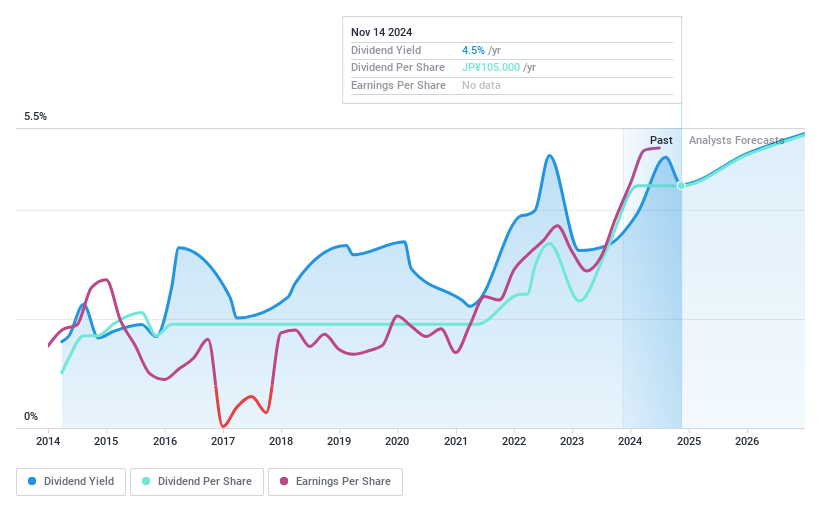

Toyo Tire (TSE:5105)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyo Tire Corporation manufactures and sells tires in Japan, North America, and internationally, with a market cap of ¥375.55 billion.

Operations: Toyo Tire Corporation's revenue segments include the manufacturing and sale of tires across Japan, North America, and international markets.

Dividend Yield: 4.3%

Toyo Tire's dividend yield of 4.26% is among the top 25% in Japan, supported by low payout ratios—28.3% for earnings and 27.5% for cash flows—ensuring coverage. However, dividends have been volatile over the past decade despite growth. Recent restructuring in Europe, including downsizing and a new Serbian hub, could impact future stability and performance as Toyo seeks to enhance its European operations amid declining earnings forecasts.

- Get an in-depth perspective on Toyo Tire's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Toyo Tire is trading behind its estimated value.

Key Takeaways

- Dive into all 1987 of the Top Dividend Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyo Tire might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5105

Toyo Tire

Manufactures and sells tires in Japan, North America, and internationally.

Flawless balance sheet, undervalued and pays a dividend.