- Japan

- /

- Personal Products

- /

- TSE:4922

3 Growth Stocks Insiders Are Betting On

Reviewed by Simply Wall St

As global markets experience a rebound with cooling inflation and strong bank earnings propelling U.S. stocks higher, investors are keenly observing growth trends amid shifting economic landscapes. In this environment, companies with high insider ownership often attract attention as insiders' confidence can signal potential growth opportunities that align with current market optimism.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 35.8% | 110.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Norwegian Air Shuttle (OB:NAS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Norwegian Air Shuttle ASA, along with its subsidiaries, offers air travel services both within Norway and internationally, with a market cap of NOK10.24 billion.

Operations: Norwegian Air Shuttle ASA generates revenue primarily through its provision of air travel services domestically and internationally.

Insider Ownership: 14.3%

Norwegian Air Shuttle's revenue is forecast to grow at 7.2% annually, outpacing the Norwegian market's 1.7%, with earnings expected to rise by 9.1%. Despite trading significantly below its estimated fair value, recent guidance lowered operating profit expectations for 2024 to NOK 1,850 million due to increased unit costs. The company has shown steady passenger growth and improved load factors year-over-year, but insider trading activity in recent months remains unclear.

- Click to explore a detailed breakdown of our findings in Norwegian Air Shuttle's earnings growth report.

- Our valuation report here indicates Norwegian Air Shuttle may be undervalued.

M31 Technology (TPEX:6643)

Simply Wall St Growth Rating: ★★★★★★

Overview: M31 Technology Corporation offers silicon intellectual property design services in the integrated circuit industry, with a market cap of NT$26.21 billion.

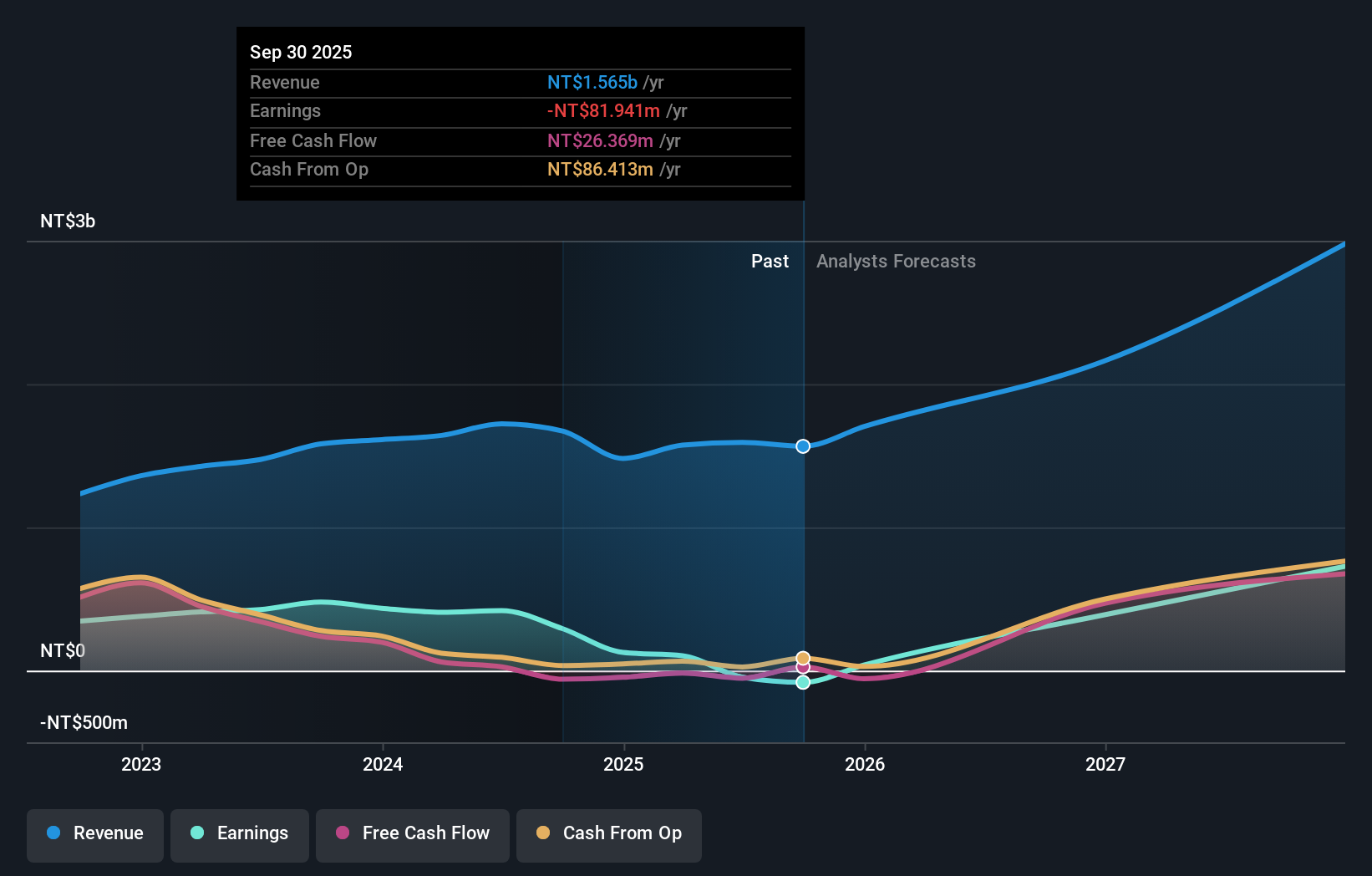

Operations: The company's revenue is primarily derived from its Semiconductor Equipment and Services segment, which generated NT$1.67 billion.

Insider Ownership: 27.2%

M31 Technology's revenue is forecast to grow at 21.7% annually, exceeding the TW market's 11.4%, with earnings expected to rise by a significant 47.89%. Despite trading slightly below its estimated fair value, profit margins have decreased from last year, and recent earnings reports show a decline in net income compared to the previous year. The company recently achieved silicon validation for its USB4 IP on TSMC’s advanced process, highlighting its commitment to innovation and high-performance solutions.

- Unlock comprehensive insights into our analysis of M31 Technology stock in this growth report.

- In light of our recent valuation report, it seems possible that M31 Technology is trading beyond its estimated value.

KOSÉ (TSE:4922)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: KOSÉ Corporation manufactures and sells cosmetics and cosmetology products primarily in Japan and internationally, with a market cap of ¥381.48 billion.

Operations: The company's revenue segments include ¥253.43 billion from the Cosmetics Business and ¥64.22 billion from Cosmetaries.

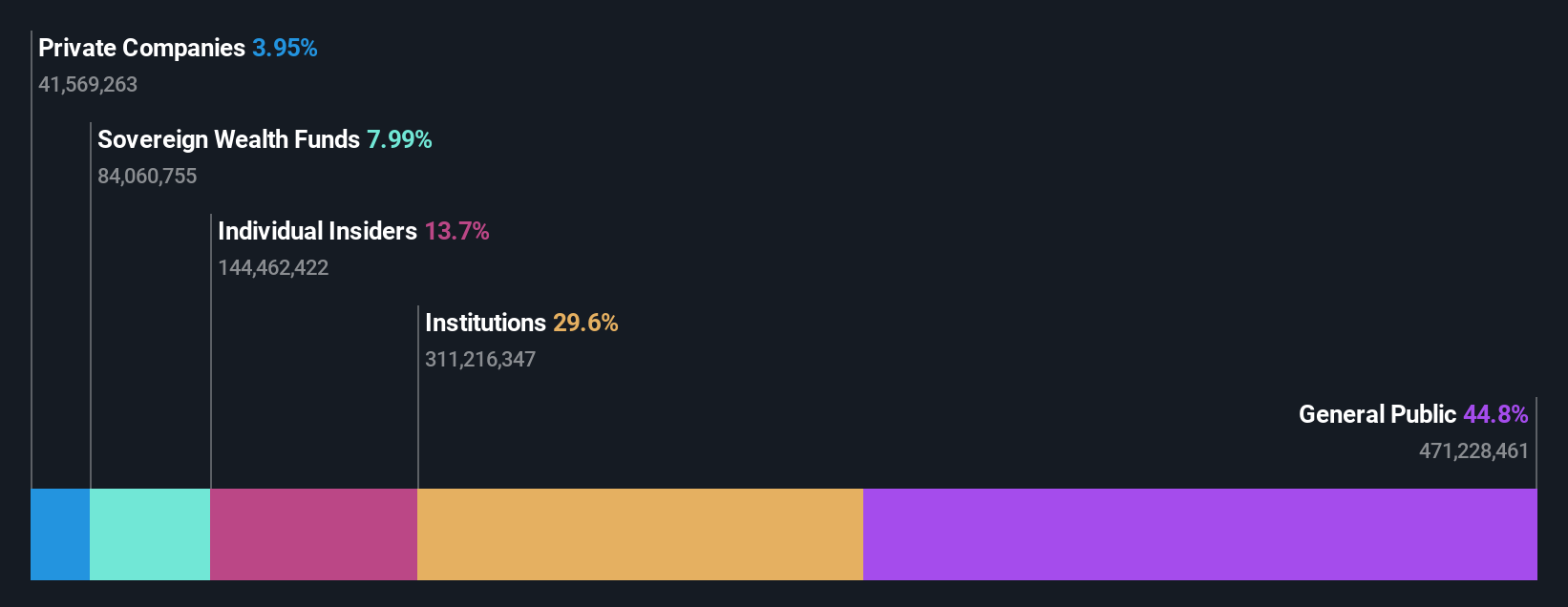

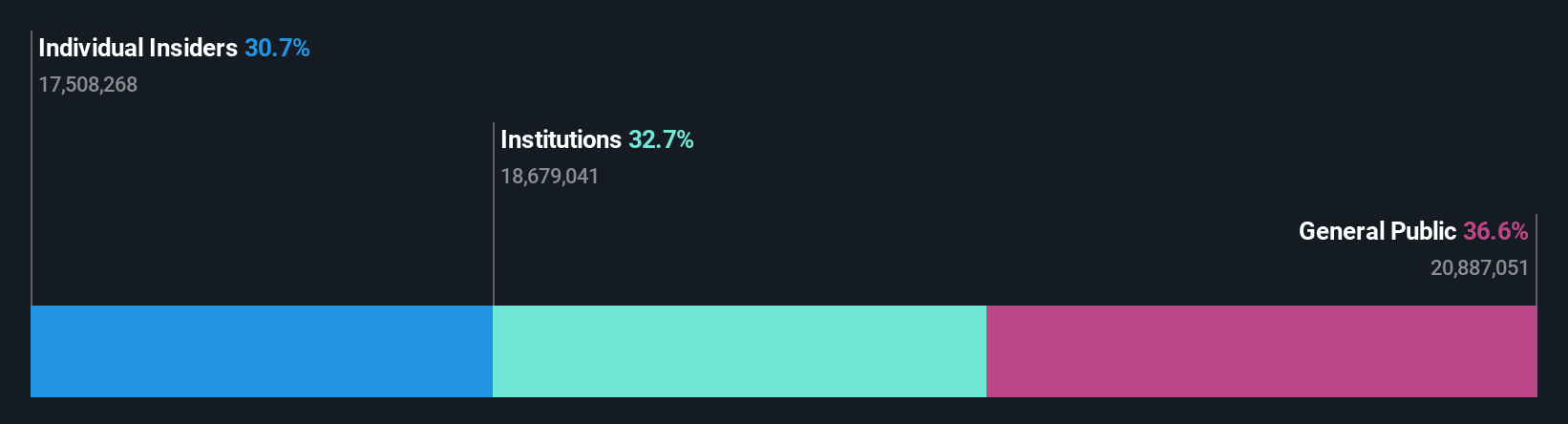

Insider Ownership: 32.9%

KOSÉ's earnings are projected to grow significantly at 22.3% annually, outpacing the JP market's 8.1%, though its return on equity is expected to be low at 6.9% in three years. Recent organizational changes aim to enhance global operations and manufacturing efficiency, but profit margins have decreased from last year. The company revised its financial guidance downward for 2024, with net sales now expected at ¥320 billion and operating profit at ¥18 billion.

- Navigate through the intricacies of KOSÉ with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility KOSÉ's shares may be trading at a premium.

Where To Now?

- Discover the full array of 1471 Fast Growing Companies With High Insider Ownership right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade KOSÉ, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KOSÉ might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4922

KOSÉ

Manufactures and sells cosmetics and cosmetology products primarily in Japan and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives