As global markets experience a rebound, with U.S. stocks rising on the back of easing core inflation and strong bank earnings, investors are increasingly looking for stability and income in their portfolios. In this environment, dividend stocks stand out as a compelling option, offering not only potential capital appreciation but also regular income streams that can enhance portfolio resilience amidst economic fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.02% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

Click here to see the full list of 1987 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

KH Neochem (TSE:4189)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KH Neochem Co., Ltd. is involved in the research, manufacturing, and sale of petrochemical products both in Japan and internationally, with a market cap of ¥75.17 billion.

Operations: KH Neochem Co., Ltd.'s revenue primarily derives from its Chemical Business segment, which generated ¥116.52 million.

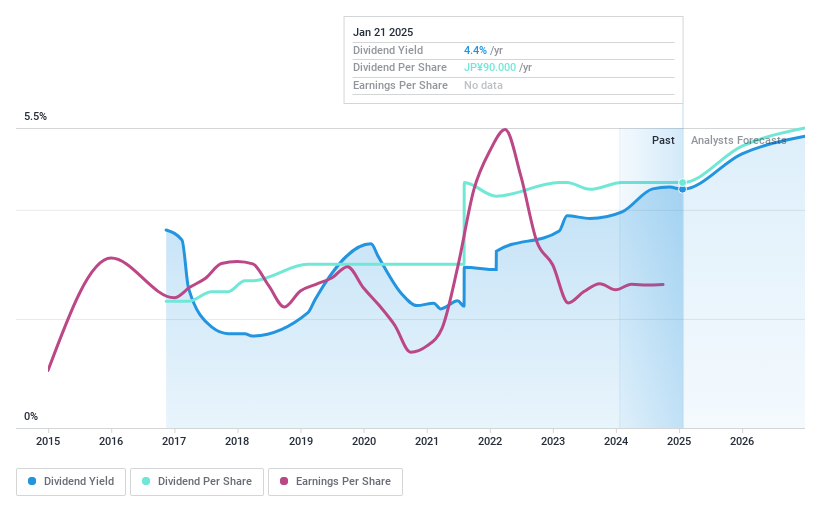

Dividend Yield: 4.4%

KH Neochem's dividend payments are well-supported by both earnings and cash flows, with payout ratios of 23.5% and 25.2%, respectively. Despite only eight years of dividend history, the company offers a competitive yield in Japan's market and has shown stable growth in dividends. Trading at a significant discount to estimated fair value, KH Neochem recently announced a ¥5 billion fixed-income offering, which may enhance financial flexibility for sustaining future dividends.

- Take a closer look at KH Neochem's potential here in our dividend report.

- Our valuation report unveils the possibility KH Neochem's shares may be trading at a discount.

Eagle IndustryLtd (TSE:6486)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Eagle Industry Co., Ltd. manufactures, markets, and sells mechanical seals, special valves, and other sealed products both in Japan and internationally with a market cap of ¥92.77 billion.

Operations: Eagle Industry Ltd.'s revenue is primarily derived from the Automotive and Construction Machinery Industries at ¥90.73 billion, followed by the General Machinery Industry (excluding Semiconductor Business) at ¥40.58 billion, Marine Industry at ¥16.22 billion, Semiconductor Industry at ¥12.45 billion, and Aerospace Industry at ¥8.21 billion.

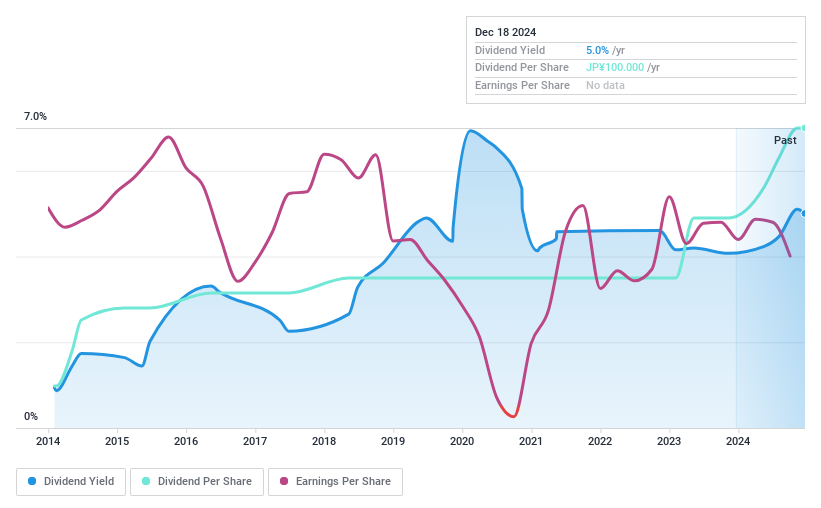

Dividend Yield: 4.8%

Eagle Industry Ltd. recently increased its dividend for the second quarter to ¥50.00 per share, up from ¥35.00 last year, and projects a year-end dividend of ¥50.00 per share, reflecting growth in payouts. The company's dividends are supported by earnings with a payout ratio of 73.6% and cash flows at an 84.8% ratio, indicating sustainability despite higher coverage ratios compared to peers. A recent buyback program may further bolster shareholder value amidst stable historical dividend performance.

- Click to explore a detailed breakdown of our findings in Eagle IndustryLtd's dividend report.

- Our valuation report here indicates Eagle IndustryLtd may be overvalued.

Gunma Bank (TSE:8334)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Gunma Bank, Ltd. offers a range of banking and financial products and services in Japan with a market cap of ¥401.32 billion.

Operations: Gunma Bank generates revenue primarily from its banking operations, amounting to ¥106.77 billion, and leasing services, contributing ¥30.25 billion.

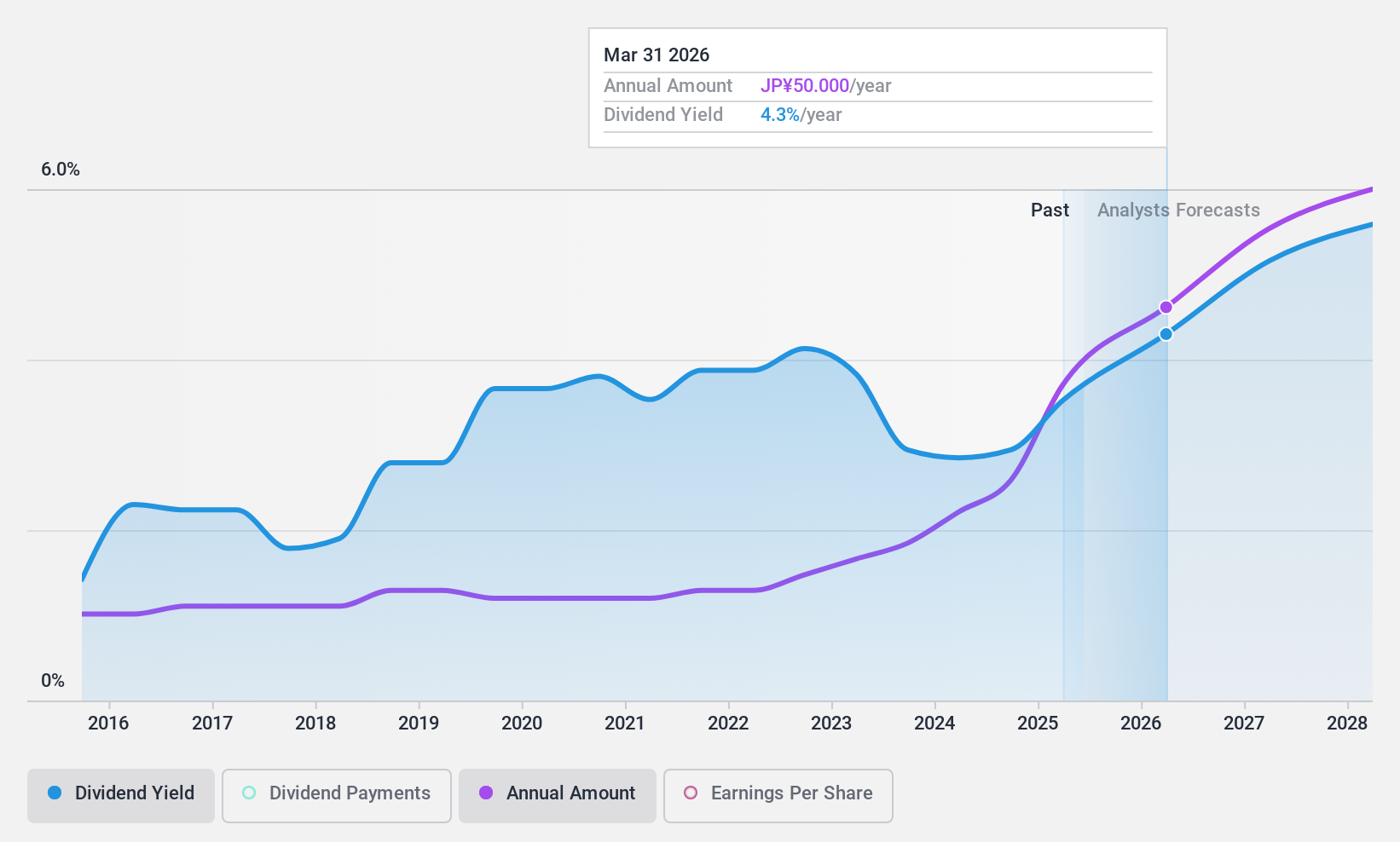

Dividend Yield: 3.7%

Gunma Bank's dividends have grown steadily over the past decade, supported by a low payout ratio of 32%, indicating strong coverage by earnings. Recent announcements include an increase in interim dividends to ¥20 per share from ¥10 last year and a revised year-end dividend guidance of ¥20 per share, up from ¥14. The bank's earnings growth and strategic buyback program—repurchasing shares worth approximately ¥5 billion—enhance its appeal for dividend investors seeking stability and value.

- Navigate through the intricacies of Gunma Bank with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Gunma Bank's current price could be quite moderate.

Next Steps

- Discover the full array of 1987 Top Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8334

Gunma Bank

Provides various banking and financial products and services in Japan.

Solid track record with excellent balance sheet and pays a dividend.