Exploring Three High Growth Tech Stocks with Promising Potential

Reviewed by Simply Wall St

As global markets experience a rebound, driven by cooling U.S. inflation and strong bank earnings, major indices like the S&P 500 and Dow Jones Industrial Average have seen significant gains, while value stocks outperformed growth shares. In this dynamic environment, identifying high-growth tech stocks requires a focus on companies that demonstrate resilience and adaptability to evolving economic conditions, as these traits can position them well for future opportunities in an ever-changing market landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.43% | 56.40% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 30.02% | 61.89% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Probi (OM:PROB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Probi AB (publ) is engaged in the research, manufacturing, and sale of probiotics for dietary supplements and food companies across various regions including North America, South America, Europe, Sweden, the Middle East, Africa, Asia Pacific, and internationally with a market capitalization of SEK3.99 billion.

Operations: Probi AB focuses on the development and distribution of probiotics, catering to dietary supplement and food sectors worldwide. The company operates across diverse regions, enhancing its global footprint in the probiotics market.

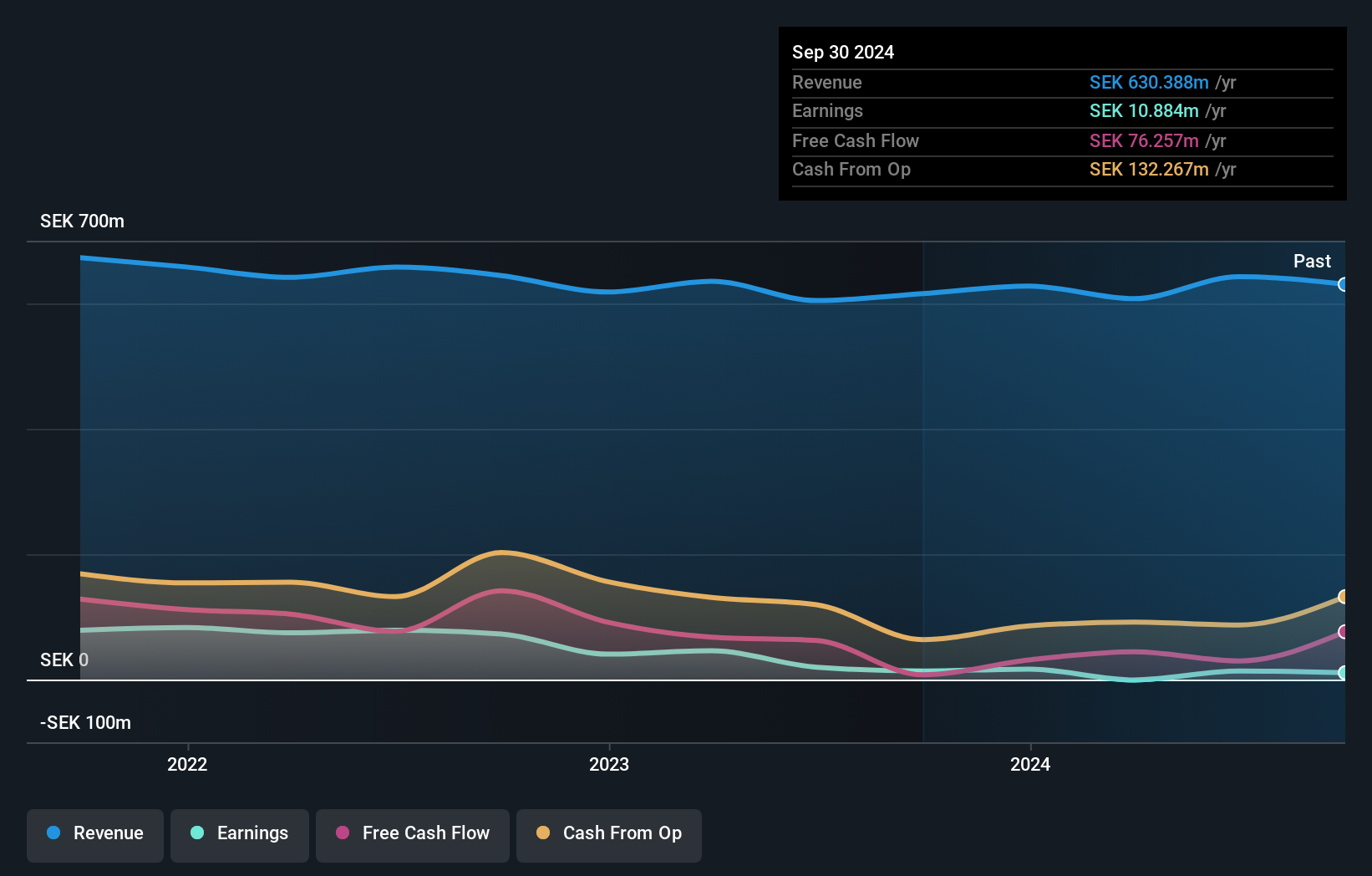

Probi AB, amidst a transformative acquisition by Symrise AG, showcases significant strategic moves in the biotech landscape. The deal, valued at SEK 1.2 billion, not only underscores Probi's valuation but also its pivotal role in the industry, evidenced by a substantial 62% forecasted annual earnings growth and an above-market revenue growth rate of 5.3%. This acquisition could potentially streamline operations and enhance market reach for Probi, aligning with Symrise's broader objectives to consolidate its position in health and nutrition sectors. Moreover, this move might catalyze further innovations within Probi’s product offerings while ensuring financial robustness through enhanced cash flows and operational efficiencies post-integration.

- Get an in-depth perspective on Probi's performance by reading our health report here.

Evaluate Probi's historical performance by accessing our past performance report.

Orbbec (SHSE:688322)

Simply Wall St Growth Rating: ★★★★★☆

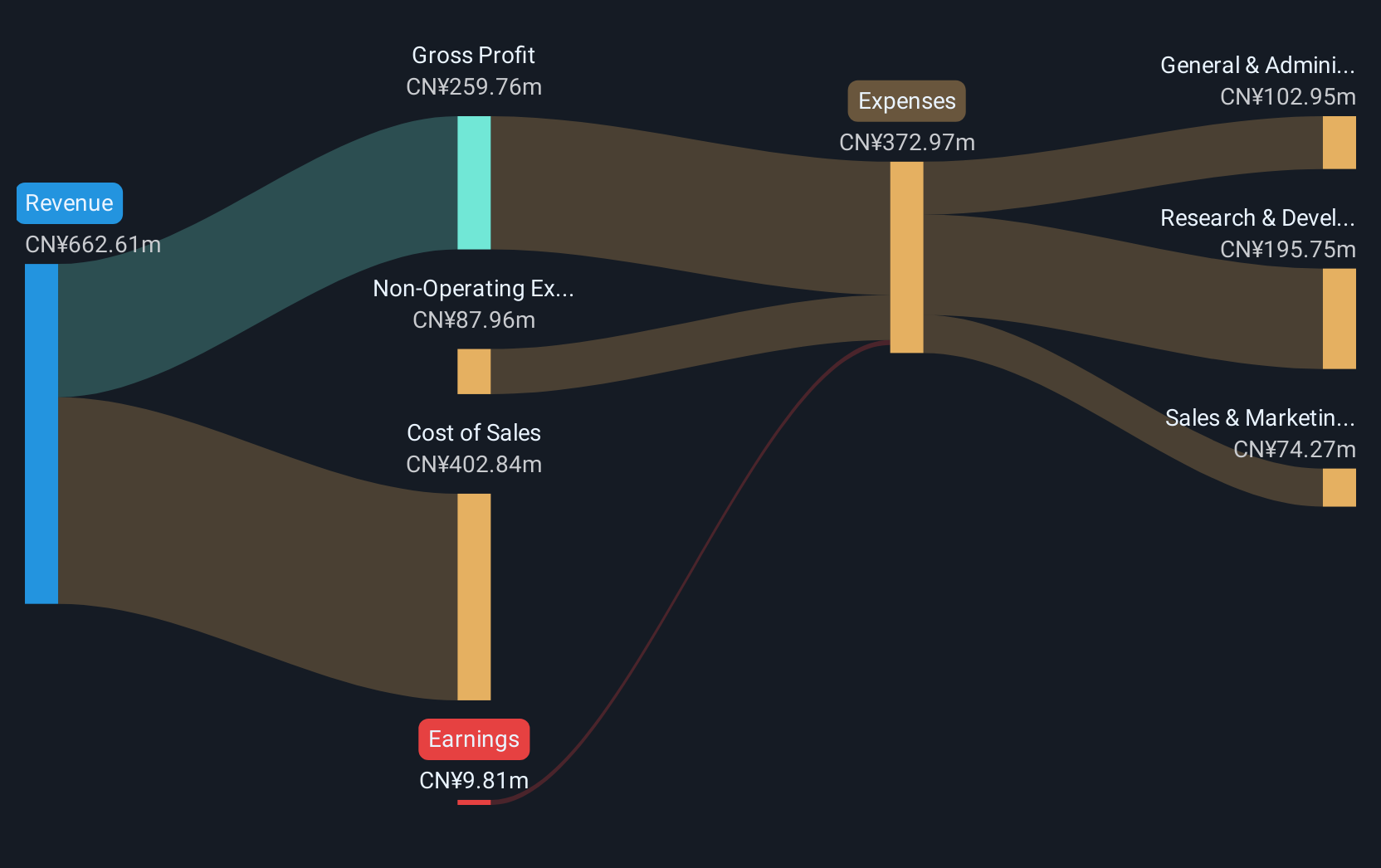

Overview: Orbbec Inc. designs, manufactures, and sells 3D vision sensors with a market capitalization of CN¥19.12 billion.

Operations: Orbbec generates revenue primarily through the design, manufacture, and sale of 3D vision sensors. The company's market capitalization is CN¥19.12 billion.

Orbbec's recent financial performance underscores its resilience and potential within the tech sector, with sales soaring to CNY 350.86 million from CNY 259.37 million year-over-year, reflecting a robust growth trajectory. Despite a net loss reduction from CNY 191.94 million to CNY 60.31 million, the company's strategic maneuvers, including a significant share buyback program totaling CNY 33.83 million, demonstrate confidence in its future prospects and commitment to shareholder value. This is further bolstered by an impressive forecast of annual revenue growth at 39.9%, significantly outpacing the Chinese market average of 13.4%.

- Take a closer look at Orbbec's potential here in our health report.

Gain insights into Orbbec's past trends and performance with our Past report.

Vector (TSE:6058)

Simply Wall St Growth Rating: ★★★★☆☆

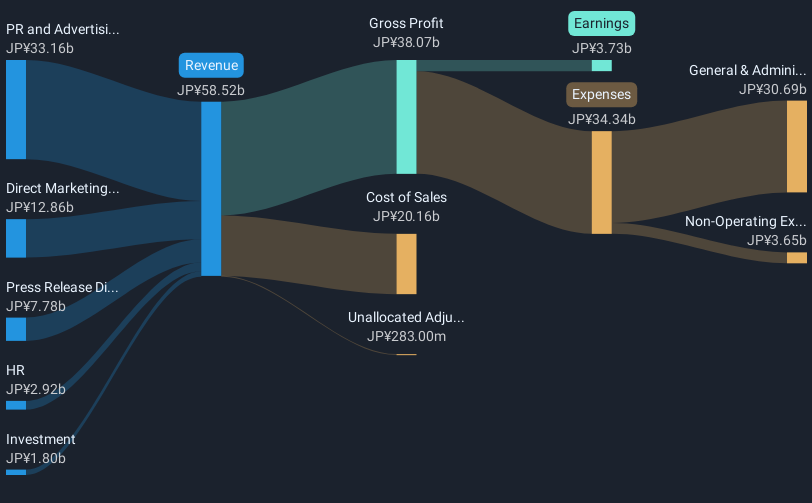

Overview: Vector Inc. operates in public relations, advertising, press release and video distribution, direct marketing, media, investment, and human resources sectors across Japan, China, and internationally with a market cap of ¥47.89 billion.

Operations: Vector Inc. generates revenue primarily from PR and advertising, direct marketing, and press release distribution, with PR and advertising contributing ¥33.16 billion, direct marketing ¥12.86 billion, and press release distribution ¥7.78 billion. The company also has smaller revenue streams from human resources at ¥2.92 billion and investment activities at ¥1.80 billion within its diversified operations across Japan, China, and beyond.

Vector's recent strategic move to establish a joint venture in Taiwan with Mars Holdings, aimed at expanding its taxi advertisement business, underscores its innovative approach to growth in niche markets. This decision follows a year where Vector saw earnings grow by 13.4%, outstripping the media industry's average of 8.4%. Additionally, with an expected annual profit growth forecast of 13% per year—higher than Japan's market average of 8.1%—Vector is positioning itself strongly within the competitive landscape. The company’s focus on leveraging existing media and advertisement expertise through international partnerships highlights a robust strategy for sustained revenue streams and market expansion starting from fiscal year 2026.

- Unlock comprehensive insights into our analysis of Vector stock in this health report.

Understand Vector's track record by examining our Past report.

Next Steps

- Dive into all 1225 of the High Growth Tech and AI Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6058

Vector

Engages in the public relations (PR) and advertising, press release distribution, video release distribution, direct marketing, media, investment, and human resources businesses in Japan, China, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion