- Japan

- /

- Auto Components

- /

- TSE:5105

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of mixed performance, with the Nasdaq Composite reaching new heights while other indices face declines, investors are keeping a close eye on potential Federal Reserve rate cuts and inflation trends. Amidst these economic shifts, dividend stocks remain an attractive option for those seeking steady income streams; they can offer stability and consistent returns even when market volatility is high.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.12% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.62% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.00% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.96% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.44% | ★★★★★★ |

Click here to see the full list of 1829 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

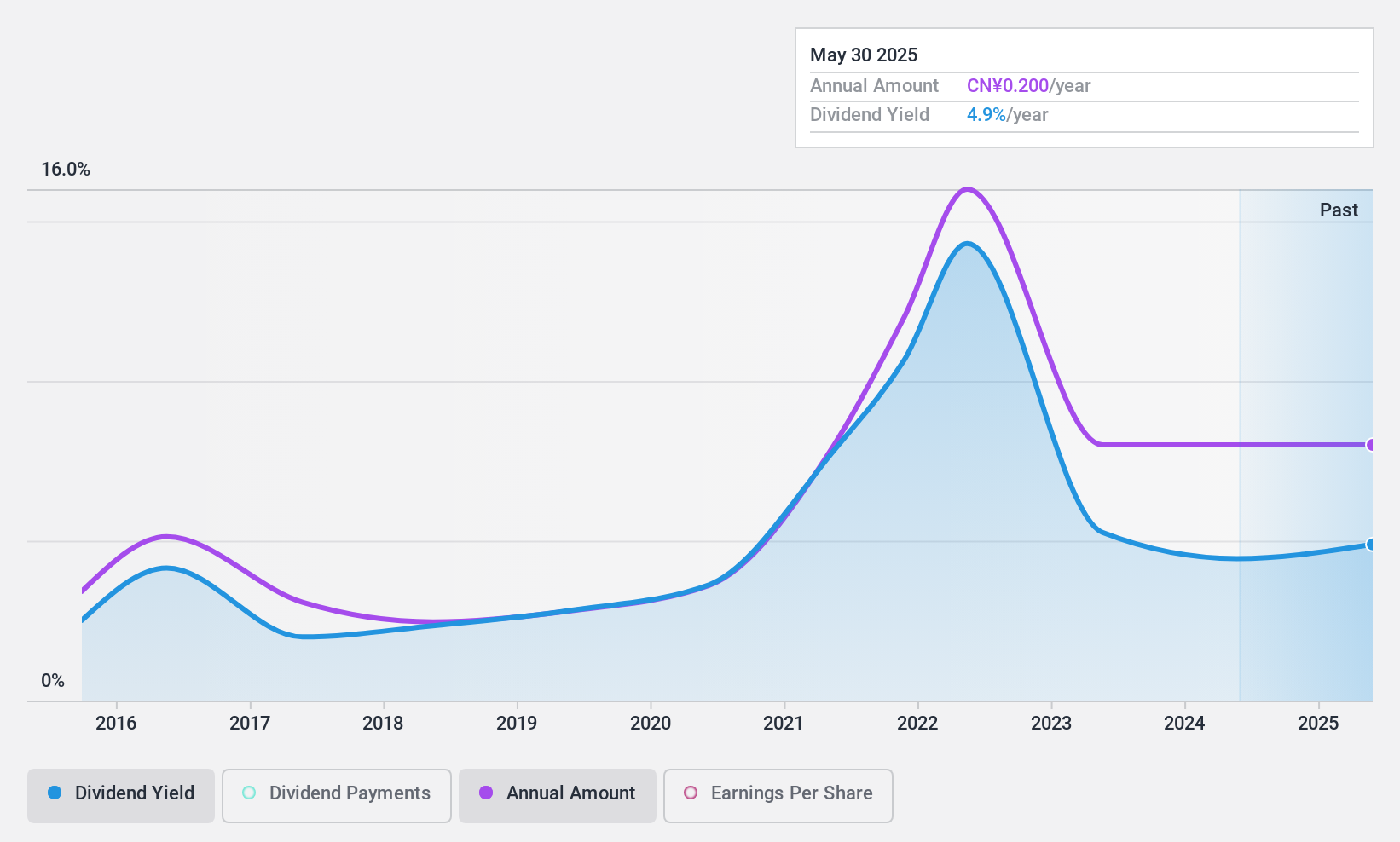

TangShan Port GroupLtd (SHSE:601000)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TangShan Port Group Co., Ltd, with a market cap of CN¥27.50 billion, offers transportation and warehousing services in China through its subsidiaries.

Operations: TangShan Port Group Co., Ltd generates revenue from its transportation and warehousing services in China.

Dividend Yield: 4.3%

TangShan Port Group Ltd. offers a dividend yield of 4.31%, placing it in the top 25% of dividend payers in China, though its dividend history has been volatile and unreliable over the past decade. Despite this, dividends are well-covered by both earnings and cash flows with payout ratios of 62.6% and 60%, respectively. The stock trades at a discount to its estimated fair value, suggesting potential relative value compared to peers in the industry.

- Click here and access our complete dividend analysis report to understand the dynamics of TangShan Port GroupLtd.

- Our valuation report here indicates TangShan Port GroupLtd may be undervalued.

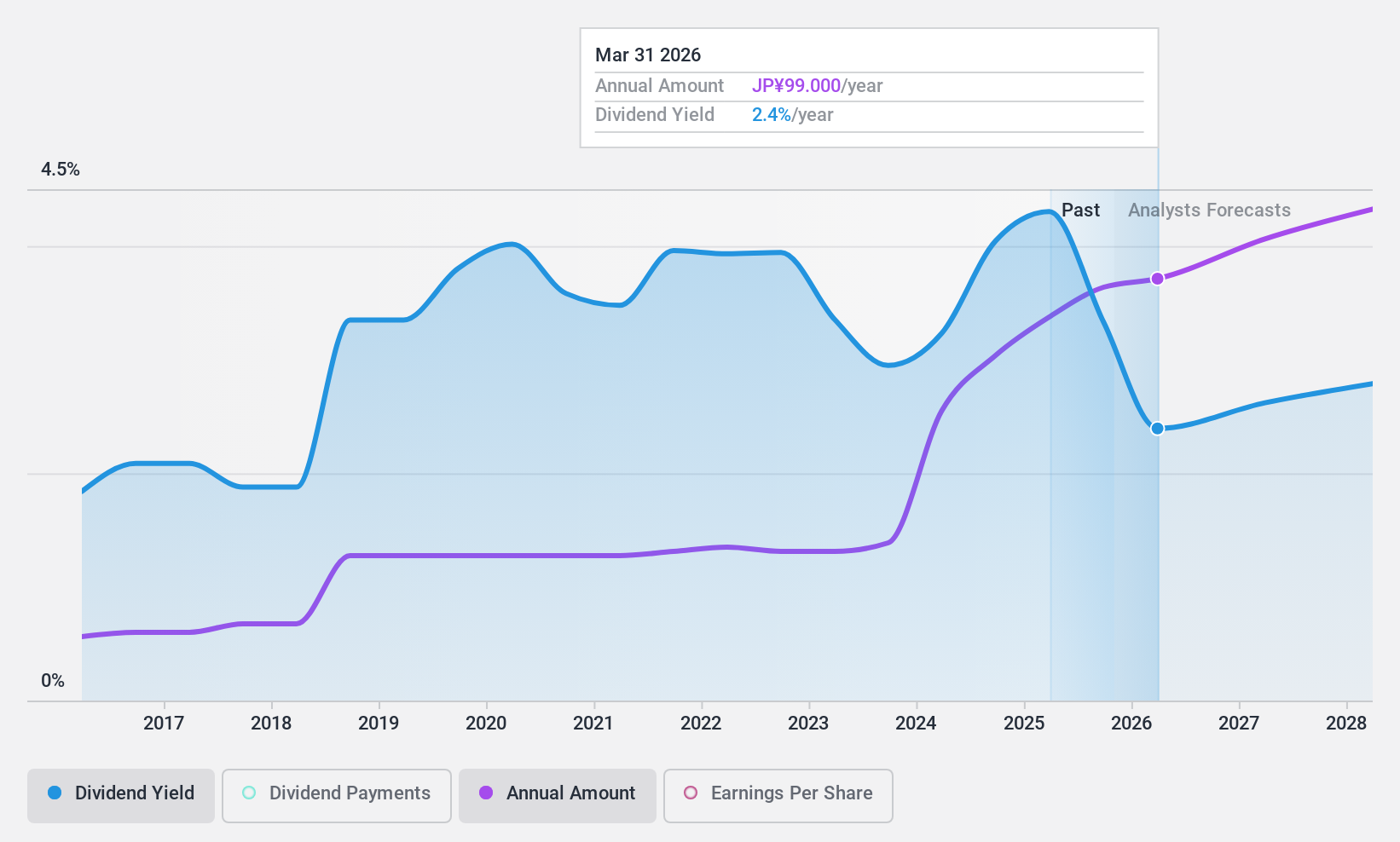

Chugoku Marine Paints (TSE:4617)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chugoku Marine Paints, Ltd. is a company that produces and sells functional coatings globally, with a market cap of ¥117.90 billion.

Operations: Chugoku Marine Paints, Ltd. generates revenue from various regions, with ¥30.66 billion from China, ¥48.33 billion from Japan, ¥18.04 billion from South Korea, ¥23.61 billion from Southeast Asia, and ¥29.07 billion from Europe and the United States of America.

Dividend Yield: 3.6%

Chugoku Marine Paints offers a stable dividend yield of 3.57%, though it falls short of the top 25% in Japan. Dividends are well-covered by both earnings and cash flows, with low payout ratios of 30.9% and 33.6%, ensuring sustainability. The company's dividends have been reliable over the past decade, showing consistent growth without volatility. Additionally, the stock trades at a discount to its estimated fair value, enhancing its appeal for value-conscious investors.

- Get an in-depth perspective on Chugoku Marine Paints' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Chugoku Marine Paints shares in the market.

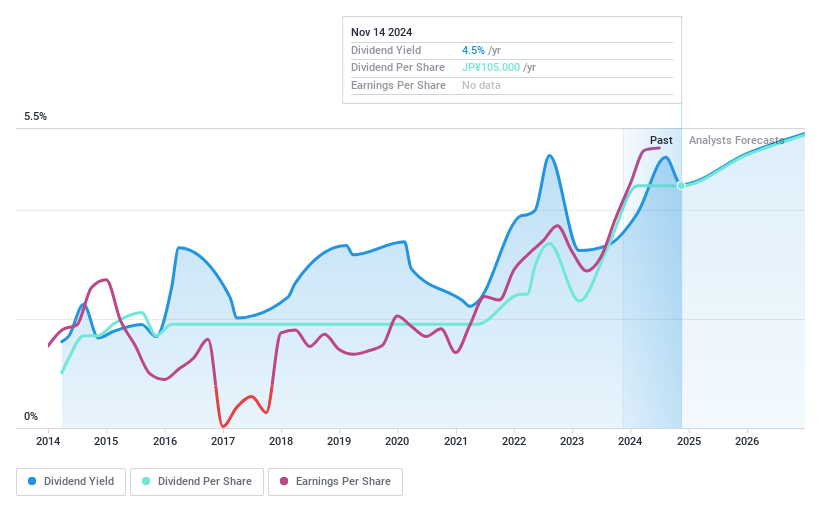

Toyo Tire (TSE:5105)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyo Tire Corporation manufactures and sells tires in Japan, North America, and internationally, with a market cap of ¥377.32 billion.

Operations: Toyo Tire Corporation's revenue is primarily generated from its tire manufacturing and sales operations across Japan, North America, and international markets.

Dividend Yield: 4.3%

Toyo Tire's dividend yield of 4.28% ranks in the top 25% of Japanese dividend payers, with a sustainable payout ratio supported by earnings (28.3%) and cash flows (27.5%). However, its dividend history has been volatile over the past decade despite recent growth. The company is undergoing significant restructuring in Europe, consolidating operations to Serbia, which may impact future financial stability and dividend reliability amidst declining earnings forecasts.

- Dive into the specifics of Toyo Tire here with our thorough dividend report.

- Our valuation report unveils the possibility Toyo Tire's shares may be trading at a discount.

Where To Now?

- Reveal the 1829 hidden gems among our Top Dividend Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyo Tire might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5105

Toyo Tire

Manufactures and sells tires in Japan, North America, and internationally.

Flawless balance sheet, undervalued and pays a dividend.