- Japan

- /

- Specialty Stores

- /

- TSE:2726

3 Growth Companies With High Insider Ownership Expecting 74% Earnings Growth

Reviewed by Simply Wall St

In a week marked by heightened inflation concerns and political uncertainties, global markets have experienced significant volatility, with U.S. equities facing notable declines and small-cap stocks underperforming their larger counterparts. As investors navigate this turbulent landscape, identifying growth companies with substantial insider ownership can be an effective strategy, as these firms often demonstrate strong alignment between management and shareholder interests, potentially driving robust earnings growth even amidst challenging market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Medley (TSE:4480) | 34% | 27.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

Let's dive into some prime choices out of the screener.

Vobile Group (SEHK:3738)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content asset protection and transactions across the United States, Japan, Mainland China, and internationally, with a market cap of HK$7.13 billion.

Operations: The company generates revenue primarily from its software as a service offerings, amounting to HK$2.18 billion.

Insider Ownership: 23.1%

Earnings Growth Forecast: 74.1% p.a.

Vobile Group is positioned in the rapidly evolving generative AI sector, with its new copyright management services targeting the $3 trillion media and entertainment industry. Despite a volatile share price, Vobile's earnings are forecast to grow significantly at 74.1% annually, outpacing the Hong Kong market. Recent revenue growth of 29% underscores its potential, although profit margins have declined from last year. The company recently raised HK$78 million through convertible bonds to support expansion efforts.

- Navigate through the intricacies of Vobile Group with our comprehensive analyst estimates report here.

- The analysis detailed in our Vobile Group valuation report hints at an inflated share price compared to its estimated value.

Wuxi Taclink Optoelectronics Technology (SHSE:688205)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Taclink Optoelectronics Technology Co., Ltd. operates in the field of optoelectronic components and technologies, with a market capitalization of approximately CN¥9.81 billion.

Operations: Wuxi Taclink Optoelectronics Technology Co., Ltd. generates revenue from its operations in the optoelectronic components and technologies sector.

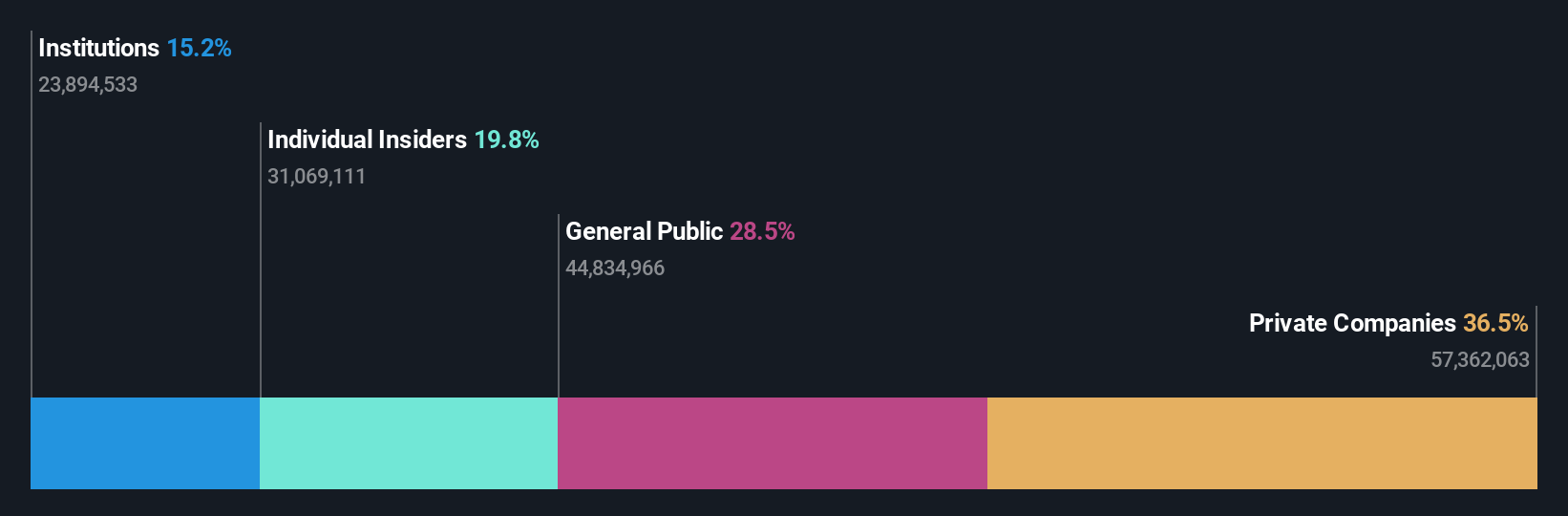

Insider Ownership: 19.8%

Earnings Growth Forecast: 33.7% p.a.

Wuxi Taclink Optoelectronics Technology is poised for robust growth, with earnings expected to rise significantly at 33.66% annually, surpassing the Chinese market's average. Revenue is also forecast to grow rapidly at 27.9% per year. Despite recent volatility in its share price, the company reported a solid increase in net income and sales for the first nine months of 2024, reaching CNY 600.68 million in revenue and CNY 76.29 million in net income.

- Get an in-depth perspective on Wuxi Taclink Optoelectronics Technology's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Wuxi Taclink Optoelectronics Technology's share price might be on the expensive side.

PAL GROUP Holdings (TSE:2726)

Simply Wall St Growth Rating: ★★★★☆☆

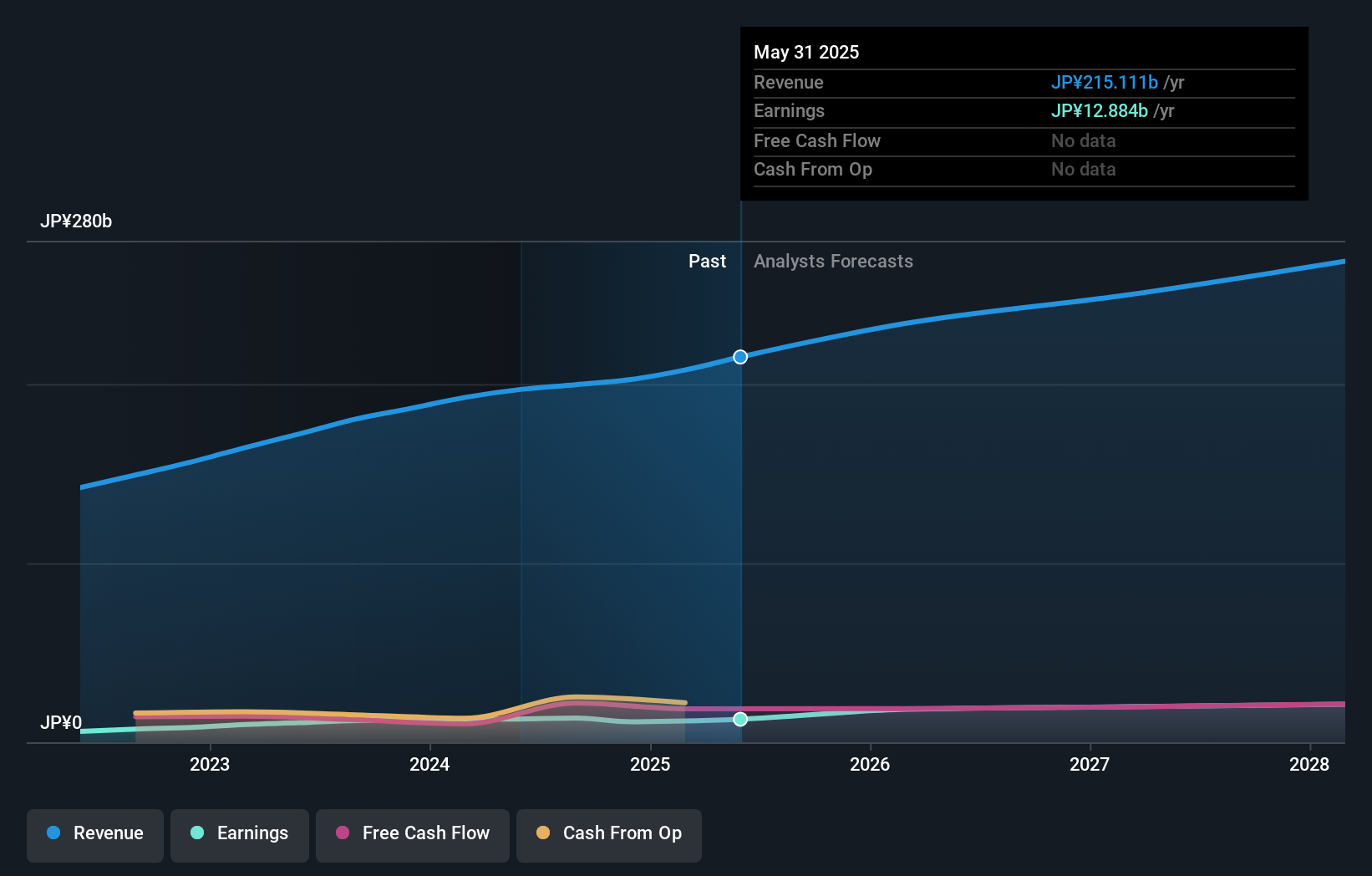

Overview: PAL GROUP Holdings CO., LTD. operates in Japan, focusing on the planning, manufacture, wholesale, and retail of men's and women's clothing and accessories, with a market cap of ¥258.39 billion.

Operations: The company's revenue segments include the planning, manufacture, wholesale, and retail of men's and women's clothing and accessories in Japan.

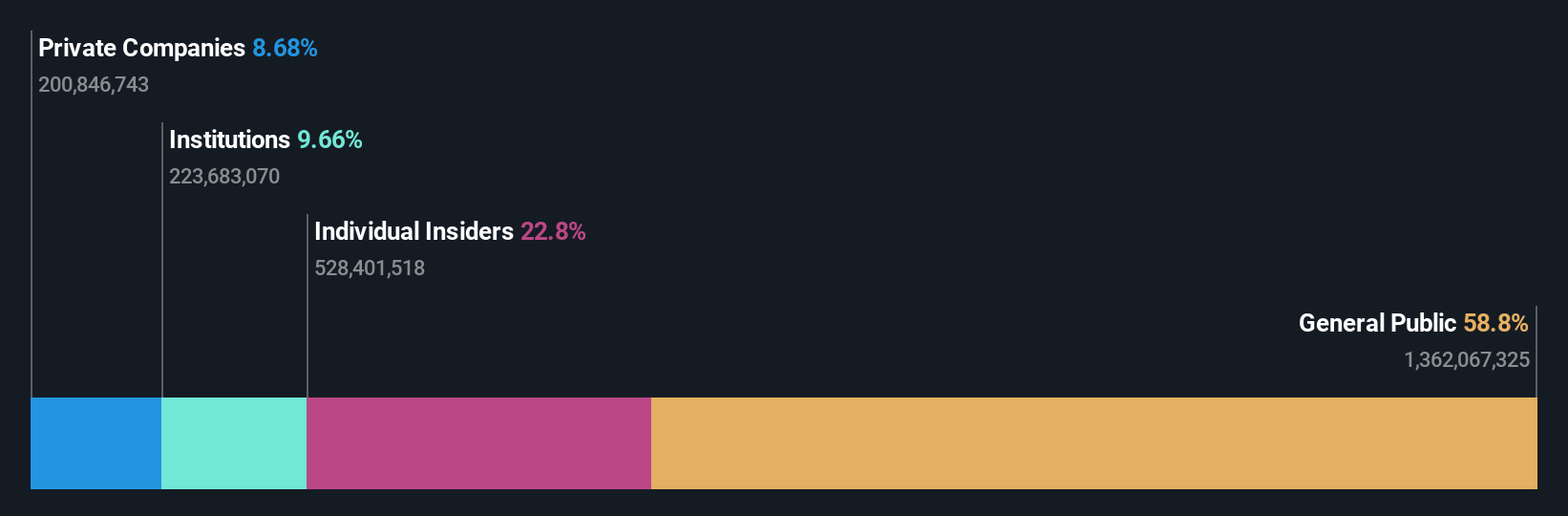

Insider Ownership: 10.9%

Earnings Growth Forecast: 18.4% p.a.

PAL GROUP Holdings is positioned for growth with earnings projected to increase at 18.4% annually, outpacing the JP market. Revenue is also set to rise at 8.7% per year, exceeding the market average. Trading at a significant discount to its estimated fair value, PAL GROUP's return on equity is anticipated to reach 20.4% in three years. No substantial insider trading activity has been reported recently, and Q3 results were released on January 14, 2025.

- Click here and access our complete growth analysis report to understand the dynamics of PAL GROUP Holdings.

- The valuation report we've compiled suggests that PAL GROUP Holdings' current price could be inflated.

Seize The Opportunity

- Embark on your investment journey to our 1474 Fast Growing Companies With High Insider Ownership selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2726

PAL GROUP Holdings

Engages in the planning, manufacture, wholesale, and retail of clothing products, including men’s and women’s clothing and accessories in Japan.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives