Investors can approximate the average market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Unfortunately the Unipol Gruppo S.p.A. (BIT:UNI) share price slid 21% over twelve months. That contrasts poorly with the market decline of 7.9%. However, the longer term returns haven't been so bad, with the stock down 11% in the last three years. Unhappily, the share price slid 4.8% in the last week.

Check out our latest analysis for Unipol Gruppo

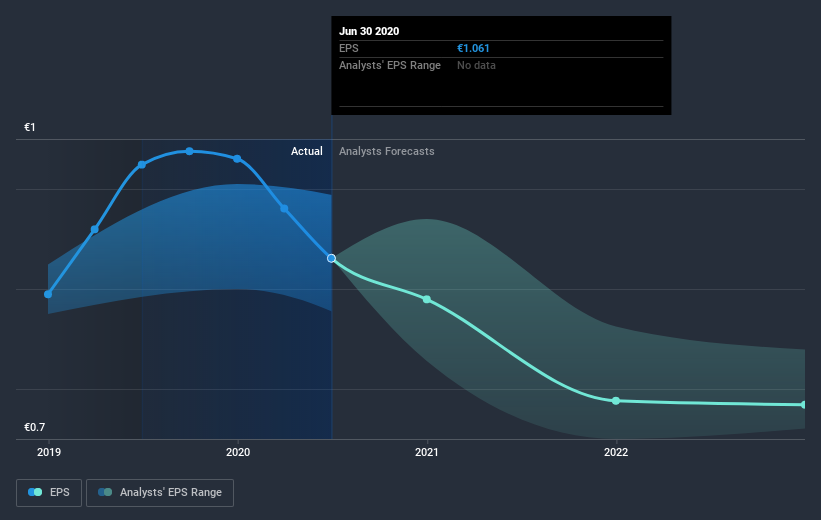

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Unhappily, Unipol Gruppo had to report a 15% decline in EPS over the last year. The share price decline of 21% is actually more than the EPS drop. So it seems the market was too confident about the business, a year ago. The less favorable sentiment is reflected in its current P/E ratio of 3.64.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Unipol Gruppo has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Unipol Gruppo's financial health with this free report on its balance sheet.

A Different Perspective

We regret to report that Unipol Gruppo shareholders are down 21% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 7.9%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 4%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Unipol Gruppo (1 is a bit unpleasant) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you’re looking to trade Unipol Gruppo, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:UNI

Unipol Assicurazioni

Provides insurance products and services primarily in Italy.

Average dividend payer and fair value.