- Italy

- /

- Medical Equipment

- /

- BIT:ELN

Uncovering 3 European Small Caps with Promising Potential

Reviewed by Simply Wall St

Amid a backdrop of trade uncertainty and monetary policy shifts, the European market has shown resilience with the pan-European STOXX Europe 600 Index rising by nearly 4% recently. As investor sentiment improves with interest rate cuts from the ECB, small-cap stocks in Europe present intriguing opportunities for those seeking growth potential in a dynamic economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nederman Holding | 69.60% | 11.43% | 16.35% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

EL.En (BIT:ELN)

Simply Wall St Value Rating: ★★★★★☆

Overview: EL.En. S.p.A. is involved in the research, development, production, sale, and distribution of laser solutions across Italy, Europe, and internationally with a market cap of €658.20 million.

Operations: EL.En. S.p.A.'s revenue streams are primarily derived from the production and sale of laser solutions across various regions, including Italy and Europe. The company's financial performance is highlighted by its gross profit margin, which provides insight into its profitability relative to production costs.

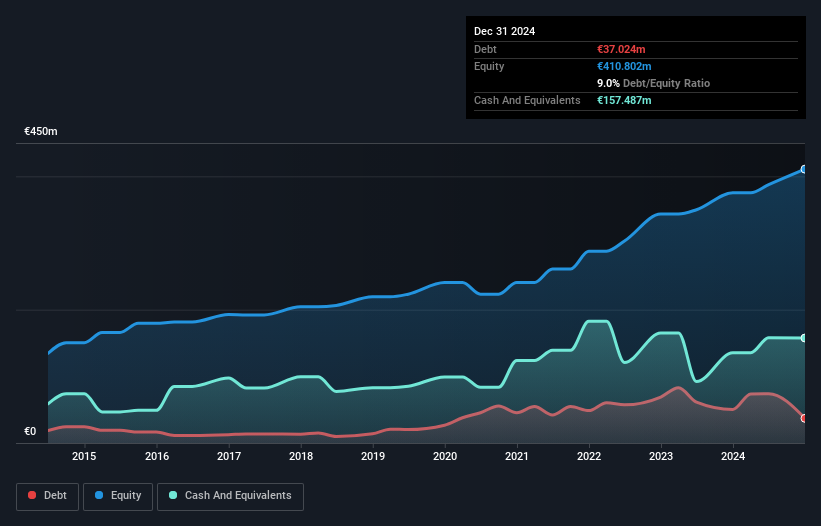

EL.En, a nimble player in the medical equipment sector, showcases robust financial health with cash exceeding total debt. Its earnings growth of 28% outpaces the industry average of 10%, underscoring its competitive edge. Despite recent share price volatility, EL.En trades at a favorable P/E ratio of 10.6x compared to Italy's market average of 14.1x, suggesting good value for investors. The company’s strategic focus on high-margin medical products and divestment from non-core areas like laser metal cutting aims to boost profit margins further. However, challenges such as legal disputes and weak performance in China could impact future stability.

SpareBank 1 Nord-Norge (OB:NONG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SpareBank 1 Nord-Norge offers comprehensive banking services in Northern Norway and has a market capitalization of NOK13.28 billion.

Operations: The bank generates revenue primarily from its Retail Market segment, contributing NOK2.51 billion, and Corporate Banking (Excluding SMB), which adds NOK1.71 billion. Additionally, Sparebank 1 Finans Nord-Norge and Sparebank 1 Regnskaps-Huset Nord-Norge contribute NOK344 million and NOK334 million respectively.

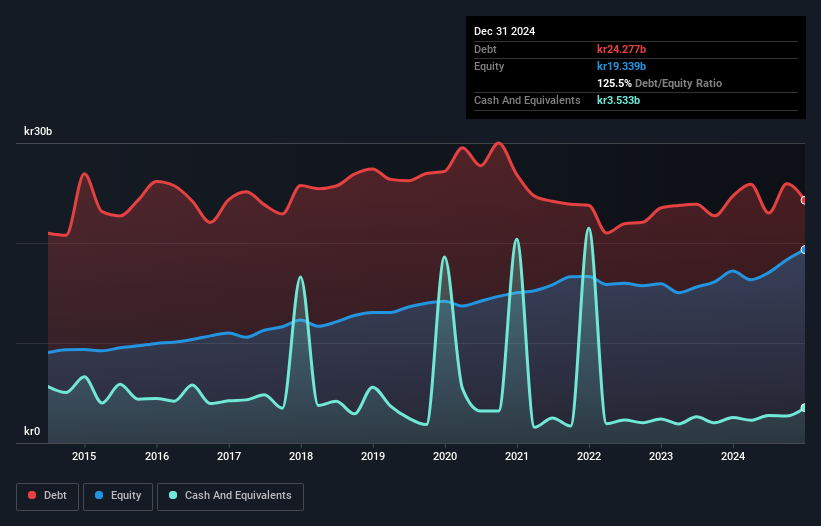

SpareBank 1 Nord-Norge, a notable player in the financial sector, has been trading at 46% below its estimated fair value. The bank's earnings surged by 43% last year, outpacing the industry average of 14.6%. With total assets of NOK135.7B and equity of NOK19.3B, it relies on low-risk funding sources for 76% of its liabilities, primarily customer deposits. However, bad loans constitute 2% of total loans with an insufficient allowance at just 60%. Recent changes include appointing PwC as auditors and proposing a cash dividend of NOK8.75 per share approved recently in April.

Clas Ohlson (OM:CLAS B)

Simply Wall St Value Rating: ★★★★★★

Overview: Clas Ohlson AB (publ) is a retail company that offers hardware, electrical, multimedia, home, and leisure products across Sweden, Norway, Finland, and other international markets with a market cap of approximately SEK17.07 billion.

Operations: Clas Ohlson generates revenue primarily through its retail segment, with SEK11.45 billion from specialty products. The company's financial performance includes a focus on managing costs to impact net profit margins effectively.

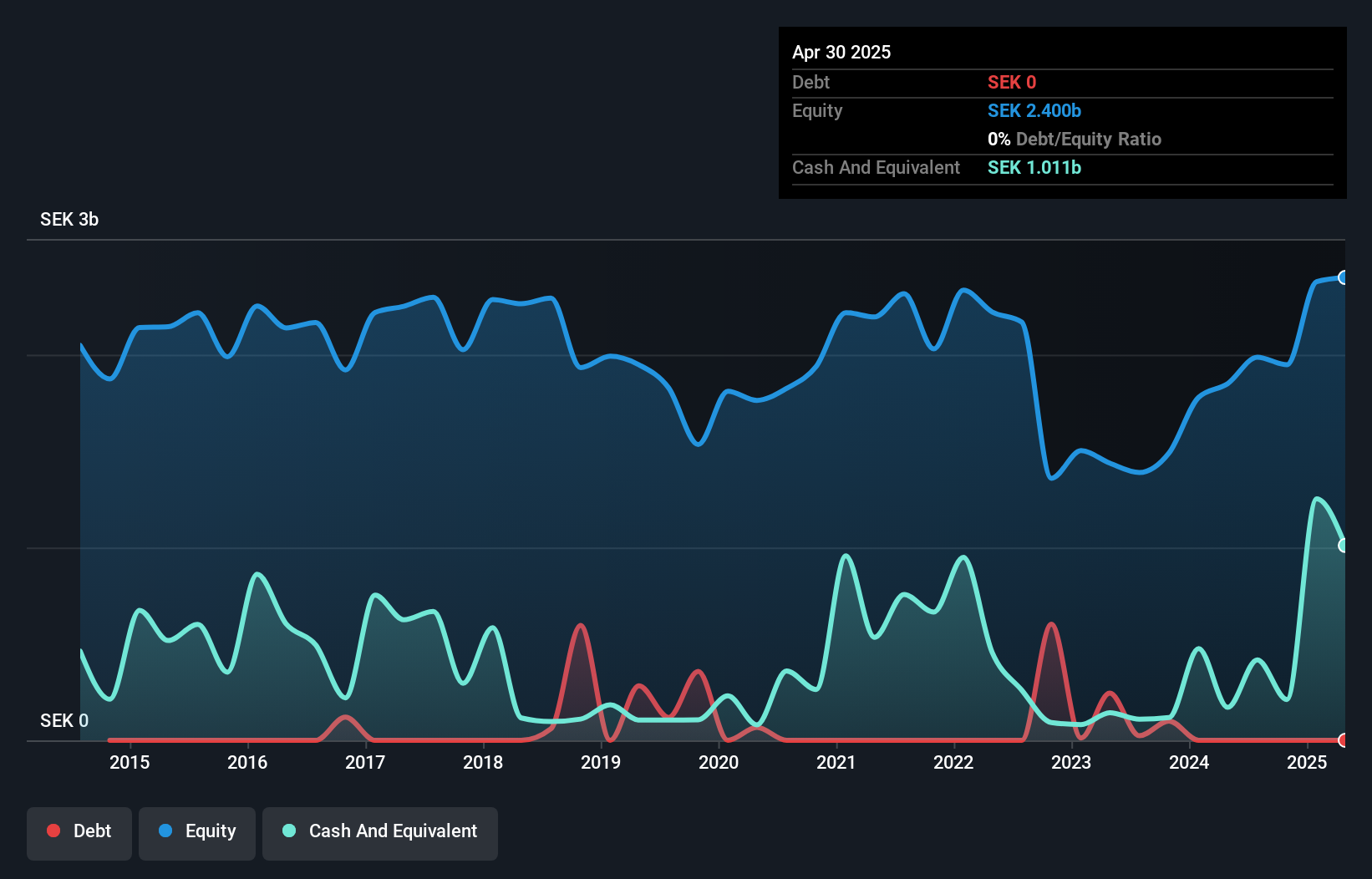

With its strategic shift to multi-niche retailing, Clas Ohlson is carving out a unique position in the market. The company reported an impressive 89.5% earnings growth over the past year, surpassing industry averages. Trading at 38.5% below estimated fair value, it offers potential upside for investors. Debt-free for five years, Clas Ohlson's robust financial health supports its aggressive expansion strategy of opening about ten new stores annually and launching new products like solar lighting and garden tools. Recent sales figures show a 14% increase from SEK 9 billion to SEK 10 billion year-over-year, highlighting strong organic growth despite currency challenges.

Taking Advantage

- Click here to access our complete index of 356 European Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EL.En might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ELN

EL.En

Engages in the research, development, production, sale, and distribution of laser solutions in Italy, rest of Europe, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives