As European markets navigate a complex landscape of mixed inflation data and economic contractions in major economies like Germany and France, the pan-European STOXX Europe 600 Index has shown resilience by posting its longest streak of weekly gains since August 2012. Against this backdrop, identifying stocks that may be undervalued becomes particularly pertinent for investors seeking opportunities amidst uncertainty.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK55.20 | SEK108.16 | 49% |

| Sword Group (ENXTPA:SWP) | €33.20 | €64.81 | 48.8% |

| CD Projekt (WSE:CDR) | PLN221.60 | PLN441.21 | 49.8% |

| Tinexta (BIT:TNXT) | €7.77 | €15.40 | 49.6% |

| Canatu Oyj (HLSE:CANATU) | €12.50 | €24.78 | 49.6% |

| Surgical Science Sweden (OM:SUS) | SEK157.50 | SEK310.93 | 49.3% |

| Cint Group (OM:CINT) | SEK6.775 | SEK13.32 | 49.2% |

| Nexstim (HLSE:NXTMH) | €8.48 | €16.75 | 49.4% |

| Better Collective (OM:BETCO) | SEK110.20 | SEK216.76 | 49.2% |

| Nordic Semiconductor (OB:NOD) | NOK137.45 | NOK268.83 | 48.9% |

Underneath we present a selection of stocks filtered out by our screen.

Recordati Industria Chimica e Farmaceutica (BIT:REC)

Overview: Recordati Industria Chimica e Farmaceutica S.p.A., along with its subsidiaries, is involved in the research, development, production, and sale of pharmaceuticals both in Italy and internationally, with a market cap of approximately €11.10 billion.

Operations: Recordati's revenue is primarily derived from its Rare Diseases segment, which accounts for €1.51 billion, and its Specialty & Primary Care segment, contributing €833.61 million.

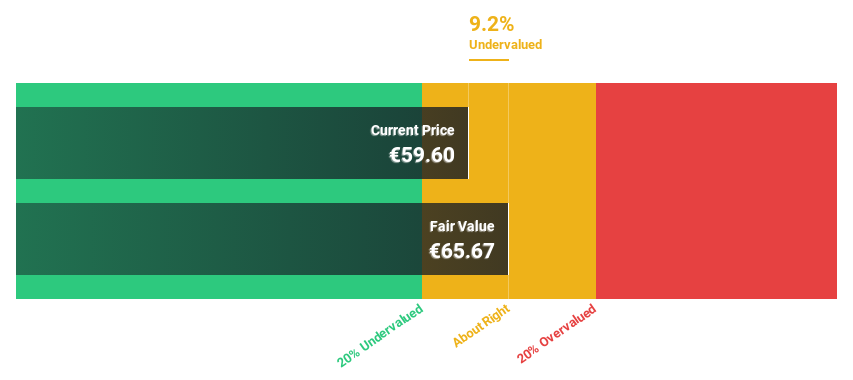

Estimated Discount To Fair Value: 17.3%

Recordati Industria Chimica e Farmaceutica is trading at €54.3, below its estimated fair value of €65.67, indicating it may be undervalued based on cash flows. Despite a high level of debt, the company maintains a reliable dividend yield of 2.27% and is expected to grow earnings by 11.9% annually, outpacing the Italian market's growth rate of 8%. Recent guidance projects net revenue between €2.6 billion and €2.67 billion for 2025.

- In light of our recent growth report, it seems possible that Recordati Industria Chimica e Farmaceutica's financial performance will exceed current levels.

- Dive into the specifics of Recordati Industria Chimica e Farmaceutica here with our thorough financial health report.

Salvatore Ferragamo (BIT:SFER)

Overview: Salvatore Ferragamo S.p.A. is a luxury goods company that designs, manufactures, and markets products for men and women across Europe, North America, Japan, the Asia Pacific, and Central and South America with a market cap of approximately €1.34 billion.

Operations: The company's revenue primarily comes from its footwear segment, which generated €1.08 billion.

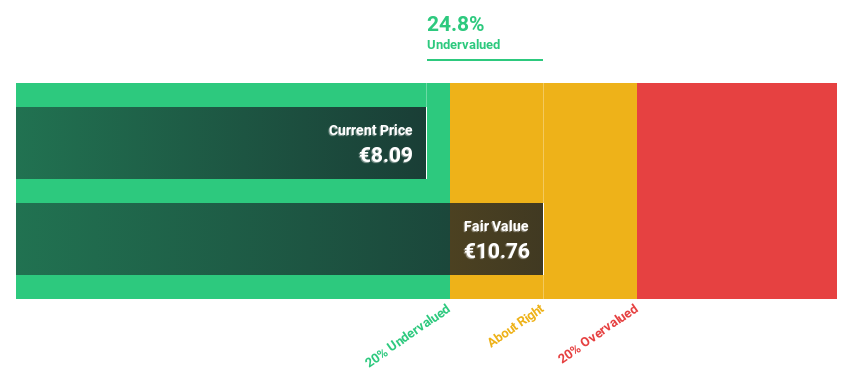

Estimated Discount To Fair Value: 25.5%

Salvatore Ferragamo, trading at €8.1, is significantly undervalued with a fair value estimate of €10.87. Despite recent volatility and lower profit margins compared to last year, the company's earnings are projected to grow substantially at 38.57% annually over the next three years, outpacing both its revenue growth and the Italian market's earnings growth rate. However, its Return on Equity is expected to remain low at 4.9%.

- According our earnings growth report, there's an indication that Salvatore Ferragamo might be ready to expand.

- Get an in-depth perspective on Salvatore Ferragamo's balance sheet by reading our health report here.

Gjensidige Forsikring (OB:GJF)

Overview: Gjensidige Forsikring ASA provides general insurance and pension products across Norway, Sweden, Denmark, Latvia, Lithuania, and Estonia with a market cap of NOK115.39 billion.

Operations: Revenue segments for Gjensidige Forsikring ASA include General Insurance Commercial at NOK20.99 billion, General Insurance Private accounting for NOK15.18 billion, General Insurance Sweden contributing NOK2 billion, and Pension products generating NOK523.4 million.

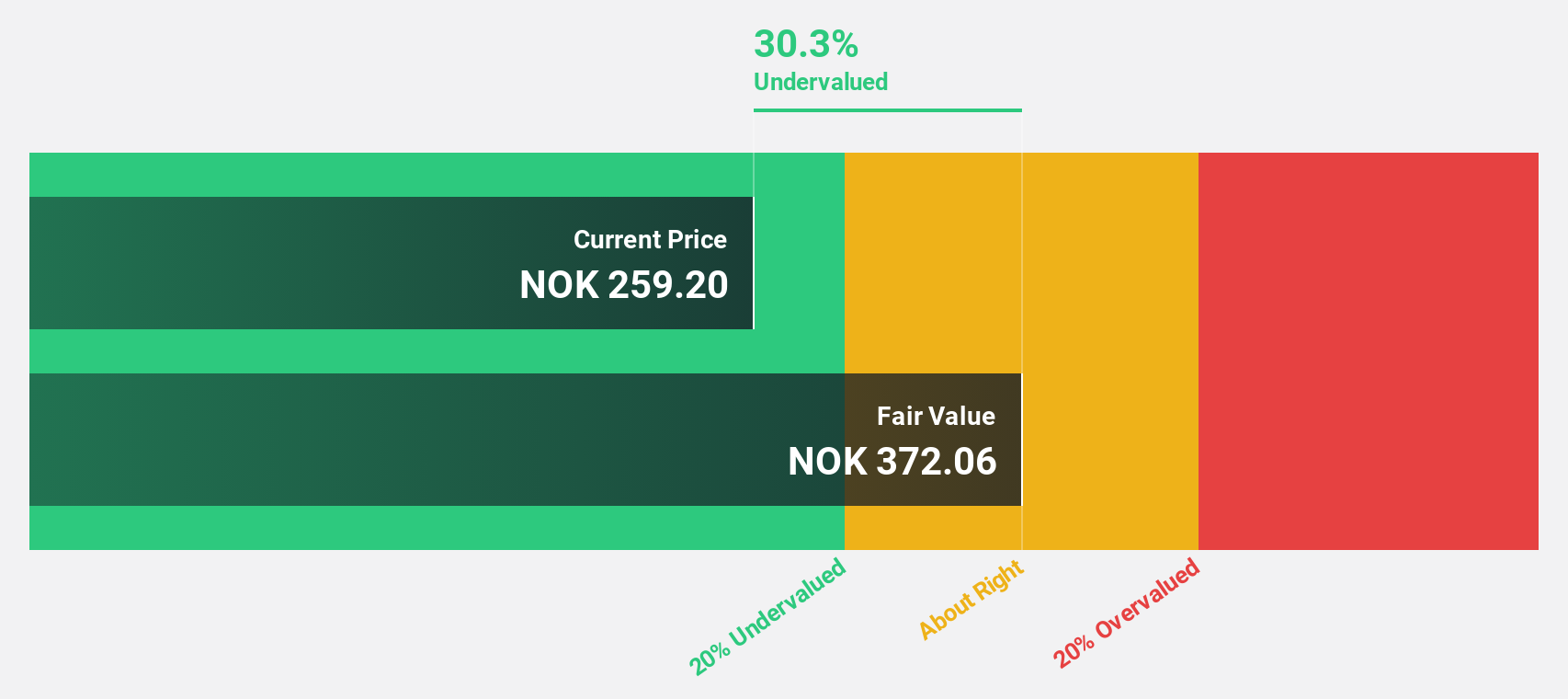

Estimated Discount To Fair Value: 36.5%

Gjensidige Forsikring, priced at NOK 230.8, is trading 36.5% below its estimated fair value of NOK 363.63, highlighting its potential undervaluation based on cash flows. Although earnings are projected to grow by 12.58% annually—outpacing the Norwegian market's growth—revenue growth is modest at 3%. Despite a high future Return on Equity forecast of 25.9%, the dividend yield of 3.9% lacks sufficient coverage from free cash flows, posing sustainability concerns.

- Our comprehensive growth report raises the possibility that Gjensidige Forsikring is poised for substantial financial growth.

- Click here to discover the nuances of Gjensidige Forsikring with our detailed financial health report.

Seize The Opportunity

- Embark on your investment journey to our 203 Undervalued European Stocks Based On Cash Flows selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:REC

Recordati Industria Chimica e Farmaceutica

Engages in the research, development, production, and sale of pharmaceuticals in Italy and internationally.

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives