European Stocks Estimated To Be Trading Below Intrinsic Value In December 2025

Reviewed by Simply Wall St

As European markets navigate a mixed landscape, with the STOXX Europe 600 Index inching higher amid hopes for interest rate cuts in the U.S. and UK, investors are keenly observing opportunities that might arise from fluctuating economic indicators such as rising inflation and tight labor markets. In this context, identifying stocks trading below their intrinsic value can be particularly appealing, as they may offer potential for growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Straumann Holding (SWX:STMN) | CHF95.58 | CHF187.25 | 49% |

| Sanoma Oyj (HLSE:SANOMA) | €9.14 | €18.16 | 49.7% |

| PVA TePla (XTRA:TPE) | €22.60 | €44.28 | 49% |

| Ottobock SE KGaA (XTRA:OBCK) | €70.25 | €138.58 | 49.3% |

| Jæren Sparebank (OB:JAREN) | NOK379.95 | NOK754.39 | 49.6% |

| Gentili Mosconi (BIT:GM) | €3.34 | €6.53 | 48.8% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.395 | €0.78 | 49.1% |

| Exail Technologies (ENXTPA:EXA) | €86.30 | €171.25 | 49.6% |

| E-Globe (BIT:EGB) | €0.61 | €1.22 | 49.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €2.56 | €5.05 | 49.3% |

Here we highlight a subset of our preferred stocks from the screener.

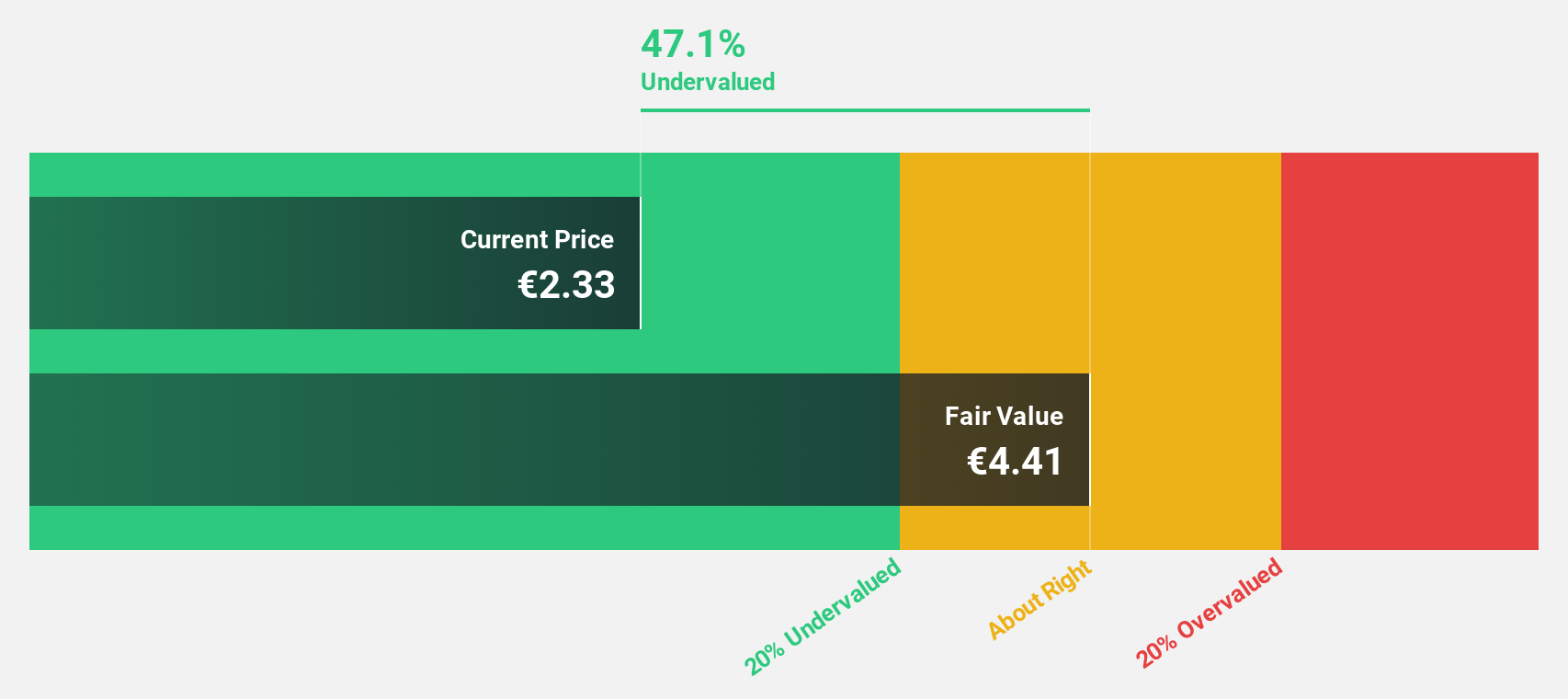

doValue (BIT:DOV)

Overview: doValue S.p.A. specializes in managing non-performing loans, unlikely to pay, early arrears, and performing loans for banks and investors across Italy, Spain, Greece, and Cyprus with a market cap of €549.23 million.

Operations: doValue S.p.A. generates revenue through the management of non-performing loans, unlikely to pay, early arrears, and performing loans for financial institutions and investors in Italy, Spain, Greece, and Cyprus.

Estimated Discount To Fair Value: 18.2%

doValue is trading at €2.9, below its estimated fair value of €3.54, suggesting it may be undervalued based on cash flows. Despite a recent net loss of €7.68 million for the nine months ending September 2025, revenue increased to €405.23 million from the previous year’s €318.04 million. The company completed a €350 million fixed-income offering in November 2025, indicating strategic financial maneuvers amidst forecasted profitability within three years and high expected earnings growth.

- The analysis detailed in our doValue growth report hints at robust future financial performance.

- Take a closer look at doValue's balance sheet health here in our report.

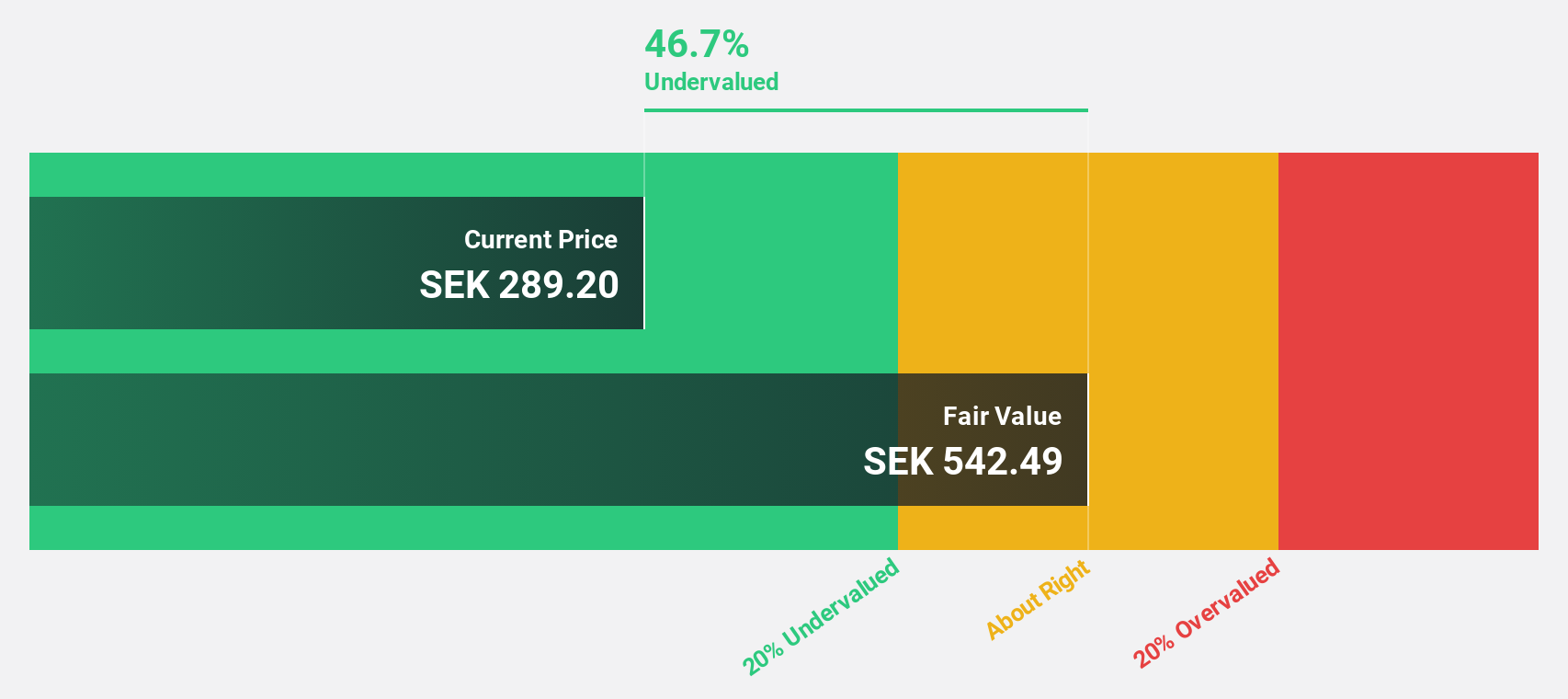

Bonesupport Holding (OM:BONEX)

Overview: Bonesupport Holding AB (publ) is an orthobiologics company that develops and sells injectable bio-ceramic bone graft substitutes in Europe, North America, and internationally, with a market cap of SEK12.36 billion.

Operations: The company's revenue segment is focused on pharmaceuticals, generating SEK1.12 billion.

Estimated Discount To Fair Value: 39.1%

Bonesupport Holding's stock is trading at SEK187.7, significantly below its estimated fair value of SEK308.1, highlighting potential undervaluation based on cash flows. Recent earnings reports show robust growth with sales reaching SEK 862.11 million for the first nine months of 2025, up from SEK 641.72 million the previous year, and net income increasing to SEK 98.01 million from SEK 79.84 million a year ago. The company anticipates substantial revenue and profit growth outpacing the Swedish market averages.

- In light of our recent growth report, it seems possible that Bonesupport Holding's financial performance will exceed current levels.

- Navigate through the intricacies of Bonesupport Holding with our comprehensive financial health report here.

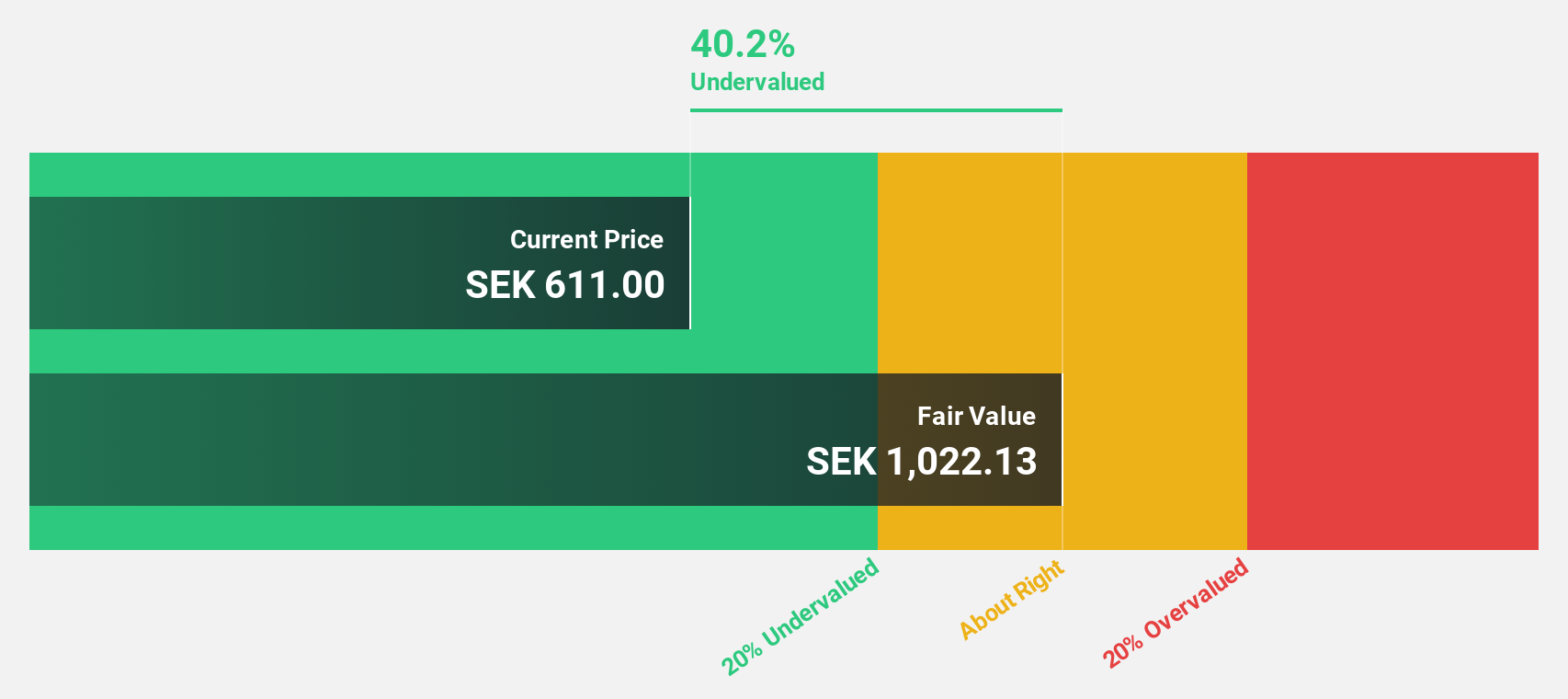

Camurus (OM:CAMX)

Overview: Camurus AB is a biopharmaceutical company that develops and commercializes medicines for severe and chronic diseases across Europe, Africa, the Middle East, North America, and Asia with a market cap of SEK36.44 billion.

Operations: The company's revenue is primarily derived from the development of pharmaceutical products based on its technology platform, totaling SEK2.35 billion.

Estimated Discount To Fair Value: 40.2%

Camurus is trading at SEK611, well below its estimated fair value of SEK1022.13, suggesting undervaluation based on cash flows. Analysts forecast significant earnings growth of 32.4% annually, outpacing the Swedish market's 13.5%. Recent results show strong performance with third-quarter sales rising to SEK567.07 million from SEK479.6 million last year and net income increasing to SEK192.64 million from SEK129.35 million, despite revised revenue guidance for 2025 down to between SEK2.3 billion and SEK2.6 billion.

- Our comprehensive growth report raises the possibility that Camurus is poised for substantial financial growth.

- Dive into the specifics of Camurus here with our thorough financial health report.

Where To Now?

- Embark on your investment journey to our 195 Undervalued European Stocks Based On Cash Flows selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CAMX

Camurus

A biopharmaceutical company, develops and commercializes medicines for severe and chronic diseases in Europe, Africa, the Middle East, North America, and Asia.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion